Lululemon: Under Pressure, Overlooked Fundamentals, and Undervalued

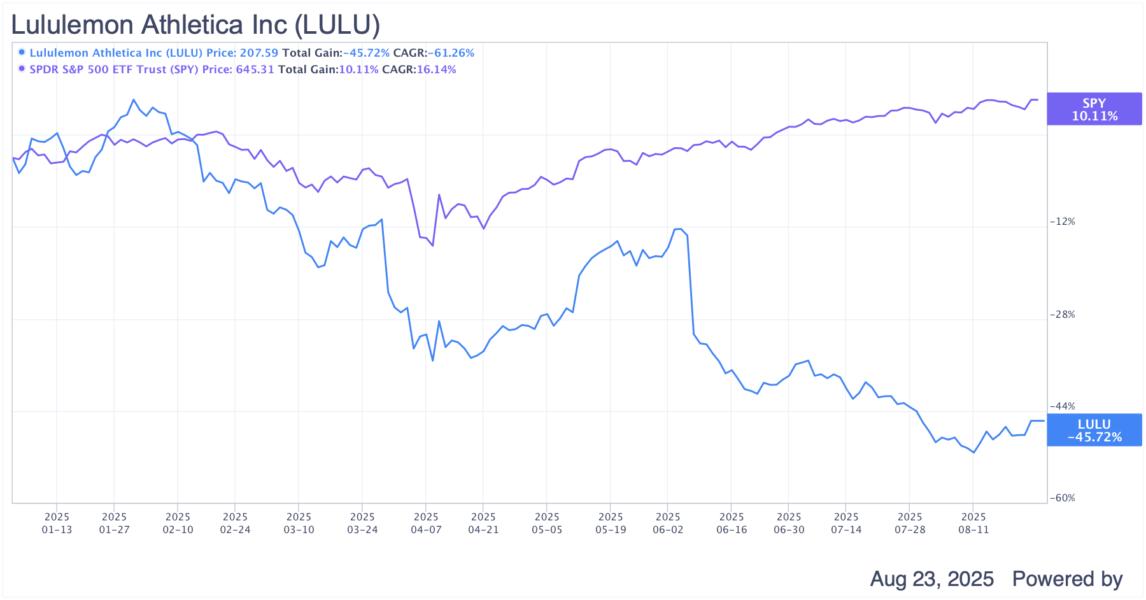

Lululemon's LULU stock has been in a slump, with a very disappointing performance throughout this year. It is down more than 45% year-to-date at the moment I write this, while the S&P 500 has grown 9% in the same period.

Of course, the reasons behind this prolonged underperformance are plausible. Economic headwinds, from weaker consumer spending and tariffs to structural issues such as competition gaining market share and inventory missteps, raise a red flag. So much so that the market projection, in line with Lululemon's own guidance, is that earnings per share for the full 2025 will represent a 0.5% decline versus last year, when at the beginning of this year, Lululemon was estimated to grow around 6%.

Even though the growth story, especially on the bottom line, seems to be going in a very different direction than in recent years, considering that Lululemon has grown earnings per share over the last three years at a rate of 23% per year (CAGR), there is arguably still a significant leeway before a in-depth deterioration in the company's fundamentals.

Looking at Lululemon's value case, even with all the headwinds, the company still shows a strong ability to create shareholder value, consistently earning well above its cost of capital. Backed by high-quality fundamentals and durable competitive advantages, I see a clear valuation asymmetry here: shares trade at a meaningful discount both to peers and tothe company's own history. At today's price levels, Lululemon looks like a genuine value pick worth owning.

