Evening Wrap: ASX 200 down as Trump bump turns slump on global growth fears, MIN and FMG sag

The S&P/ASX 200 closed 56.3 points lower, down 0.68%.

Markets hate uncertainty. That's the first rule of Investing 101.

Events in the US, both economic news related and Trump & Musk ("T&M") related, continue to ratchet up uncertainty over both US and global economic growth. This is translating into lower stock prices, and increasing pain and uncertainty for investors (there's the "U" word again!).

But, there are areas of the market that tend to prosper in uncertain times, and these areas of the ASX managed to log solid gains today. Defensive and bond proxy sectors were up.

Heading the other way, though, were sectors exposed to simmering economic growth concerns. Iron ore majors Mineral Resources MIN (-4.6%) and Fortescue

FMG (-2.8%) were particularly harshly dealt with.

Click/scroll through for the usual reporting of the major sector and stock-specific moves, the broker responses to them, as well as all the key upcoming economic data in tonight's Evening Wrap.

Also, I have detailed technical analysis on the S&P/ASX 200 (XJO) and in today's ChartWatch.

Let's dive in!

Today in Review

Tue 25 Feb 25, 5:06pm (AEDT)

| Name | Value | % Chg |

|---|---|---|

| Major Indices | ||

| ASX 200 | 8,251.9 | -0.68% |

| All Ords | 8,498.0 | -0.73% |

| Small Ords | 3,174.1 | -0.37% |

| All Tech | 3,847.5 | -1.41% |

| Emerging Companies | 2,353.5 | -0.69% |

| Currency | ||

| AUD/USD | 0.6354 | +0.08% |

| US Futures | ||

| S&P 500 | 6,011.25 | +0.17% |

| Dow Jones | 43,610.0 | +0.17% |

| Nasdaq | 21,440.75 | +0.10% |

| Name | Value | % Chg |

|---|---|---|

| Sector | ||

| Utilities | 9,108.2 | +1.60% |

| Consumer Staples | 12,245.1 | +0.32% |

| Energy | 8,258.1 | +0.31% |

| Health Care | 43,525.7 | +0.29% |

| Real Estate | 3,785.6 | -0.50% |

| Financials | 8,630.1 | -0.62% |

| Industrials | 7,955.0 | -0.65% |

| Communication Services | 1,690.4 | -0.69% |

| Materials | 16,760.2 | -0.89% |

| Information Technology | 2,617.2 | -1.58% |

| Consumer Discretionary | 4,063.8 | -2.66% |

Markets

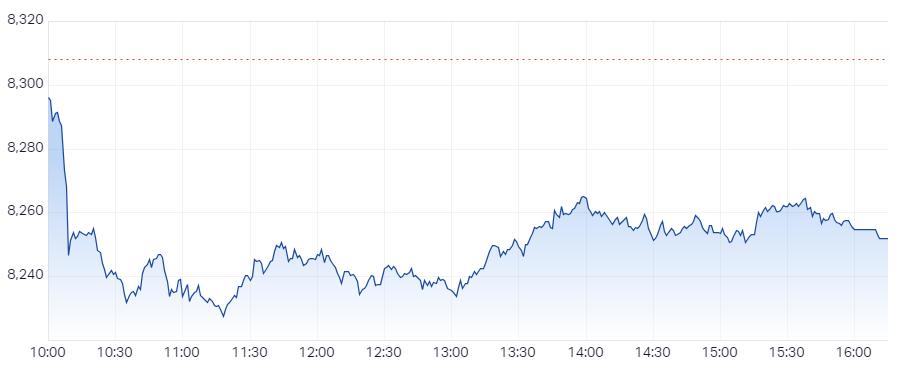

ASX 200 Session Chart

The S&P/ASX 200 (XJO) finished 56.3 points lower at 8,251.9, 0.68% from its session high and 0.38% from its low. In the broader-based S&P/ASX 300 (XKO), advancers lagged decliners by a dismal 103 to 176.

Trump bump is over. The honeymoon markets experienced following the new President’s inauguration has well and truly come to an end.

Now, markets are concerned about Trump’s trade war, Trump and Musk’s (“T&M”) DOGE layoffs and spending cuts, and the general uncertainty that both above may create for the US economy.

