1. Current Market Structure

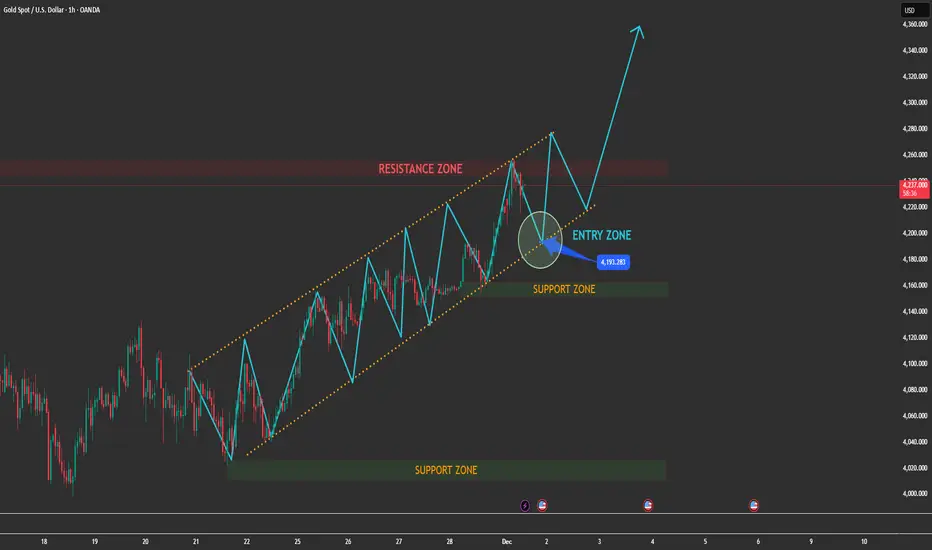

- Gold is moving inside a well-defined ascending channel, respecting each swing high and swing low with precision — a clear sign that the bullish structure is still intact.

- Key observations:

+ Price has just rejected from the resistance zone at the top of the channel.

+ The current correction is healthy and normal within an uptrend, not a reversal signal.

+ Buyers are still defending the structure as long as price stays above the mid-channel + support zone.

+ Momentum remains bullish — any pullback into the highlighted ENTRY ZONE becomes a high-probability continuation setup.

This is exactly how a strong trending market behaves before its next leg up.

2. MAIN TRADING SCENARIO (HIGH PROBABILITY) – LOOK FOR LONG

➤ Scenario: Price pulls back into the ENTRY ZONE (channel bottom + support zone)

Expectations:

Price retests the lower boundary of the ascending channel

Buyers step in at the confluence area (trendline + structure)

A bullish rejection pattern → strong confirmation for LONG entries

Reasons this setup is high probability:

✓ Confluence of trendline support + horizontal support zone

✓ Clear bullish market structure (higher highs – higher lows)

✓ Retracement after hitting channel resistance is expected

✓ No sign of bearish reversal structure at the moment

Upside Target:

Once price bounces from the entry zone:

TP1: Retest of the resistance zone

TP2: Breakout of the channel → continuation to higher highs (as marked on the chart)

3. Alternative Scenario (Low Probability)

If price breaks below the channel and closes under the support zone:

Market shifts into a corrective phase

Wait for structure to rebuild

No aggressive sells — only reassess when major levels break decisively

But at the moment, the bullish structure remains strong.

4. Conclusion

Gold is still respecting its bullish channel perfectly.

The upcoming pullback is NOT weakness — it is an opportunity.

→ Priority: LOOK FOR LONG in the ENTRY ZONE.

→ Target: A new bullish impulse wave forming toward higher highs.

- Gold is moving inside a well-defined ascending channel, respecting each swing high and swing low with precision — a clear sign that the bullish structure is still intact.

- Key observations:

+ Price has just rejected from the resistance zone at the top of the channel.

+ The current correction is healthy and normal within an uptrend, not a reversal signal.

+ Buyers are still defending the structure as long as price stays above the mid-channel + support zone.

