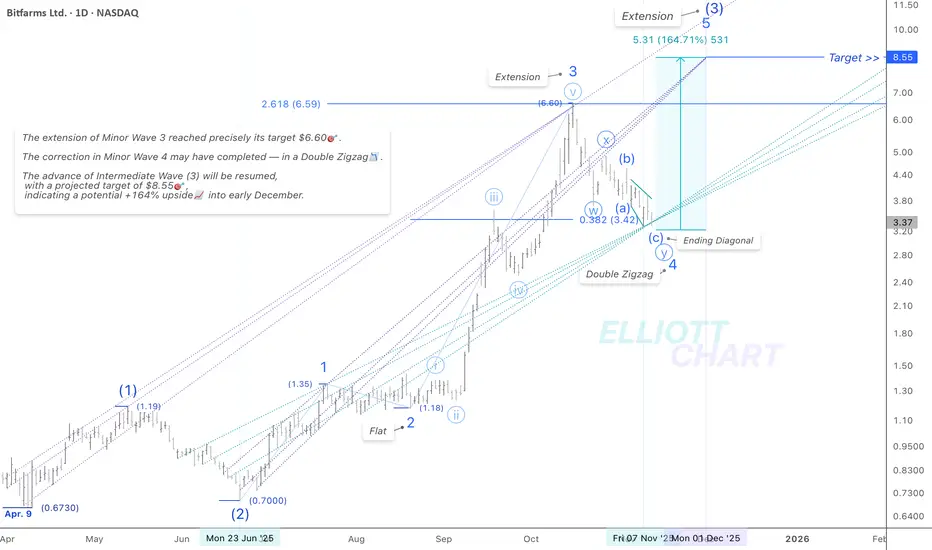

The market should be in a very late stage of the correction in Minor Wave 4, unfolding through a Double Zigzag retracement and finding support near the apex of the equivalence lines, around the 0.382 Fibonacci retracement level.

As depicted on the chart, Wave (c) within Minute Wave ⓨ appears to have formed an Ending Diagonal — suggesting that the correction in Minor Wave 4 is nearing completion around the apex of the equivalence lines, likely within the next session.

Sometimes, patience is the key!!🕒

No significant change to the

The near-term bullish structure remains intact. In my view, there is sufficient space between the convergent and divergent equivalence lines to project the next advance — with Intermediate Wave (3) anticipated to re-extend through Minor Wave 5, targeting around $8.55🎯, implying an estimated +164%📈 upside into early December.

🔖 It’s worth noting that the equivalence lines form a core component of my personal framework, which I apply through my Quantum Models methodology.

#QuantumModels #EquivalenceLines #Targeting #MarketAnalysis #TechnicalAnalysis #ElliottWave #WaveAnalysis #TrendAnalysis #StocksToWatch #FibLevels #FinTwit #Investing #MiningStocks #BITF #Bitfarms #DataCenters #BitcoinMining #CryptoMining #AIStocks #HPC #AI #BTC #Bitcoin #BTCUSD

Declinazione di responsabilità

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Declinazione di responsabilità

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.