Add in a few softer than expected US economic data points, starting on Friday with PMI data that showed the once-robust services industry had dipped to its first contraction in over 2 years...plus weaker US housing market data…and it’s all become a little too much for risk-averse investors to stomach.

The natural response in such circumstances is to go to cash, or to put some of your money in the relative safety of risk-free bonds.

Stocks down (because of the move to cash) and bonds up (and due to the inverse relationship between bond prices and yields, this means bond yields down).

US 10-year Treasury bond yield (click here for full size image)

The US 10-year Treasury bond yield has fallen four sessions in a row, from around 4.58% to 4.37%. That’s over 20 basis points or nearly an entire typical Federal Reserve 0.25% rate cut.

Usually, in this part of the Evening Wrap we’ll generally link lower risk-free market yields to higher stock prices. But we also note that relationship persists only up to a point.

When risk-free market yields are falling due to economic growth concerns, you will often find stock prices falling in unison with risk-free yields. This is because the market is tipping both lower company earnings plus lower official interest rates in response to the perceived worsening economic growth down the track.

Markets hate uncertainty, that has been the case as long as markets have been around to prise risk and return. So, until investors begin to regain some clarity on how the current set of moving parts are going to impact the US and global economies – and therefore company earnings – we could be in for a continued bumpy ride.

Still, there are sectors that can do well in the current environment. Today’s trade on the ASX largely reflected these themes with the exception of those sectors that were adversely affected by company earnings.

So, we saw bond proxy sectors like Utilities (XUJ) (+1.6%) and Consumer Staples (XSJ) (+0.32%) still manage gains. The other key bond proxy sector, Real Estate Investment Trusts (XPJ) (-0.39%) was down, but some of this was earnings related (Lifestyle Communities LIC (-11.0%)) and some of sill to do with the Goodman Group

GMG (-1.4%) capital raise fallout.

Another area of the market that loves lower risk-free rates is Gold (XGD) (+0.70), the gold price was up overnight but has pulled back slightly in Asian trade. Gold doesn’t have a yield, but rather cost you to store and insure it. So we say that when risk-free market yields fall, so too does the opportunity cost of holding gold.

The local Health Care (XHJ) (+0.29%) sector is both defensive, and high-PE – the former handy given the increase in risk-aversion and the latter a beneficiary of lower risk-free market rates.

On the other hand, lower US and global economic growth is usually bad for Consumer Discretionary (XDJ) (-2.7%), today’s worst performing sector index, and Materials (XMJ) (-0.89%).

In Resources, I note Mineral Resources MIN (-4.6%) took yet another big hit today as a lower iron ore price in Singapore dragged on our big iron ore majors. Fortescue

FMG (-2.8%) wasn't far behind.

So, I suggest that some stuff did make sense today! 🤔

If there were a couple of outliers in today’s ASX trade, I note that sandwiched in between the XDJ and XMJ as the bottom of the pile was Information Technology (XIJ) (-1.6%).

To be fair, this sector was unlikely to prosper today from lower market yields as investors aimed to sell risky, non-defensive high-PE first. Add in as post-earnings/news falls from Nuix NXL (-9.5%) and Wisetech Global

WTC (-2.8%) that continue to wash through the market.

The other outlier was Energy (XEJ) (+0.31%), logging a gain today despite those global growth concerns. The crude oil price was slightly higher overnight, sure, but today’s strength was more likely a result of a tidy bump in Woodside Energy Group WDS (+2.8%) following it FY24 results release.

ChartWatch

S&P/ASX 200 (XJO)

The line between bull and bear market continues to hold...just! 🤞 (click here for full size image)

Just a quick follow up from yesterday's Evening Wrap update. The long term uptrend ribbon continues to hold, but the supply side took a more effective shot at it today.

As always, we will continue to monitor price action and candles at this important (for us!) zone of potential dynamic demand. As far as price action goes, we'd love to see a higher high and higher low in tomorrow's session to set yesterday's downward pointing shadow into the long term trend ribbon as a trough.

We'd also like to see tomorrow's candle (and the next, and the next...) show a long white body and or another long downward pointing shadow.

But we don't get to pick the next candle(s)! We get what we're given!

