Evening Wrap: ASX 200 logs record as big bounce in metals and crude oil drives gains across energy and mining stocks

The S&P/ASX 200 closed 22.4 points higher, up 0.28%.

It was another solid performance by local stocks today as a combination of positive overseas stock and bond market leads, plus a solid bounce in commodity prices helped drive broad-based gains.

Real Estate, Tech, Energy, and Resources stocks extended their gains from yesterday's record-beating index performance, while Industrials and Financial stocks lagged.

News that global lithium giant Albemarle is planning to drastically cut production at its WA-based operations sent several other local producers higher on hopes the price is finally low enough to drive out supply out and rebalance the market. The news didn't help lithium prices, though, they were down sharply again in China.

There were plenty of interesting stock-specific moves, and for all of these, plus the latest in broker moves, and technical analysis on uranium and iron ore...

Let's dive in!

Today in Review

Thu 01 Aug 24, 4:27pm (AEST)

| Name | Value | % Chg |

|---|---|---|

| Major Indices | ||

| ASX 200 | 8,114.7 | +0.28% |

| All Ords | 8,343.8 | +0.28% |

| Small Ords | 3,087.5 | +0.41% |

| All Tech | 3,207.2 | +0.89% |

| Emerging Companies | 2,134.1 | -0.23% |

| Currency | ||

| AUD/USD | 0.6528 | -0.22% |

| US Futures | ||

| S&P 500 | 5,583.5 | +0.46% |

| Dow Jones | 41,110.0 | +0.09% |

| Nasdaq | 19,631.25 | +0.65% |

| Name | Value | % Chg |

|---|---|---|

| Sector | ||

| Real Estate | 3,863.0 | +1.69% |

| Information Technology | 2,384.6 | +1.62% |

| Energy | 10,110.6 | +1.16% |

| Materials | 16,978.5 | +0.70% |

| Utilities | 9,074.6 | +0.60% |

| Consumer Staples | 12,899.0 | +0.40% |

| Communication Services | 1,584.2 | +0.24% |

| Consumer Discretionary | 3,836.0 | +0.15% |

| Health Care | 46,392.6 | +0.15% |

| Industrials | 7,179.5 | -0.23% |

| Financials | 8,107.0 | -0.37% |

Markets

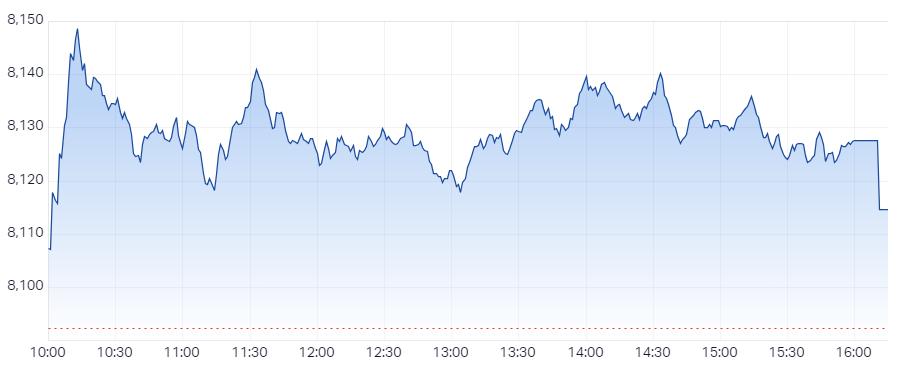

ASX 200 Session Chart

The S&P/ASX 200 (XJO) finished 22.4 points higher at 8,114.7, 0.28% from its session low and 0.42% from its high. In the broader-based S&P/ASX 300 (XKO), advancers beat decliners by 154 to 108.

The Real Estate Investment Trusts (XPJ) (+1.7%) sector was the best performer, no surprise given the plunge in both local and US key benchmark yields. I suggest most of the gains in the sector though were concentrated in sector leaders HMC Capital HMC and Goodman Group

GMG.

