ChartWatch ASX Scans: Silver stocks return to strength as iron ore stocks RIO and CIA feature in downtrends

- Interesting uptrends in today's Scans: Uranium ETF (ATOM), Antipa Minerals (AZY), Droneshield (DRO), Metcash (MTS), Nexgen Energy (NXG), St Barbara (SBM), Sigma Healthcare (SIG), Sun Silver (SS1), Silver Mines (SVL), Tasmea (TEA), Telstra (TLS).

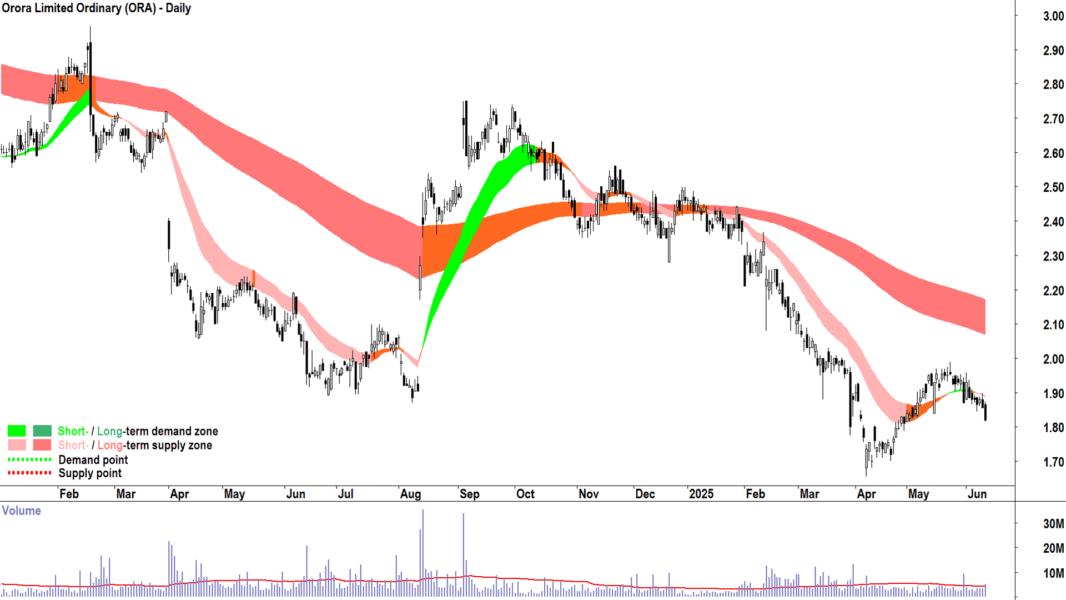

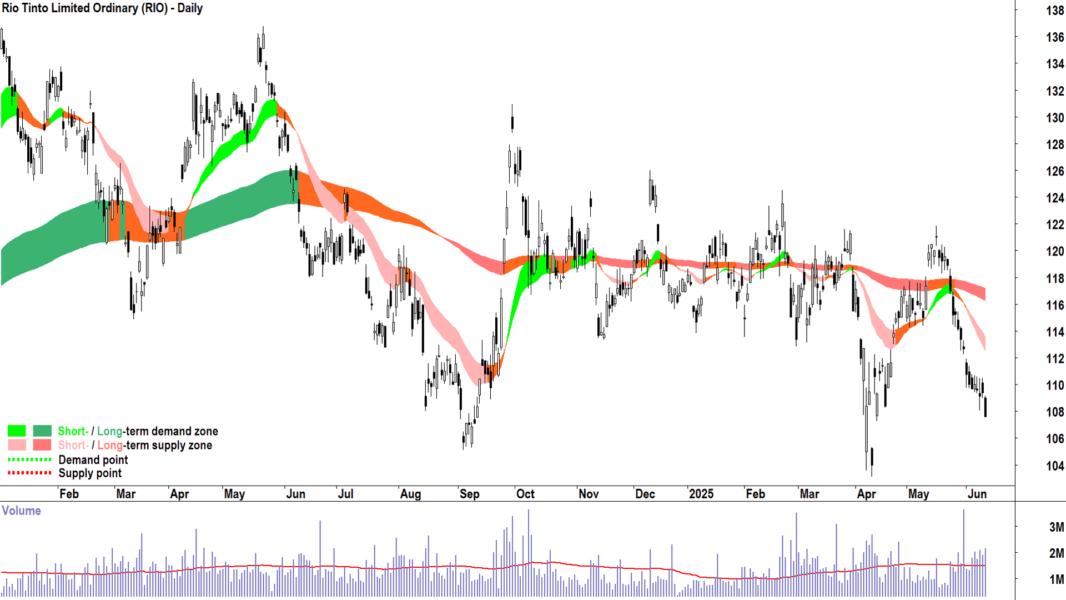

- Interesting downtrends in today's Scans: Champion Iron (CIA), Cettire (CTT), Domino's Pizza Enterprises (DMP), HMC Capital (HMC), IDP Education (IEL), Orora (ORA), Rio Tinto (RIO), Treasury Wine Estates (TWE).

