Macquarie tips NextDC and Infratil as undervalued AI plays

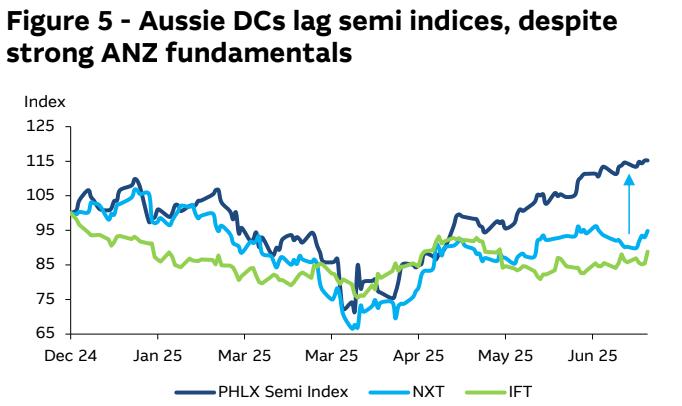

Australian data centre stocks like NextDC NXT and Infratil

IFT are trading at a significant discount to the Philadelphia Semiconductor Index, a key barometer for AI-related investment comprising the 30 largest US semiconductor companies.

Macquarie analysts believe this disconnect presents a potential value opportunity as artificial intelligence infrastructure investment accelerates globally.

Valuation Gap Emerges

NextDC has underperformed the PHLX Semiconductor Index by 22% since March lows, while Infratil lags by 18%. This disconnect is unusual given the strong historical correlation between Australian data centre stocks and global semiconductor performance.

Source: Macquarie Research, July 2025

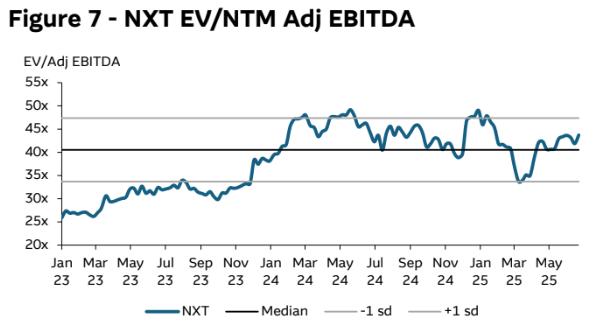

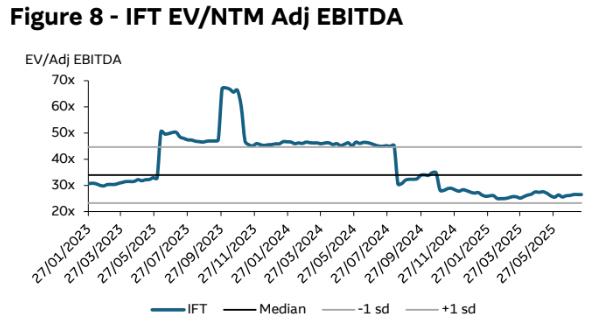

Both companies are trading below one standard deviation of their median multiples during the AI era, suggesting current valuations may not reflect underlying fundamentals.

Source: Macquarie Research, July 2025

Source: Macquarie Research, July 2025

Strong Demand Fundamentals Intact

The Australian data centre sector is experiencing robust demand driven by hyperscaler investment. Amazon Web Services' recent increased commitment implies 1.8 gigawatts of Australian data centre capacity demand, creating substantial growth opportunities for both NextDC and Infratil.

Current contracted and optioned capacity could more than double earnings for both companies over the next two years if fully deployed. Google and Oracle have also increased their Australian leasing activity, reinforcing the strong demand environment.

Semiconductor Recovery

The semiconductor rally has been driven by NVIDIA's restart of China sales following relaxed US export restrictions on specialised AI chips. Despite NVIDIA facing US$2.6 billion in lost revenue and a US$4.5 billion inventory write-off, the company still generated US$4.6 billion from China chip sales in the first quarter.

Media speculation suggests the relaxed restrictions are part of a broader US-China rare earths agreement, restoring confidence in AI infrastructure investment globally.

Closer to home, an improving regulatory landscape in Australia is reducing risks around supplying increased data centre capacity. This development, combined with strong demand fundamentals, creates a supportive environment for expansion.

The Bottom Line

Macquarie analysts argue the March semiconductor sell-off incorrectly priced in an AI earnings bubble, with recent hyperscaler results confirming continued global AI infrastructure investment. Australian data centre operators appear positioned to benefit from this trend while trading at attractive relative valuations.

The valuation discount to historical norms and the semiconductor recovery suggests potential for multiple expansion, particularly given the strong underlying demand drivers and improving regulatory environment.