🔎Overview

____________________________________________________________

📌 How to Use

____________________________________________________________

📊 Chart Explanation

____________________________________________________________

👀 Observations

____________________________________________________________

💡 Why It Matters

____________________________________________________________

✅ Conclusion

____________________________________________________________

⚠️ Disclaimer

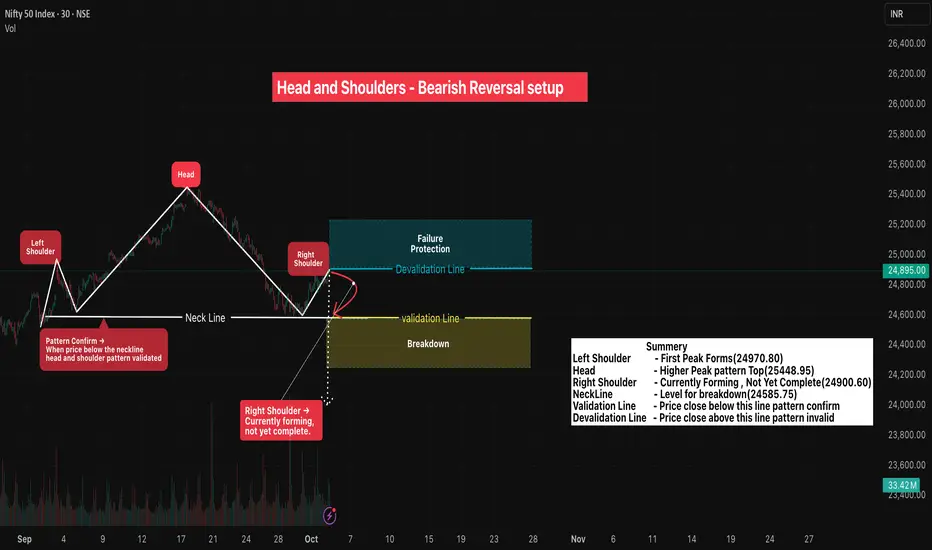

The Head and Shoulders Pattern is a classic bearish reversal formation that signals a potential change in trend from uptrend to downtrend.

It is formed by three peaks:

- Left Shoulder → Price rises, forms a peak, then retraces.

- Head → Price moves higher than the left shoulder, creating the tallest peak, then falls back.

- Right Shoulder → Price rises again but fails to surpass the head, showing loss of momentum.

- Neckline → A line drawn through the two troughs between the shoulders and the head. A breakdown below the neckline confirms bearish sentiment.

This pattern reflects weakening buying pressure and strengthening selling interest, often appearing at the end of strong rallies.

____________________________________________________________

📌 How to Use

• ✅ Pattern Confirmed → When candle closes below the Validation Line

• ❌ Pattern Invalid → If candle closes above the Devalidation Line(Failure Protection).

• Protects against false signals & ensures structured risk management.

____________________________________________________________

📊 Chart Explanation

• Symbol →NIFTY

• Timeframe → 30m

• Left Shoulder Peak - 24970.30

• Head (Highest Peak) - 25448.95

• Right Shoulder Peak - 24900.80

• Neckline → Drawn by connecting the two troughs between shoulders and head.

• Validation Level → 24,585.75 → Close below = Pattern Confirmed.

• Devalidation Level → 24,910.65 → Close above = Pattern Invalid.

____________________________________________________________

👀 Observations

- The right shoulder often appears weaker, highlighting reduced buyer confidence.

- Once the neckline is tested multiple times, probability of a breakdown increases.

- Volume generally decreases during formation and expands during breakdown, strengthening confirmation.

- This setup helps traders anticipate major reversals rather than chasing late entries.

- Head and Shoulders is widely followed, making it self-fulfilling as many traders act on the same signal.

____________________________________________________________

💡 Why It Matters

Head & Shoulders is one of the most reliable reversal patterns, giving clear validation/devalidation levels for structured risk management. It helps avoid false breakouts and provides traders with predefined stop-loss and target zones.

____________________________________________________________

✅ Conclusion

Breakdown below the Validation Lineconfirms bearish reversal bias. Combine this with broader market context, volume confirmation, and disciplined position sizing for effective trading decisions.

____________________________________________________________

⚠️ Disclaimer

📘 For educational purposes only.

🙅 Not SEBI registered.

❌ Not a buy/sell recommendation.

🧠 Purely a learning resource.

📊 Not Financial Advice.

Declinazione di responsabilità

Le informazioni ed i contenuti pubblicati non costituiscono in alcun modo una sollecitazione ad investire o ad operare nei mercati finanziari. Non sono inoltre fornite o supportate da TradingView. Maggiori dettagli nelle Condizioni d'uso.

Declinazione di responsabilità

Le informazioni ed i contenuti pubblicati non costituiscono in alcun modo una sollecitazione ad investire o ad operare nei mercati finanziari. Non sono inoltre fornite o supportate da TradingView. Maggiori dettagli nelle Condizioni d'uso.