IDEX: Precision-Driven Growth in a World of Complex Flow Systems

Introduction

IDEX Corporation operates behind the scenes of some of the world's most critical technologies. From precise fluidic systems used in semiconductor and life sciences equipment to mission-critical pumps in firefighting, IDEX quietly enables functionality in industries where failure is not an option. The company has built a portfolio of high-margin, low-replacement products that serve specialized, high-regulation end markets.

While IDEX rarely makes headlines, its consistent pricing power, disciplined acquisition strategy, and stable customer base have resulted in a track record of reliable earnings growth. What sets IDEX apart is not scale, but selectivity, a disciplined focus on niche markets where engineering expertise translates directly into long-term pricing control. With over 90% of its revenue coming from businesses where it holds the No. 1 or No. 2 position, IDEX is a quiet leader in precision.

Even as broader industrial peers chase volume or cyclical rebounds, IDEX continues to prioritize cash flow resilience, aftermarket penetration, and intelligent capital deployment. In a world of increasingly complex systems, IDEX offers investors a rare combination of pricing stability, product criticality, and long-term financial strength.

Business Model: Precision in Niche Markets

IDEX's business model is built around precision engineering in narrow but essential applications. Rather than competing in scale-driven markets, IDEX owns a decentralized portfolio of high-margin businesses serving industries where performance, safety, and reliability are non-negotiable. This model has enabled IDEX to build pricing power over time, not through size, but through specificity.

Over 85% of IDEX's revenue comes from businesses that are leaders in their respective verticals. These include metering pumps used in water treatment, fluidics systems essential for DNA sequencing, and high-pressure rescue tools deployed by emergency services globally. The high cost of failure in these cases gives IDEX leverage in pricing and long customer relationships, with many products integrated into regulatory and technical frameworks that are expensive to redesign around.

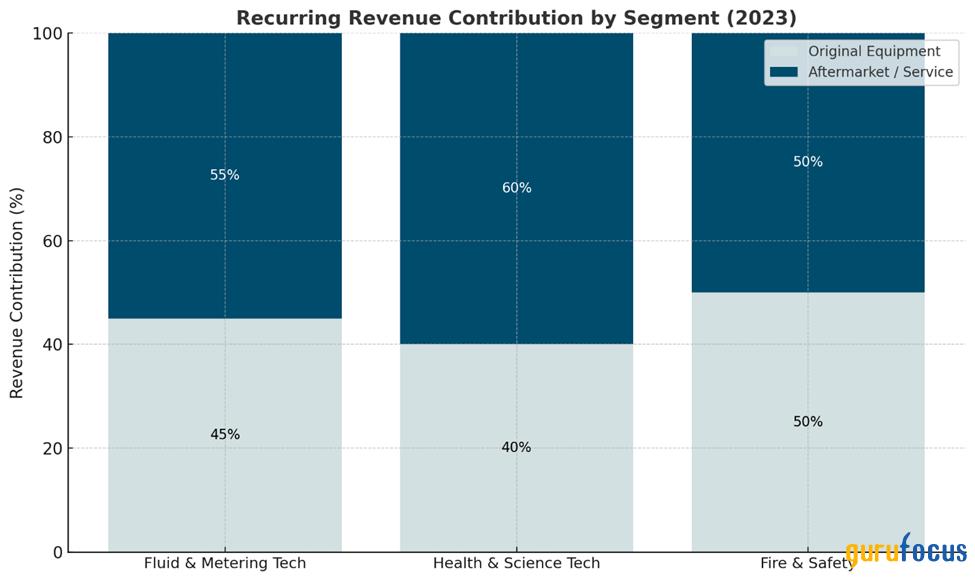

What makes this model durable is the aftermarket-driven revenue stream. Once IDEX products are installed, they generate years of service revenue and consumable sales. In its Health & Science Technologies segment, for example, component replacement cycles can be more frequent than capital budgets, creating a stable revenue base even in cyclical downturns. Similarly, its Fire & Safety segment benefits from mandated testing and equipment replacement regulations.

IDEX's decentralized operating structure also plays a critical role. By allowing each business unit to operate with autonomy, it retains the entrepreneurial agility of smaller firms while gaining the financial discipline of a larger corporation. This structure has historically supported high ROIC, consistently above 20%, while maintaining low cyclicality, even during broader industrial slowdowns.

Valuation: A Premium on Predictability

IDEX rarely trades at a discount. Its historical valuation has almost always embedded a premium relative to peers in the diversified industrials space. That's not due to growth alone, but the predictability of that growth. While most industrial companies rely heavily on cyclical capital expenditure, IDEX earns more than 50% of its revenue from recurring aftermarket products and services. This creates a baseline of earnings stability that few peers can match.