Company | Last Price | Change $ | Change % | 1mo % | 1yr % |

HMC Capital (HMC) | $8.05 | +$0.3 | +3.9% | +12.7% | +54.5% |

Goodman Group (GMG) | $36.44 | +$1.34 | +3.8% | +5.2% | +77.4% |

Cromwell Property Group (CMW) | $0.430 | +$0.015 | +3.6% | +11.7% | -21.8% |

Pexa Group (PXA) | $14.15 | +$0.35 | +2.5% | +6.2% | +7.0% |

Lifestyle Communities (LIC) | $9.16 | +$0.16 | +1.8% | -27.0% | -47.1% |

Abacus Storage King (ASK) | $1.295 | +$0.02 | +1.6% | +15.1% | 0% |

Charter Hall Social Infrastructure Reit (CQE) | $2.60 | +$0.04 | +1.6% | +8.3% | -13.0% |

Arena Reit. (ARF) | $3.92 | +$0.06 | +1.6% | -0.3% | +2.6% |

Waypoint Reit (WPR) | $2.56 | +$0.03 | +1.2% | +12.3% | -2.3% |

Also doing well today was the Information Technology (XIJ) (+1.6%) sector. The sector also tends to do well when market yields are declining, and a big pop in their US counterparts overnight likely also helped.

Australian 2 Year Government Bond Yield

US 2-Year T-Note Yield %

Energy (XEJ) (+1.2%) and Resources (XJR) (+0.9%) stocks enjoyed their second day of solid gains, underpinned by the biggest bounce we’ve seen in key base metals and crude oil prices Wednesday.

Company | Last Price | Change $ | Change % | 1mo % | 1yr % |

|---|---|---|---|---|---|

Aluminium - LME Official Cash | $2252 | +$90.5 | +4.2% | -9.5% | +4.2% |

Copper - LME Official Cash | $9014.50 | +$205.5 | +2.3% | -5.6% | +4.9% |

Iron Ore CFR China 62% Fe Spot | $105.94 | -$0.31 | -0.3% | -1.9% | -6.2% |

Nickel - LME Official Cash | $16255 | +$555 | +3.5% | -5.4% | -24.9% |

Lead - LME Official Cash | $2024 | +$23 | +1.1% | -7.9% | -6.2% |

Tin - LME Official Cash | $29610 | +$1205 | +4.2% | -10.0% | +3.0% |

Zinc - LME Official Cash | $2634.50 | +$64 | +2.5% | -8.3% | +6.0% |

Lithium Carbonate 99.5pct Battery Grade | $82000 | -$400 | -0.5% | -9.6% | -73.1% |

