DefiLlama to delist Aster perpetual volume data over integrity concerns

Decentralized finance (DeFi) analytics platform DefiLlama is delisting perpetual futures volume data for the Aster decentralized exchange platform (DEX) due to data integrity concerns, according to 0xngmi, a pseudonymous co-founder of DefiLlama.

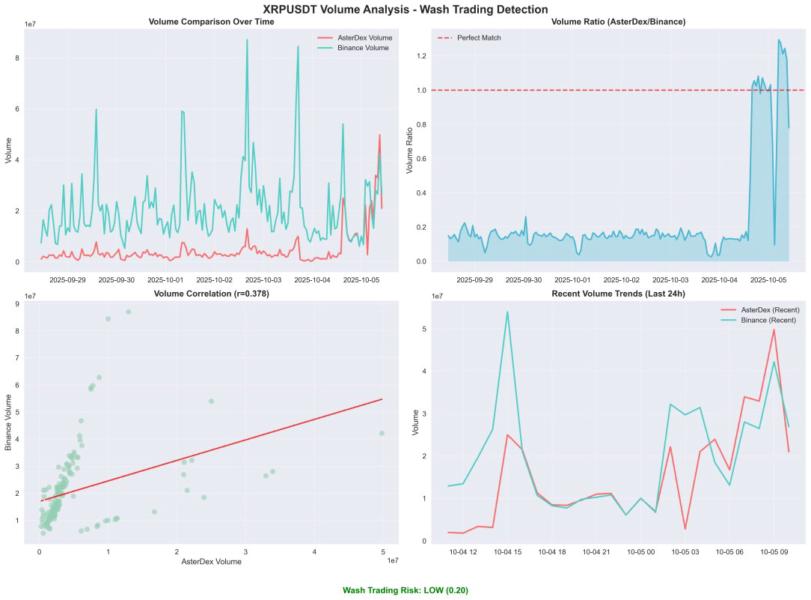

Trading volume on Aster, which is linked to CZ, co-founder of the Binance crypto exchange, is now “mirroring Binance Perp volumes almost exactly,” 0xngmi said, adding that the correlation ratio between Binance and Aster trading volumes is about 1. He continued:

Cointelegraph reached out to the Aster team, but had not received a response by the time of publication.

Aster emerged as a competitor to Hyperliquid, a decentralized perpetual crypto futures exchange, in September, and has captured narrative attention from the crypto community due to CZ’s ties with the platform and the popularity of Hyperliquid.

Analysts weigh whether Aster can overtake Hyperliquid

Open Interest on Aster surged by over 33,500% in less than seven days during the week of Sept. 24, signaling significant demand for the perpetual futures DEX and putting its trading activity on par with Hyperliquid.

Daily perpetual trading volume surged to an all-time high of $60 billion on Sept. 25, according to DeFi analytics platform DefiLlama.

The surge in trading volume was attributed to the growth of Aster, as the platform captures mindshare from traders and investors in the crypto community.

Aster’s price can still grow by 480%, putting its price around $10, market analyst Marcell predicted in September. “Aster already flipped HYPE in daily volume and in daily revenue,” he said.

The Aster token is trading at about $1.83 at the time of this writing, down from its all-time high price of over $2.30, according to CoinMarketCap.

Aster’s token could rally by up to 35% and form new all-time highs in October, which is typically a good month for crypto prices, analysts forecast.