📘 Mastering the Double Top Pattern — Structure, Psychology & How Smart Money Uses It

- The Double Top is one of the most powerful reversal patterns in technical analysis. When used correctly, it helps traders catch the transition from bullish momentum → bearish reversal with high accuracy.

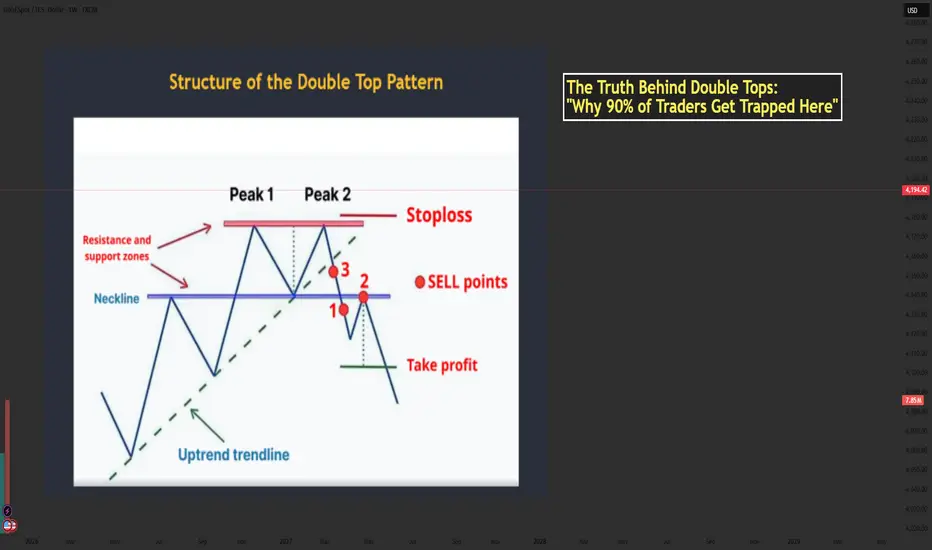

- Let’s break down the structure using the chart you provided and enhance it with professional-level insights.

🔶 1. Structure of the Double Top

1️⃣ The First Top

- Price pushes upward strongly during an uptrend.

- Buyers are in full control and create the first peak.

- After reaching resistance, price pulls back → forming the neckline.

This pullback is normal and represents the market taking profits.

2️⃣ The Second Top

- Price rallies again but fails to break above Peak 1.

- This failure is extremely important — it shows bulls are losing strength.

- The second top traps late buyers who expect a breakout.

3️⃣ The Neckline Break

- Once price breaks below the neckline, the structure is officially confirmed.

- This represents sellers overwhelming buyers.

- A break of structure → shift in market control.

📌 Professional traders only consider the pattern valid AFTER the neckline break.

🔶 2. Market Psychology Behind the Double Top

Understanding the pattern’s psychology is what separates beginners from professional traders.

1️⃣ At Peak 1

Bulls believe the trend will continue.

Retail traders buy aggressively.

2️⃣ Pullback to Neckline

A healthy correction occurs; no one expects a reversal yet.

3️⃣ At Peak 2

This is where emotions start to shift:

- Retail buyers expect a breakout.

- Smart Money uses this area as a liquidity zone to trigger buy stops.

- Institutions often sell into this liquidity, creating the foundation for reversal.

4️⃣ Neckline Break

Panic begins:

Buyers trapped at Peak 2 start closing positions.

Sellers enter aggressively.

Momentum shifts — the trend has reversed.

5️⃣ Retest

The retest is a psychological trap:

- Trapped buyers hope for “one more push up.”

- Sellers add positions at better prices.

- When price rejects the neckline → the downtrend accelerates.

💡 This is why the retest is the safest sell entry.

🔶 3. Conditions for a High-Quality Double Top

To avoid fake patterns, check these criteria:

✔️ Must appear after a clear uptrend

✔️ Both tops should be similar in height

✔️ Volume should decrease on the second top

✔️ Neckline breakout must be decisive and clean

✔️ Better if second peak creates a stop-hunt wicking above Peak 1

✔️ Even more powerful when aligned with:

- HTF resistance

- Institutional zones

- Liquidity sweeps

- Overbought RSI

- Divergence

🔶 4. How to Trade the Double Top

1️⃣ Entry (Sell Zone)

Best Entry:

👉 SELL on the neckline retest after the breakout.