Spodumene Concentrate Index ($US-mt) | $915 | -$6 | -0.7% | -12.6% | -75.0% |

West Texas Int. Crude Oil ($US/brl) | $77.91 | +$3.18 | +4.3% | -5.0% | +6.6% |

Commodity prices on Wednesday

Company | Last Price | Change $ | Change % | 1mo % | 1yr % |

|---|---|---|---|---|---|

Core Lithium (CXO) | $0.105 | +$0.01 | +10.5% | +23.5% | -84.1% |

Develop Global (DVP) | $2.28 | +$0.12 | +5.6% | +3.6% | -30.5% |

Sandfire Resources (SFR) | $9.09 | +$0.39 | +4.5% | +3.4% | +34.9% |

Pilbara Minerals (PLS) | $3.06 | +$0.13 | +4.4% | +2.0% | -36.8% |

Karoon Energy (KAR) | $1.935 | +$0.07 | +3.8% | +5.2% | -11.6% |

Strike Energy (STX) | $0.205 | +$0.005 | +2.5% | -8.9% | -52.9% |

South32 (S32) | $3.14 | +$0.07 | +2.3% | -16.9% | -19.1% |

Paladin Energy (PDN) | $11.66 | +$0.25 | +2.2% | -11.3% | +58.6% |

Evolution Mining (EVN) | $4.01 | +$0.08 | +2.0% | +15.9% | +9.0% |

Beach Energy (BPT) | $1.520 | +$0.03 | +2.0% | +1.3% | -5.9% |

Newmont Corporation (NEM) | $75.09 | +$1.44 | +2.0% | +19.8% | 0% |

Champion Iron (CIA) | $6.40 | +$0.12 | +1.9% | -0.3% | +7.0% |

Rio Tinto (RIO) | $119.70 | +$2.22 | +1.9% | -1.2% | +2.2% |

Liontown Resources (LTR) | $0.965 | +$0.015 | +1.6% | +6.0% | -65.5% |

Westgold Resources (WGX) | $2.65 | +$0.04 | +1.5% | +9.1% | +60.1% |

Woodside Energy Group (WDS) | $28.02 | +$0.42 | +1.5% | -3.6% | -26.2% |

Northern Star Resources (NST) | $14.21 | +$0.13 | +0.9% | +11.3% | +23.5% |

Whitehaven Coal (WHC) | $7.79 | +$0.07 | +0.9% | -12.7% | +12.6% |

Fortescue (FMG) | $18.99 | +$0.12 | +0.6% | -13.4% | -12.4% |

Santos (STO) | $8.04 | +$0.05 | +0.6% | +4.7% | +1.0% |

IGO (IGO) | $5.58 | +$0.03 | +0.5% | -2.1% | -59.1% |

BHP Group (BHP) | $42.49 | +$0.19 | +0.4% | -2.7% | -7.7% |

ASX Energy and Resources stocks today

Only Financials (XFJ) (-0.36%) and Industrials (XNJ) (-0.23%) sectors suffered losses today, but fortunately, these were fairly modest.

ChartWatch

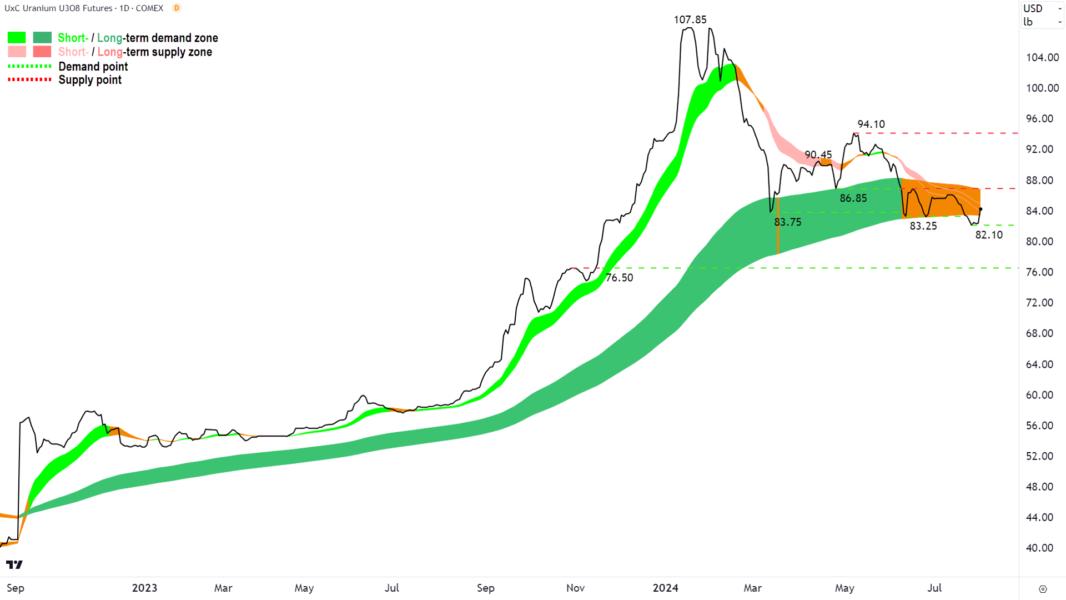

Uranium Futures (Front month, back-adjusted) COMEX

Touch and go for the uranium trend

The last time we covered uranium was in ChartWatch in the Evening Wrap on 23 July.

In that update, it was edging ever closer to closing below the key 83.15 (now 83.25 due to subsequent contract roll and back-adjustment), and below the long term downtrend ribbon.

I said such a close would “seal the deal” in terms of ending the uranium long term uptrend that had been in place since September 2022.

Well, history shows uranium did do both things, and therefore, as per my model, its long term uptrend is over and a new long term downtrend has commenced.

I can’t tell the future, yes, I know this is disappointing for all of us – so I don’t know how long the new long term downtrend will last. What I do know is that if the uranium price all of a sudden starts closing back above the long term trend ribbon and starts making rising peaks and rising troughs – that’s usually a very good sign we’ve returned to an environment of excess demand.

Until then, I must trust the prevailing short term downtrend at the very least. This current fledgling rally is testing this zone of dynamic supply, so the good news is we should get some information about whether this rally has any legs very soon.

The top of the long term trend ribbon and its associated dynamic supply coincides with the 86.85. I suggest that’s now the critical level going forward. A close above it is essential to signal to momentum traders the uranium bull market actually isn’t over…just yet!

Alternatively, a close below the 82.10 point of supply would likely lead to a probe of the 76.50 point of supply.

