Technical Overview

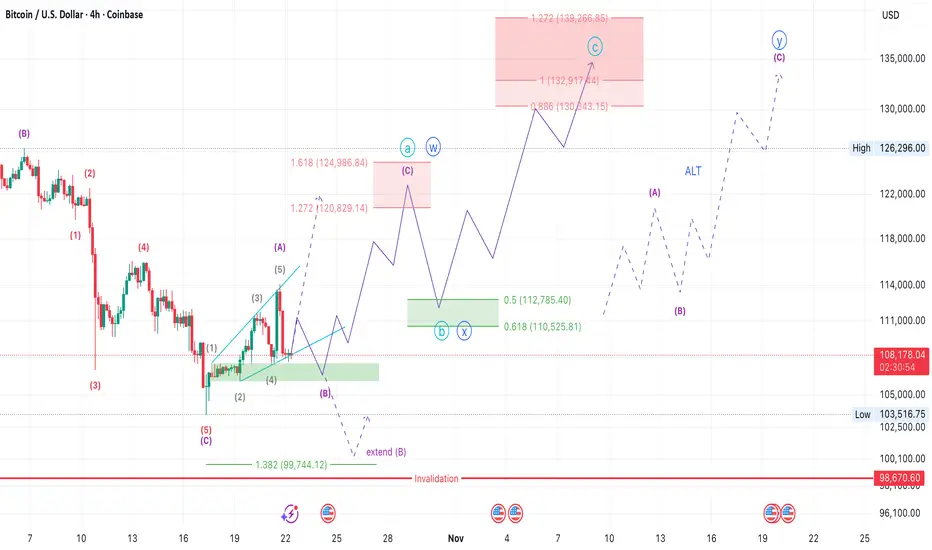

Bitcoin appears to be developing the final micro-structure inside Wave 5 of a larger ending diagonal pattern, which aligns with the broader weekly count.

After the recent low near $103500, price began forming a corrective rise that may represent wave ABC OR WXY of the final push to complete the terminal pattern.

The current 4H projection suggests that BTC will building subwave (C) within a potential W–X–Y structure. The next impulsive move could lift prices toward $130K–$139K, completing the upper boundary of the diagonal before a major reversal begins.

Key Levels:

Summary:

BTC is in the final phase of an extended ending diagonal, likely completing wave (5) of (V).

The short-term setup remains bullish toward 130–139K, but traders should prepare for a major macro reversal once that zone is reached.

Momentum divergences and weakening volume will be key confirmation signals for the top.

Bitcoin appears to be developing the final micro-structure inside Wave 5 of a larger ending diagonal pattern, which aligns with the broader weekly count.

After the recent low near $103500, price began forming a corrective rise that may represent wave ABC OR WXY of the final push to complete the terminal pattern.

The current 4H projection suggests that BTC will building subwave (C) within a potential W–X–Y structure. The next impulsive move could lift prices toward $130K–$139K, completing the upper boundary of the diagonal before a major reversal begins.

Key Levels:

- Support / Buy Zone: 106 – 107k

- First Target: 120 - 124k

- Main Target Zone: 130 – 139k

- Invalidation: Below 99,744 (1.382 Fib level) which will invalidate the idea of extended wave B

Summary:

BTC is in the final phase of an extended ending diagonal, likely completing wave (5) of (V).

The short-term setup remains bullish toward 130–139K, but traders should prepare for a major macro reversal once that zone is reached.

Momentum divergences and weakening volume will be key confirmation signals for the top.

Declinazione di responsabilità

Le informazioni ed i contenuti pubblicati non costituiscono in alcun modo una sollecitazione ad investire o ad operare nei mercati finanziari. Non sono inoltre fornite o supportate da TradingView. Maggiori dettagli nelle Condizioni d'uso.

Declinazione di responsabilità

Le informazioni ed i contenuti pubblicati non costituiscono in alcun modo una sollecitazione ad investire o ad operare nei mercati finanziari. Non sono inoltre fornite o supportate da TradingView. Maggiori dettagli nelle Condizioni d'uso.