Watsco: A Durable Compounder in America's Heating and Cooling Backbone

Introduction

Watsco Inc. isn't a flashy name in tech or a disruptor in artificial intelligence. Instead, it's the largest distributor of HVAC/R (heating, ventilation, air conditioning, and refrigeration) equipment and parts in North America, powering an industry that underpins comfort, productivity, and health across homes and businesses. While the business may look simple on the surface, Watsco has quietly built a distribution empire with remarkable pricing power, recession-resilient demand, and a capital-light model that compounds value over decades.

In an industry driven by replacement cycles, regulation, and contractor loyalty, Watsco's dominance stems not from manufacturing products but from owning the customer relationship and controlling the supply chain at scale. With over 670 locations and a product portfolio spanning mission-critical systems, the company thrives at the intersection of necessity and scale. As the U.S. faces ongoing climate volatility and infrastructure aging, Watsco stands to benefit from secular tailwinds that are less cyclical and more structural.

What makes this story particularly compelling today is the market's muted recognition of Watsco's long-term optionality: embedded pricing power, underappreciated tech integration, and a shareholder-friendly capital allocation model that continues to return cash while expanding margin. For investors seeking compounding without complexity, Watsco presents a uniquely durable case.

The Engine Behind Long-Term Accumulation

Watsco's strength lies not in innovation, but in execution, an often-underappreciated edge in industrial distribution. The company dominates a fragmented HVAC distribution market by building trust with tens of thousands of contractors and maintaining exclusive or preferred rights to distribute premium equipment from giants like Carrier and Trane. With over 120,000 contractor relationships and more than $7 billion in annual sales, Watsco's scale generates real economic advantages: better pricing from suppliers, faster inventory turns, and unmatched geographic reach.

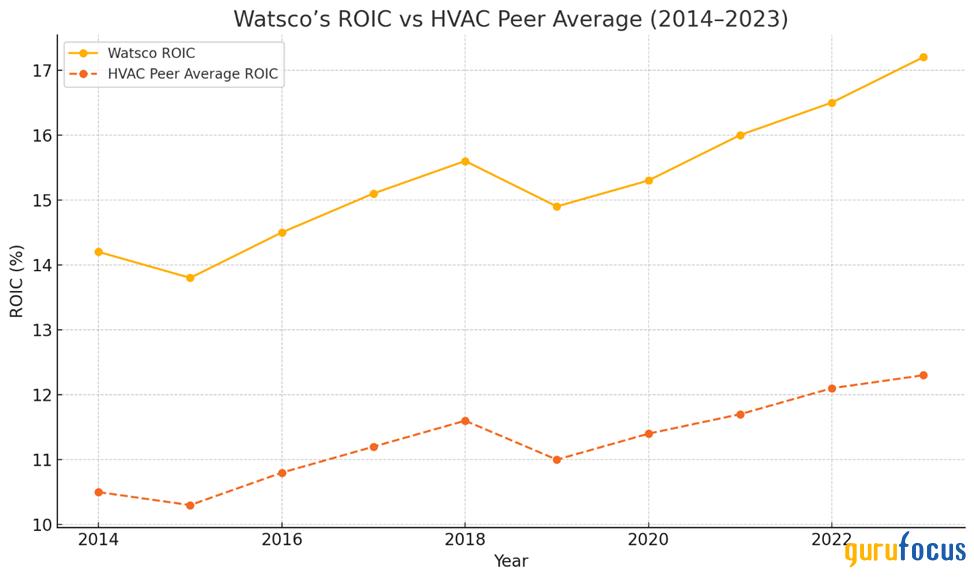

Unlike manufacturers, Watsco doesn't carry the capital intensity of product development or the margin volatility of raw input costs. Instead, it sits at the midpoint of a value chain that continues to expand, quietly clipping a take rate on every system replacement or installation. This model produces consistently high returns on invested capital, averaging above 20% for the past decade, and allows the company to reinvest in organic growth, tech infrastructure, and shareholder returns with minimal dilution or leverage.

Crucially, HVAC is not discretionary. More than 85% of residential demand is replacement-driven, meaning units fail and must be replaced regardless of broader economic trends. The typical HVAC system lasts 1015 years, and with 2024 marking the tail end of the 20082009 replacement cycle, a new wave of aging units is driving volume growth. Rising temperatures and regulatory tailwinds, like the phase-out of older refrigerants, only accelerate this trend.

While most investors focus on AI and software, Watsco has been quietly digitizing its operations, introducing apps and digital platforms that make contractor ordering seamless and sticky. Over 70% of sales now come through digital channels, increasing wallet share and lowering costs without touching product margins.