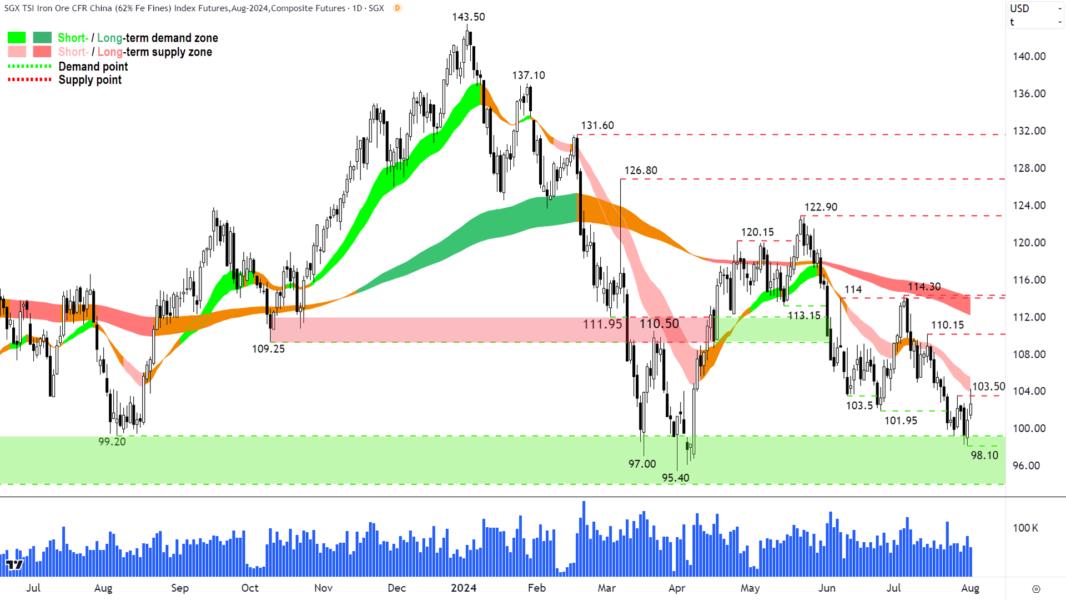

Iron Ore 62% (Front month, back-adjusted) SGX

We're at the demand zone, now what!?

The last time we covered iron ore was in ChartWatch in the Evening Wrap on 24 July.

In that update, the iron ore price was trudging towards an inevitable date with the 95.40-99.20 demand zone. It did eventually probe the zone, with yesterday’s candle low of 98.10 so far the extend of the current exploration.

Today’s candle’s bounce (still live) appears to be fading at the time of writing at the previous point of supply at 103.50. It’s also finding some dynamic supply at the short term downtrend ribbon.

I suggest that as long as the iron ore price continues to close below the short term downtrend ribbon, the short term downtrend remains intact.

If the iron ore price closes below 98.10, we’re going to see a deeper probe of 95.40-99.20. A close below 95.40 must hold above 94 (i.e., the point of supply coinciding with the bottom of the light green box in the chart – it’s just off screen to the left) or face a substantially deeper decline to 80. Yes…80!

As always, watch those candles. We would need to see some decent hitters in terms of long white candles that close at or near their highs to really turn the tide here. Firstly closing above 103.50, then 110.15 (preferably back to rising peaks and rising troughs by then), and ultimately, above the long term downtrend ribbon.

Economy

Today

There weren't any major data releases in our time zone today

Later this week

Thursday

21:00 UK BOE interest rate decision (forecast -0.25% to 5.0%)

Friday

00:00 ISM Manufacturing PMI July (49.0 forecast vs 48.5 previous)

11:30 AUS Producer Price Index (PPI) June Quarter (forecast +1.0% q/q vs +0.9% q/q forecast)

22:30 USA Non-Farm Employment Change July (+177k forecast vs +206k June); Average Hourly Earnings July (+0.3% m/m forecast vs +0.3% June); Unemployment Rate (4.1% forecast vs 4.1% June)

Latest News

Economy

Forget RBA hikes! Market now pricing 3 interest rate cuts by Christmas 2025

Thu 01 Aug 24, 2:08pm (AEST)

Earnings Transcripts rio

Rio Tinto 1H24 Earnings Call Highlights

Thu 01 Aug 24, 1:39pm (AEST)

Markets dro

DroneShield shares have halved in two weeks – Where to from here?

