ChartWatch ASX Scans: Ansell, Ausgold, Botanix, Genesis Minerals, Lendlease, Titomic, A2 Milk, Ampol, Dicker Data

- Interesting uptrends in today's Scans: Ausgold (AUC), Botanix (BOT), Breville (BRG), Brambles (BXB), Codan (CDA), Catalyst Metals (CYL), Genesis Minerals (GMD), Healius (HLS), Opthea (OPT), Pro Medicus (PME), Spartan Resources (SPR), Titomic (TTT)

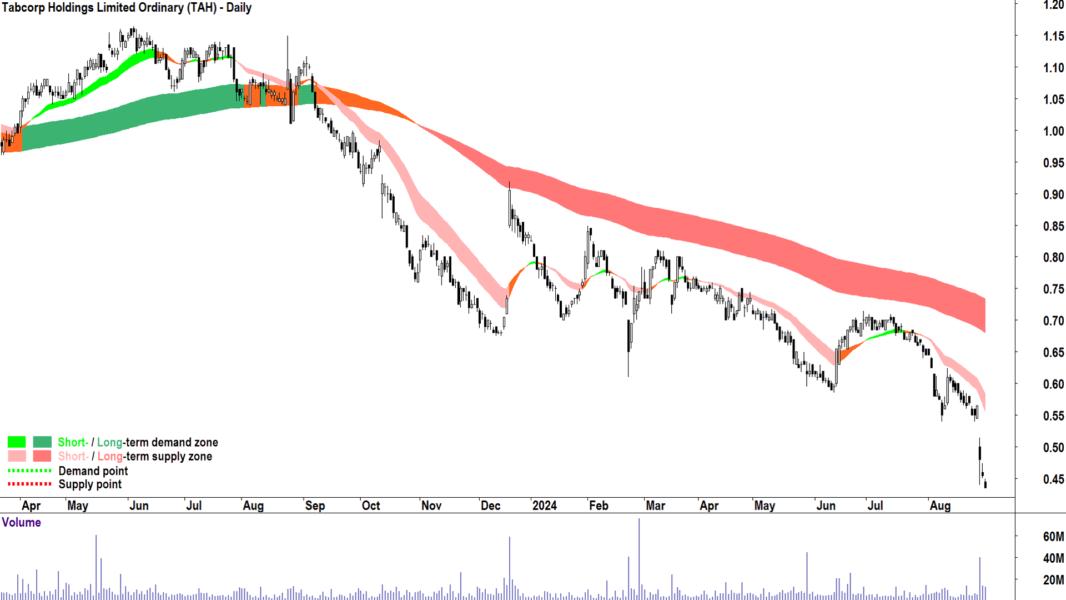

- Interesting downtrends in today's Scans: The A2 Milk Company (A2M), Ampol (ALD), Dicker Data (DDR), Paladin Energy (PDN), Patriot Battery Metals (PMT), Ramsay Health Care (RHC), Spark New Zealand (SPK), Tabcorp (TAH)

Welcome to my ChartWatch Daily ASX Scans series. Here I present scan lists based on my trend following technical analysis methodology. My goal is to alert you to the best uptrends and downtrends on the ASX.