So, if we see the opposite of the above good stuff, that is, lower peaks, a close below yesterday's downward pointing shadow, plus black bodied candles and or upward pointing shadows – we will learn very quickly if there is indeed demand in the long term ribbon or not. 🤞

Economy

Today

There weren't any major data releases in our time zone today

Later this week

Wednesday

02:00 USA CB Consumer Confidence February (103.3 forecast vs 104.1 in January)

11:30 AUS Consumer Price Index (CPI) January y/y (+2.6% p.a. vs +2.5% p.a. in December)

Thursday

Nil

Friday

00:30 USA Preliminary GDP December quarter y/y (+2.3% p.a. forecast vs +2.3% p.a. in September quarter)

00:30 USA Core Durable Goods Orders January m/m (+0.4% m/m vs +0.3% m/m in December)

Saturday

00:30 USA Core Personal Consumption Expenditures (PCE) Price Index January m/m (+0.3% m/m vs +0.2% m/m in December)

Note: This is the Federal Reserve's preferred measure of US inflation!

12:30 CHN Manufacturing & Services Purchasing Managers Index February (PMI)

Manufacturing: 50.0 vs 49.1 in January

Services: 50.3 vs 50.2 in January

Latest News

Reporting Season bhp drr

Big broker buys! ASX mining stocks BHP, RIO, FMG, MIN, PLS and more

Tue 25 Feb 25, 2:37pm (AEDT)

Dividends hli

Special dividend up for grabs: Helia delivers a 12% yield

Tue 25 Feb 25, 11:54am (AEDT)

Technical Analysis 29m 4dx

ChartWatch ASX Scans: Goodman Group, Coles Group, A2 Milk Company, IGO, Metals X, Ramelius Resources

Tue 25 Feb 25, 9:00am (AEDT)

Market Wraps

Morning Wrap: ASX 200 to fall, S&P 500 extends pullback + AUB, Johns Lyng and Domino's Pizza earnings

Tue 25 Feb 25, 8:49am (AEDT)

Market Wraps apa arn

Evening Wrap: ASX 200 dodges sixth loss on ANZ, CBA, NAB, WBC rebound as Wisetech plummets on board woes

Mon 24 Feb 25, 6:17pm (AEDT)

Director Transactions amp aov

Insider Trades: 29 ASX 200 directors bought and sold these stocks last week

Mon 24 Feb 25, 3:30pm (AEDT)

More News

Interesting Movers

Trading higher

+25.4% Pointerra (3DP) - Half Yearly Report and Accounts, rise is consistent with prevailing short term uptrend and long term trend is transitioning from down to up 🔎📈

+17.1% Helia Group (HLI) - 2024 Full Year Results Investor Presentation, rise is consistent with prevailing short and long term uptrends, a regular in ChartWatch ASX Scans Uptrends list 🔎📈

+16.7% Stealth Group (SGI) - Stealth 1H FY25 Briefing Presentation, rise is consistent with prevailing short and long term uptrends 🔎📈

+16.6% Energy One (EOL) - EOL H1 FY2025 Investor Presentation, rise is consistent with prevailing short and long term uptrends, a recent regular in ChartWatch ASX Scans Uptrends list 🔎📈

+13.9% Zip Co. (ZIP) - 1H FY25 Investor Presentation.

+8.6% Perenti (PRN) - No news since 24-Feb 1H25 Results Presentation, generally positive broker views on yesterday's results (see Broker Moves for more details), bounced in the wake of the recent sharp selloff.

+8.5% Qualitas (QAL) - 1H25 Results Presentation.

+8.1% APA Group (APA) - Continued positive response to 24-Feb APA 1H25 Results Presentation.

+7.7% Meeka Metals (MEK) - No news, rise is consistent with prevailing short and long term uptrends, a regular in ChartWatch ASX Scans Uptrends list 🔎📈

Trading lower

-33.4% Johns Lyng Group (JLG) - 1H25 Results Presentation, repelled perfectly from long term downtrend ribbon!, a regular in ChartWatch ASX Scans Downtrends list 🔎📉

-26.9% Viva Energy Group (VEA) -Results presentation, fall is consistent with prevailing short and long term downtrends, one of the most Featured (highest conviction) stocks in ChartWatch ASX Scans Downtrends list 🔎📉

-20.0% Cyclopharm (CYC) - Preliminary Final Report.