Thu 01 Aug 24, 1:07pm (AEST)

Earnings Transcripts cia

Champion Iron Q1 Earnings Call Highlights

Thu 01 Aug 24, 9:50am (AEST)

Technical Analysis cba ccp

ChartWatch ASX Scans: Commonwealth Bank, Lovisa, Qantas, Newmont, Lifestyle Communities, Meteoric Resources, Vulcan Steel

Thu 01 Aug 24, 9:00am (AEST)

Market Wraps

Morning Wrap: ASX 200 to rise, Chip sector rally lifts the S&P 500 + Fed hints at possible rate cut

Thu 01 Aug 24, 8:36am (AEST)

More News

Interesting Movers

Trading higher

+10.5% Core Lithium (CXO) - No news, Albermarle has announced it is going to halve production at its WA operations, didn't help the lithium price today in China (kept falling), but did spike a few ASX lithium stocks

+7.7% Syrah Resources (SYR) - No news since 25 July June 2024 Quarterly Activities Presentation

+6.3% Iperionx (IPX) - No news since 25 July June 2024 Quarterly Report, rise is consistent with prevailing short and long term uptrends 🔎📈

+5.6% Develop Global (DVP) - No news since 26 July Quarterly Activities Report

+5.2% Zip Co. (ZIP) - No news, still positive response to Tuesday's 4Q24 Appendix 4C Quarterly Cash Flow Report, rise is consistent with prevailing short and long term uptrends 🔎📈

+5.1% Temple & Webster Group (TPW) - No news, bouncing from long term uptrend ribbon

+5.0% Pointsbet (PBH) - Continued positive response to yesterday's Q4 FY24 - Appendix 4C and Investor Presentation, upgraded to buy from overweight at Jarden

+4.8% Life360 (360) - No news, generally stronger ASX tech sector today following big rally in US tech stocks Wednesday, rise is consistent with prevailing short and long term uptrends 🔎📈

+4.5% Sandfire Resources (SFR) - Copper price rallied 2.3% on the London Metals Exchange Wednesday

+4.4% Pilbara Minerals (PLS) - No news since 24 July June Quarter FY24 Activities Presentation, likely rising due to Albermarle news

+4.0% Appen (APX) - Continued positive response to yesterday's Q2 FY24 Quarterly Activity Report and Appendix 4C, yesterday upgraded to buy from hold at Canaccord Genuity

Trading lower

-14.7% Droneshield (DRO) - Successful Completion of $120m Underwritten Placement and Capital Raise Investor Presentation

-5.1% Red 5 (RED) - No news since yesterday's Quarterly Activities Report

-4.9% Monadelphous Group (MND) - Albemarle Contracts Update and Response to ASX Price Query, fall is consistent with prevailing short and long term downtrends 🔎📉

-4.8% Peninsula Energy (PEN) - No news since yesterday's Lance Project Update, fall is consistent with prevailing short and long term downtrends 🔎📉

-4.7% Tyro Payments (TYR) - No news since yesterday's Chief Financial Officer Changes, fall is consistent with prevailing short and long term downtrends 🔎📉

-4.3% OFX Group (OFX) - Annual General Meeting - CEO's address and Annual General Meeting - Presentation

-4.0% Kingsgate Consolidated (KCN) - Quarterly Activities/Appendix 5B Cash Flow Report

-3.4% Audinate Group (AD8) - No news, fall is consistent with prevailing short and long term downtrends 🔎📉

Broker Notes

Australian Clinical Labs (ACL)

Retained at neutral at Macquarie; Price Target: $2.55

Aeris Resources (AIS)

Retained at buy at Bell Potter; Price Target: $0.28 from $0.30

Aristocrat Leisure (ALL)

Retained at outperform at Macquarie; Price Target: $55.00

ALS (ALQ)

Retained at outperform at Macquarie; Price Target: $16.15 from $15.20

Ansell (ANN)

Retained at outperform at Macquarie; Price Target: $28.15

ANZ Group (ANZ)

Retained at buy at Goldman Sachs; Price Target: $29.10 from $28.15

Retained at underperform at Macquarie; Price Target: $26.50

Autosports Group (ASG)

Downgraded to neutral from buy at Citi; Price Target: $2.25 from $3.05

Australian Vanadium (AVL)

Retained at buy at Shaw and Partners; Price Target: $0.08

Accent Group (AX1)