Uptrends Scan List

Company | Code | Last Price | 1mo % | 1yr % |

|---|---|---|---|---|

AI-Media Technologies | AIM | $0.550 | +27.9% | +107.5% |

Argo Global Listed Infrastructure | ALI | $2.29 | +6.0% | +4.6% |

AGL Energy | AGL | $11.61 | +9.9% | +4.6% |

Aristocrat Leisure | ALL | $54.71 | +0.7% | +34.3% |

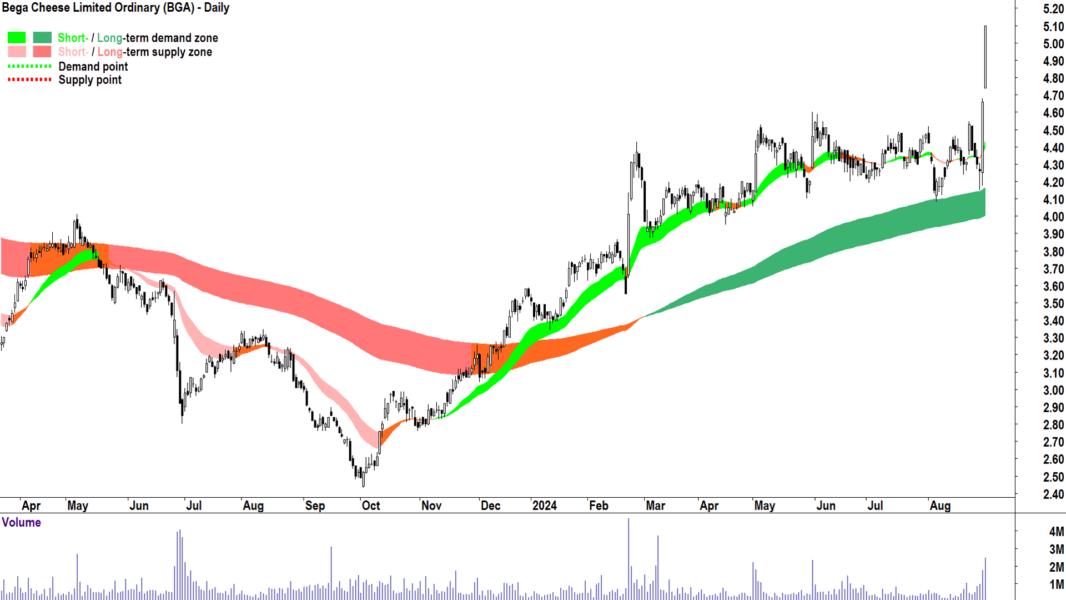

Bega Cheese | BGA | $5.10 | +15.4% | +69.4% |

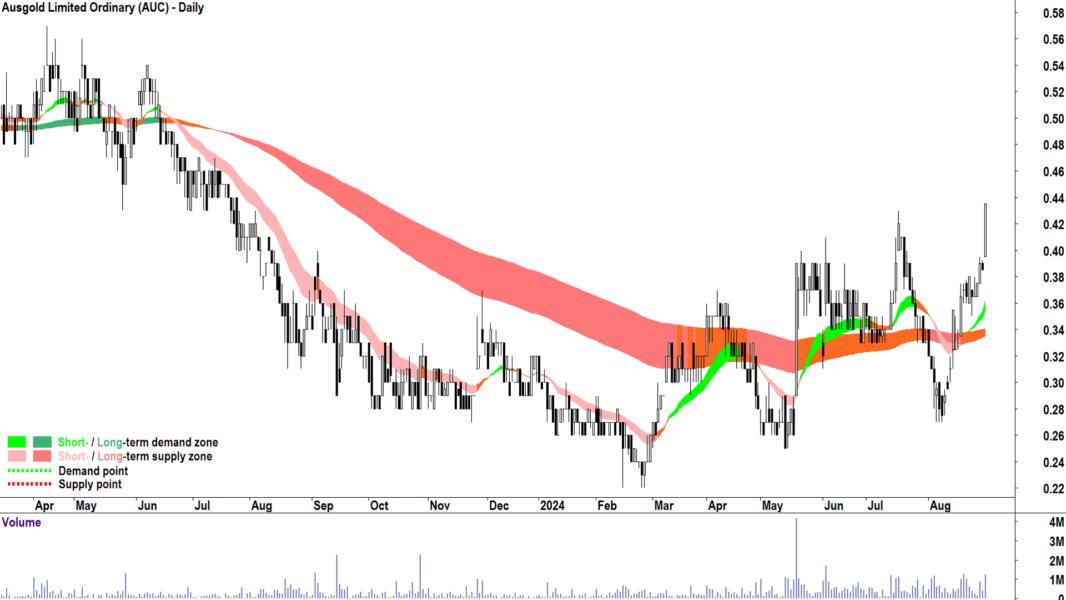

Ausgold | AUC | $0.435 | +35.9% | +31.8% |

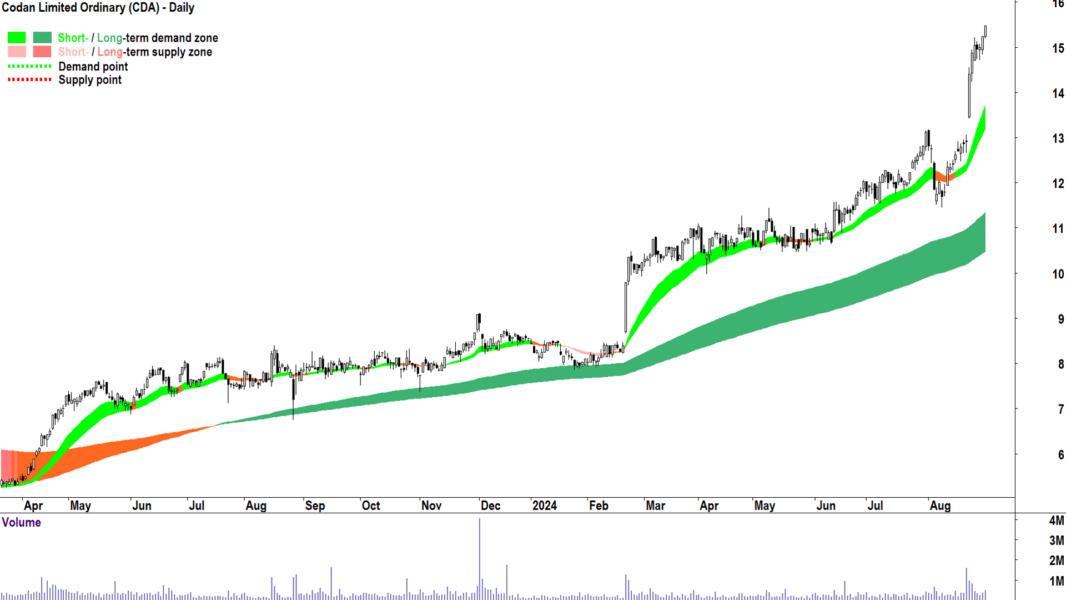

Codan | CDA | $15.48 | +20.8% | +99.0% |

Charter Hall Long Wale Reit | CLW | $3.89 | +8.7% | +11.8% |

Amcor | AMC | $16.69 | +3.2% | +11.2% |

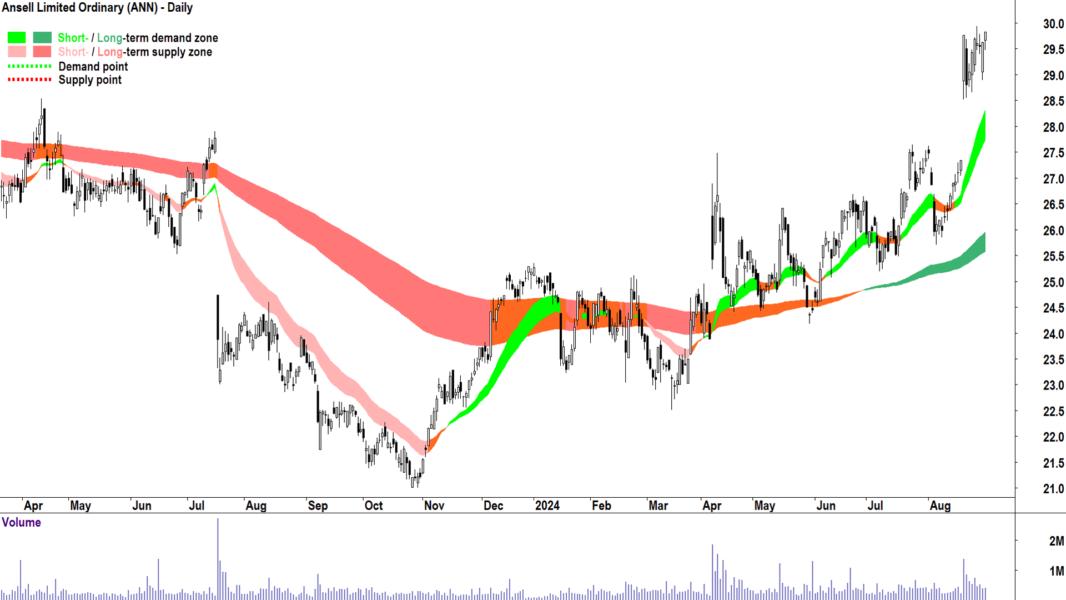

Ansell | ANN | $29.83 | +8.6% | +28.3% |

