hi traders,

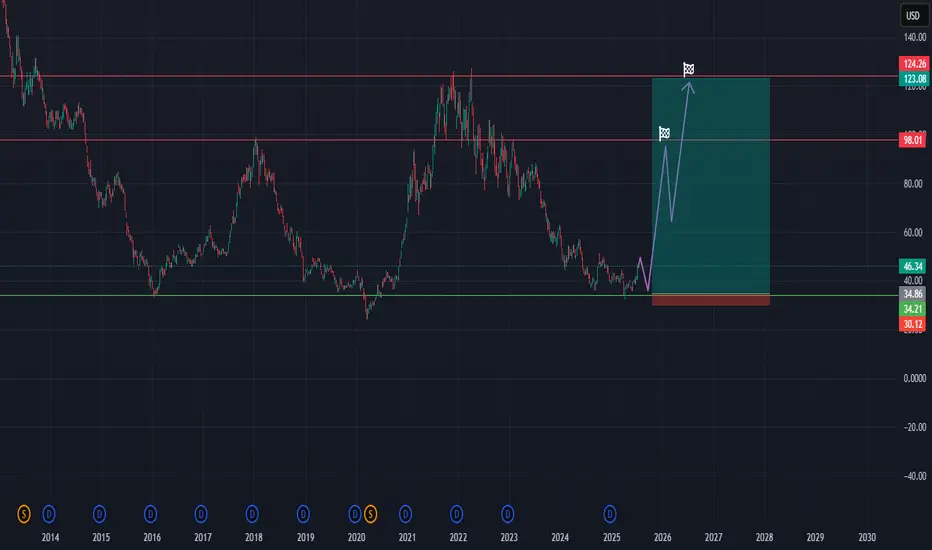

1. The chart shows REMX has experienced a significant downtrend since late 2021/early 2022, reaching levels last seen around 2020.

2. Entry Strategy (Green Box):

The idea is to enter long positions as the price approaches or bounces from this established support area, anticipating a reversal or a significant rebound.

3. Stop-Loss ($30):

A stop-loss is crucial to limit potential losses if the support level fails and the price continues to decline, invalidating the bullish thesis.

4. Price Targets (Purple Arrows and Red Lines):

Target 1 (First Purple Arrow & Red Line): The first target is around $98.01. This level acted as significant resistance/support in the past (around mid-2022 and early 2021).

Target 2 (Second Purple Arrow & Red Line): The second, more ambitious target is around $124.26 to $123.08. This represents a major resistance level from the 2021-2022 peaks.

These targets are based on previous price action, aiming to capture a substantial portion of a potential recovery. The two targets allow for a tiered profit-taking strategy.

* Summary of the Trading Idea:

This trading idea is a long-term bullish bet on REMX, based on the assumption that the ETF is currently near a significant historical support level and is due for a substantial rebound. The strategy involves accumulating positions in the identified entry zone, setting a stop-loss below the key support, and aiming for two distinct profit targets corresponding to prior resistance levels. The time horizon for this trade appears to be medium to long-term, potentially extending into 2026-2028,

1. The chart shows REMX has experienced a significant downtrend since late 2021/early 2022, reaching levels last seen around 2020.

2. Entry Strategy (Green Box):

The idea is to enter long positions as the price approaches or bounces from this established support area, anticipating a reversal or a significant rebound.

3. Stop-Loss ($30):

A stop-loss is crucial to limit potential losses if the support level fails and the price continues to decline, invalidating the bullish thesis.

4. Price Targets (Purple Arrows and Red Lines):

Target 1 (First Purple Arrow & Red Line): The first target is around $98.01. This level acted as significant resistance/support in the past (around mid-2022 and early 2021).

Target 2 (Second Purple Arrow & Red Line): The second, more ambitious target is around $124.26 to $123.08. This represents a major resistance level from the 2021-2022 peaks.

These targets are based on previous price action, aiming to capture a substantial portion of a potential recovery. The two targets allow for a tiered profit-taking strategy.

* Summary of the Trading Idea:

This trading idea is a long-term bullish bet on REMX, based on the assumption that the ETF is currently near a significant historical support level and is due for a substantial rebound. The strategy involves accumulating positions in the identified entry zone, setting a stop-loss below the key support, and aiming for two distinct profit targets corresponding to prior resistance levels. The time horizon for this trade appears to be medium to long-term, potentially extending into 2026-2028,

💥 Free signals and ideas ➡ t.me/vfinvestment

Declinazione di responsabilità

Le informazioni ed i contenuti pubblicati non costituiscono in alcun modo una sollecitazione ad investire o ad operare nei mercati finanziari. Non sono inoltre fornite o supportate da TradingView. Maggiori dettagli nelle Condizioni d'uso.

💥 Free signals and ideas ➡ t.me/vfinvestment

Declinazione di responsabilità

Le informazioni ed i contenuti pubblicati non costituiscono in alcun modo una sollecitazione ad investire o ad operare nei mercati finanziari. Non sono inoltre fornite o supportate da TradingView. Maggiori dettagli nelle Condizioni d'uso.