Retained at overweight at Jarden; Price Target: $2.28

Black Cat Syndicate (BC8)

Retained at buy at Shaw and Partners; Price Target: $0.86

Bendigo and Adelaide Bank (BEN)

Retained at underperform at Macquarie; Price Target: $9.25

BHP Group (BHP)

Retained at neutral at Macquarie; Price Target: $43.00

Retained at equal-weight at Morgan Stanley; Price Target: $46.30

Bank of Queensland (BOQ)

Retained at underperform at Macquarie; Price Target: $4.75

Beach Energy (BPT)

Retained at neutral at Macquarie; Price Target: $1.45

Car Group (CAR)

Retained at buy at Goldman Sachs; Price Target: $41.40

Commonwealth Bank of Australia (CBA)

Retained at underperform at Macquarie; Price Target: $95.00

Champion Iron (CIA)

Retained at outperform at Macquarie; Price Target: $7.50

Retained at buy at Jarden; Price Target: $7.47 from $7.58

Retained at buy at Citi; Price Target: $8.20

Centuria Industrial Reit (CIP)

Retained at neutral at Macquarie; Price Target: $3.20 from $3.22

Retained at hold at Bell Potter; Price Target: $3.30 from $3.35

Retained at overweight at Jarden; Price Target: $3.65

Retained at equal-weight at Morgan Stanley; Price Target: $3.81

Cooper Energy (COE)

Retained at outperform at Macquarie; Price Target: $0.30

Cochlear (COH)

Retained at underperform at Macquarie; Price Target: $300.00

Conrad Asia Energy (CRD)

Retained at buy at Bell Potter; Price Target: $1.70 from $1.85

CSL (CSL)

Retained at outperform at Macquarie; Price Target: $330.00

Clarity Pharmaceuticals (CU6)

Retained at buy at Bell Potter; Price Target: $10.00 from $4.00

Carnarvon Energy (CVN)

Retained at outperform at Macquarie; Price Target: $0.29

Domain Australia (DHG)

Retained at neutral at Goldman Sachs; Price Target: $3.40 from $3.60

Endeavour Group (EDV)

Retained at overweight at Jarden; Price Target: $6.30

Evolution Energy Minerals (EV1)

Retained at buy at Shaw and Partners; Price Target: $0.24

Frontier Digital Ventures (FDV)

Retained at buy at Bell Potter; Price Target: $0.74 from $0.77

Firefly Metals (FFM)

Retained at buy at Shaw and Partners; Price Target: $1.10

Flight Centre Travel Group (FLT)

Retained at buy at Jarden; Price Target: $24.00

Fortescue (FMG)

Retained at underweight at Morgan Stanley; Price Target: $18.10

Fisher & Paykel Healthcare Corporation (FPH)

Retained at neutral at Macquarie; Price Target: $27.85

Fleetpartners Group (FPR)

Retained at buy at Citi; Price Target: $4.10

Gold Road Resources (GOR)

Retained at buy at Goldman Sachs; Price Target: $2.05 from $2.10

Downgraded to hold from buy at Argonaut Securities; Price Target: $1.85 from $2.00

Upgraded to overweight from neutral at JP Morgan; Price Target: $1.85 from $1.90

Upgraded to buy from hold at Moelis Australia; Price Target: $2.10 from $1.95

Retained at buy at Bell Potter; Price Target: $2.10

Genetic Signatures (GSS)

Retained at buy at Bell Potter; Price Target: $1.10

Guzman y Gomez (H L)

Retained at neutral at Macquarie; Price Target: $1.45

Insurance Australia Group (IAG)

Retained at neutral at Goldman Sachs; Price Target: $7.30 from $6.72

Integral Diagnostics (IDX)

Retained at outperform at Macquarie; Price Target: $2.85

IGO (IGO)

Retained at buy at Goldman Sachs; Price Target: $6.75 from $7.15

Retained at sell at Bell Potter; Price Target: $5.00 from $5.15

Retained at underweight at Morgan Stanley; Price Target: $4.60 from $5.05

Ingenia Communities Group (INA)

Retained at buy at Citi; Price Target: $5.30

JB HI-FI (JBH)

Retained at underweight at Jarden; Price Target: $50.50

Judo Capital (JDO)

Retained at underperform at Macquarie; Price Target: $1.00

Jupiter Mines (JMS)

Retained at outperform at Macquarie; Price Target: $0.37 from $0.40

Karoon Energy (KAR)