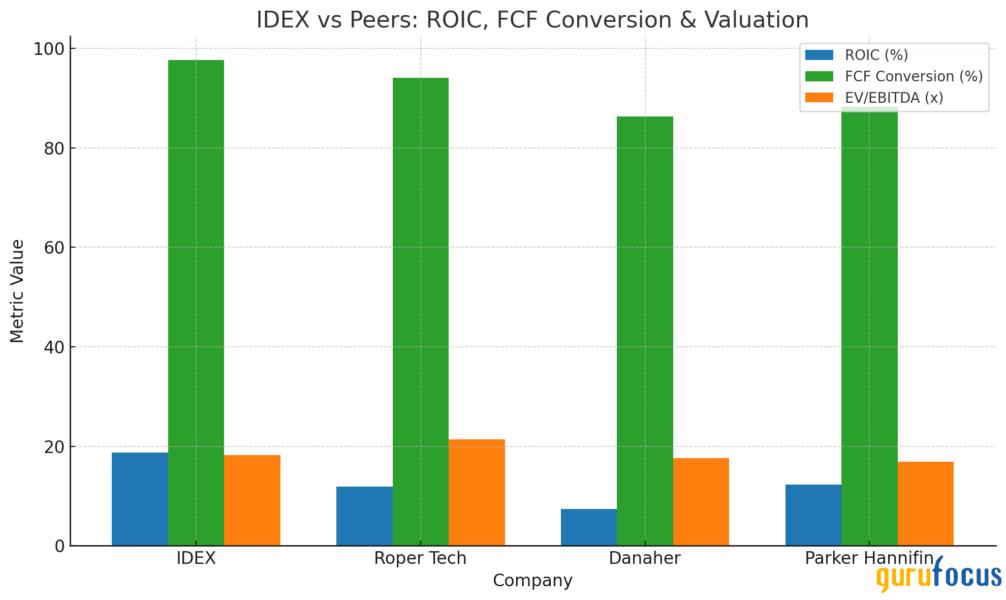

To assess IDEX's standing among industrial peers, we can focus on three high-conviction metrics: ROIC, free cash flow conversion, and EV/EBITDA. Return on invested capital reflects how efficiently a company converts capital into profits.

IDEX leads the group with an ROIC of nearly 19%. Its free cash flow conversion is also best-in-class at 97.6%, indicating strong earnings quality and minimal working capital friction. Yet, despite these advantages, IDEX trades at a relatively modest EV/EBITDA multiple of 18.2x, lower than Roper's 21.4x and only slightly higher than Danaher's 17.6x. This combination of superior profitability and fair valuation underpins the case for IDEX as a quietly efficient outperformer.

Capital Allocation: A Quiet Masterclass in Long-Term Discipline

IDEX's capital allocation philosophy stands out not for bold moves or splashy headlines, but for a remarkably disciplined approach that quietly builds long-term value. The company has consistently struck a balance between reinvestment, shareholder returns, and selective acquisitions, ensuring that no single lever is overused or misused.

1. Selective M&A as a Growth Lever

Unlike serial acquirers that chase scale, IDEX is highly selective, often targeting niche players that reinforce its existing high-margin platforms. Since 2010, the company has deployed over $3.5 billion in acquisitions, including mu-Dynamics, Nexsight, and Abel Pumps, each strengthening IDEX's moat in fluidics and metering systems. These deals are almost always bolt-on, small-to-mid-sized, and integrated into IDEX's decentralized structure, preserving autonomy while leveraging group-level operational expertise.

2. Return of Capital to Shareholders

IDEX has returned over $1.8 billion to shareholders via dividends and buybacks in the past five years. The dividend has grown consistently, currently yielding around 1.3%, and boasts a five-year CAGR of 10%. More importantly, management has shown restraint, repurchasing shares opportunistically rather than mechanically.

3. Internal Reinvestment in High-ROIC Businesses

Perhaps most impressively, IDEX reinvests selectively within its high-return core. With ROIC consistently above 15% (and often above 20%), the company doesn't chase growth for its own sake. Instead, it allocates capital where customer-specific customization, pricing power, and niche dominance enable durable returns. Its decentralized model gives each business the autonomy to reinvest in targeted innovations that meet real customer needs, particularly in critical markets like semiconductor manufacturing and life sciences.

Peer Positioning: Quiet Excellence in an Overlooked Segment

IDEX operates in a niche largely ignored by flashy industrial peers, but that's precisely what gives it strength. While conglomerates like Danaher, Roper Technologies, or Parker Hannifin often capture headlines with high-profile moves, IDEX quietly thrives in low-competition, mission-critical niches with high switching costs. Its businesses serve applications where performance failure isn't an option, optical detection in semiconductors, precision fluidics in medical devices, and metering technologies in energy systems.