ChartWatch is going *LIVE* 📈

If you want to LEARN MORE about technical analysis and trend following using real case studies on the ASX stocks you're interested in, be sure to register for this upcoming lunchtime webinar on Wednesday 18 June at 12pm AEST. Hosted by our resident technical analyst, Carl Capolingua.

ChartWatch *LIVE* Webinar - REGISTER NOW!

(100 places only! Will fill fast...so register now!)

ChartWatch ASX Scans is a great place to check up on the strongest uptrends and downtrends on the ASX.

ChartWatch ASX Scans isn't a signal service, that is, it won't tell you when to get in and when to get out.

As always, it's up to you howyou use the lists presented here each day. However, if one is familiar with the criteria used to select Uptrends and Downtrends lists' constituents, then it shouldn't be difficult to work out when a particular stock likely no longer meets the criteria for each list.

I discussed the qualification criteria in this recent Birthday Week edition. Basically, if you start to put crosses in any of the uptrend / downtrend criteria qualification boxes, then the trend in question is losing momentum. The more crosses, the less likely you want to have capital committed to that trend.

Maintaining candles, price action, and respecting the trend ribbons – these are the key basics of strong trends. To help those who wish to learn more about both the ChartWatch qualification and disqualification criteria, I'll be running a lunchtime webinar workshop next Wednesday at 12pm. Details are in the highlighted section above – all are welcome!

Welcome to my ChartWatch Daily ASX Scans series. Here I present scan lists based on my trend following technical analysis methodology. My goal is to alert you to the best uptrends and downtrends on the ASX.

Feel free to get your favourite AI to convert the tables below into lists you can upload to your favourite trading platform like TradingView. Then you'll be able to skip from chart to chart and quickly and easily see the best uptrends and downtrends on the ASX.

Some investors prefer to buy those stocks in strong uptrends, and avoid, sell, or short sell those stocks in strong downtrends – but how you use the lists is really up to you!

Note, many stocks in both lists have appeared there many times before. As long as they keep meeting my criteria – they'll keep appearing. But note, there won't be any notifications when they don't, so you'll have to do your own research on when a particular trend changes!