ANZ Group | ANZ | $30.40 | +4.0% | +22.6% |

BetaShares Global Healthcare Hedged ETF | DRUG | $9.12 | +4.0% | +14.9% |

Downer EDI | DOW | $5.59 | +11.6% | +34.4% |

Findi | FND | $4.43 | +17.5% | +795.0% |

Brambles | BXB | $18.23 | +17.4% | +28.8% |

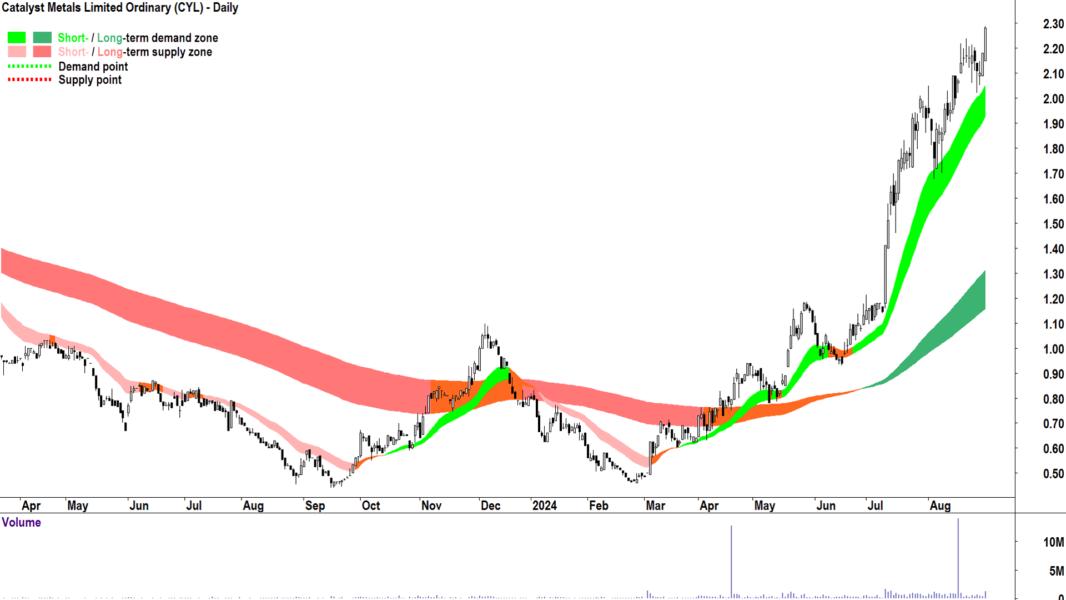

Catalyst Metals | CYL | $2.28 | +17.5% | +365.3% |

Botanix Pharmaceuticals | BOT | $0.400 | +5.3% | +116.2% |

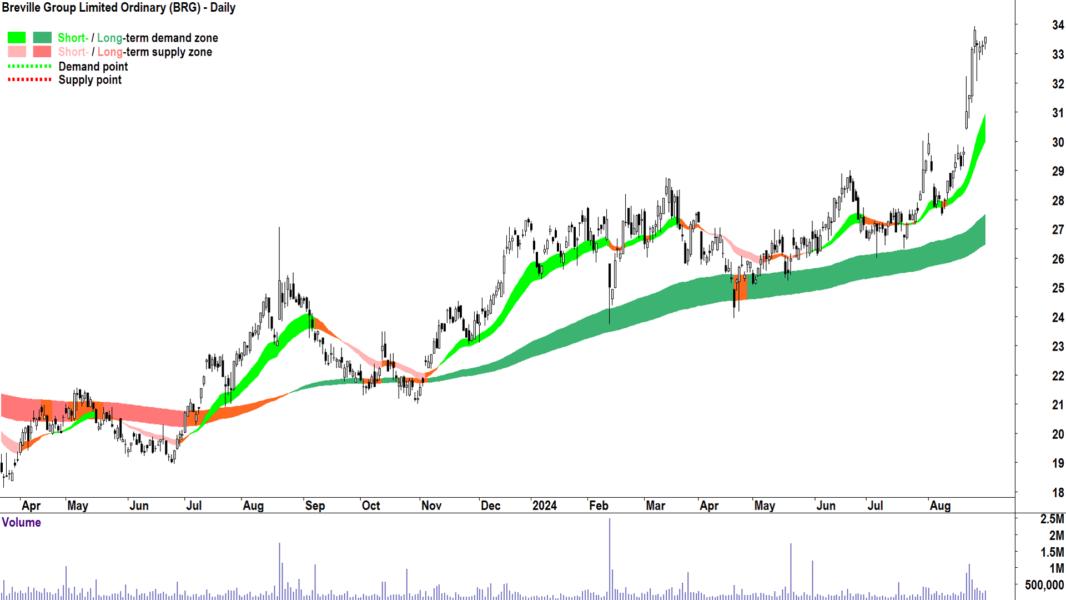

Breville Group | BRG | $33.58 | +12.2% | +37.1% |

Fisher & Paykel Healthcare Corporation | FPH | $33.01 | +10.8% | +63.2% |

Charter Hall Retail Reit | CQR | $3.64 | +3.7% | +6.4% |

Finbar Group | FRI | $0.980 | +10.1% | +40.0% |

Generation Development Group | GDG | $2.78 | +8.2% | +134.1% |

Genesis Minerals | GMD | $2.27 | +7.6% | +45.5% |