-17.6% Polynovo (PNV) - 1H FY25 Results Presentation, fall is consistent with prevailing short term downtrend and long term trend is transitioning from up to down, a recent regular in ChartWatch ASX Scans Downtrends list 🔎📉

-11.6% Adairs (ADH) - Continued negative response to 24-Feb ADH 1H FY2025 Results Presentation.

-11.0% Lifestyle Communities (LIC) - Half-Year Results Presentation, repelled perfectly from long term downtrend ribbon!, a regular in ChartWatch ASX Scans Downtrends list 🔎📉

-10.5% Domino's Pizza Enterprises (DMP) - Half Year 2025 Market Presentation, fall is consistent with prevailing long term downtrend, one of the most Featured (highest conviction) stocks in ChartWatch ASX Scans Downtrends list 🔎📉

-10.3% Praemium (PPS) - Investor Presentation - H1 FY2025 Results.

-9.5% Nuix (NXL) - Continued negative response to 24-Feb 1H25 Financial Results Investor Presentation.

Broker Moves

Alfabs Australia (AAL)

Retained at buy at Bell Potter; Price Target: $0.550 from $0.400

Aussie Broadband (ABB)

Retained at buy at Citi; Price Target: $4.60 from $4.40

Retained at neutral at Goldman Sachs; Price Target: $3.90 from $3.80

Retained at buy at Ord Minnett; Price Target: $4.49 from $4.42

Upgraded to buy from neutral at UBS; Price Target: $4.80 from $3.95

Upgraded to overweight from market-weight at Wilsons; Price Target: $5.08 from $3.62

Abacus Group (ABG)

Retained at buy at Citi; Price Target: $1.350

Retained at outperform at Macquarie; Price Target: $1.290 from $1.260

Retained at buy at Shaw and Partners; Price Target: $1.200

Adairs (ADH)

Retained at buy at Canaccord Genuity; Price Target: $3.25 from $3.80

Retained at overweight at Jarden; Price Target: $2.59 from $2.54

Retained at add at Morgans; Price Target: $2.85 from $2.75

Retained at hold at Ord Minnett; Price Target: $2.70 from $2.50

Retained at neutral at UBS; Price Target: $2.55 from $2.25

Aml3d (AL3)

Retained at buy at Shaw and Partners; Price Target: $0.400

Ampol (ALD)

Retained at buy at Goldman Sachs; Price Target: $31.70 from $32.00

Upgraded to outperform from neutral at Macquarie; Price Target: $29.45 from $30.65

Retained at equal-weight at Morgan Stanley; Price Target: $31.00

Retained at buy at Ord Minnett; Price Target: $33.00

APA Group (APA)

Upgraded to buy from hold at Jefferies; Price Target: $8.44 from $8.35

Retained at outperform at Macquarie; Price Target: $8.02 from $8.14

Retained at equal-weight at Morgan Stanley; Price Target: $8.28

Upgraded to neutral from sell at UBS; Price Target: $7.00 from $6.60

AUB Group (AUB)

Retained at positive at E&P; Price Target: $36.80

Retained at neutral at UBS; Price Target: $33.30

Accent Group (AX1)

Retained at buy at Bell Potter; Price Target: $2.60

Codan (CDA)

Retained at buy at UBS; Price Target: $18.50 from $16.20

Charter Hall Group (CHC)

Downgraded to neutral from buy at Citi; Price Target: $18.50 from $15.70

Centuria Industrial Reit (CIP)

Retained at buy at UBS; Price Target: $3.80

Chorus (CNU)

Retained at outperform at Macquarie; Price Target: NZ$9.83

Charter Hall Retail Reit (CQR)

Retained at buy at Citi; Price Target: $4.00

Domain Australia (DHG)

Downgraded to hold from buy at Bell Potter; Price Target: $4.20 from $3.30

Domino's Pizza Enterprises (DMP)

Retained at sector perform at RBC Capital Markets; Price Target: $36.00

Retained at neutral at UBS; Price Target: $36.00

Deterra Royalties (DRR)

Retained at outperform at Macquarie; Price Target: $4.40

EVT (EVT)

Retained at buy at Citi; Price Target: $16.12 from $12.73

Retained at overweight at Morgan Stanley; Price Target: $13.30

Retained at buy at Ord Minnett; Price Target: $16.17 from $13.70

Fletcher Building (FBU)

