Evening Wrap: ASX 200 edges higher despite consumer stocks chaos as Bapcor and Woolies belted

The S&P/ASX 200 closed 17.1 points higher, up 0.23%.

It appeared to be a quiet day for the S&P/ASX200, but there was plenty going on under the surface.

This time of the year is notorious for third quarter updates as well as company's looking to massage market expectations (read as coming clean on poor performance) ahead of end of financial year reporting.

Today, Bapcorp BAP (-24%) got bapped, and Woolworths Group

WOW (-4.2%) got, um, woolied? Either way, each was belted on the back of worse than expected trading updates.

Gold stocks bounced back, but really only very mildly from two days of their own beltings, and uranium stocks continued their winning ways. For everything bubbling beneath the surface of today's trade...

Let's dive in!

Today in Review

Thu 02 May 24, 4:27pm (AEST)

| Name | Value | % Chg |

|---|---|---|

| Major Indices | ||

| ASX 200 | 7,587.0 | +0.23% |

| All Ords | 7,849.4 | +0.22% |

| Small Ords | 2,976.3 | +0.12% |

| All Tech | 2,972.4 | +0.12% |

| Emerging Companies | 2,179.4 | -0.44% |

| Currency | ||

| AUD/USD | 0.6538 | +0.23% |

| US Futures | ||

| S&P 500 | 5,070.75 | +0.48% |

| Dow Jones | 38,213.0 | +0.38% |

| Nasdaq | 17,538.0 | +0.57% |

| Name | Value | % Chg |

|---|---|---|

| Sector | ||

| Information Technology | 2,177.4 | +0.96% |

| Financials | 7,194.8 | +0.72% |

| Industrials | 6,842.2 | +0.46% |

| Materials | 17,800.4 | +0.41% |

| Real Estate | 3,509.2 | +0.39% |

| Health Care | 41,962.0 | +0.20% |

| Consumer Discretionary | 3,372.3 | -0.30% |

| Energy | 10,008.8 | -0.53% |

| Utilities | 8,573.7 | -0.71% |

| Communication Services | 1,472.9 | -0.84% |

| Consumer Staples | 11,558.4 | -2.46% |

Markets

ASX 200 Session Chart

The S&P/ASX 200 (XJO) finished 17.1 points higher at 7,587.0, 0.58% from its session high and just 0.23% from its low. In the broader-based S&P/ASX 300 (XKO), advancers beat decliners only narrowly by 149 to 127.

The Gold (XGD) (+1.0%) sub-index was the best performing sector today, a minor bounce compared to the last two days of heavy losses. The gold price only edged higher in overnight trade, but is 0.7% higher in Asian trade at the time of writing.

Company | Last Price | Change $ | Change % | 1mo % | 1yr % |

|---|---|---|---|---|---|

West African Resources (WAF) | $1.340 | +$0.065 | +5.1% | +5.1% | +39.6% |

Red 5 (RED) | $0.430 | +$0.015 | +3.6% | +8.9% | +168.8% |

Resolute Mining (RSG) | $0.435 | +$0.015 | +3.6% | -1.1% | -4.4% |

Silver Lake Resources (SLR) | $1.425 | +$0.045 | +3.3% | +12.2% | +17.8% |

Capricorn Metals (CMM) | $4.86 | +$0.11 | +2.3% | -8.6% | +11.5% |

Perseus Mining (PRU) | $2.23 | +$0.05 | +2.3% | +2.3% | +1.4% |

St Barbara (SBM) | $0.260 | +$0.005 | +2.0% | +36.8% | -0.4% |

Westgold Resources (WGX) | $2.20 | +$0.04 | +1.9% | -20.6% | +47.7% |

Emerald Resources (EMR) | $3.32 | +$0.06 | +1.8% | +8.9% | +79.5% |

De Grey Mining (DEG) | $1.265 | +$0.015 | +1.2% | -3.8% | -22.9% |

Gold stocks limped back from two days of beatings

Also doing well today was the Information Technology (XIJ) (+0.96%) sector, with the Financials (XFJ) (+0.74%) sector the only other gainer of any real note. Both sectors (along with Real Estate (XRE) (+0.38%)) likely got a boost from a modest pullback in bond yields as investors found a greater number of dovish versus hawkish cues from yesterday's FOMC meeting.