Uptrends Scan List

Company | Code | Last Price | 1mo % | 1yr % |

Autosports Group | ASG | $2.17 | -0.5% | -2.3% |

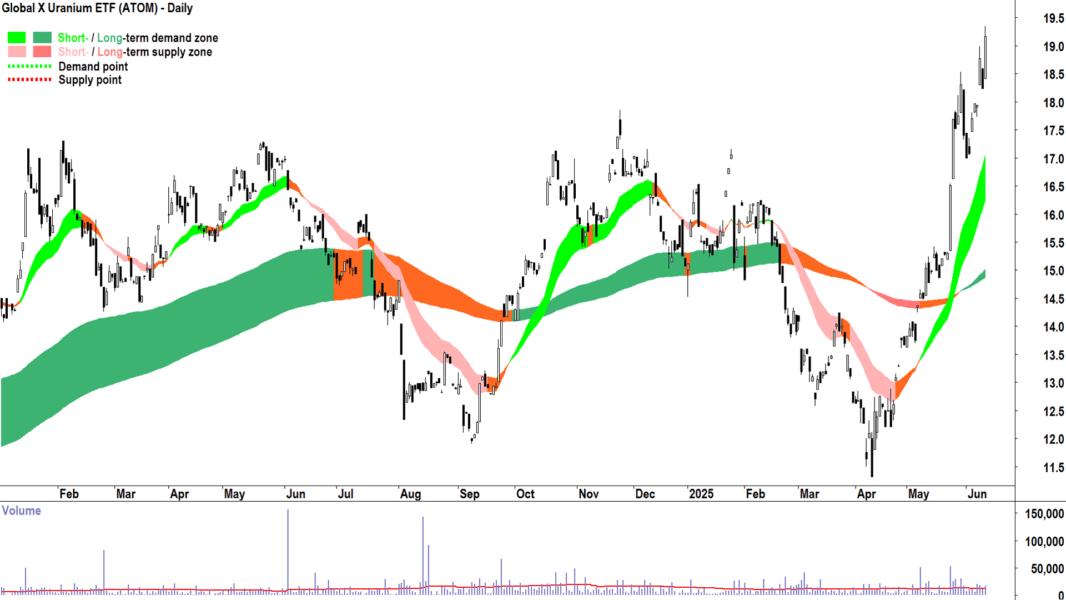

Global X Uranium ETF | ATOM | $19.17 | +29.7% | +18.3% |

Ausgold | AUC | $0.755 | +19.8% | +93.6% |

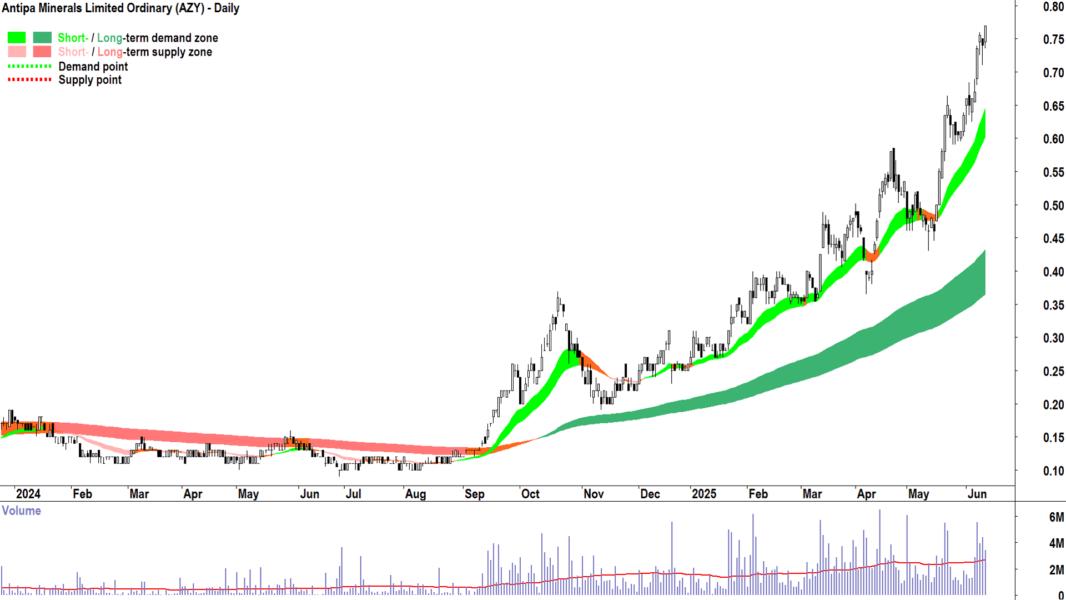

Antipa Minerals | AZY | $0.770 | +67.4% | +431.0% |

Bubs Australia | BUB | $0.150 | +25.0% | +25.0% |

Downer EDI | DOW | $6.20 | +0.5% | +31.9% |

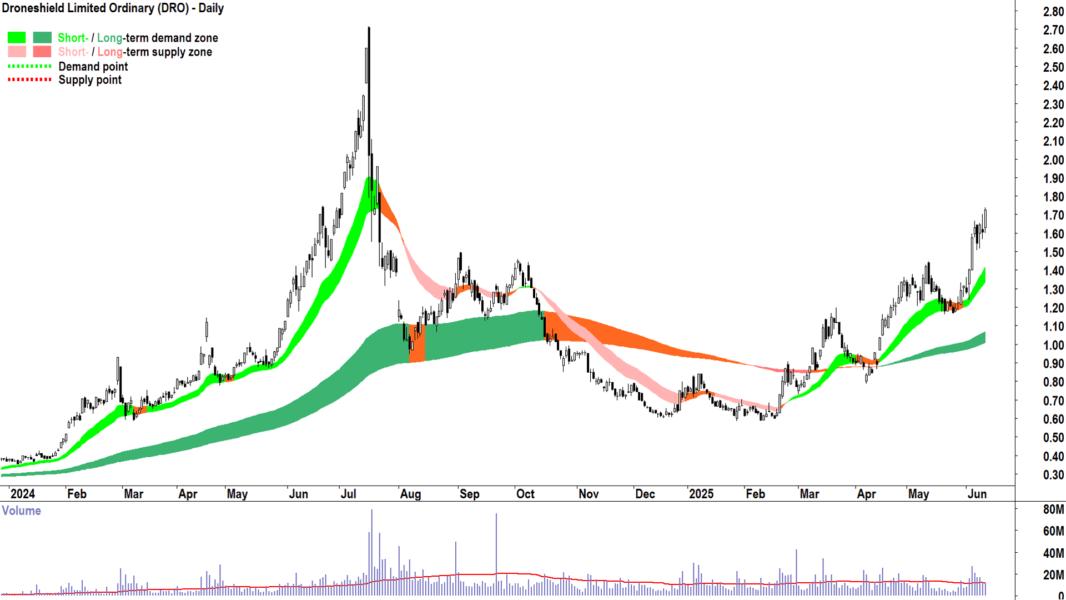