Retained at buy at Citi; Price Target: NZ$3.90 from NZ$3.30

GDI Property Group (GDI)

Retained at buy at Bell Potter; Price Target: $0.800

G8 Education (GEM)

Retained at outperform at RBC Capital Markets; Price Target: $1.800

Retained at neutral at UBS; Price Target: $1.350

Goodman Group (GMG)

Upgraded to overweight from neutral at JP Morgan; Price Target: $38.00 from $40.00

Genusplus Group (GNP)

Retained at buy at Bell Potter; Price Target: $3.20 from $3.10

IVE Group (IGL)

Retained at buy at Bell Potter; Price Target: $2.80 from $2.70

Ingenia Communities Group (INA)

Retained at neutral at UBS; Price Target: $6.15

IPD Group (IPG)

Retained at buy at Bell Potter; Price Target: $5.50 from $5.30

Retained at buy at Shaw and Partners; Price Target: $5.50 from $5.10

Iress (IRE)

Retained at hold at Jefferies; Price Target: $8.40 from $10.15

Upgraded to outperform from neutral at JP Morgan; Price Target: $9.00 from $10.00

Upgraded to outperform from neutral at Macquarie; Price Target: $8.42 from $10.25

Retained at overweight at Wilsons; Price Target: $10.00 from $11.00

Jumbo Interactive (JIN)

Retained at positive at E&P; Price Target: $15.30 from $17.90

Retained at neutral at JP Morgan; Price Target: $12.20 from $13.20

Retained at overweight at Wilsons; Price Target: $14.38 from $14.14

Johns Lyng Group (JLG)

Retained at neutral at Citi; Price Target: $3.95

Kogan.Com (KGN)

Retained at sell at Citi; Price Target: $4.40

Retained at neutral at UBS; Price Target: $5.20 from $5.50

Liberty Financial Group (LFG)

Retained at buy at Citi; Price Target: $4.15

Retained at outperform at Macquarie; Price Target: $4.40 from $4.05

Lifestyle Communities (LIC)

Retained at neutral at Citi; Price Target: $10.00

Retained at buy at UBS; Price Target: $11.31

Lovisa (LOV)

Retained at sell at Citi; Price Target: $25.86 from $25.45

Upgraded to hold from underperform at CLSA; Price Target: $28.20 from $23.50

Retained at overweight at Jarden; Price Target: $29.02 from $29.03

Retained at neutral at JP Morgan; Price Target: $26.50 from $27.00

Retained at outperform at Macquarie; Price Target: $33.40 from $34.10

Retained at overweight at Morgan Stanley; Price Target: $31.50 from $32.00

Retained at underperform at RBC Capital Markets; Price Target: $27.00

Retained at sell at UBS; Price Target: $27.00

Michael Hill International (MHJ)

Retained at outperform at Macquarie; Price Target: $0.750 from $0.700

Monadelphous Group (MND)

Retained at sell at Goldman Sachs; Price Target: $15.40 from $13.40

Newmont Corporation (NEM)

Retained at buy at Goldman Sachs; Price Target: $78.50 from $76.20

Retained at outperform at Macquarie; Price Target: $85.00 from $86.00

NIB (NHF)

Retained at neutral at Citi; Price Target: $6.75 from $6.00

Retained at buy at Goldman Sachs; Price Target: $7.00 from $6.50

Upgraded to overweight from neutral at Jarden; Price Target: $7.00 from $6.70

Retained at hold at Jefferies; Price Target: $7.05 from $6.00

Retained at overweight at JP Morgan; Price Target: $7.00

Retained at underperform at Macquarie; Price Target: $5.55 from $5.50

Retained at equal-weight at Morgan Stanley; Price Target: $6.65 from $6.30

Downgraded to hold from add at Morgans; Price Target: $7.06 from $6.10

Retained at buy at Ord Minnett; Price Target: $7.65 from $6.90

Retained at neutral at UBS; Price Target: $6.75 from $6.15

Nickel Industries (NIC)

Retained at buy at Bell Potter; Price Target: $1.470 from $1.390

Retained at hold at Canaccord Genuity; Price Target: $0.800 from $0.850

Retained at buy at Citi; Price Target: $1.000

Retained at neutral at Macquarie; Price Target: $0.830 from $0.880

Retained at overweight at Morgan Stanley; Price Target: $1.050

Retained at buy at UBS; Price Target: $1.000 from $1.050

Nuix (NXL)

