Here's What to Expect from Boeing's Next Earnings Report

Arlington, Virginia-based The Boeing Company BA designs, develops, manufactures, sells, and services commercial jetliners, military aircraft, satellites, missile defense, human space flight, and launch systems. With a market cap of $104.2 billion, Boeing’s operations span the Americas, Indo-Pacific, Europe, and internationally.

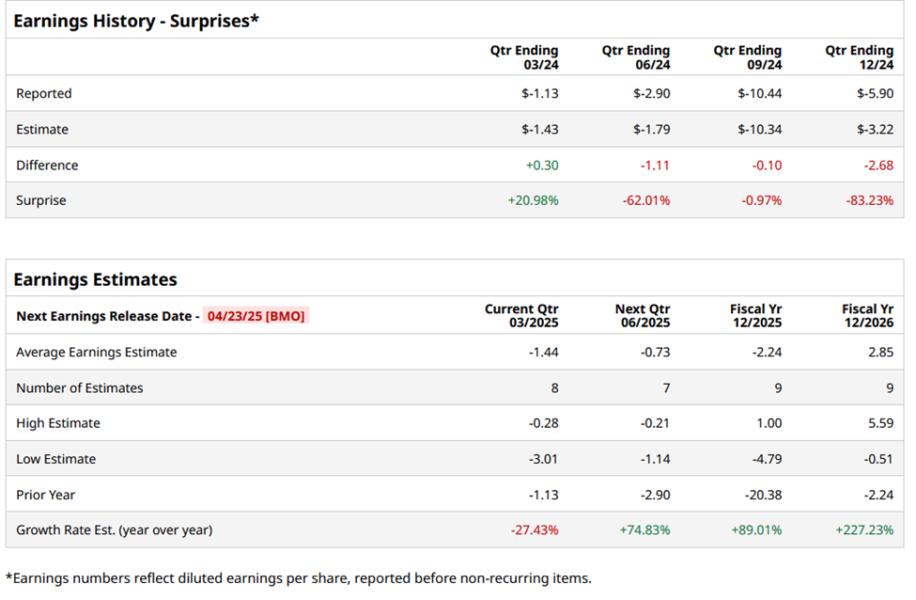

The airline giant is set to announce its Q1 results before the market opens on Wednesday, Apr. 23. Ahead of the event, analysts expect BA to report a loss of $1.44 per share, up 27.4% from the year-ago quarter's loss of $1.13 per share. Furthermore, the company has failed to surpass analysts' consensus estimates in three of the last four quarters, while surpassing in only one quarter. In the previous quarter, it reported a loss per share of $5.90, which failed to meet the consensus estimate by 83.2%.

More Top Stocks Daily: Go behind Wall Street’s hottest headlines with Barchart’s Active Investor newsletter.However, for the full fiscal 2025, analysts expect BA to report a loss per share of $2.24, down 89% from a loss per share of $20.38 in fiscal 2024. Looking ahead, analysts expect its earnings to surge 227.2% year-over-year to $2.85 per share in fiscal 2026.

Over the past year, BA shares have tanked 23.2%, significantly underperforming the S&P 500 Index’s ($SPX) 4.2% fall and the Industrial Select Sector SPDR Fund’s (XLI) 7.2% decline over the same time frame.

Despite missing Street expectations, Boeing's stock prices rose 1.5% following its Q4 earnings release on Jan. 28. The company reported a 30.8% year-over-year decline in its revenues, which amounted to $15.2 billion. Meanwhile, the International Association of Machinists and Aerospace Workers (IAM) work stoppage and agreement, charges for certain defense programs, and costs associated with workforce reductions, collectively caused the company to announce disappointing financials and miss the Street's earnings estimates. Moreover, BA also reported a loss from operations of $3.8 billion, down from an income of $283 million in the previous year's Q4. Following the initial uptick, BA stock plunged 2.3% in the subsequent trading session.

However, analysts' consensus opinion on BA stock is moderately optimistic, with a "Moderate Buy" rating overall. Among 25 analysts covering the stock, opinions include 17 "Strong Buys," one "Moderate Buy,” six "Holds," and one “Strong Sell.” BA's mean price of $204.17 implies a premium of 46.5% from its prevailing price level.

On the date of publication, Aditya Sarawgi did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Elliott Management Is Buying Up Shares of This 1 European Company in Hopes of a Turnaround. Should You?

- 3 Dividend Kings You’ll Regret Ignoring - Wall Street Sees Big Upside in These Picks

- 1 Defense Stock to Buy for Protection During These Uncertain Times

- DARPA Just Picked IonQ in a Major Win for the Quantum Computing Company. Is That Enough to Buy IONQ Stock on the Dip?