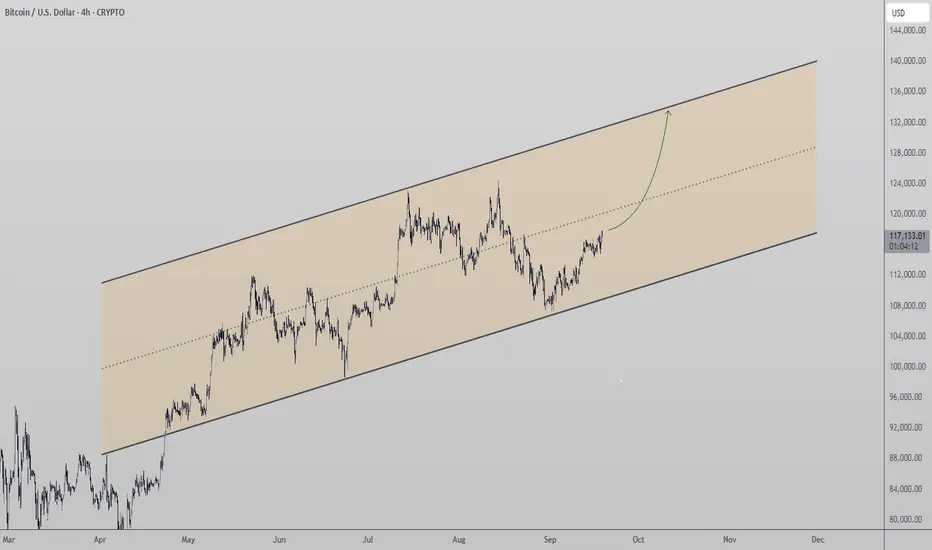

Bitcoin’s price action remains highly technical as it trades within a clearly defined high-time-frame channel. After rebounding from the channel’s lower boundary, price is now testing the midpoint. This midpoint has historically acted as a pivotal level that determines whether Bitcoin continues higher or re-enters a period of extended consolidation.

Key Technical Points

- Channel Support: Lower boundary respected, reinforcing bullish structure.

- Midpoint Test: A close above confirms bullish continuation.

- Upside Target: Channel resistance aligns with $133,000.

Analysis

The structure of this channel has remained consistent over the past months, providing both support and resistance zones. Bitcoin’s defense of the lower base confirmed that bulls are still in control of the broader trend. The move toward the midpoint is the next critical step.

Reclaiming the midpoint on a closing basis would significantly strengthen the bullish case. It would provide a technical base for price to begin targeting the upper boundary of the channel, which sits around $133,000. Until that reclaim is confirmed, Bitcoin may continue consolidating around the midpoint, with shorter-term swings dictated by intraday order flow.

The bullish case remains intact as long as the channel boundaries continue to hold. Structural invalidation would only occur if price breaks below the lower channel support, but current market behavior shows no sign of such weakness.

What to Expect

Bitcoin is likely to consolidate near the midpoint before making a decisive move. If bulls succeed in reclaiming and holding this level, price has a strong probability of accelerating toward $133,000.

Key Technical Points

- Channel Support: Lower boundary respected, reinforcing bullish structure.

- Midpoint Test: A close above confirms bullish continuation.

- Upside Target: Channel resistance aligns with $133,000.

Analysis

The structure of this channel has remained consistent over the past months, providing both support and resistance zones. Bitcoin’s defense of the lower base confirmed that bulls are still in control of the broader trend. The move toward the midpoint is the next critical step.

Reclaiming the midpoint on a closing basis would significantly strengthen the bullish case. It would provide a technical base for price to begin targeting the upper boundary of the channel, which sits around $133,000. Until that reclaim is confirmed, Bitcoin may continue consolidating around the midpoint, with shorter-term swings dictated by intraday order flow.

The bullish case remains intact as long as the channel boundaries continue to hold. Structural invalidation would only occur if price breaks below the lower channel support, but current market behavior shows no sign of such weakness.

What to Expect

Bitcoin is likely to consolidate near the midpoint before making a decisive move. If bulls succeed in reclaiming and holding this level, price has a strong probability of accelerating toward $133,000.

Join the Free Trading Group

Telegram: t.me/freetradingden 🔥

Claim $1000 Deposit Bonus 🎁

Trade with perks & support the community!

partner.blofin.com/d/TheAlchemist

Stay sharp, trade smart.

— Team The Alchemist ⚔️

Telegram: t.me/freetradingden 🔥

Claim $1000 Deposit Bonus 🎁

Trade with perks & support the community!

partner.blofin.com/d/TheAlchemist

Stay sharp, trade smart.

— Team The Alchemist ⚔️

Declinazione di responsabilità

Le informazioni ed i contenuti pubblicati non costituiscono in alcun modo una sollecitazione ad investire o ad operare nei mercati finanziari. Non sono inoltre fornite o supportate da TradingView. Maggiori dettagli nelle Condizioni d'uso.

Join the Free Trading Group

Telegram: t.me/freetradingden 🔥

Claim $1000 Deposit Bonus 🎁

Trade with perks & support the community!

partner.blofin.com/d/TheAlchemist

Stay sharp, trade smart.

— Team The Alchemist ⚔️

Telegram: t.me/freetradingden 🔥

Claim $1000 Deposit Bonus 🎁

Trade with perks & support the community!

partner.blofin.com/d/TheAlchemist

Stay sharp, trade smart.

— Team The Alchemist ⚔️

Declinazione di responsabilità

Le informazioni ed i contenuti pubblicati non costituiscono in alcun modo una sollecitazione ad investire o ad operare nei mercati finanziari. Non sono inoltre fornite o supportate da TradingView. Maggiori dettagli nelle Condizioni d'uso.