Lululemon's Financial Edge

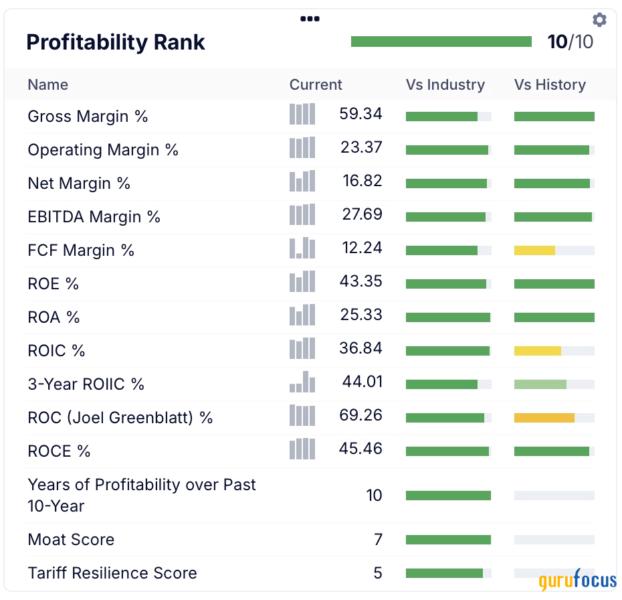

To begin with, Lululemon is a company with a moat, based on being an aspirational brand with loyal customers who are willing to pay a premium price for the brand's clothing. And that moat ultimately translates into immense pricing power, which ultimately translates into very high margins. More precisely, today Lululemon has nearly 60% gross margins and 23.4% operating margins, versus averages of 38% and 7.7%, respectively, for the apparel retail sector.

Source: GuruFocus

As high margins result in consistent profits, this leads to strong cash generation. Over the last twelve months, Lululemon has generated more than double the operating cash flows (around $2 billion) than it did three years ago, with just over half of this converted into free cash flow. However, cash generation only becomes relevant and consistent when it translates into a return on invested capital above its cost of capital. And this is something that Lululemon has managed to do with great mastery, as I will explain below.

While there is a mix of headwinds haunting Lululemon, from a financial and business fundamentals perspective, the thesis remains very solid. And Lululemon continuing to deliver returns on invested capital (ROIC) well above the industry average speaks volumes. After all, a high ROIC means that the company is highly efficient in using the capital at its disposal to convert into earnings, which is why it is worth investing in a business that can convert this amount in a significant but also sustainable way.

Historically, Lululemon has had an average ROIC of 27.3% over the last five yearswell above peers such as Nike (NKE) and Adidas (ADDYY), which range between 11-12%largely due to its massive pricing power stemming from a premium brand and an asset-light model, with no manufacturing base of its own and operating mainly through third parties.

As of the latest filings update, Lululemon has a ROIC of 36.8% on a trailing twelve-month basis, and of course, much of this high percentage comes from operating income of $2.51 billion in the same period, including a 12% annual increase. To get an idea of how attractive Lululemon's ROIC is at this level, even considering the costs the company has in raising the necessary capital through an ROIC between 7-9%, there would still be a spread of approximately 28 to 30 percentage points, which is extremely high and worthy of a company with a strong "moat."

The fact that Lululemon, even in the face of current headwinds, continues to generate a ROIC consistently well above its cost of capital is not just a nice number to overlook, but a key feature to be appreciated by value investors. After all, Lululemon proves to be creating sustainable value for shareholders, indicating a defensible competitive advantage, and has room to burn in adverse cycles, such as the one it is currently experiencing.

Attractive Valuation Meets High-Quality Business

Arguably, within the value investing philosophy, buying companies below their intrinsic value guarantees a much higher percentage return than buying companies trading at rich multiples. And in the case of Lululemon, we see that the company not only has a high and sustainable ROIC, but can also be acquired at prices that offer significant upside.