This gives:

- Best accuracy

- Best risk–reward

- Confirmation that the market has shifted bearish

2️⃣ Stop Loss Placement

Place SL:

- Above Peak 2

- Or above Peak 1 (more conservative)

🛑 SL must sit outside the structure to avoid fake moves.

3️⃣ Take Profit Target

The classic measurement:

- Distance from Peak → Neckline

- Projected downward

This gives the first TP.

TP2 can be placed at:

Next support zone

- Fib 1.618 extension

- HTF demand area

🔶 5. Real Market Example

Your image shows:

- Two clear peaks forming under a resistance zone

- Neckline support holding price

- A strong break below the neckline

- Sell entries at the ideal points:

+ Point 1 → aggressive breakout trader

+ Point 2 → safest retest entry

+ Point 3 → early anticipation entry (riskier)

The downward projection after the pattern aligns perfectly with the expected target zone.

🔶 6. Trader Psychology: Why People Lose with Double Tops

Most traders get trapped because they:

❌ Sell too early (before neckline break)

❌ Expect the second top to drop immediately

❌ Ignore volume or candle strength

❌ Enter without waiting for retest

❌ Fear missing out and chase price after the big drop

Smart Money uses these emotions:

- Greed → traps buyers at Peak 2

- Fear → forces panic selling at neckline break

- FOMO → attracts late sellers at the worst price

Your job is to stay patient and enter only at the retest, where probability is highest.

🔶 7. Professional Tips to Master the Double Top

✔️ Wait for structure confirmation → neckline break

✔️ Don’t sell inside the range between the two peaks

✔️ Use RSI divergence to strengthen accuracy

✔️ Look for stop-hunt wicks above Peak 2

✔️ Combine with trendline breaks for timing

✔️ Use a top-down approach (H4 + H1 → M15 entry)

✨ Final Message for Traders

The Double Top is not just a pattern it is a reflection of fear, greed, and trapped liquidity.

Master the psychology behind it, and it becomes one of your most reliable reversal tools.

If this helped your trading, drop a comment and share your thoughts!

Let’s grow together. ❤️📈

- The Double Top is one of the most powerful reversal patterns in technical analysis. When used correctly, it helps traders catch the transition from bullish momentum → bearish reversal with high accuracy.

- Let’s break down the structure using the chart you provided and enhance it with professional-level insights.

🔶 1. Structure of the Double Top

1️⃣ The First Top

- Price pushes upward strongly during an uptrend.

- Buyers are in full control and create the first peak.

- After reaching resistance, price pulls back → forming the neckline.

This pullback is normal and represents the market taking profits.

2️⃣ The Second Top

- Price rallies again but fails to break above Peak 1.

- This failure is extremely important — it shows bulls are losing strength.

- The second top traps late buyers who expect a breakout.

3️⃣ The Neckline Break

- Once price breaks below the neckline, the structure is officially confirmed.

- This represents sellers overwhelming buyers.

- A break of structure → shift in market control.

📌 Professional traders only consider the pattern valid AFTER the neckline break.

🔶 2. Market Psychology Behind the Double Top

Understanding the pattern’s psychology is what separates beginners from professional traders.

1️⃣ At Peak 1

Bulls believe the trend will continue.

Retail traders buy aggressively.

2️⃣ Pullback to Neckline

A healthy correction occurs; no one expects a reversal yet.

3️⃣ At Peak 2

This is where emotions start to shift:

- Retail buyers expect a breakout.

- Smart Money uses this area as a liquidity zone to trigger buy stops.

- Institutions often sell into this liquidity, creating the foundation for reversal.

4️⃣ Neckline Break

Panic begins:

Buyers trapped at Peak 2 start closing positions.

Sellers enter aggressively.

Momentum shifts — the trend has reversed.

5️⃣ Retest

The retest is a psychological trap:

- Trapped buyers hope for “one more push up.”

- Sellers add positions at better prices.

- When price rejects the neckline → the downtrend accelerates.

💡 This is why the retest is the safest sell entry.