GPT Group | GPT | $4.92 | +5.6% | +18.8% |

HMC Capital | HMC | $8.46 | +5.1% | +58.7% |

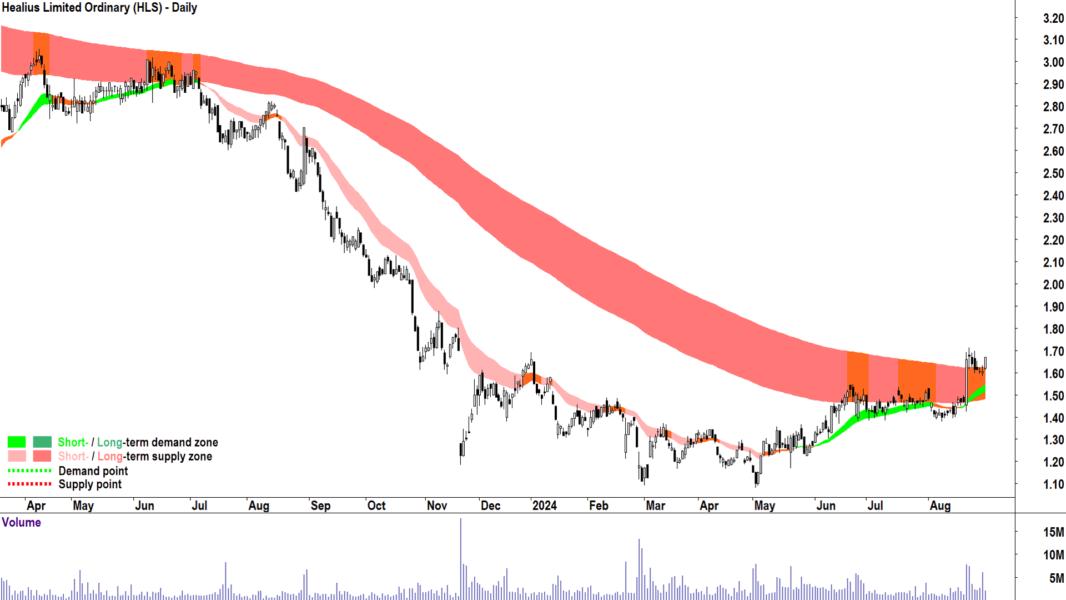

Healius | HLS | $1.670 | +12.5% | -30.9% |

Hotel Property Investments | HPI | $3.46 | +3.0% | +16.1% |

Hub24 | HUB | $55.76 | +11.0% | +74.3% |

Judo Capital | JDO | $1.645 | +15.4% | +78.8% |

Humm Group | HUM | $0.685 | +47.3% | +55.7% |

Insurance Australia Group | IAG | $7.55 | +1.8% | +32.7% |

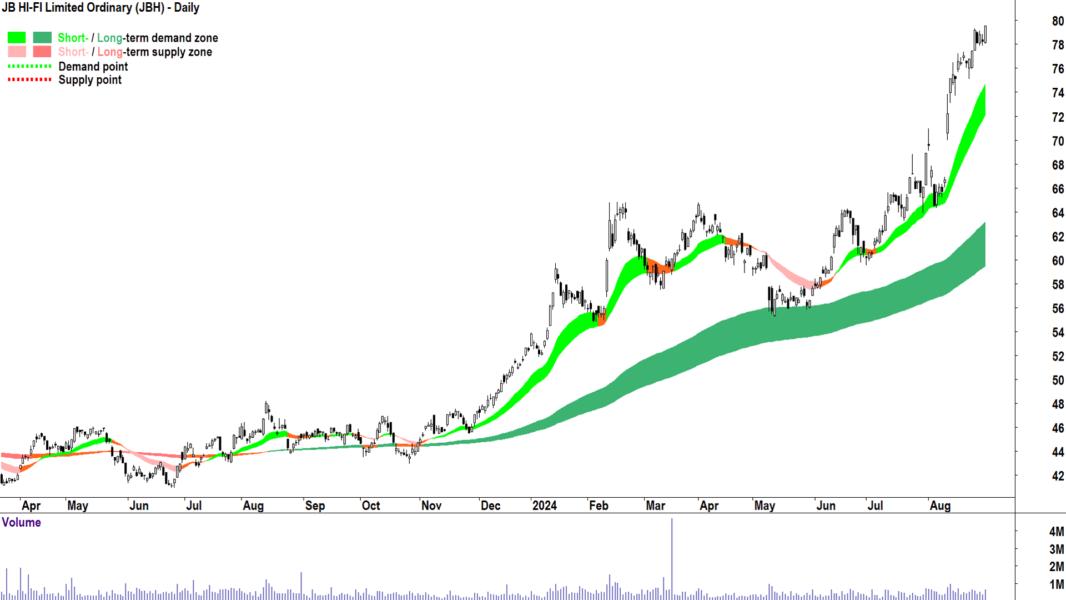

JB HI-FI | JBH | $79.57 | +14.4% | +77.8% |

Mayur Resources | MRL | $0.290 | +20.8% | +61.1% |

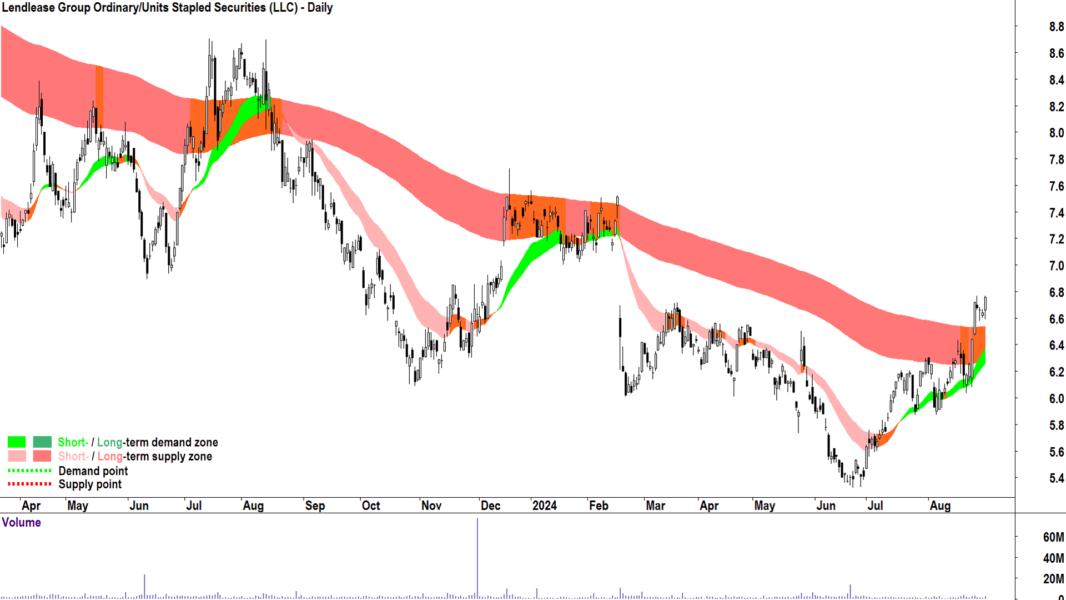

Lendlease Group | LLC | $6.76 | +8.2% | -11.1% |

Macmahon | MAH | $0.335 | +17.5% | +109.4% |

Vaneck Australian Banks ETF | MVB | $37.62 | +2.6% | +30.8% |