Despite operating on a smaller scale, IDEX consistently achieves higher ROIC and best-in-class cash conversion, suggesting superior capital discipline and operational efficiency. It also carries far less leverage, which gives it more resilience and dry powder in downturns. Meanwhile, the valuation remains reasonable, cheaper than Roper, and only modestly above the broader industrial average.

Roper, often viewed as the gold standard in niche industrials, trades at a premium due to its software-heavy mix. Yet IDEX's portfolio, despite being more hardware-oriented, achieves comparable margins with greater manufacturing exposure, underscoring the strength of its process discipline and pricing power.

Institutional and Guru Holdings

The long-term orientation of IDEX's business hasn't gone unnoticed by some of the most thoughtful value-oriented investors. Several well-regarded firms with a track record of patience and discipline have built meaningful positions.

Wallace Weitz (Trades, Portfolio)'s Weitz Investment Management holds the largest stake among this group, with 401,000 shares valued at approximately $72.6 million. Weitz has been known for gravitating toward high-quality, underappreciated industrial franchises. IDEX's steady margin profile and decentralized operating model align well with its typical criteria.

Andrew Weiss of Weiss Asset Management, known for opportunistic bets in niche corners of the market, made a significant move, increasing his position by over 750% in the latest quarter. His stake now totals more than 230,000 shares worth $41.7 million, suggesting a sharp conviction around a possible mispricing.

Jeffrey Talpins' Element Capital, primarily known for macro trading, has also initiated a new position in IDEX, which is notable given the firm's usually sparse equity exposure. Though smaller at $2.7 million, the presence of a macro-oriented investor hints at IDEX's perceived resilience amid broader economic shifts.

Finny Kuruvilla at Eventide Asset Management, whose investment philosophy blends growth with ethical sustainability, maintains a $17.9 million position. His thesis likely hinges on IDEX's role in enabling life sciences and fluid-handling technologies that support long-term industrial innovation.

George Soros (Trades, Portfolio)' Soros Fund Management increased its IDEX position by over 250%, now owning 109,000 shares worth nearly $19.8 million. Soros' fund has a history of acting on inflection points and misunderstood fundamentals; the renewed interest in IDEX may reflect a belief in near-term rerating potential.

Meanwhile, Mario Gabelli (Trades, Portfolio)'s Gamco Investors, long associated with bottom-up industrial stock picking, holds 175,000 shares, worth approximately $31.8 million. Gabelli's valuation-driven approach often favors companies with clear cash flow visibility and reliable management teams, qualities that IDEX has demonstrated over decades.

Other noteworthy holders include Alec Litowitz's Magnetar Financial, which increased its stake by nearly 900% to over 52,000 shares, and John Overdeck's Two Sigma Advisers, with a $47 million position despite trimming 17% of its stake recently. While these funds differ in style, their presence underscores the institutional support behind IDEX.

Risks

Acquisition Integration Risks

M&A has been a core part of IDEX's growth strategy, with dozens of bolt-on deals executed over the years. While management has a strong track record, the decentralized model means integration success depends heavily on subsidiary leadership. A poorly integrated acquisition, particularly in unfamiliar or fast-changing end markets, could lead to margin pressure or capital misallocation that's not immediately visible at the group level.

Industrial Demand Cyclicality

While IDEX serves diversified end markets, from life sciences to municipal infrastructure, many of its businesses remain sensitive to industrial capital spending cycles. Slowdowns in sectors like semiconductor manufacturing, agriculture, or water treatment could reduce order volumes and stretch working capital cycles, especially for the company's engineered fluidics and fire & safety platforms.

Valuation Reversion

IDEX trades at a premium to many industrial peers due to its asset-light structure, high returns on capital, and sticky customer relationships. If growth slows or margin expansion stalls, this premium multiple could compress. Investors expecting continued multiple expansion might be exposed to downside risk if IDEX's earnings quality is perceived to plateau.

Succession and Leadership Transition

IDEX's operating model is heavily reliant on local autonomy balanced with disciplined central capital allocation. Leadership transitions at either the segment or corporate level could disrupt this balance. While current management has maintained strong continuity, any misalignment in future leadership philosophy could dilute the decentralized culture that has served IDEX so well.

Final Thoughts

IDEX doesn't shout for attention, but that's precisely what makes it compelling. With a disciplined, acquisition-driven strategy rooted in niche industrial markets, the company has built a quietly durable engine for long-term value creation. Its high returns on capital, steady margin profile, and low leverage give it the flexibility to weather economic cycles and remain opportunistic when others pull back.

While IDEX may not deliver breakout growth in any single segment, its consistency across the board and clarity in execution make it a rare compounder in the industrial space. For long-term investors looking for quality in quiet places, IDEX deserves a closer look.