Doing it tough today was the Consumer Staples (XSJ) (-2.5%) sector. It was the victim of a disappointing third quarter trading update from sector heavyweight Woolworths Group WOW (-4.2%).

The company noted slower sales growth in the March quarter than rival Coles Group COL (-1.9%) which implies it's likely losing some market share in the largely duopolous battle between the two. Major broker Goldman Sachs said this "could signal weaker margins in FY25/26."

ChartWatch

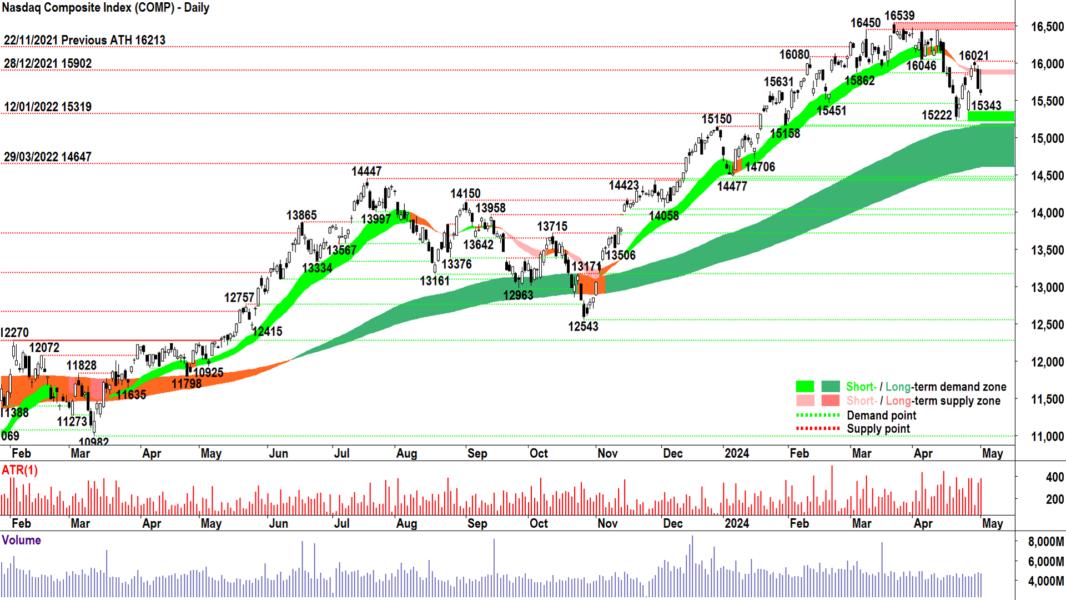

Nasdaq Composite Index

The last two candles are concerning

You often hear me bang on about supply side candles. I classify these as candles with black bodies and or upward pointing shadows.

I'm just alerting you to two excellent case studies of each which occurred on the Nasdaq Composite Index on Tuesday and Wednesday.

As in, they're about as good an indication the supply-side has wrestled back control of the price here as you're likely to get.

15222, and more broadly, the long term uptrend ribbon, are the key points of demand. I'm still going to back their ability to hold up against the selling – but the candles from here are crucial.

It's the demand-side candles we want to see at expected support levels to prove to us they are indeed support. Logically, these are the opposite of supply-side candles, so those with white bodies and or downward pointing shadows.

The market will tell us. It always does.

