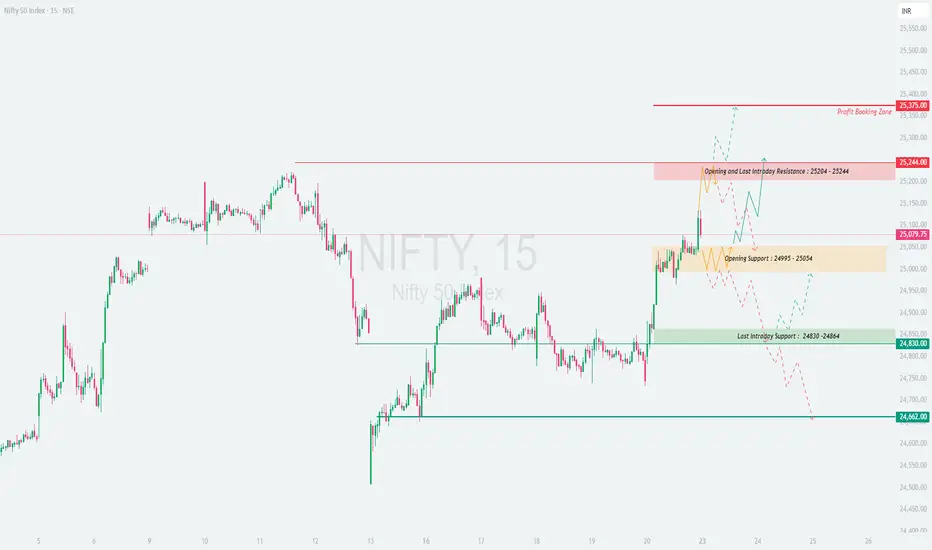

\📊 NIFTY TRADING PLAN – 21-Jun-2025\

📍 \Previous Close:\ 25,079.75

📏 \Gap Threshold:\ 100+ points

🕒 \Chart Reference:\ 15-minute timeframe

---

\

\[\*]\🚀 GAP-UP OPENING (Above 25,244):\

If Nifty opens above 25,244, it would break above the \Opening & Last Intraday Resistance zone (25,204 – 25,244)\, entering a profit-booking territory.

✅ \Plan of Action:\

• Wait for 15–30 minutes for confirmation candles.

• If sustained above 25,244, bullish continuation is likely toward the \Profit Booking Zone – 25,375+\.

• However, if the index shows rejection near 25,244, expect a retest of the previous resistance zone.

🎯 \Trade Setup:\

– Buy on a successful retest or breakout above 25,244

– Stop-loss: below 25,200

– Target: 25,350–25,375

📘 \Pro Tip:\ Avoid impulsive longs on big gap-ups. Let price digest the gap and give a clear entry.

\[\*]\📘 FLAT OPENING (Between 25,054 – 25,204):\

A flat opening places the index in a volatile consolidation zone between \Opening Support (24,995 – 25,054)\ and resistance.

✅ \Plan of Action:\

• Avoid trading inside the range of 25,054–25,204 due to fakeouts.

• Trade directional breakout from either side of this box:

– \Above 25,204\: Possible bullish breakout toward 25,350

– \Below 24,995\: Breakdown can push index to 24,864 or lower

🎯 \Trade Setup:\

– Buy above 25,204 or sell below 24,995 with confirmation

– Tight SL (20–30 pts) is necessary inside this choppy zone

📘 \Pro Tip:\ Avoid trading in the orange "Opening Support" zone unless a strong volume-based breakout or breakdown is seen.

\[\*]\📉 GAP-DOWN OPENING (Below 24,864):\

A gap-down opening below the \Last Intraday Support (24,864 – 24,830)\ signals early weakness in the market.

✅ \Plan of Action:\

• First support to watch: \24,662\

• If price bounces from 24,662 with strength, short-covering may lead to a test of 24,864

• A breakdown below 24,662 can open doors to 24,500–24,420 levels

🎯 \Trade Setup:\

– Short if price sustains below 24,830

– Stop-loss: above 24,880

– Buy only if sharp reversal seen at 24,662

📘 \Pro Tip:\ Avoid panic selling. Wait for price to stabilize post-gap down and then decide.

---

\🛡 RISK MANAGEMENT & OPTIONS TRADING TIPS:\

✅ \1. Never chase trades at market open – observe price structure first\

✅ \2. For gap-ups, prefer debit spreads instead of naked calls to limit risk\

✅ \3. Don’t hold OTM options during range-bound action – decay is rapid\

✅ \4. Trail profits – especially after a breakout move hits your first target\

✅ \5. Respect volatility – no trade is also a trade in indecision zones\

---

\📌 SUMMARY – LEVELS TO WATCH FOR 21-Jun-2025:\

• 🔴 \Resistance Zone:\ 25,204 – 25,244

• 🎯 \Profit Booking Zone:\ 25,375

• 🟠 \Opening Support Zone:\ 24,995 – 25,054

• 🟢 \Last Intraday Support:\ 24,864 – 24,830

• 🔻 \Breakdown Support:\ 24,662

💡 \Summary Recap:\

• 🔼 Above 25,244 = Bullish momentum resumes

• ⏸ Between 25,054–25,204 = Sideways chop, avoid trades

• 🔽 Below 24,864 = Watch for sell pressure and bounce from 24,662

---

\📢 DISCLAIMER:\

I am not a SEBI-registered analyst. This trading plan is for educational and informational purposes only. Please consult your financial advisor before taking any market decisions. Trade safe and always manage your risk! ⚖️📉📈

Declinazione di responsabilità

Le informazioni e le pubblicazioni non sono intese come, e non costituiscono, consulenza o raccomandazioni finanziarie, di investimento, di trading o di altro tipo fornite o approvate da TradingView. Per ulteriori informazioni, consultare i Termini di utilizzo.

Declinazione di responsabilità

Le informazioni e le pubblicazioni non sono intese come, e non costituiscono, consulenza o raccomandazioni finanziarie, di investimento, di trading o di altro tipo fornite o approvate da TradingView. Per ulteriori informazioni, consultare i Termini di utilizzo.