Dominating a $50 Billion Market One Outlet at a Time

Watsco operates in a massive but fragmented market. The North American HVAC distribution industry exceeds $50 billion in annual sales, spanning tens of thousands of contractors and thousands of independent distributors. Despite being the largest player, Watsco controls only about 13-14% of the market, underscoring just how much room there is for continued expansion.

What sets Watsco apart isn't size alone, but how it uses that scale. With over 670 locations, exclusive relationships with top manufacturers like Carrier and Trane, and a tech-enabled supply chain, Watsco achieves efficiency and pricing power that smaller peers simply can't match.

Importantly, this is a business built for durable, repeat demand. Roughly 85% of HVAC replacements are non-discretionary; systems fail, and they must be replaced quickly, regardless of the economic cycle. Watsco thrives in this environment by owning the last mile of that replacement process: contractor relationships, product availability, and seamless fulfillment.

Contractors trust Watsco not only for inventory but for uptime, credit, and digital convenience. Over 70% of sales now flow through its e-commerce and mobile platforms, reducing friction, boosting loyalty, and quietly expanding wallet share without sacrificing margin.

In a market where most players compete on price, and scale is rare, Watsco's model compounds quietly but powerfully. The company isn't just growing with the market; it's taking share from it. That structural edge is what makes its growth unusually consistent, and what could eventually unlock a 3x revenue trajectory.

Valuation: Why Paying Up for Quality Still Makes Sense

Watsco trades at around 23x forward earnings and 16x EV/EBITDA, multiples that may seem steep in a distribution-heavy industrial sector. But a closer look at its fundamentals reveals why this valuation is not only justified, but potentially conservative for long-term holders.

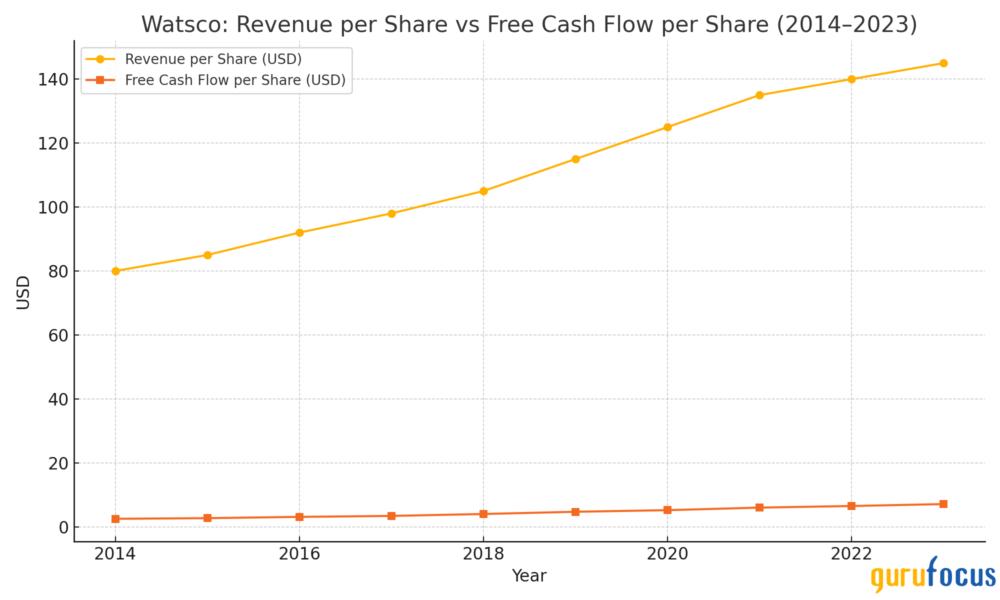

Over the past decade, gross margin has expanded from 24% to 26%, while net margin has climbed from 4% to 7%. Meanwhile, per-share revenue is up nearly 70%. These gains suggest the company isn't just growing, it's improving as it grows. Scale efficiencies, digital adoption, and pricing discipline are flowing through to the bottom line. This is the hallmark of a best-in-class operator in a fragmented market, a profile that historically justifies long runways for compounding.

To frame the long-term opportunity, it's important to consider Watsco's share of the North American HVAC distribution market, which is estimated to exceed $50 billion annually. Despite generating over $7 billion in revenue, Watsco still commands less than a 15% share, leaving significant room for organic and bolt-on expansion. If the company triples revenue over the next 15 years while expanding margins even modestly, its current P/E could look cheap in hindsight.