Northern Star Resources | NST | $15.26 | +7.4% | +31.2% |

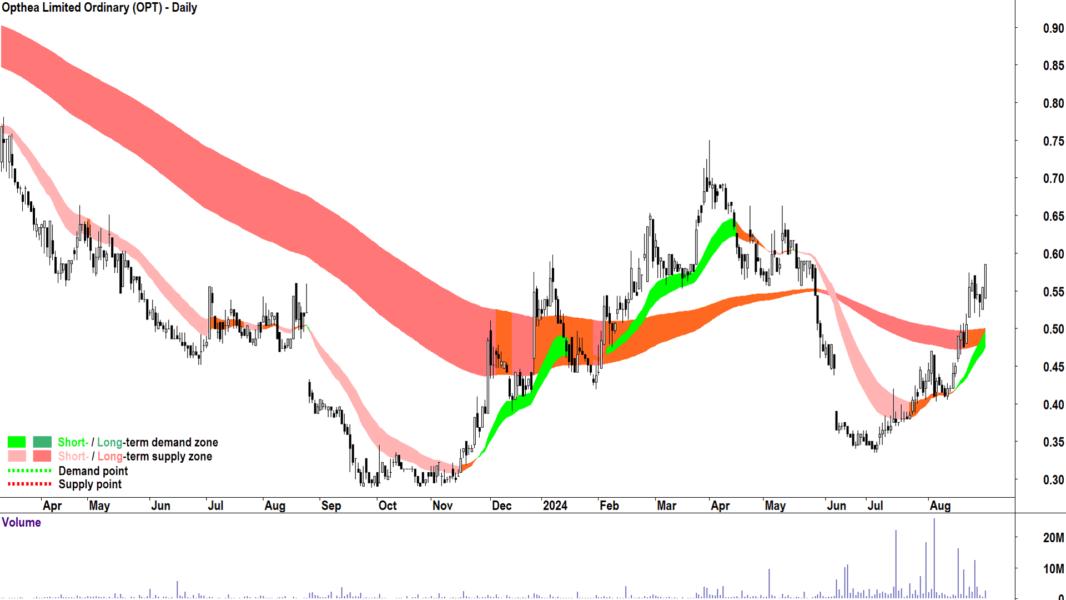

Opthea | OPT | $0.585 | +31.5% | +14.2% |

Pacific Current Group | PAC | $11.40 | +4.6% | +4.4% |

Pinnacle Investment Management Group | PNI | $17.49 | +6.3% | +90.1% |

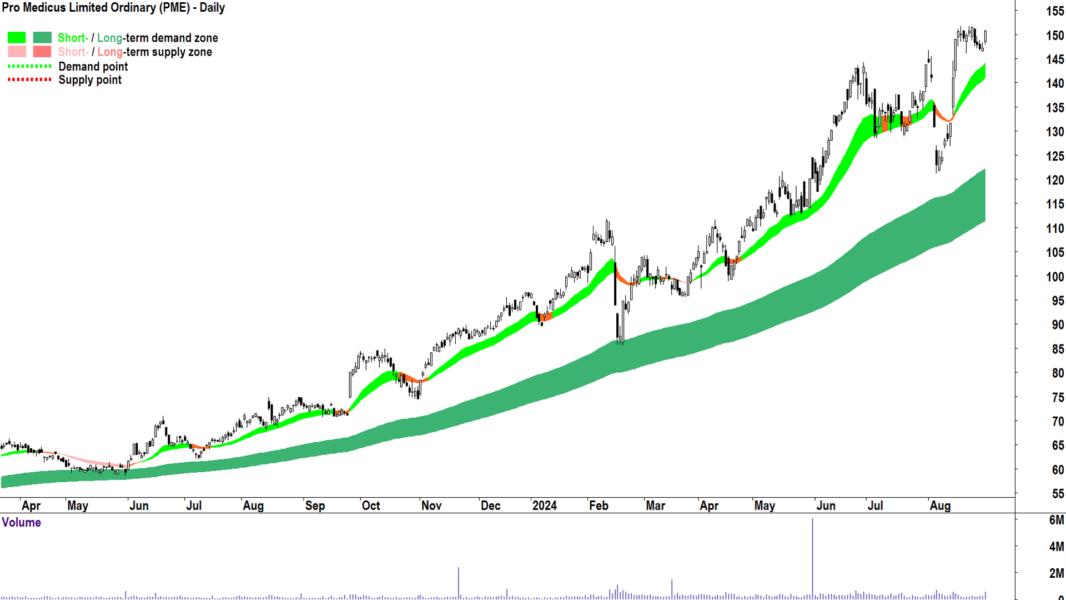

Pro Medicus | PME | $150.70 | +4.4% | +103.4% |

Qantas Airways | QAN | $6.71 | +5.8% | +11.3% |

REA Group | REA | $219.00 | +7.3% | +34.5% |

Rimfire Pacific Mining | RIM | $0.078 | +69.6% | +1200.0% |

Reliance Worldwide Corporation | RWC | $5.36 | +3.1% | +30.1% |

Reece | REH | $27.34 | -2.4% | +36.6% |

Ramelius Resources | RMS | $2.22 | +13.3% | +70.1% |

Scentre Group | SCG | $3.44 | -1.7% | +26.0% |