Droneshield | DRO | $1.725 | +30.2% | +33.2% |

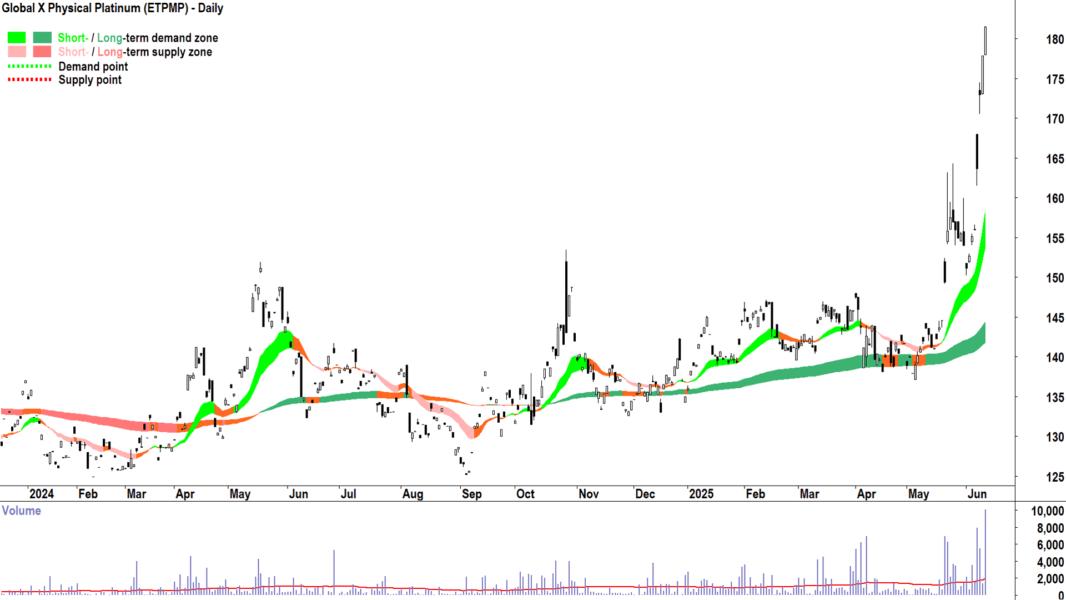

Global X Physical Platinum ETF | ETPMPT | $181.47 | +27.1% | +29.9% |

IVE Group | IGL | $2.76 | +3.4% | +44.9% |

Inghams Group | ING | $3.85 | +1.9% | +6.1% |

Kina Securities | KSL | $1.235 | +10.3% | +26.7% |

Mithril Resources | MTH | $0.530 | +43.2% | +152.4% |

Metcash | MTS | $3.71 | +12.4% | -3.1% |

Nine Entertainment | NEC | $1.645 | +7.5% | +17.5% |