While skeptics may point to the drop in effective tax rate from 30% to 20% over the same period as a key driver of net margin gains, this overlooks the operating leverage embedded in Watsco's model. The widening gap between gross and net margins reflects efficiency improvements that can't be explained by tax arbitrage alone.

It's also worth acknowledging concerns around share-based compensation. While Watsco has consistently repurchased stock to offset dilution, the pace of issuance, particularly to management, deserves monitoring. Even so, the company's ability to fund both dividends and buybacks from free cash flow, without resorting to debt, reinforces its identity as a rare compounder that returns capital as it grows.

Comparisons to early-stage compounders like Boston Beer (SAM) are not unwarranted. Both began as category leaders in niche markets, steadily grew share through execution, and delivered 10x returns to patient investors. For Watsco, the ingredients are all present: pricing power, efficiency, capital discipline, and a massive TAM to grow into.

Institutional Holdings

Watsco has quietly attracted some of the most respected long-term investors in the world, not because it's flashy, but because it's dependable. Two standouts, Caledonia Investments and Markel Group (led by Tom Gayner (Trades, Portfolio)), offer strong validation of Watsco's compounding potential.

Caledonia Investments, a concentrated, long-horizon firm based in London, has made Watsco its largest U.S. equity position. The firm owns over 11.5% of its portfolio in Watsco, with an estimated average cost of $160, a stake that has more than doubled. More notably, they've held the position without trimming, signaling deep belief in Watsco's durability and capital discipline. This kind of inactivity from a high-conviction fund reflects alignment with the company's long-term compounding path.

Markel Group, led by Tom Gayner (Trades, Portfolio), often called a modern-day Buffett, holds a $300 million position in Watsco, a top holding in their portfolio. Gayner's investing framework prizes predictable cash flows, pricing power, and low-debt balance sheets, all traits Watsco exhibits. Markel initiated the position well before the stock's current run, and like Caledonia, they've let it compound quietly. That patience is not passive; it's conviction.

Both investors understand what makes Watsco rare: it grows without consuming capital, earns trust in a fragmented industry, and reinvests with discipline. Their continued presence isn't just a signal; it's a blueprint for how quality investors behave when they've found a wonderful business.

Disciplined Capital Allocation

Watsco's capital allocation is simple, consistent, and shareholder-friendly, a rarity in industrials. Rather than pursue debt-fueled expansion or flashy acquisitions, management has opted for organic growth, bolt-on deals, and meaningful dividend increases. The result is a financial profile that compounds steadily without stretching the balance sheet.

The company has grown its dividend every year since 1975 and paid out over $2.3 billion in dividends over the past decade, a remarkable feat for a distributor. In 2023 alone, Watsco returned over $450 million to shareholders, even while continuing to invest in tech infrastructure and inventory capacity. Its payout ratio remains conservative relative to free cash flow, leaving room for reinvestment.

On the M&A front, Watsco sticks to its playbook: small regional distributors with sticky contractor bases and cultural alignment. These acquisitions are almost always immediately accretive and are funded through internal cash flow or equity issuance only when the valuation is attractive. Notably, the company avoids leveraging even when the market environment makes debt tempting.

As of the latest filings, Watsco holds virtually no net debt, maintains an investment-grade credit rating, and has ample liquidity to support future growth. The absence of financial leverage in a capital-light, cash-generative business enhances its resilience during economic slowdowns, a hidden strength often missed in cursory peer comparisons.

Conclusion

Watsco may not spark headlines, but its business model quietly embodies everything great investors seek: scalability, operational leverage, capital efficiency, and a long reinvestment runway. In an industry still highly fragmented, Watsco is the best-positioned player, one whose scale, loyalty-driven distribution network, and disciplined execution enable it to widen its moat year after year.

The company has managed to grow per-share revenue by over 70% in the last decade, with net margins expanding faster than gross margins, clear evidence of operating leverage and efficiency. Critics may point to falling tax rates or stock-based compensation, but those fade against the reality: Watsco grows without consuming capital and returns cash as it scales, something few businesses can claim.

What makes the case particularly compelling is the market structure. HVAC distribution still has ample TAM left, and Watsco's share remains modest despite its dominance. If the company merely continues gaining share and expanding margins at its current pace, it could triple revenue over 15 years and deliver multi-bagger returns from here. That's how long-term wealth is built.

For the patient investor, Watsco represents a rare class of asset: one that grows, returns capital, and gets more efficient with scale, all while selling products that are non-discretionary and increasingly essential in a warming, aging America.