🔶 3. Conditions for a High-Quality Double Top

To avoid fake patterns, check these criteria:

✔️ Must appear after a clear uptrend

✔️ Both tops should be similar in height

✔️ Volume should decrease on the second top

✔️ Neckline breakout must be decisive and clean

✔️ Better if second peak creates a stop-hunt wicking above Peak 1

✔️ Even more powerful when aligned with:

- HTF resistance

- Institutional zones

- Liquidity sweeps

- Overbought RSI

- Divergence

🔶 4. How to Trade the Double Top

1️⃣ Entry (Sell Zone)

Best Entry:

👉 SELL on the neckline retest after the breakout.

This gives:

- Best accuracy

- Best risk–reward

- Confirmation that the market has shifted bearish

2️⃣ Stop Loss Placement

Place SL:

- Above Peak 2

- Or above Peak 1 (more conservative)

🛑 SL must sit outside the structure to avoid fake moves.

3️⃣ Take Profit Target

The classic measurement:

- Distance from Peak → Neckline

- Projected downward

This gives the first TP.

TP2 can be placed at:

Next support zone

- Fib 1.618 extension

- HTF demand area

🔶 5. Real Market Example

Your image shows:

- Two clear peaks forming under a resistance zone

- Neckline support holding price

- A strong break below the neckline

- Sell entries at the ideal points:

+ Point 1 → aggressive breakout trader

+ Point 2 → safest retest entry

+ Point 3 → early anticipation entry (riskier)

The downward projection after the pattern aligns perfectly with the expected target zone.

🔶 6. Trader Psychology: Why People Lose with Double Tops

Most traders get trapped because they:

❌ Sell too early (before neckline break)

❌ Expect the second top to drop immediately

❌ Ignore volume or candle strength

❌ Enter without waiting for retest

❌ Fear missing out and chase price after the big drop

Smart Money uses these emotions:

- Greed → traps buyers at Peak 2

- Fear → forces panic selling at neckline break

- FOMO → attracts late sellers at the worst price

Your job is to stay patient and enter only at the retest, where probability is highest.

🔶 7. Professional Tips to Master the Double Top

✔️ Wait for structure confirmation → neckline break

✔️ Don’t sell inside the range between the two peaks

✔️ Use RSI divergence to strengthen accuracy

✔️ Look for stop-hunt wicks above Peak 2

✔️ Combine with trendline breaks for timing

✔️ Use a top-down approach (H4 + H1 → M15 entry)

✨ Final Message for Traders

The Double Top is not just a pattern it is a reflection of fear, greed, and trapped liquidity.

Master the psychology behind it, and it becomes one of your most reliable reversal tools.

If this helped your trading, drop a comment and share your thoughts!

Let’s grow together. ❤️📈

MY COMMUNITY GROUP FREE SIGNAL

✅ 100% Free — I don’t take a penny from anyone

✅ Free Signal: 4 - 6 signals

✅ Trading Idea / Setup / Technical

✅ JOIN MY COMMUNITY GROUP IN Telegram:

t.me/+2pCKgjf_zxplMmQ1

✅ 100% Free — I don’t take a penny from anyone

✅ Free Signal: 4 - 6 signals

✅ Trading Idea / Setup / Technical

✅ JOIN MY COMMUNITY GROUP IN Telegram:

t.me/+2pCKgjf_zxplMmQ1

Pubblicazioni correlate

Declinazione di responsabilità

Le informazioni e le pubblicazioni non sono intese come, e non costituiscono, consulenza o raccomandazioni finanziarie, di investimento, di trading o di altro tipo fornite o approvate da TradingView. Per ulteriori informazioni, consultare i Termini di utilizzo.

MY COMMUNITY GROUP FREE SIGNAL

✅ 100% Free — I don’t take a penny from anyone

✅ Free Signal: 4 - 6 signals

✅ Trading Idea / Setup / Technical

✅ JOIN MY COMMUNITY GROUP IN Telegram:

t.me/+2pCKgjf_zxplMmQ1

✅ 100% Free — I don’t take a penny from anyone

✅ Free Signal: 4 - 6 signals

✅ Trading Idea / Setup / Technical

✅ JOIN MY COMMUNITY GROUP IN Telegram:

t.me/+2pCKgjf_zxplMmQ1

Pubblicazioni correlate

Declinazione di responsabilità

Le informazioni e le pubblicazioni non sono intese come, e non costituiscono, consulenza o raccomandazioni finanziarie, di investimento, di trading o di altro tipo fornite o approvate da TradingView. Per ulteriori informazioni, consultare i Termini di utilizzo.