National Storage Reit | NSR | $2.44 | +3.4% | +7.0% |

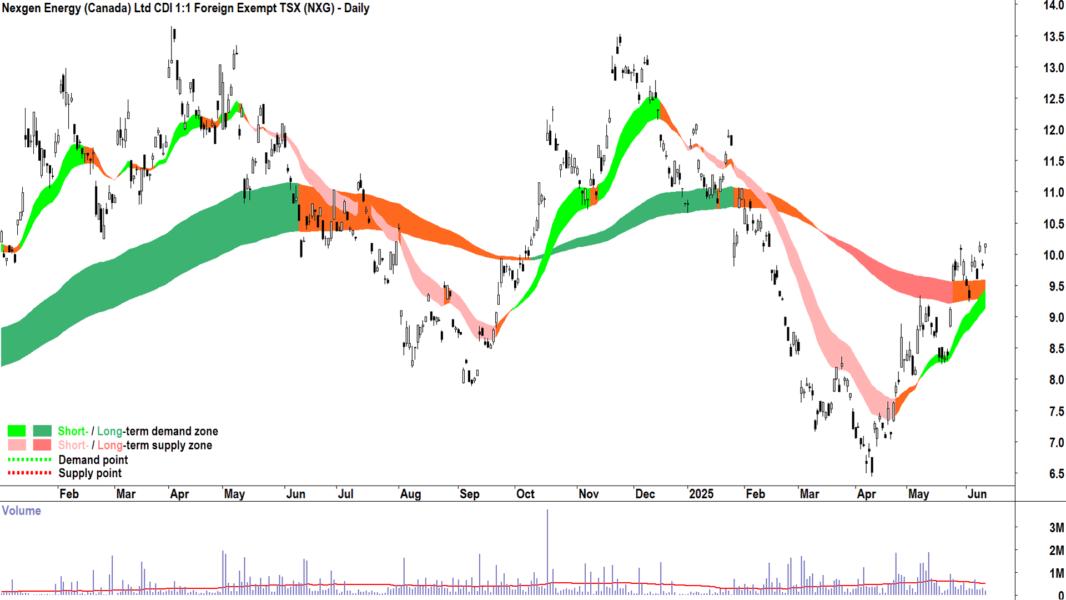

Nexgen Energy | NXG | $10.17 | +12.9% | -6.8% |

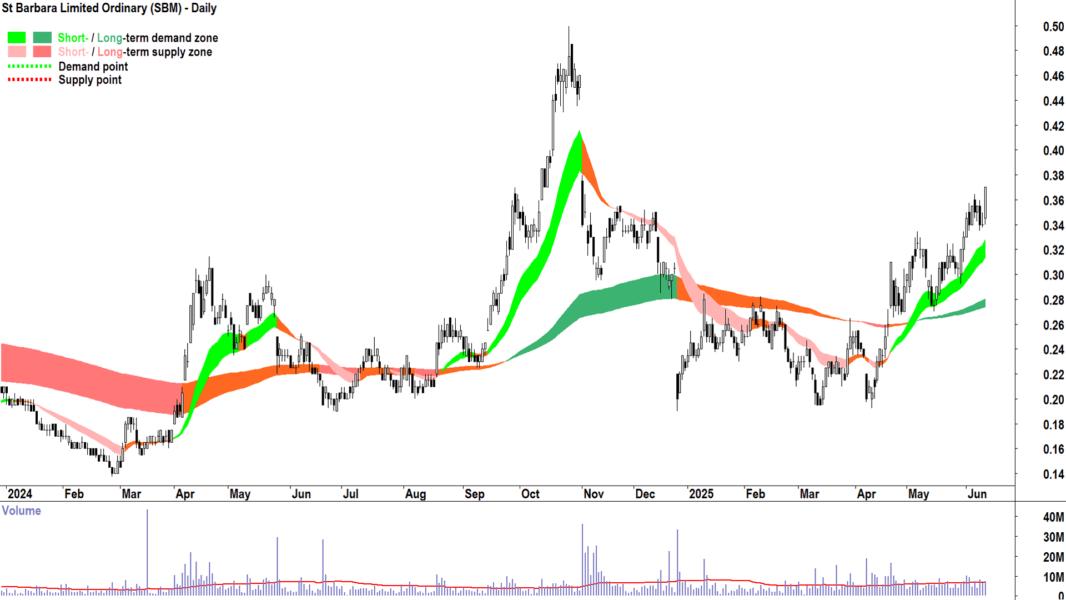

St Barbara | SBM | $0.370 | +25.4% | +64.4% |

Shape Australia Corporation | SHA | $3.62 | +11.0% | +63.1% |

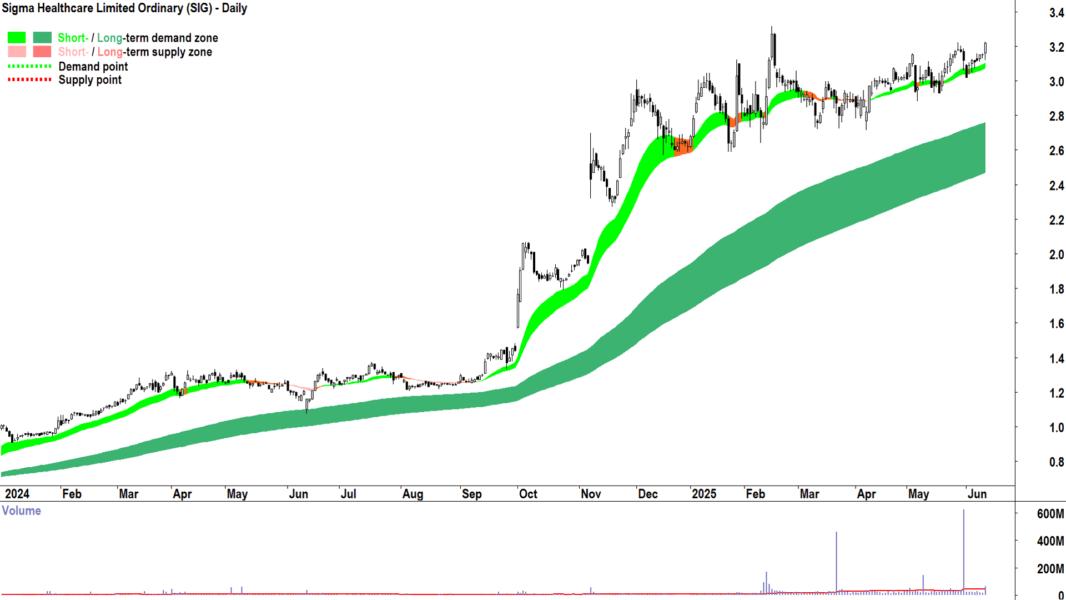

Sigma Healthcare | SIG | $3.22 | +6.3% | +172.9% |

Superloop | SLC | $2.87 | +14.8% | +107.2% |

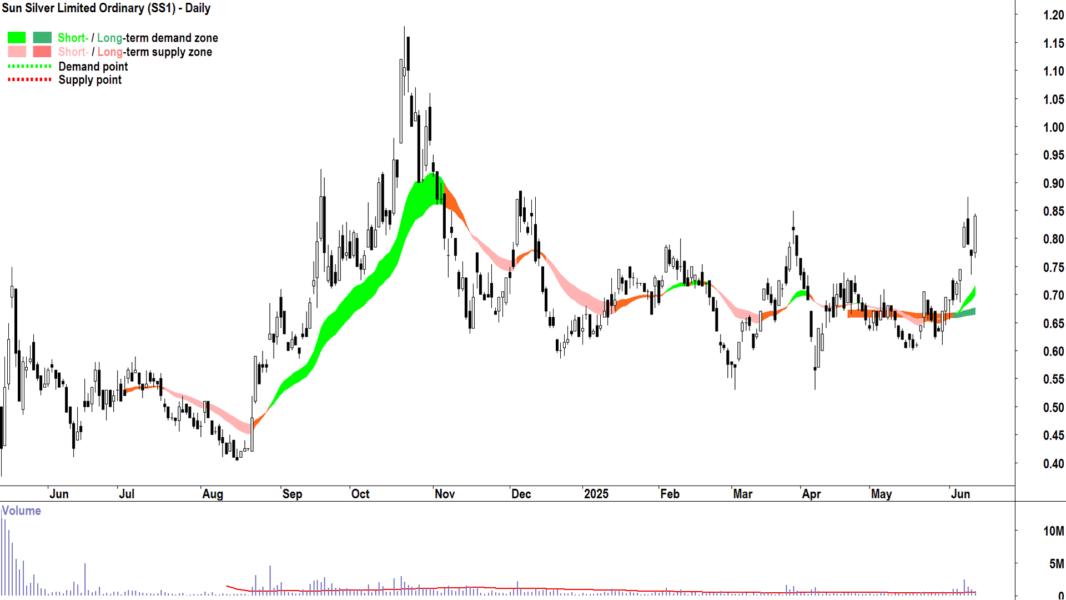

Sun Silver | SS1 | $0.840 | +34.4% | +48.7% |