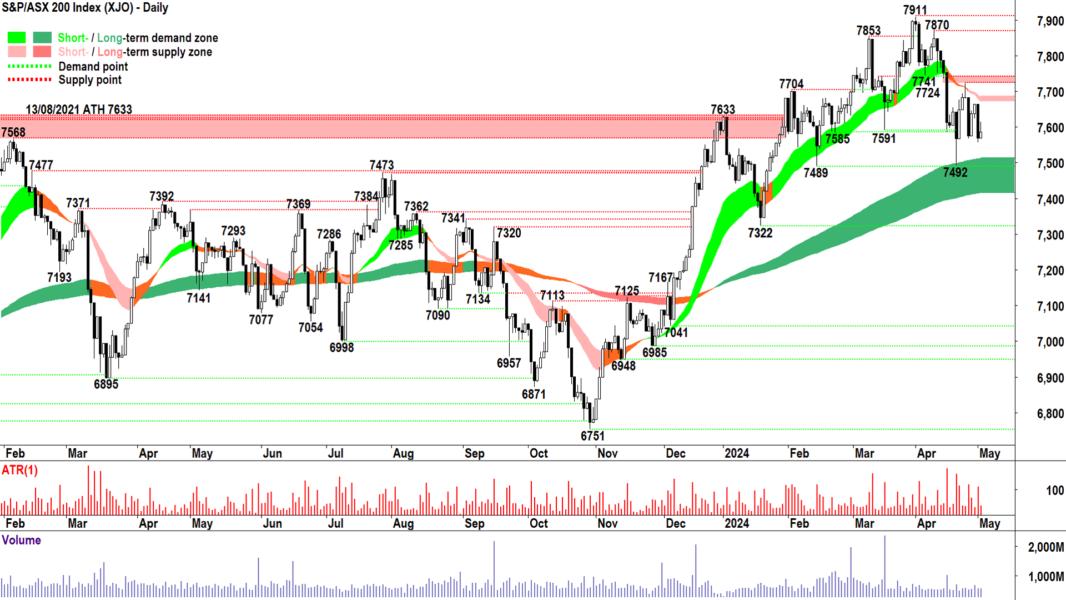

S&P/ASX 200 (XJO)

Is another test of the long term uptrend ribbon required?

Just a quick update here in light of the above analysis. Assuming the Nasdaq goes the way indicated by those last two candles, there's every chance it's going to mean points shaved off here.

Our own duo of static and dynamic support in the form of 7492 and the long term uptrend ribbon respectively, may well come into play as a result. Again, we want to see demand side candles down there if they do.

Apart from that, I really need to see the XJO close above what is shaping as a major supply zone between 7724-7741 before I could feel comfortable the bull is back. Until then, caution is warranted ⚠️.

Brent Crude Oil Futures NYMEX

Rolling hard, but close to dynamic support

The last time I covered Brent Crude Oil on 23 April, I noted that the 17 and 19 April supply-side candles had "blown a significant hole in the bull case".

The end of the short term uptrend has progressed, with the price of Brent now trading below the short term trend ribbon, exhibiting falling peaks and falling troughs, and taking out key points of demand at 84.76 and 83.49.

There are a few interesting potential points of demand here, though. I'm thinking candles and price action around 82.77 and the all-important long term uptrend ribbon which will kick in around $82 will be interesting.

I can't be bullish on Brent until we see some decent demand side candles at either, or until we're back in rising peaks and rising troughs.

84.76 is now supply. Above that, 88.64-89.72 may cap for some time...

Economy

Today

AU Building approvals rose 1.9% in March, up from February's -0.9% (revised up from -1.9%), but below the +3.5% forecast by economists

Later this week

Friday

22:30 USA Non-Farm Employment Change April (+243,000 forecast vs +303,000 March); Unemployment rate April (3.8% forecast, no change); Average Hourly Earnings April (+0.3% forecast, no change)

Saturday

00:00 USA ISM Services PMI April (52.0 forecast vs 51.4 March)

Latest News

Economy

RBA 40-60 hike vs hold, and you can forget about a rate cut in the next 12 months

Thu 02 May 24, 1:15pm (AEST)

Director Transactions wtc iel

Insider Trades: Directors are offloading their shares as Aussie share market comes off the boil

Thu 02 May 24, 10:17am (AEST)

Market Wraps

Morning Wrap: ASX 200 to fall, Fed Chair Powell says the next move is "unlikely" to be a hike

Thu 02 May 24, 8:23am (AEST)

Market Wraps sfr nic

Evening Wrap: ASX 200 belted on further rate cut delay woes, gold stocks smashed, uranium stocks soar

Wed 01 May 24, 5:45pm (AEST)

Copper sfr

Sandfire Resources still first choice in ASX copper after March quarterly

Wed 01 May 24, 4:07pm (AEST)

Broker Watch aub gpt

Macquarie tips these 6 ASX stocks could outperform

Wed 01 May 24, 1:41pm (AEST)