Retained at buy at Shaw and Partners; Price Target: $5.70

Nextdc (NXT)

Retained at buy at Citi; Price Target: $18.70

Retained at buy at Goldman Sachs; Price Target: $17.10 from $18.30

Retained at buy at Jefferies; Price Target: $18.58 from $20.03

Retained at overweight at JP Morgan; Price Target: $16.50 from $18.50

Retained at outperform at Macquarie; Price Target: $21.20

Retained at overweight at Morgan Stanley; Price Target: $20.50

Retained at buy at UBS; Price Target: $19.20 from $20.00

OOH!Media (OML)

Retained at neutral at Goldman Sachs; Price Target: $1.500 from $1.350

Retained at outperform at Macquarie; Price Target: $1.750 from $1.450

Propel Funeral Partners (PFP)

Retained at buy at Bell Potter; Price Target: $6.30 from $6.80

Retained at neutral at E&P; Price Target: $5.70 from $5.76

Retained at outperform at Macquarie; Price Target: $6.65 from $7.15

Retained at buy at Moelis Australia; Price Target: $6.10 from $6.20

Upgraded to buy from hold at Moelis Australia; Price Target: $6.10 from $6.20

Retained at overweight at Morgan Stanley; Price Target: $6.40

Polynovo (PNV)

Retained at buy at Bell Potter; Price Target: $2.80 from $3.00

Retained at positive at E&P; Price Target: $2.60 from $2.80

Retained at neutral at JP Morgan; Price Target: $1.950 from $2.350

Retained at outperform at Macquarie; Price Target: $2.80 from $2.85

Downgraded to market-weight from overweight at Wilsons; Price Target: $1.850 from $3.000

Peoplein (PPE)

Upgraded to add from hold at Morgans; Price Target: $1.400 from $0.750

Retained at buy at Ord Minnett; Price Target: $1.150 from $1.140

Praemium (PPS)

Retained at outperform at RBC Capital Markets; Price Target: $1.000

Perenti (PRN)

Retained at buy at Bell Potter; Price Target: $1.350 from $1.470

Retained at buy at Canaccord Genuity; Price Target: $1.350 from $1.280

Retained at buy at Citi; Price Target: $1.600

Retained at outperform at CLSA; Price Target: $1.500

Upgraded to buy from hold at Jefferies; Price Target: $1.400 from $1.300

Retained at outperform at Macquarie; Price Target: $1.500

Retained at buy at Moelis Australia; Price Target: $1.300 from $1.290

Perseus Mining (PRU)

Retained at buy at Citi; Price Target: $3.20

Retained at outperform at Macquarie; Price Target: $3.70

Retained at buy at UBS; Price Target: $3.95 from $3.90

Regis Healthcare (REG)

Retained at buy at Jefferies; Price Target: $7.60 from $7.45

Retained at overweight at JP Morgan; Price Target: $7.10 from $6.90

Retained at outperform at Macquarie; Price Target: $7.25

Retained at buy at Ord Minnett; Price Target: $7.40 from $7.20

Retained at outperform at RBC Capital Markets; Price Target: $8.25

Reece (REH)

Retained at neutral at Citi; Price Target: $20.25 from $25.85

Retained at sell at Goldman Sachs; Price Target: $19.50 from $22.80

Retained at underweight at JP Morgan; Price Target: $17.50 from $20.00

Retained at neutral at Macquarie; Price Target: $21.00 from $25.40

Retained at underweight at Morgan Stanley; Price Target: $18.00

Upgraded to hold from reduce at Morgans; Price Target: $18.70 from $19.95

Upgraded to hold from lighten at Ord Minnett; Price Target: $23.20 from $20.40

Retained at sell at UBS; Price Target: $17.70 from $20.50

Rio Tinto (RIO)

Retained at overweight at Morgan Stanley; Price Target: $130.50

Sims (SGM)

Retained at neutral at Citi; Price Target: $13.50

Retained at sector perform at RBC Capital Markets; Price Target: $13.75

Retained at neutral at UBS; Price Target: $13.60

Superloop (SLC)