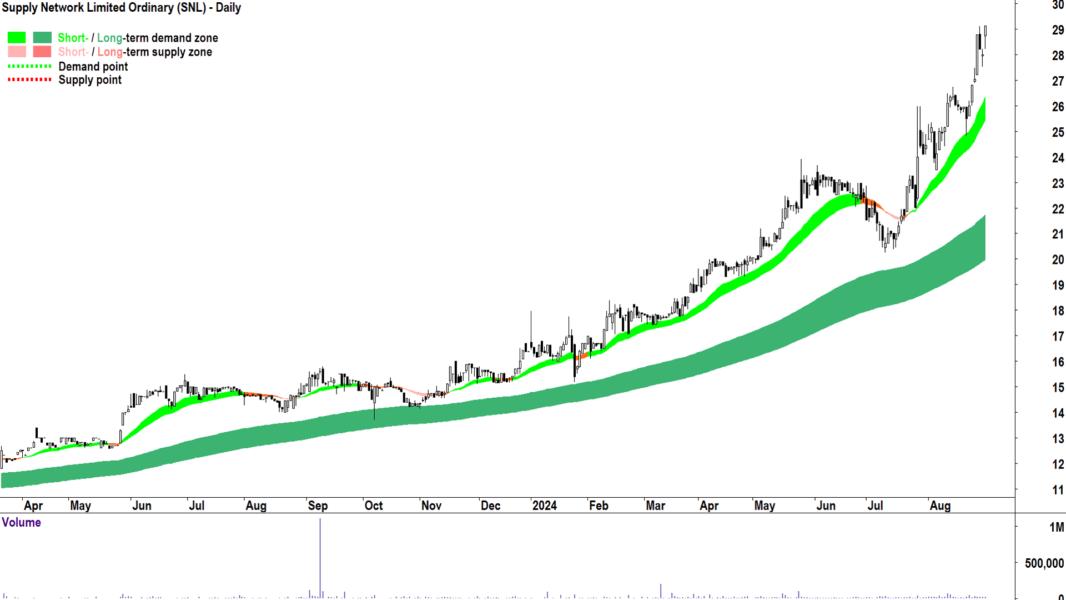

Supply Network | SNL | $29.13 | +17.9% | +99.5% |

Stockland | SGP | $5.02 | +8.9% | +19.2% |

Spartan Resources | SPR | $1.455 | +15.5% | +388.1% |

SRG Global | SRG | $1.090 | +16.0% | +60.3% |

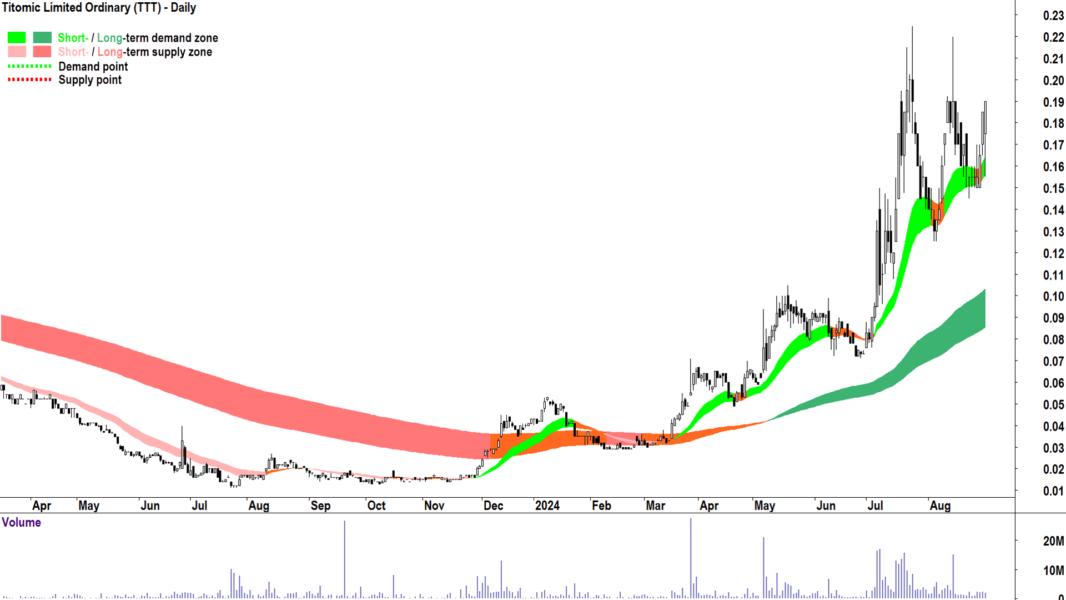

Titomic | TTT | $0.190 | +35.7% | +850.0% |

Super Retail Group | SUL | $17.86 | +11.5% | +41.3% |

Telstra Group | TLS | $3.93 | -0.5% | -2.2% |

Vicinity Centres | VCX | $2.22 | +5.2% | +20.3% |

Westgold Resources | WGX | $3.04 | +14.7% | +96.8% |

Westpac Banking Corporation | WBC | $31.24 | +5.2% | +45.7% |

Today's Uptrends Scan List

Feature charts from today's Uptrends List 🔎📈

The stocks that I feel are showing the strongest excess demand from today's Uptrends List are: Amcor AMC, Ansell