Service Stream | SSM | $1.975 | +4.8% | +61.2% |

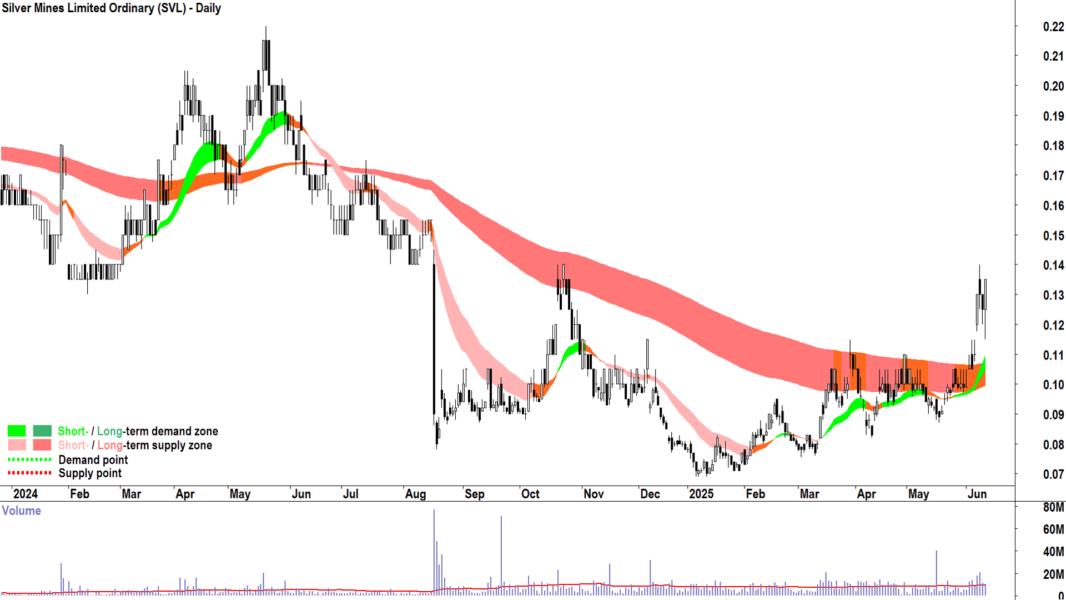

Silver Mines | SVL | $0.135 | +42.1% | -22.9% |

Transurban Group | TCL | $14.42 | +3.3% | +12.7% |

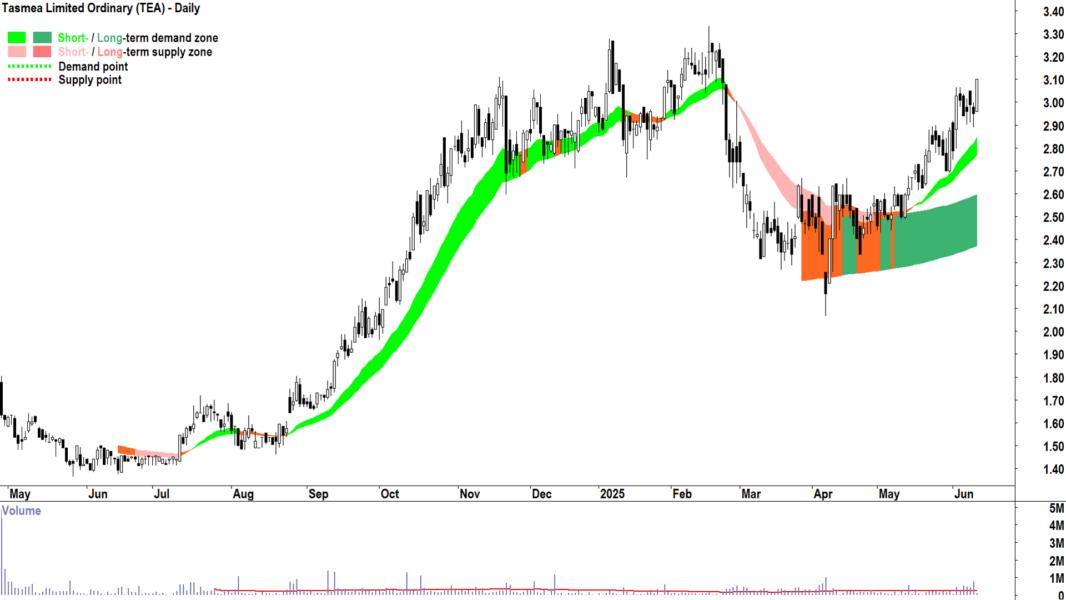

Tasmea | TEA | $3.10 | +19.5% | +108.1% |

Telstra Group | TLS | $4.90 | +9.6% | +37.6% |

Toubani Resources | TRE | $0.305 | +10.9% | +110.3% |

Ventia Services Group | VNT | $4.92 | +5.8% | +33.3% |

Today's Uptrends Scan List

Feature Charts from today's Uptrends List 🔎📈

The stocks that I feel are showing the strongest excess demand from today's Uptrends List are: Global X Uranium ETF ATOM, Antipa Minerals

AZY, Droneshield

DRO, Global X Physical Platinum

ETPMPT, Metcash

MTS, Nexgen Energy

NXG, St Barbara

SBM, Shape Australia Corporation

SHA, Sigma Healthcare

SIG, Sun Silver

SS1, Silver Mines

SVL, Tasmea

TEA, Telstra Group

TLS, Ventia Services Group

VNT.

Uptrends Feature Charts below:

Downtrends Scan List

Company | Code | Last Price | 1mo % | 1yr % |

Alpha HPA | A4N | $0.820 | -17.2% | -7.9% |

Coast Entertainment | CEH | $0.375 | -13.8% | -24.2% |

Champion Iron | CIA | $4.21 | -12.1% | -36.1% |

Collins Foods | CKF | $7.50 | -10.5% | -20.7% |

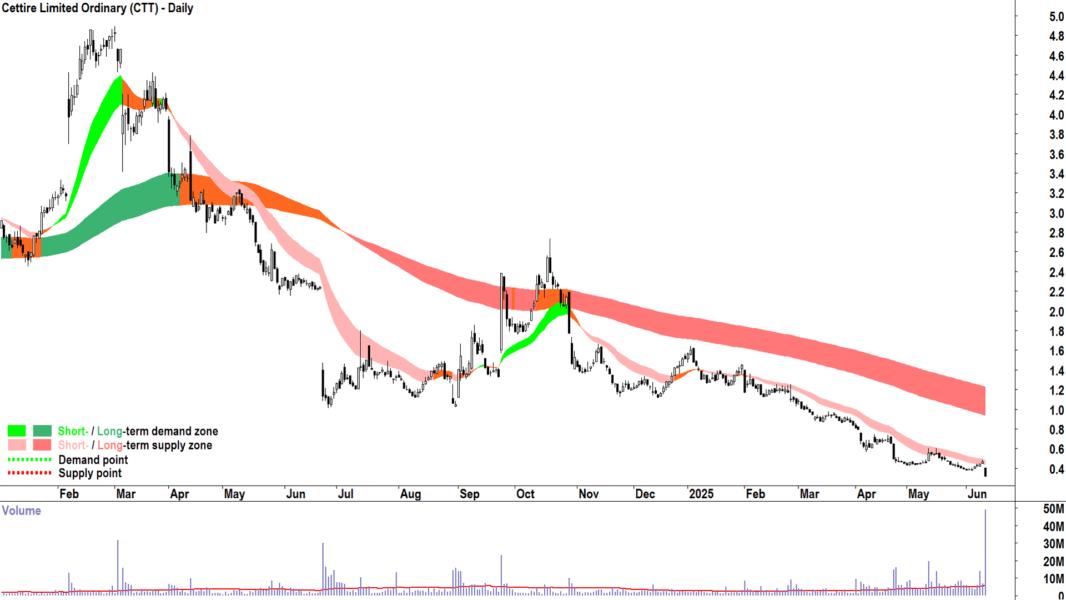

Cettire | CTT | $0.320 | -42.3% | -86.4% |

Clinuvel Pharmaceuticals | CUV | $10.18 | -8.3% | -32.1% |

Domino's Pizza Enterprises | DMP | $20.32 | -23.0% | -48.2% |

Flight Centre Travel Group | FLT | $13.10 | -4.7% | -32.4% |

Fortescue | FMG | $15.66 | -5.7% | -35.7% |

G8 Education | GEM | $1.190 | -10.2% | -1.7% |

Helloworld Travel | HLO | $1.430 | -9.2% | -33.5% |

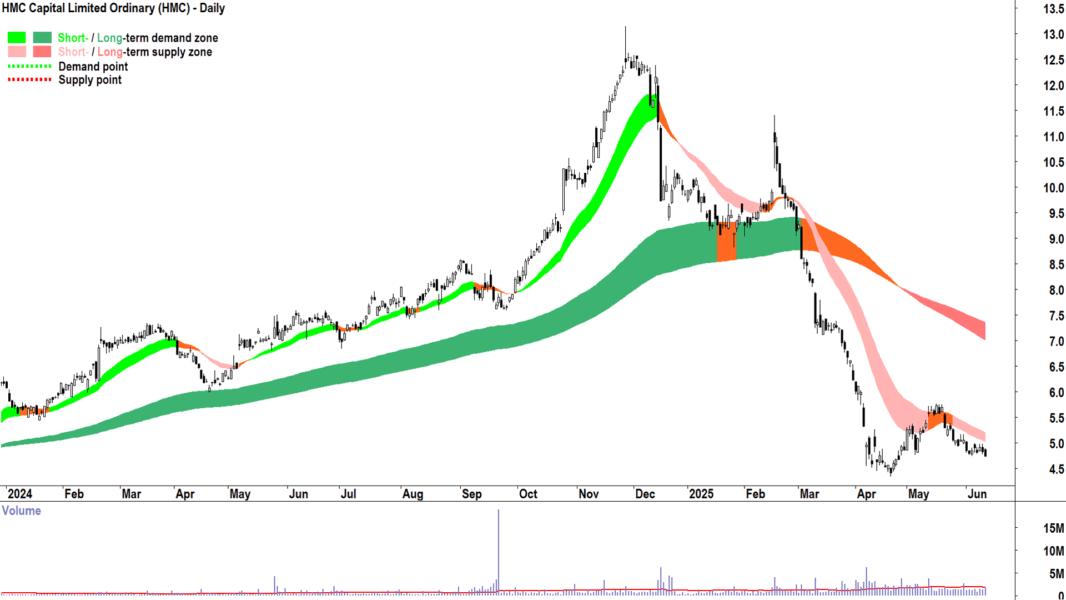

HMC Capital | HMC | $4.74 | -15.1% | -36.8% |

Humm Group | HUM | $0.440 | -16.2% | +2.3% |

IDP Education | IEL | $3.48 | -65.0% | -77.3% |

Imugene | IMU | $0.015 | -34.8% | -75.0% |

IPD Group | IPG | $3.06 | -20.5% | -28.5% |

Lotus Resources | LOT | $0.160 | -13.5% | -65.6% |

Orora | ORA | $1.820 | -6.7% | -14.6% |

Polynovo | PNV | $1.265 | -24.3% | -44.8% |

Rio Tinto | RIO | $107.58 | -10.2% | -14.1% |

Skycity Entertainment Group | SKC | $0.855 | -10.5% | -38.9% |

Stanmore Resources | SMR | $1.895 | -3.8% | -46.8% |

Treasury Wine Estates | TWE | $8.08 | -11.1% | -33.1% |

Vulcan Energy Resources | VUL | $3.91 | -15.7% | -18.2% |

Today's Downtrends Scan List

Feature Charts from today's Downtrends List 🔎📉

The stocks that I feel are showing the strongest excess supply from today's Downtrends List are: Champion Iron CIA, Cettire

CTT, Domino's Pizza Enterprises

DMP, HMC Capital

HMC, IDP Education

IEL, Orora

ORA, Rio Tinto

RIO, Treasury Wine Estates

TWE.

Downtrend Feature Charts below:

Important considerations when using the ChartWatch Daily ASX Scans:

1. The future is unknown. Anything can happen to change the trends in the lists above. A stock in a perfect uptrend or downtrend may not remain that way by the close of trading today. 2. These lists are not exhaustive, they are curated by Carl. You will find that certain stocks might not appear in a particular list on consecutive days but might reappear when Carl feels it deserves to return to the list. 3. This is not a recommendation service, merely an aid to help you better understand the workings of Carl’s technical analysis model in a practical way. Carl will not alert you to stocks that have dropped off a list because their trend has changed – it is up to you to apply the criteria to determine why a particular stock might not still be included. 4. This is general, educational information only – always do your own research.