Retained at outperform at Macquarie; Price Target: $2.40

LGI (LGI)

Retained at buy at Shaw and Partners; Price Target: $3.60

Lifestyle Communities (LIC)

Retained at buy at Citi; Price Target: $11.70

Light & Wonder (LNW)

Retained at outperform at Macquarie; Price Target: $120.00

Lotus Resources (LOT)

Retained at buy at Bell Potter; Price Target: $0.65 from $0.60

Retained at buy at Shaw and Partners; Price Target: $0.72

Mirvac Group (MGR)

Downgraded to neutral from buy at Citi; Price Target: $2.10

Megaport (MP1)

Retained at buy at Goldman Sachs; Price Target: $14.00 from $14.85

Monash IVF Group (MVF)

Retained at outperform at Macquarie; Price Target: $1.55

National Australia Bank (NAB)

Retained at underperform at Macquarie; Price Target: $32.50

Nine Entertainment (NEC)

Retained at buy at Goldman Sachs; Price Target: $1.90 from $2.10

Nickel Industries (NIC)

Retained at buy at Citi; Price Target: $1.05

Retained at overweight at Morgan Stanley; Price Target: $0.95

Noumi (NOU)

Retained at buy at Bell Potter; Price Target: $0.18

News Corporation (NWS)

Retained at buy at Goldman Sachs; Price Target: $48.70 from $44.70

Nextdc (NXT)

Retained at buy at Goldman Sachs; Price Target: $19.00 from $18.59

OOH!Media (OML)

Retained at buy at Goldman Sachs; Price Target: $1.50 from $1.67

Orora (ORA)

Retained at buy at Jarden; Price Target: $2.50 from $2.55

Origin Energy (ORG)

Retained at outperform at Macquarie; Price Target: $10.74 from $10.52

Retained at overweight at Jarden; Price Target: $10.70 from $11.00

Retained at buy at Citi; Price Target: $11.50 from $12.00

Pointsbet (PBH)

Upgraded to buy from overweight at Jarden; Price Target: $0.85

Retained at buy at Bell Potter; Price Target: $0.63

Paladin Energy (PDN)

Retained at overweight at Morgan Stanley; Price Target: $16.65

Peninsula Energy (PEN)

Retained at buy at Shaw and Partners; Price Target: $0.26

Pro Medicus (PME)

Retained at buy at Goldman Sachs; Price Target: $148.00 from $136.00

Retained at outperform at Macquarie; Price Target: $127.50

Polynovo (PNV)

Retained at outperform at Macquarie; Price Target: $2.75

Pexa Group (PXA)

Upgraded to buy from neutral at Goldman Sachs; Price Target: $16.00 from $14.20

REA Group (REA)

Retained at buy at Goldman Sachs; Price Target: $223.00 from $202.00

Regis Healthcare (REG)

Retained at outperform at Macquarie; Price Target: $5.50

Ramsay Health Care (RHC)

Retained at neutral at Macquarie; Price Target: $50.10

Rio Tinto (RIO)

Retained at buy at Goldman Sachs; Price Target: $136.60 from $136.10

Retained at Macquarie; Price Target: $118.00

Retained at neutral at UBS; Price Target: $125.00

Retained at neutral at Citi; Price Target: $128.00 from $137.00

Retained at overweight at Morgan Stanley; Price Target: $137.50

Resmed Inc (RMD)

Retained at outperform at Macquarie; Price Target: $35.40

Siteminder (SDR)

Retained at neutral at Goldman Sachs; Price Target: $5.70 from $5.50

Downgraded to overweight from buy at Jarden; Price Target: $5.85 from $6.02

Retained at buy at UBS; Price Target: $6.65

Retained at overweight at Morgan Stanley; Price Target: $6.80

Seek (SEK)

Retained at sell at Goldman Sachs; Price Target: $20.60

Stockland (SGP)

Retained at buy at Citi; Price Target: $5.10 from $5.00

Sonic Healthcare (SHL)

Retained at neutral at Macquarie; Price Target: $26.10

Silk Logistics (SLH)

Retained at buy at Shaw and Partners; Price Target: $2.10

Spark New Zealand (SPK)

Upgraded to neutral from sell at Goldman Sachs; Price Target: NZ$4.50 from NZ$4.70

Saturn Metals (STN)