ANN, ANZ Group

ANZ, Ausgold

AUC, Bega Cheese

BGA, Botanix Pharmaceuticals

BOT, Breville Group

BRG, Brambles

BXB, Codan

CDA, Catalyst Metals

CYL, Fisher & Paykel Healthcare Corporation

FPH, Generation Development Group

GDG, Genesis Minerals

GMD, GPT Group

GPT, Healius

HLS, Hub24

HUB, JB HI-FI

JBH, Lendlease Group

LLC, Macmahon

MAH, Opthea

OPT, Pro Medicus

PME, Reliance Worldwide Corporation

RWC, Supply Network

SNL, Spartan Resources SSPR, SRG Global

SRG, Titomic

TTT, Westpac Banking Corporation

WBC.

Charts below:

Downtrends Scan List

Company | Code | Last Price | 1mo % | 1yr % |

|---|---|---|---|---|

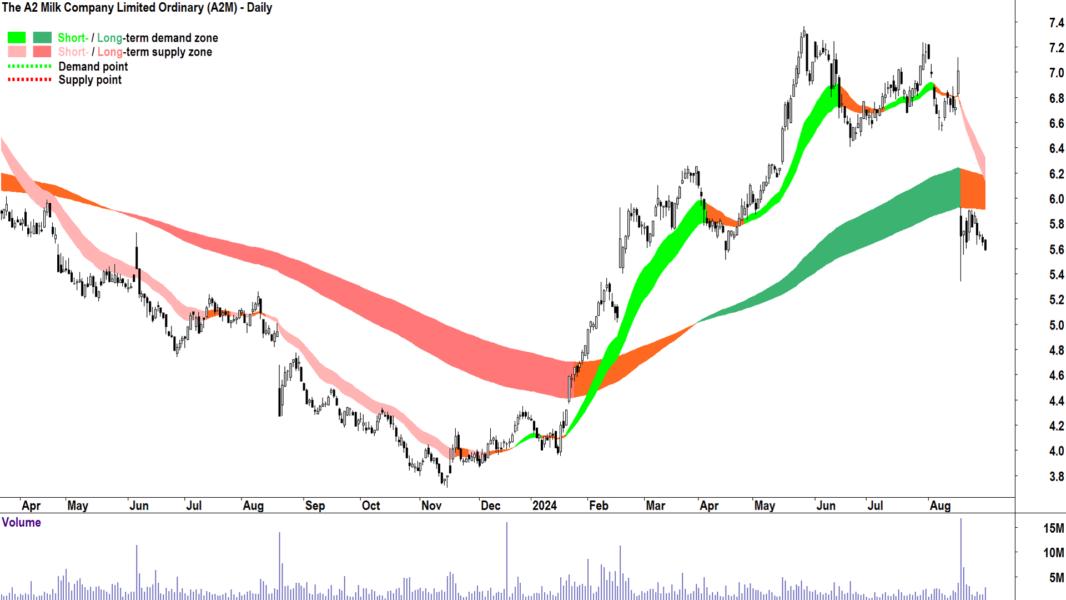

The A2 Milk Company | A2M | $5.59 | -21.4% | +20.2% |

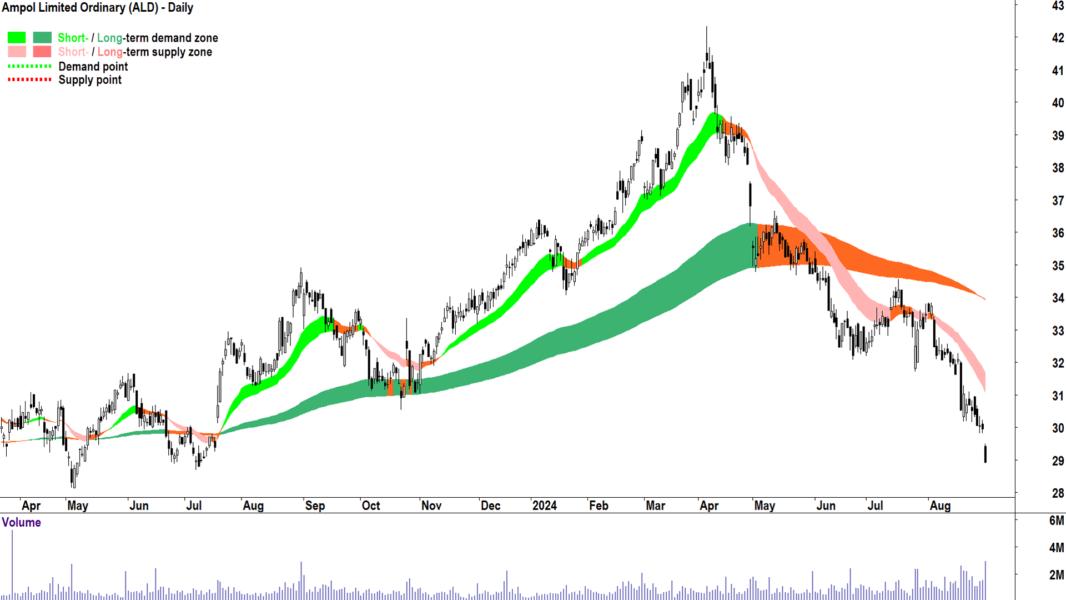

Ampol | ALD | $28.93 | -13.8% | -15.0% |

Bellevue Gold | BGL | $1.265 | -9.3% | -18.7% |

Brainchip | BRN | $0.170 | -10.5% | -47.7% |

Dicker Data | DDR | $9.11 | -11.2% | +8.3% |

Grange Resources | GRR | $0.275 | -12.7% | -33.7% |

Kelsian Group | KLS | $3.76 | -27.6% | -43.3% |

Lifestyle Communities | LIC | $7.72 | -15.7% | -53.6% |

Meteoric Resources | MEI | $0.100 | -4.8% | -45.9% |

Mineral Resources | MIN | $40.15 | -25.4% | -42.2% |

Neuren Pharmaceuticals | NEU | $15.59 | -19.6% | +27.1% |

New Hope Corporation | NHC | $4.48 | -9.1% | -20.0% |

NIB | NHF | $6.26 | -16.8% | -22.5% |

OOH!Media | OML | $1.260 | -13.4% | -14.3% |

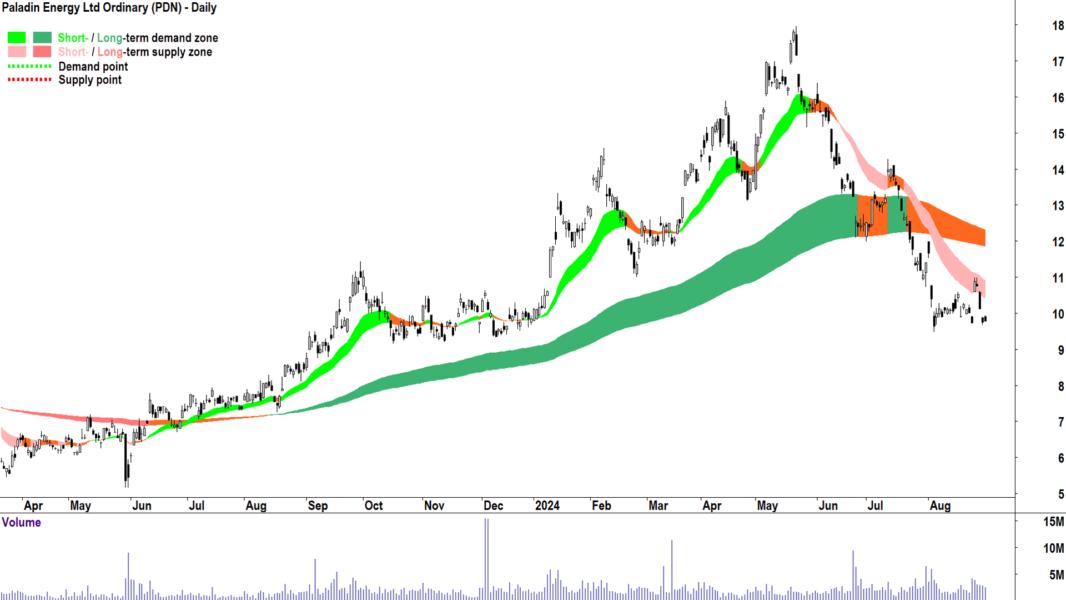

Paladin Energy | PDN | $9.79 | -16.0% | +15.9% |

Patriot Battery Metals | PMT | $0.445 | -15.2% | -66.0% |

Perpetual | PPT | $19.65 | -10.2% | -6.3% |

Platinum Asset Management | PTM | $0.995 | -7.0% | -33.9% |

Ramsay Health Care | RHC | $41.55 | -10.5% | -18.9% |

Stanmore Resources | SMR | $3.01 | -18.0% | +7.6% |

Spark New Zealand | SPK | $3.33 | -17.4% | -27.5% |

Santos | STO | $7.22 | -10.2% | -5.1% |

Syrah Resources | SYR | $0.225 | -19.6% | -58.7% |

Tabcorp | TAH | $0.435 | -32.6% | -59.9% |

Talga Group | TLG | $0.435 | +1.2% | -62.8% |

Viva Energy Group | VEA | $2.88 | -11.7% | -7.1% |

Whitehaven Coal | WHC | $6.69 | -14.1% | +1.1% |

Today's Downtrends Scan List

Feature charts from today's Downtrends List 🔎📉

The stocks that I feel are showing the strongest excess supply from today's Downtrends List are: The A2 Milk Company A2M, Ampol

