With the drop in oil prices,  JETS, the new ETF that holds airline companies like Delta (

JETS, the new ETF that holds airline companies like Delta ( DAL), American Airlines (

DAL), American Airlines ( AAL) and southwest airlines company (

AAL) and southwest airlines company ( LUV) had a very nice rally during the month of July.

LUV) had a very nice rally during the month of July.

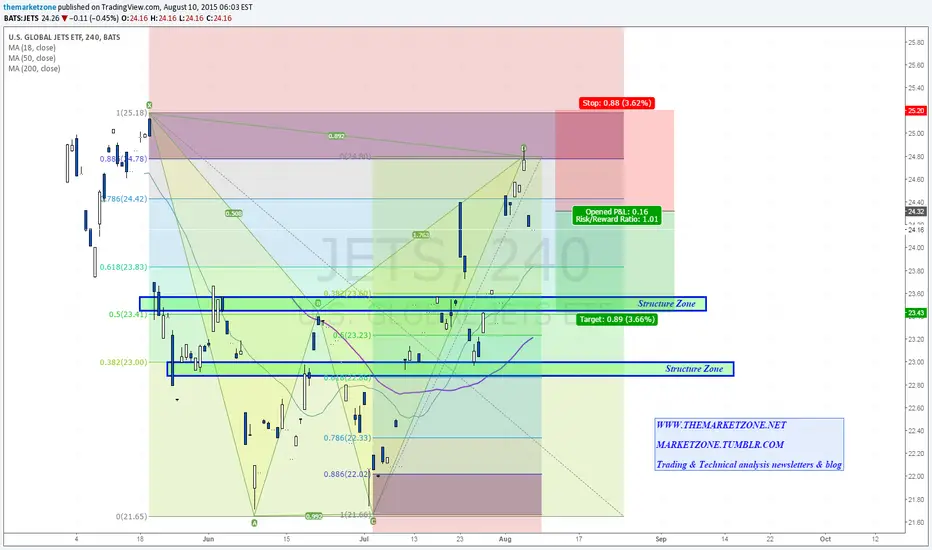

The ETF rallied all the way up to the 88.6 Fib level to complete a bearish Bat pattern and declined from there.

ETF rallied all the way up to the 88.6 Fib level to complete a bearish Bat pattern and declined from there.

The pattern's targets are 23.5$ and 23$ which also come with daily support zones.

The current price level offer about 1:1 R/R ration for the short position with stop loss above X and 23.5$ as initial target zone.

This might work with the bullish scenario I posted earlier for oil

The

The pattern's targets are 23.5$ and 23$ which also come with daily support zones.

The current price level offer about 1:1 R/R ration for the short position with stop loss above X and 23.5$ as initial target zone.

This might work with the bullish scenario I posted earlier for oil

Pubblicazioni correlate

Declinazione di responsabilità

Le informazioni ed i contenuti pubblicati non costituiscono in alcun modo una sollecitazione ad investire o ad operare nei mercati finanziari. Non sono inoltre fornite o supportate da TradingView. Maggiori dettagli nelle Condizioni d'uso.

Pubblicazioni correlate

Declinazione di responsabilità

Le informazioni ed i contenuti pubblicati non costituiscono in alcun modo una sollecitazione ad investire o ad operare nei mercati finanziari. Non sono inoltre fornite o supportate da TradingView. Maggiori dettagli nelle Condizioni d'uso.