Geopolitical Tensions Drive Short-Term Gold Rally – Strategic Approach for the Next Move

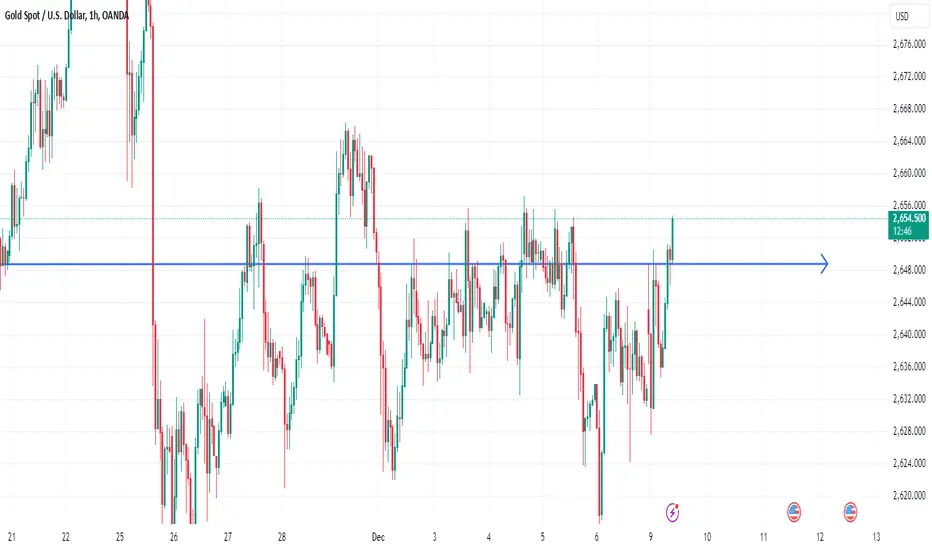

In recent sessions, geopolitical tensions, particularly Israel's military actions in Syria, have spurred risk-off sentiment, driving gold prices higher in early trading. However, despite the short-term surge fueled by geopolitical risks, gold prices have failed to break above last week's key resistance level at 2655. Given that gold is currently trading at historical highs, a correction or consolidation at these levels seems likely.

We believe this rally is primarily driven by short-term geopolitical risk factors, rather than fundamental support. Once the market has priced in these risks, gold prices are likely to undergo a pullback, creating more favorable conditions for a long position at lower levels.

Today's Strategy Recommendations:

Short Strategy at Key Resistance: If gold rises above 2655, consider implementing a short position. If the price breaks above 2660, additional short positions can be added, anticipating downward pressure in the near term.

Wait for Pullback to Enter Long: It is recommended to wait for a price pullback to a suitable support level before considering a long position. Exact entry points will depend on market reactions and technical signals.

Disclaimer: This analysis is for informational purposes only. All trades should be executed with strict risk management in place, avoiding over-leveraging and ensuring capital protection.

In recent sessions, geopolitical tensions, particularly Israel's military actions in Syria, have spurred risk-off sentiment, driving gold prices higher in early trading. However, despite the short-term surge fueled by geopolitical risks, gold prices have failed to break above last week's key resistance level at 2655. Given that gold is currently trading at historical highs, a correction or consolidation at these levels seems likely.

We believe this rally is primarily driven by short-term geopolitical risk factors, rather than fundamental support. Once the market has priced in these risks, gold prices are likely to undergo a pullback, creating more favorable conditions for a long position at lower levels.

Today's Strategy Recommendations:

Short Strategy at Key Resistance: If gold rises above 2655, consider implementing a short position. If the price breaks above 2660, additional short positions can be added, anticipating downward pressure in the near term.

Wait for Pullback to Enter Long: It is recommended to wait for a price pullback to a suitable support level before considering a long position. Exact entry points will depend on market reactions and technical signals.

Disclaimer: This analysis is for informational purposes only. All trades should be executed with strict risk management in place, avoiding over-leveraging and ensuring capital protection.

Declinazione di responsabilità

Le informazioni e le pubblicazioni non sono intese come, e non costituiscono, consulenza o raccomandazioni finanziarie, di investimento, di trading o di altro tipo fornite o approvate da TradingView. Per ulteriori informazioni, consultare i Termini di utilizzo.

Declinazione di responsabilità

Le informazioni e le pubblicazioni non sono intese come, e non costituiscono, consulenza o raccomandazioni finanziarie, di investimento, di trading o di altro tipo fornite o approvate da TradingView. Per ulteriori informazioni, consultare i Termini di utilizzo.