ALD, Dicker Data

DDR, Paladin Energy

PDN, Patriot Battery Metals

PMT, Ramsay Health Care

RHC, Spark New Zealand

SPK, Tabcorp

TAH.

Charts of each below:

ChartWatch ASX Scans Criteria

Criteria for Uptrends List

Short term uptrend (ST trend ribbon is light green)

Long term uptrend or long term trend is transitioning from down to up (LT trend ribbon is dark green, or LT trend ribbon is amber and contracting)

Demand-side price action (rising peaks and rising troughs is preferred, but based upon weight of evidence of other criteria rising peaks only or rising troughs only may be permitted)

Predominance of demand-side candles (i.e., white bodies and or downward pointing shadows)

The last candle in particular is a strong demand-side candle

Criteria for Downtrends List

Short term downtrend (ST trend ribbon is light pink)

Long term downtrend or long term trend is transitioning from up to down (LT trend ribbon is dark pink, or LT trend ribbon is amber and contracting)

Supply-side price action (falling peaks and falling troughs is preferred, but based upon weight of evidence of other criteria falling peaks only or falling troughs only may be permitted)

Predominance of supply-side candles (i.e., black bodies and or upward pointing shadows)

The last candle in particular is a strong supply-side candle

Important considerations when using the ChartWatch ASX Scan Lists:

1. The future is unknown. Anything can happen to change the trends in the lists above. A stock in a perfect uptrend or downtrend may not remain that way by the close of trading today. 2. These lists are not exhaustive, they are curated by Carl. You will find that certain stocks might not appear in a particular list on consecutive days but might reappear when Carl feels it deserves to return to the list. 3. This is not a recommendation service, merely an aid to help you better understand the workings of Carl’s technical analysis model in a practical way. Carl will not alert you to stocks that have dropped off a list because their trend has changed – it is up to you to apply the criteria to determine why a particular stock might not still be included. 4. This is general, educational information only – always do your own research.