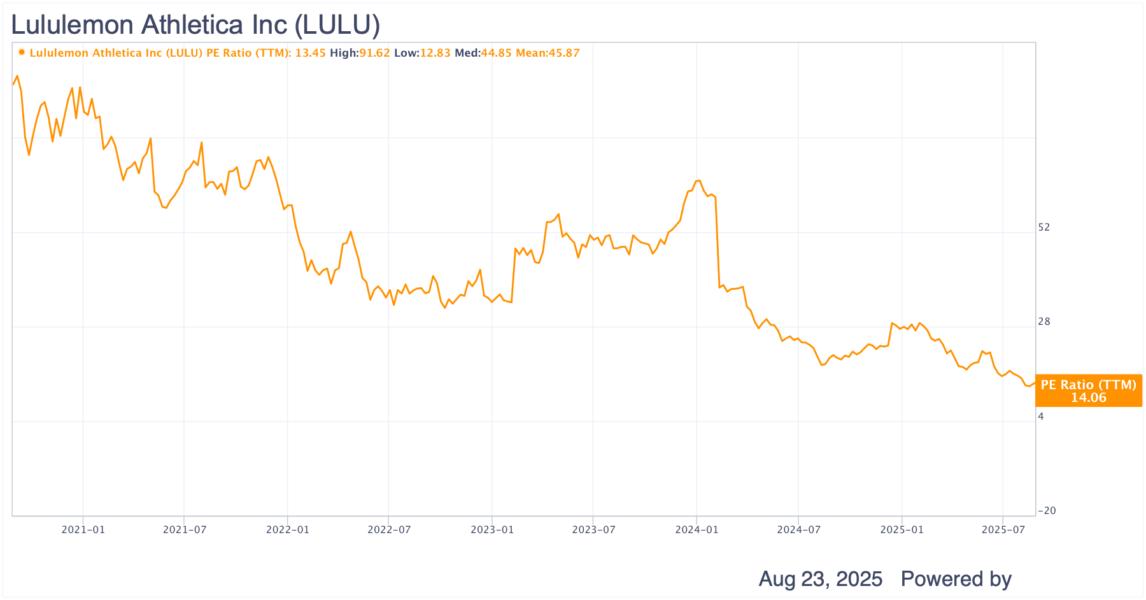

From an earnings perspective, Lulu trades at 14x P/E, which is the lowest level in the last two years, when the average was around 25.5x.

However, to better fit Lululemon's model, which is characterized by being asset-light and having strong cash generation, analyzing valuations through earnings yield lenses (operating income divided by enterprise value) seems reasonable, considering that the intention is to focus on operational efficiency, not necessarily on profit generation.

In this case, considering the $2.51 billion in operating profit generated in the last twelve months, and Lululemon trading at an enterprise value of $24.1 billion, the earnings yield would be ~10.4%, also higher than the WACC, considering a range of 7-9%.

In other words, once again, Lululemon not only generates operating returns well above the cost of capital, but the market has allowed it to "buy" this profit at a relatively attractive valuation, combining a high-quality business traded at a justifiable price.

Market Risks and Guru Activity

Of course, even though operational metrics indicate a strong return on investment and the company is trading at seemingly cheap valuations, Lululemon's thesis still depends heavily on premium discretionary consumption. Despite its moat in this area, strong competition from entrants such as Alo Yoga and Vuori could threaten Lululemon's growth story.

Furthermore, at the end of the day, the stock price is determined by how many bulls are willing to buy and how many bears are willing to sell. And when we look at the big fish, we can see that Lululemon has been sold much more than it has been bought throughout this year.

Amid Lululemon's recent developments, when we look at the trading activity of Wall Street gurus, the highlight is the notorious investor Ken Fisher (Trades, Portfolio), who owned 62,620 shares in mid-last year and sold out his position in June this year, as well as Joel Greenblatt (Trades, Portfolio), who in recent years had been steadily increasing his position in LULU, reaching 68,024 shares in March of this year, but recently trimmed his exposure in Lululemon to 58,082 shares.

Final Remarks

Lululemon has faced headwinds from all sides. While cyclical factors (consumer spending, tariffs) are less frightening, structural factors (management missteps, competition, fashion trends) bring a greater perception of risk to the moat and need to be actively addressed.

However, looking at the financial fundamentals, the company maintains a high and consistent ROIC, robust pricing power, and margins that support quality cash generation. When we cross-reference this with still reasonable valuationsespecially considering the earnings yield above WACCthe investment case proves to be very suitable for value investors, even if a challenging context in the short to medium term is still a trend.