Canadian GDP is a clear sign that rates will need to come down next year - CIBC

Today's advanced reading on GDP suggested a flat reading for Q3 following a slight contraction in Q2. That's much softer than the Bank of Canada's forecast for +0.8% GDP growth

Goods-producing industries have been in decline for five consecutive months, with agriculture notably down due to dry conditions in Western Canada and CIBC warns that could understate strength in the economy.

Overall though, they think the Bank of Canada is done hiking and will increasingly tilt towards rate cuts.

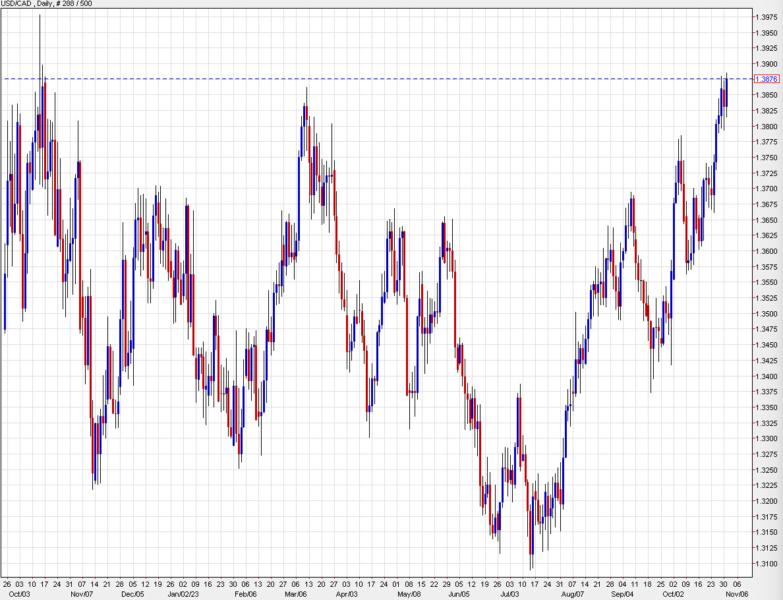

USD/CAD hit a one-year high today and I suspect it has much further to go.

USDCAD daily