📊 MSTR – MicroStrategy Technical & Bitcoin Correlation

Ticker: MSTR | Sector: Bitcoin Treasury Proxy / Enterprise Software

Date: July 26, 2025

Current MSTR Price: ~$405.89

Current Bitcoin Price: ~$118,127

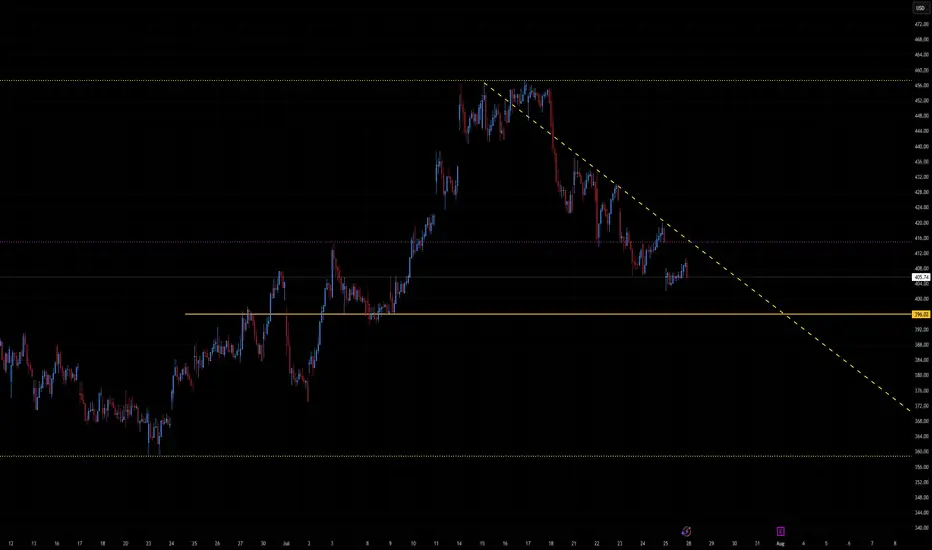

🔍 Chart & Price Structure

Recent Action: MSTR declined from the ~$430–450 range and has consolidated around the $405 level, forming a tight base.

Support Zone: $395–$400 — prior volume cluster, recent dip buyers stepped in.

Weak Resistance: $415–$420 — a shallow supply zone; bigger resistance lies at ~$430.

Volume & Candles: Mixed volume, with small-bodied candles showing indecision near $405. Buyers are attempting to hold.

📈 Bitcoin Outlook & Influence

MicroStrategy remains tethered to Bitcoin’s trajectory. Recent BTC consolidation around $118K closely influences MSTR sentiment.

BTC Projections

From Citi (Jul 25):

Base Case: $135K by year-end

Bull Case: $199K

Bear Case: $64K if equities falter or ETF flows wane

Other Views:

Hashdex sees BTC reaching up to $140K in 2025

Omni Ekonomi

Global X ETF-based models anticipate $200K within 12 months

The Australian

Kiyosaki warns of potential crash despite optimism

These imply a possible 25–70% upside in BTC, which could drive MSTR toward $500–$600+ if holdings are stable.

⏱️ Short-Term Outlook (1–2 Weeks)

✅ Bullish Scenario

Trigger: Hold above support at $400, reclaim $415–$420

Immediate Upside Targets:

First: $430

Break above $430 → $450

Drivers: Bitcoin breaking back above recent highs, ETF inflows, favorable regulatory headlines

❌ Bearish Scenario

Trigger: Break below $395

Downside Targets:

$380 → $360 → $350

Drivers: BTC weakness → below $110K, altcoin rotation, broader equity weakness

🔭 Long-Term Outlook (H2 2025 / beyond)

🚀 Bull Case

If Bitcoin reaches $135K–$200K (Citi bull case, institutional demand, ETF momentum), MSTR could rally alongside to $550–$650.

MicroStrategy’s business fundamentals (data analytics/AI) may contribute optionality beyond BTC.

🐻 Bear Case

If Bitcoin retraces toward $64K or below due to risk-off sentiment or regulatory changes, MSTR could fall back toward $300–$350.

