AMD Q2 Earnings Loom--Should You Buy, Hold, or Sell?

Aug 4 - Advanced Micro Devices AMD will release its Q2 earnings after Tuesday's market close, with Wall Street expecting a 27% year-over-year revenue jump to $7.43 billion. Profits, however, are projected to decline 30% to $0.48 per share, as the chipmaker continues to face margin pressures and higher R&D expenses.

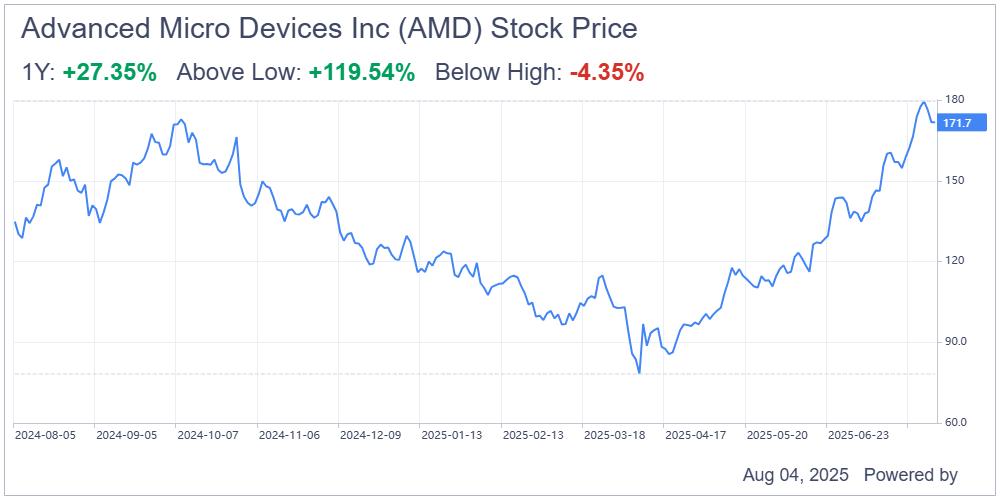

AMD shares have delivered a 27% gain over the past year and an impressive 46% year-to-date surge. Analysts remain split on the stock. Wall Street maintains a Buy rating, on the stock, but Some investors are taking profits after the run-up, pointing to stretched near-term valuation.

Meanwhile, analysts see ongoing CPU strength, rather than AI, as the key near-term driver, with potential upside from tariff-driven pull-ins and supportive Instinet MI350 pricing.

AMD has exceeded EPS estimates in seven of its last eight quarters and beat revenue expectations every time. Investors now look to Q3 as a pivotal period for gauging whether the company can sustain its growth trajectory.

Is AMD Stock a Buy or Sell?

Based on the one year price targets offered by 42 analysts, the average target price for Advanced Micro Devices Inc is $156.66 with a high estimate of $223.00 and a low estimate of $111.00. The average target implies a downside of -8.76% from the current price of $171.70.

Based on GuruFocus estimates, the estimated GF Value for Advanced Micro Devices Inc in one year is $170.24, suggesting a downside of -0.85% from the current price of $171.70. Gf value is Gurufocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. For deeper insights, visit the forecast page.