Retained at buy at Shaw and Partners; Price Target: $0.37

Strike Energy (STX)

Retained at neutral at Macquarie; Price Target: $0.22

Super Retail Group (SUL)

Retained at neutral at Jarden; Price Target: $15.10

Suncorp Group (SUN)

Retained at buy at Goldman Sachs; Price Target: $18.50 from $18.00

Retained at overweight at Morgan Stanley; Price Target: $20.20

Seven Group (SVW)

Retained at buy at Goldman Sachs; Price Target: $41.80 from $42.10

Seven West Media (SWM)

Retained at sell at Goldman Sachs; Price Target: $0.14 from $0.21

Tamboran Resources Corporation (TBN)

Retained at outperform at Macquarie; Price Target: $0.30

Tasmea (TEA)

Retained at buy at Shaw and Partners; Price Target: $2.15

Telstra Group (TLS)

Retained at buy at Goldman Sachs; Price Target: $4.30

Technology One (TNE)

Retained at outperform at Macquarie; Price Target: $22.20 from $18.30

TPG Telecom (TPG)

Downgraded to sell from neutral at Goldman Sachs; Price Target: $4.35 from $4.90

Westpac Banking Corporation (WBC)

Retained at underperform at Macquarie; Price Target: $26.00

Woolworths Group (WOW)

Retained at overweight at Jarden; Price Target: $39.90

Wisetech Global (WTC)

Retained at neutral at Goldman Sachs; Price Target: $91.00

Xero (XRO)

Retained at buy at Goldman Sachs; Price Target: $180.00

Scans

Top Gainers

| Code | Company | Last | % Chg |

|---|---|---|---|

| BEZ | Besra Gold Inc | $0.086 | +43.33% |

| AMS | Atomos Ltd | $0.045 | +25.00% |

| KAI | Kairos Minerals Ltd | $0.011 | +23.53% |

| EPY | Earlypay Ltd | $0.215 | +22.86% |

| PPG | Pro-Pac Packaging... | $0.085 | +21.43% |

View all top gainers

Top Fallers

| Code | Company | Last | % Chg |

|---|---|---|---|

| GR8 | Great Dirt Resour... | $0.15 | -25.00% |

| CR1 | Constellation Res... | $0.13 | -18.75% |

| MGU | Magnum Mining and... | $0.013 | -18.75% |

| ENL | Enlitic Inc | $0.11 | -18.52% |

| MMM | Marley Spoon Se | $0.022 | -18.52% |

View all top fallers

52 Week Highs

| Code | Company | Last | % Chg |

|---|---|---|---|

| AMS | Atomos Ltd | $0.045 | +25.00% |

| BWN | Bhagwan Marine Ltd | $0.70 | +9.38% |

| PSQ | Pacific Smiles Gr... | $2.03 | +7.41% |

| ZIP | ZIP Co Ltd | $2.01 | +5.24% |

| 360 | LIFE360 Inc | $17.35 | +4.77% |

View all 52 week highs

52 Week Lows

| Code | Company | Last | % Chg |

|---|---|---|---|

| GR8 | Great Dirt Resour... | $0.15 | -25.00% |

| ENL | Enlitic Inc | $0.11 | -18.52% |

| MOZ | Mosaic Brands Ltd | $0.057 | -17.39% |

| AZ9 | Asian Battery Met... | $0.022 | -15.39% |

| TOR | Torque Metals Ltd | $0.11 | -15.39% |

View all 52 week lows

Near Highs

| Code | Company | Last | % Chg |

|---|---|---|---|

| VVLU | Vanguard Global V... | $73.92 | +2.14% |

| IHD | Ishares S&P/ASX D... | $14.17 | +1.58% |

| AYLD | Global X S&P/ASX ... | $10.58 | +0.38% |

| PGC | Paragon Care Ltd | $0.45 | 0.00% |

| IRE | Iress Ltd | $10.63 | +2.31% |

View all near highs

Relative Strength Index (RSI) Oversold

| Code | Company | Last | % Chg |

|---|---|---|---|

| MGX | Mount Gibson Iron... | $0.355 | 0.00% |

| CCX | City Chic Collect... | $0.105 | -4.55% |

| LOT | Lotus Resources Ltd | $0.26 | 0.00% |

| DEV | DEVEX Resources Ltd | $0.24 | -5.88% |

| GLN | Galan Lithium Ltd | $0.135 | -3.57% |

View all RSI oversold