📊 Summary Table

View Trigger Level Targets Bitcoin Scenario Confidence

Short-Term Bull Above $405 and reclaim $415–420 $430 → $450 BTC > $118K and flat-to-up Moderate

Short-Term Bear Below $395 $380 → $360 → $350 BTC dips < $115K Moderate

Long-Term Bull BTC to $135K–$200K $550 → $600+ ETF inflows + adoption acceleration High (if BTC strength)

Long-Term Bear BTC drops below $110K $350 → $300 Sentiment collapse or regulation Moderate

🧠 Conclusion

MicroStrategy’s stock remains inherently tethered to Bitcoin performance. The $395–$405 zone acts as critical support, while a push above $415–$430 could signal renewed upside. Longer-term, BTC strength into the $135K–200K range would propel MSTR toward $600+ levels; a BTC pullback could drag it toward $300 or lower.

Watch Bitcoin flows, ETF updates, and pillar crypto adoption trends—these are likely to dictate MSTR’s next leg.

Ticker: MSTR | Sector: Bitcoin Treasury Proxy / Enterprise Software

Date: July 26, 2025

Current MSTR Price: ~$405.89

Current Bitcoin Price: ~$118,127

🔍 Chart & Price Structure

Recent Action: MSTR declined from the ~$430–450 range and has consolidated around the $405 level, forming a tight base.

Support Zone: $395–$400 — prior volume cluster, recent dip buyers stepped in.

Weak Resistance: $415–$420 — a shallow supply zone; bigger resistance lies at ~$430.

Volume & Candles: Mixed volume, with small-bodied candles showing indecision near $405. Buyers are attempting to hold.

📈 Bitcoin Outlook & Influence

MicroStrategy remains tethered to Bitcoin’s trajectory. Recent BTC consolidation around $118K closely influences MSTR sentiment.

BTC Projections

From Citi (Jul 25):

Base Case: $135K by year-end

Bull Case: $199K

Bear Case: $64K if equities falter or ETF flows wane

Other Views:

Hashdex sees BTC reaching up to $140K in 2025

Omni Ekonomi

Global X ETF-based models anticipate $200K within 12 months

The Australian

Kiyosaki warns of potential crash despite optimism

These imply a possible 25–70% upside in BTC, which could drive MSTR toward $500–$600+ if holdings are stable.

⏱️ Short-Term Outlook (1–2 Weeks)

✅ Bullish Scenario

Trigger: Hold above support at $400, reclaim $415–$420

Immediate Upside Targets:

First: $430

Break above $430 → $450

Drivers: Bitcoin breaking back above recent highs, ETF inflows, favorable regulatory headlines

❌ Bearish Scenario

Trigger: Break below $395

Downside Targets:

$380 → $360 → $350

Drivers: BTC weakness → below $110K, altcoin rotation, broader equity weakness

🔭 Long-Term Outlook (H2 2025 / beyond)

🚀 Bull Case

If Bitcoin reaches $135K–$200K (Citi bull case, institutional demand, ETF momentum), MSTR could rally alongside to $550–$650.

MicroStrategy’s business fundamentals (data analytics/AI) may contribute optionality beyond BTC.

🐻 Bear Case

If Bitcoin retraces toward $64K or below due to risk-off sentiment or regulatory changes, MSTR could fall back toward $300–$350.

📊 Summary Table

View Trigger Level Targets Bitcoin Scenario Confidence

Short-Term Bull Above $405 and reclaim $415–420 $430 → $450 BTC > $118K and flat-to-up Moderate

Short-Term Bear Below $395 $380 → $360 → $350 BTC dips < $115K Moderate

Long-Term Bull BTC to $135K–$200K $550 → $600+ ETF inflows + adoption acceleration High (if BTC strength)

Long-Term Bear BTC drops below $110K $350 → $300 Sentiment collapse or regulation Moderate

🧠 Conclusion

MicroStrategy’s stock remains inherently tethered to Bitcoin performance. The $395–$405 zone acts as critical support, while a push above $415–$430 could signal renewed upside. Longer-term, BTC strength into the $135K–200K range would propel MSTR toward $600+ levels; a BTC pullback could drag it toward $300 or lower.

Watch Bitcoin flows, ETF updates, and pillar crypto adoption trends—these are likely to dictate MSTR’s next leg.

Declinazione di responsabilità

Le informazioni ed i contenuti pubblicati non costituiscono in alcun modo una sollecitazione ad investire o ad operare nei mercati finanziari. Non sono inoltre fornite o supportate da TradingView. Maggiori dettagli nelle Condizioni d'uso.

Declinazione di responsabilità

Le informazioni ed i contenuti pubblicati non costituiscono in alcun modo una sollecitazione ad investire o ad operare nei mercati finanziari. Non sono inoltre fornite o supportate da TradingView. Maggiori dettagli nelle Condizioni d'uso.