Retained at buy at UBS; Price Target: $2.55 from $2.30

Stanmore Resources (SMR)

Retained at buy at Citi; Price Target: $3.40

Retained at buy at Ord Minnett; Price Target: $4.00 from $4.10

Symal Group (SYL)

Retained at buy at Ord Minnett; Price Target: $2.57 from $2.44

Tabcorp (TAH)

Retained at neutral at UBS; Price Target: $0.680 from $0.580

Titan Minerals (TTM)

Retained at buy at Canaccord Genuity; Price Target: $1.100

Viva Energy Group (VEA)

Retained at buy at UBS; Price Target: $3.20

Woodside Energy Group (WDS)

Retained at sell at Citi; Price Target: $22.00

Retained at neutral at UBS; Price Target: $27.10

Westgold Resources (WGX)

Retained at outperform at RBC Capital Markets; Price Target: $3.40

Wisetech Global (WTC)

Retained at buy at Citi; Price Target: $124.50

Upgraded to buy from hold at Jefferies; Price Target: $115.30 from $132.20

Retained at overweight at Morgan Stanley; Price Target: $140.00 from $160.00

Retained at accumulate at Ord Minnett; Price Target: $132.00 from $137.00

Zip Co. (ZIP)

Retained at buy at Citi; Price Target: $3.00

Retained at outperform at RBC Capital Markets; Price Target: $3.40

Retained at buy at UBS; Price Target: $3.35

Scans

Top Gainers

| Code | Company | Last | % Chg |

|---|---|---|---|

| WOA | Wide Open Agricul... | $0.012 | +140.00% |

| EVS | Envirosuite Ltd | $0.081 | +88.37% |

| CSX | Cleanspace Holdin... | $0.50 | +28.21% |

| 3DP | Pointerra Ltd | $0.089 | +25.35% |

| 1MC | Morella Corporati... | $0.021 | +23.53% |

View all top gainers

Top Fallers

| Code | Company | Last | % Chg |

|---|---|---|---|

| JLG | Johns LYNG Group Ltd | $2.53 | -33.42% |

| RCR | Rincon Resources Ltd | $0.013 | -31.58% |

| VEA | Viva Energy Group... | $1.755 | -26.88% |

| CLA | Celsius Resources... | $0.011 | -26.67% |

| CYC | Cyclopharm Ltd | $1.52 | -20.00% |

View all top fallers

52 Week Highs

| Code | Company | Last | % Chg |

|---|---|---|---|

| EVS | Envirosuite Ltd | $0.081 | +88.37% |

| HLI | Helia Group Ltd | $5.67 | +17.15% |

| SGI | Stealth Group Hol... | $0.63 | +16.67% |

| EOL | Energy One Ltd | $11.00 | +16.65% |

| 5EADA | 5E Advanced Mater... | $1.00 | +12.36% |

View all 52 week highs

52 Week Lows

| Code | Company | Last | % Chg |

|---|---|---|---|

| JLG | Johns LYNG Group Ltd | $2.53 | -33.42% |

| VEA | Viva Energy Group... | $1.755 | -26.88% |

| PNV | Polynovo Ltd | $1.47 | -17.65% |

| ACR | ACRUX Ltd | $0.024 | -17.24% |

| BRX | Belararox Ltd | $0.125 | -16.67% |

View all 52 week lows

Near Highs

| Code | Company | Last | % Chg |

|---|---|---|---|

| PCI | Perpetual Credit ... | $1.175 | -0.42% |

| WVOL | Ishares MSCI Worl... | $43.68 | +0.60% |

| IAGPF | Insurance Austral... | $104.20 | +0.19% |

| CTD | Corporate Travel ... | $17.38 | +0.58% |

| IHD | Ishares S&P/ASX D... | $14.42 | -0.21% |

View all near highs

Relative Strength Index (RSI) Oversold

| Code | Company | Last | % Chg |

|---|---|---|---|

| XYZ | Block, Inc | $104.35 | -3.46% |

| QSML | Vaneck MSCI Intl ... | $29.65 | -0.24% |

| GMG | Goodman Group | $32.66 | -1.39% |

| IRE | Iress Ltd | $7.67 | -0.13% |

| ALD | Ampol Ltd | $26.13 | -4.32% |

View all RSI oversold