More News

Interesting Movers

Trading higher

+10.9% Pexa Group (PXA) - PEXA UK & NatWest Group announcement

+8.6% Clarity Pharmaceuticals (CU6) - Continued positive response to Tuesday's Quarterly Activities/Appendix 4C Cash Flow Report plus Complete response with Cu-67 SAR-bisPSMA, rise is consistent with prevailing short and long term uptrends 🔎📈

+6.7% Qube Holdings (QUB) - FY24 Trading Update and Outlook, rise is consistent with prevailing short and long term uptrends 🔎📈

+5.1% West African Resources (WAF) - Director purchases, rise is consistent with prevailing short and long term uptrends 🔎📈

+5.1% Bega Cheese (BGA) - No news, rise is consistent with prevailing short and long term uptrends 🔎📈

+4.4% Navigator Global Investments (NGI) - No news, rise is consistent with prevailing short and long term uptrends 🔎📈

+4.3% Botanix Pharmaceuticals (BOT) - No news, rise is consistent with prevailing short and long term uptrends 🔎📈

+4.2% Amcor (AMC) - Third quarter 2024 Results

Trading lower

-23.9% Bapcor (BAP) - Trading Update, fall is consistent with prevailing short and long term downtrends 🔎📉

-12.3% Brainchip Holdings (BRN) - No news, fall is consistent with prevailing short and long term downtrends 🔎📉

-11.6% APM Human Services International (APM) - No news, fall is consistent with prevailing short and long term downtrends 🔎📉

-10.3% Helloworld Travel (HLO) - HLO Trading Update for March Quarter 2024, fall is consistent with prevailing short term downtrend, closed below long term downtrend ribbon 🔎📉

-7.1% Predictive Discovery (PDI) - A$50M Placement to Advance the Bankan Gold Project

-6.1% Omni Bridgeway (OBL) - No news, fall is consistent with prevailing short and long term downtrends 🔎📉

-4.1% Woolworths Group (WOW) - Third Quarter Sales Results, fall is consistent with prevailing short and long term downtrends 🔎📉

Broker Notes

Atlantic Lithium (A11)

Retained at outperform at Macquarie; Price Target: $0.46

Ainsworth Game Technology (AGI)

Retained at outperform at Macquarie; Price Target: $1.45

Aeris Resources (AIS)

Retained at buy at Bell Potter; Price Target: $0.30 from $0.23

Ampol (ALD)

Retained at hold at Ord Minnett; Price Target: $35.00

Aristocrat Leisure (ALL)

Retained at outperform at Macquarie; Price Target: $48.50

Amcor (AMC)

Retained at underweight at Barrenjoey; Price Target: $14.30

Retained at hold at Jefferies; Price Target: $14.30 from $14.00

Retained at outperform at JP Morgan; Price Target: $15.40 from $15.10

Upgraded to outperform from neutral at Macquarie; Price Target: $15.40 from $14.90

Retained at equal-weight at Morgan Stanley; Price Target: $14.50

Retained at add at Morgans; Price Target: $15.95 from $15.65

Retained at accumulate at Ord Minnett; Price Target: $17.80 from $17.00

Retained at neutral at UBS; Price Target: $15.85 from $15.60

Austin Engineering (ANG)

Retained at buy at Shaw and Partners; Price Target: $0.60

Chalice Mining (CHN)

Downgraded to underweight from neutral at Barrenjoey; Price Target: $0.80 from $1.00

Collins Foods (CKF)

Retained at sell at Citi; Price Target: $10.60

IGO (IGO)

Retained at hold at Bell Potter; Price Target: $7.60 from $7.50

Johns Lyng Group (JLG)

Retained at outperform at Macquarie; Price Target: $7.40

Light & Wonder (LNW)

Upgraded to buy from overweight at Jarden; Price Target: $164.00

Retained at outperform at Macquarie; Price Target: $176.00

Mirvac Group (MGR)

Retained at neutral at Citi; Price Target: $2.30

Upgraded to underperform from sell at CLSA; Price Target: $2.02 from $2.01

Retained at outperform at Macquarie; Price Target: $2.31 from $2.38

Retained at equal-weight at Morgan Stanley; Price Target: $2.41

Mineral Resources (MIN)

Upgraded to overweight from equal-weight at Morgan Stanley; Price Target: $83.00 from $67.00

Matador Mining (MZZ)

