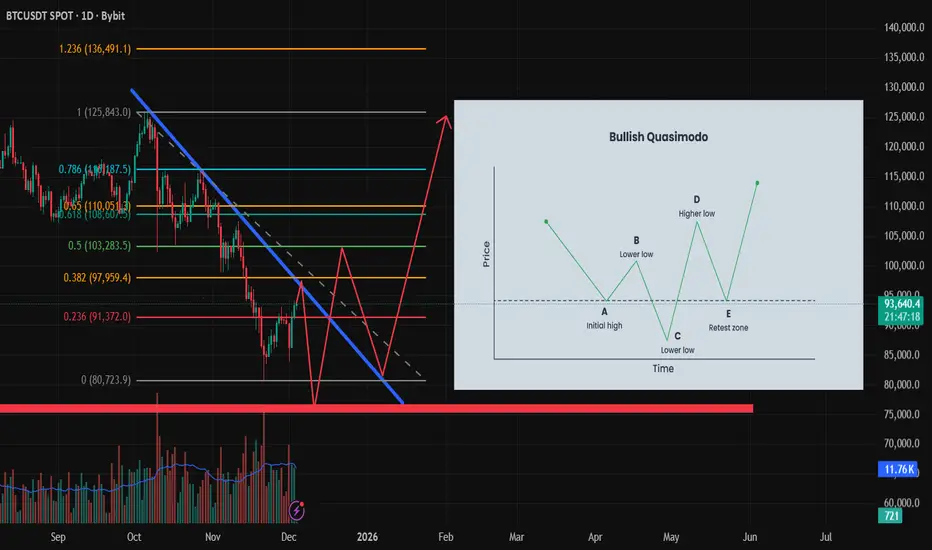

Bitcoin continues to trade below the macro descending trendline, respecting lower highs since the last major swing high. Price is currently around the 93k area, reacting to a minor resistance + Fibonacci cluster.

🔍 Why a Bullish Quasimodo Is Possible

A Bullish QM (Quasimodo) pattern forms when the market creates:

BTC appears to have formed steps 1 and 2, and may be setting up for a deeper sweep to complete the Lower Low around the major demand zone.

🧭 Projected Price Path

Final liquidity sweep into ~80k, which aligns with a major demand zone and previous volume imbalance

Mid-term expectation (bullish reversal):

🎯 Bias Summary

Short-term: Neutral to bearish (liquidity sweep expected)

Mid-term: Bullish reversal if QM structure completes and price forms a Higher Low

⚠️ Invalidation

A clean daily close below 78,500 invalidates the Bullish QM scenario.

🔍 Why a Bullish Quasimodo Is Possible

A Bullish QM (Quasimodo) pattern forms when the market creates:

- Initial High

- Lower High

- Lower Low (liquidity sweep)

- Higher Low (retest zone)

- Break of Structure to the upside

BTC appears to have formed steps 1 and 2, and may be setting up for a deeper sweep to complete the Lower Low around the major demand zone.

🧭 Projected Price Path

- Short-term expectation (bearish liquidity sweep):

- Possible rejection from the descending trendline

- Decline toward 91,300 → 88k → 86k

Final liquidity sweep into ~80k, which aligns with a major demand zone and previous volume imbalance

Mid-term expectation (bullish reversal):

- Strong bounce from the 80k zone

- Formation of the Higher Low (QM retest zone)

- Break above the descending trendline

- Upside targets:

97,900

103,200

108,000

125,000+ (Fibonacci extension target)

🎯 Bias Summary

Short-term: Neutral to bearish (liquidity sweep expected)

Mid-term: Bullish reversal if QM structure completes and price forms a Higher Low

⚠️ Invalidation

A clean daily close below 78,500 invalidates the Bullish QM scenario.

Declinazione di responsabilità

Le informazioni e le pubblicazioni non sono intese come, e non costituiscono, consulenza o raccomandazioni finanziarie, di investimento, di trading o di altro tipo fornite o approvate da TradingView. Per ulteriori informazioni, consultare i Termini di utilizzo.

Declinazione di responsabilità

Le informazioni e le pubblicazioni non sono intese come, e non costituiscono, consulenza o raccomandazioni finanziarie, di investimento, di trading o di altro tipo fornite o approvate da TradingView. Per ulteriori informazioni, consultare i Termini di utilizzo.