STRIDES PHARMA (STAR) – Wave C Completion Zone Hit | Bullish Reversal & Target 1039–1056 Loading?

🧠 Market Structure & Elliott Wave Context

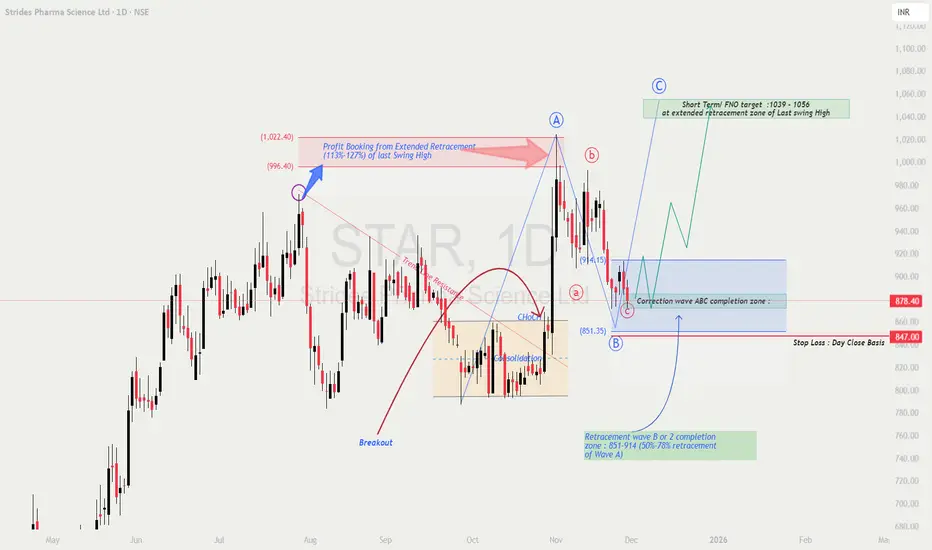

Strides Pharma has completed a classic A–B–C corrective pattern following a strong impulsive Wave A.

Price has now entered the crucial Wave C completion zone → ₹851–₹914, which aligns perfectly with the 50%–78% Fibonacci retracement of Wave A 🔥.

Key structure observations:

Profit booking earlier happened at the 113–127% extended retracement of the last swing high (textbook Elliott Wave Wave A exhaustion).

Price broke out of a consolidation block, then sharply retraced into Wave C.

The current pullback is healthy and controlled, not a trend reversal.

This is exactly where reversal setups typically appear before Wave C → Wave C extension impulses.

📚 Educational Breakdown

🎯 Price Prediction & Upside Targets

If STAR reverses from the ₹851–₹914 Wave C demand zone, bullish upside opens toward:

🎯 Short-Term Target: ₹1039 – ₹1056 (F&O / extended retracement target)

🎯 Medium-Term Target: ₹1085+ (if momentum continues)

Upside activation strengthens if price crosses ₹914–₹920 with volume.

📈 Risk–Reward Perspective

Entry Zone: ₹851 – ₹914

Stop Loss: ₹847 (daily close)

Target: ₹1039–₹1056

Risk: ~₹20–₹40

Reward: ₹125–₹200

👉 Risk–Reward Ratio: Approx 1 : 3.5 to 1 : 6 🚀

(Excellent R:R for swing traders)

💡 Trading Strategy (Educational Only)

🧩 Summary

STAR is showing a high-probability bullish reversal after completing its Wave C at the ideal Fibonacci confluence zone.

If the structure flips bullish, a strong move toward ₹1039 → ₹1056 is likely next.

This setup offers excellent risk–reward and aligns cleanly with Elliott Wave and Fibonacci principles ⚡.

⚠️ Disclaimer

I am not a SEBI-registered analyst.

This analysis is for educational and informational purposes only — not investment advice.

🧠 Market Structure & Elliott Wave Context

Strides Pharma has completed a classic A–B–C corrective pattern following a strong impulsive Wave A.

Price has now entered the crucial Wave C completion zone → ₹851–₹914, which aligns perfectly with the 50%–78% Fibonacci retracement of Wave A 🔥.

Key structure observations:

Profit booking earlier happened at the 113–127% extended retracement of the last swing high (textbook Elliott Wave Wave A exhaustion).

Price broke out of a consolidation block, then sharply retraced into Wave C.

The current pullback is healthy and controlled, not a trend reversal.

This is exactly where reversal setups typically appear before Wave C → Wave C extension impulses.

📚 Educational Breakdown

- 📘 A–B–C Corrective Wave Structure:

Wave A = initial drop

Wave B = retracement (profit taking / liquidity grab)

Wave C = final flush into demand

Once Wave C completes, price usually begins a fresh impulse. - 🔄 50%–78% Fib Retracement (Wave B/2 Zone):

This zone is statistically one of the most reliable reversal regions in corrective legs.

STAR is sitting exactly inside this zone → high-probability bounce area. - 🌀 Extended Retracement Targets (113%–128%):

Wave C → Wave C extension often targets these levels.

Your chart reflects this perfectly for the upside projection. - 📉 Stop-Loss Logic (Risk Control):

A close below ₹847 breaks the structural logic of Wave C completion → invalidation level.

🎯 Price Prediction & Upside Targets

If STAR reverses from the ₹851–₹914 Wave C demand zone, bullish upside opens toward:

🎯 Short-Term Target: ₹1039 – ₹1056 (F&O / extended retracement target)

🎯 Medium-Term Target: ₹1085+ (if momentum continues)

Upside activation strengthens if price crosses ₹914–₹920 with volume.

📈 Risk–Reward Perspective

Entry Zone: ₹851 – ₹914

Stop Loss: ₹847 (daily close)

Target: ₹1039–₹1056

Risk: ~₹20–₹40

Reward: ₹125–₹200

👉 Risk–Reward Ratio: Approx 1 : 3.5 to 1 : 6 🚀

(Excellent R:R for swing traders)

💡 Trading Strategy (Educational Only)

- 🟢 Entry Strategy:

Enter in the ₹851–₹914 zone.

Wait for bullish reversal candles → Hammer, Engulfing, or ChoCH on lower timeframes. - 📈 Confirmation Strategy:

A break above ₹914–₹920 confirms buyer strength → safer entry for wave continuation. - 🎯 Profit Booking Plan:

• Book partial at ₹1039–₹1056

• Trail SL to cost after breakout

• Hold runners for extended move - ⚖️ Risk Management:

• Keep SL strictly below ₹847

• Risk max 1–2% capital

• Don’t average below structure break

🧩 Summary

STAR is showing a high-probability bullish reversal after completing its Wave C at the ideal Fibonacci confluence zone.

If the structure flips bullish, a strong move toward ₹1039 → ₹1056 is likely next.

This setup offers excellent risk–reward and aligns cleanly with Elliott Wave and Fibonacci principles ⚡.

⚠️ Disclaimer

I am not a SEBI-registered analyst.

This analysis is for educational and informational purposes only — not investment advice.

Declinazione di responsabilità

Le informazioni e le pubblicazioni non sono intese come, e non costituiscono, consulenza o raccomandazioni finanziarie, di investimento, di trading o di altro tipo fornite o approvate da TradingView. Per ulteriori informazioni, consultare i Termini di utilizzo.

Declinazione di responsabilità

Le informazioni e le pubblicazioni non sono intese come, e non costituiscono, consulenza o raccomandazioni finanziarie, di investimento, di trading o di altro tipo fornite o approvate da TradingView. Per ulteriori informazioni, consultare i Termini di utilizzo.