+ Momentum remains bullish — any pullback into the highlighted ENTRY ZONE becomes a high-probability continuation setup.

This is exactly how a strong trending market behaves before its next leg up.

2. MAIN TRADING SCENARIO (HIGH PROBABILITY) – LOOK FOR LONG

➤ Scenario: Price pulls back into the ENTRY ZONE (channel bottom + support zone)

Expectations:

Price retests the lower boundary of the ascending channel

Buyers step in at the confluence area (trendline + structure)

A bullish rejection pattern → strong confirmation for LONG entries

Reasons this setup is high probability:

✓ Confluence of trendline support + horizontal support zone

✓ Clear bullish market structure (higher highs – higher lows)

✓ Retracement after hitting channel resistance is expected

✓ No sign of bearish reversal structure at the moment

Upside Target:

Once price bounces from the entry zone:

TP1: Retest of the resistance zone

TP2: Breakout of the channel → continuation to higher highs (as marked on the chart)

3. Alternative Scenario (Low Probability)

If price breaks below the channel and closes under the support zone:

Market shifts into a corrective phase

Wait for structure to rebuild

No aggressive sells — only reassess when major levels break decisively

But at the moment, the bullish structure remains strong.

4. Conclusion

Gold is still respecting its bullish channel perfectly.

The upcoming pullback is NOT weakness — it is an opportunity.

→ Priority: LOOK FOR LONG in the ENTRY ZONE.

→ Target: A new bullish impulse wave forming toward higher highs.

Trade attivo

➤ Scenario: Price pulls back into the ENTRY ZONE (channel bottom + support zone)

Expectations:

Price retests the lower boundary of the ascending channel

Buyers step in at the confluence area (trendline + structure)

A bullish rejection pattern → strong confirmation for LONG entries

Reasons this setup is high probability:

✓ Confluence of trendline support + horizontal support zone

✓ Clear bullish market structure (higher highs – higher lows)

✓ Retracement after hitting channel resistance is expected

✓ No sign of bearish reversal structure at the moment

Upside Target:

Once price bounces from the entry zone:

TP1: Retest of the resistance zone

TP2: Breakout of the channel → continuation to higher highs (as marked on the chart)

MY COMMUNITY GROUP FREE SIGNAL

✅ 100% Free — I don’t take a penny from anyone

✅ Free Signal: 4 - 6 signals

✅ Trading Idea / Setup / Technical

✅ JOIN MY COMMUNITY GROUP IN Telegram:

t.me/+2pCKgjf_zxplMmQ1

✅ 100% Free — I don’t take a penny from anyone

✅ Free Signal: 4 - 6 signals

✅ Trading Idea / Setup / Technical

✅ JOIN MY COMMUNITY GROUP IN Telegram:

t.me/+2pCKgjf_zxplMmQ1

Pubblicazioni correlate

Declinazione di responsabilità

Le informazioni e le pubblicazioni non sono intese come, e non costituiscono, consulenza o raccomandazioni finanziarie, di investimento, di trading o di altro tipo fornite o approvate da TradingView. Per ulteriori informazioni, consultare i Termini di utilizzo.

MY COMMUNITY GROUP FREE SIGNAL

✅ 100% Free — I don’t take a penny from anyone

✅ Free Signal: 4 - 6 signals

✅ Trading Idea / Setup / Technical

✅ JOIN MY COMMUNITY GROUP IN Telegram:

t.me/+2pCKgjf_zxplMmQ1

✅ 100% Free — I don’t take a penny from anyone

✅ Free Signal: 4 - 6 signals

✅ Trading Idea / Setup / Technical

✅ JOIN MY COMMUNITY GROUP IN Telegram:

t.me/+2pCKgjf_zxplMmQ1

Pubblicazioni correlate

Declinazione di responsabilità

Le informazioni e le pubblicazioni non sono intese come, e non costituiscono, consulenza o raccomandazioni finanziarie, di investimento, di trading o di altro tipo fornite o approvate da TradingView. Per ulteriori informazioni, consultare i Termini di utilizzo.