Traders face a busy Tuesday with developments on U.S. China trade talks, a RBA policy decision, and the latest U.S. inflation data.

U.S. China tariff deadline – Tuesday

The current truce between the U.S. and China is set to expire on 12 August, with U.S. Commerce Secretary Lutnick indicating it will likely be extended by 90 days. China may also face an additional 25% tariff on Russian oil imports, like measures already applied to India.

RBA announcement – Tuesday

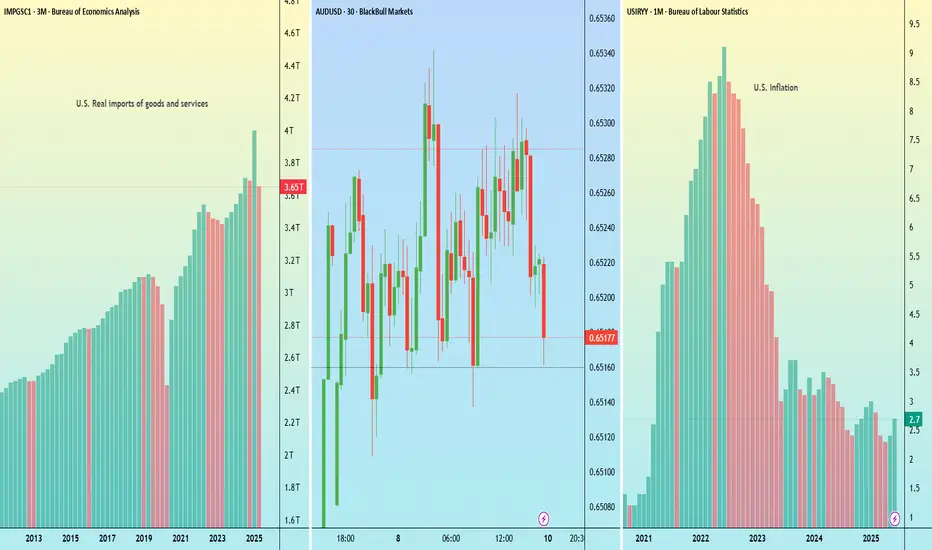

The Reserve Bank of Australia is widely expected to cut rates, with a Reuters poll showing all 40 surveyed economists anticipating a 25bp reduction to 3.60%. The broader market is pricing a 98% probability of that outcome and a 2% chance of a larger 50bp cut.

U.S. CPI – Tuesday

Headline U.S. CPI for July is expected to rise 0.2% month-on-month taking the annual rate to 2.8% from 2.7%. Wells Fargo notes that the figures may show further signs of higher tariffs feeding into consumer prices.

U.S. China tariff deadline – Tuesday

The current truce between the U.S. and China is set to expire on 12 August, with U.S. Commerce Secretary Lutnick indicating it will likely be extended by 90 days. China may also face an additional 25% tariff on Russian oil imports, like measures already applied to India.

RBA announcement – Tuesday

The Reserve Bank of Australia is widely expected to cut rates, with a Reuters poll showing all 40 surveyed economists anticipating a 25bp reduction to 3.60%. The broader market is pricing a 98% probability of that outcome and a 2% chance of a larger 50bp cut.

U.S. CPI – Tuesday

Headline U.S. CPI for July is expected to rise 0.2% month-on-month taking the annual rate to 2.8% from 2.7%. Wells Fargo notes that the figures may show further signs of higher tariffs feeding into consumer prices.

Economic Calendar:

blackbull.com/en/economic-calendar/?utm_source=tradingview

Free TradingView Premium:

blackbull.com/en/platforms/tradingview/?utm_source=tradingview

blackbull.com/en/economic-calendar/?utm_source=tradingview

Free TradingView Premium:

blackbull.com/en/platforms/tradingview/?utm_source=tradingview

Declinazione di responsabilità

Le informazioni e le pubblicazioni non sono intese come, e non costituiscono, consulenza o raccomandazioni finanziarie, di investimento, di trading o di altro tipo fornite o approvate da TradingView. Per ulteriori informazioni, consultare i Termini di utilizzo.

Economic Calendar:

blackbull.com/en/economic-calendar/?utm_source=tradingview

Free TradingView Premium:

blackbull.com/en/platforms/tradingview/?utm_source=tradingview

blackbull.com/en/economic-calendar/?utm_source=tradingview

Free TradingView Premium:

blackbull.com/en/platforms/tradingview/?utm_source=tradingview

Declinazione di responsabilità

Le informazioni e le pubblicazioni non sono intese come, e non costituiscono, consulenza o raccomandazioni finanziarie, di investimento, di trading o di altro tipo fornite o approvate da TradingView. Per ulteriori informazioni, consultare i Termini di utilizzo.