Retained at buy at Shaw and Partners; Price Target: $0.19

National Australia Bank (NAB)

Retained at sell at UBS; Price Target: $28.00

Origin Energy (ORG)

Retained at hold at Ord Minnett; Price Target: $9.00

Paladin Energy (PDN)

Retained at buy at Citi; Price Target: $17.00 from $14.50

Piedmont Lithium Inc (PLL)

Retained at outperform at Macquarie; Price Target: $0.36

Premier Investments (PMV)

Retained at neutral at Macquarie; Price Target: $31.20 from $26.00

Qube Holdings (QUB)

Retained at buy at Goldman Sachs; Price Target: $3.70

Upgraded to buy from overweight at Jarden; Price Target: $3.70 from $3.60

Reliance Worldwide Corporation (RWC)

Retained at buy at Goldman Sachs; Price Target: $5.35 from $5.00

Retained at accumulate at Ord Minnett; Price Target: $5.60 from $5.10

Sayona Mining (SYA)

Retained at neutral at Macquarie; Price Target: $0.04

Vicinity Centres (VCX)

Retained at neutral at Citi; Price Target: $2.10

Retained at underweight at Morgan Stanley; Price Target: $2.17

Woolworths Group (WOW)

Retained at underweight at Morgan Stanley; Price Target: $32.00

Xero (XRO)

Retained at buy at Citi; Price Target: $159.00

Retained at buy at Goldman Sachs; Price Target: $156.00 from $152.00

Scans

Top Gainers

| Code | Company | Last | % Chg |

|---|---|---|---|

| KTA | Krakatoa Resource... | $0.016 | +45.46% |

| SEN | Senetas Corporati... | $0.017 | +41.67% |

| HTG | Harvest Technolog... | $0.024 | +26.32% |

| CUF | Cufe Ltd | $0.015 | +25.00% |

| BPH | BPH Energy Ltd | $0.026 | +23.81% |

View all top gainers

Top Fallers

| Code | Company | Last | % Chg |

|---|---|---|---|

| MGA | Metalsgrove Minin... | $0.06 | -25.00% |

| SRK | Strike Resources Ltd | $0.053 | -24.29% |

| VRX | VRX Silica Ltd | $0.053 | -24.29% |

| BAP | Bapcor Ltd | $4.39 | -24.05% |

| CAG | Cape Range Ltd | $0.098 | -21.60% |

View all top fallers

52 Week Highs

| Code | Company | Last | % Chg |

|---|---|---|---|

| M4M | Macro Metals Ltd | $0.02 | +21.88% |

| VNL | Vinyl Group Ltd | $0.14 | +16.67% |

| CHW | Chilwa Minerals Ltd | $0.44 | +14.29% |

| SW1 | Swift Networks Gr... | $0.024 | +14.29% |

| RC1 | Redcastle Resourc... | $0.017 | +13.33% |

View all 52 week highs

52 Week Lows

| Code | Company | Last | % Chg |

|---|---|---|---|

| VRX | VRX Silica Ltd | $0.053 | -24.29% |

| BAP | Bapcor Ltd | $4.39 | -24.05% |

| AER | Aeeris Ltd | $0.066 | -15.39% |

| EWC | Energy World Corp... | $0.011 | -15.39% |

| XPN | Xpon Technologies... | $0.013 | -13.33% |

View all 52 week lows

Near Highs

| Code | Company | Last | % Chg |

|---|---|---|---|

| IXJ | Ishares Global He... | $136.62 | -0.14% |

| DBI | Dalrymple Bay Inf... | $2.80 | +0.36% |

| MXT | Metrics Master In... | $2.07 | +1.47% |

| JPEQ | JPM US100Q EQ Pre... | $57.01 | -0.84% |

| BNKS | Betashares Global... | $7.40 | +0.41% |

View all near highs

Relative Strength Index (RSI) Oversold

| Code | Company | Last | % Chg |

|---|---|---|---|

| WDS | Woodside Energy G... | $27.16 | -1.24% |

| WAM | WAM Capital Ltd | $1.48 | 0.00% |

| WOR | Worley Ltd | $15.17 | +2.02% |

| ALD | Ampol Ltd | $35.45 | -0.20% |

| GL1 | Global Lithium Re... | $0.395 | -1.25% |

View all RSI oversold