ChartWatch ASX Scans: Data#3, Evolution Mining, Healius, Lynas Rare Earths, Newmont, Solvar, Kelsian, Tabcorp

- Interesting uptrends in today's Scans: Alto Metals , Bravura , Car , Data#3 , Evolution Mining , Healius , Hub24 , Humm , Lynas Rare Earths , Newmont

- Interesting downtrends in today's Scans: Kelsian Group , Omni Bridgeway , OOH!Media , Tabcorp , The Lottery Corporation

Welcome to my ChartWatch Daily ASX Scans series. Here I present scan lists based on my trend following technical analysis methodology. My goal is to alert you to the best uptrends and downtrends on the ASX.

Uptrends Scan List

Company | Code | Last Price | 1mo % | 1yr % |

|---|---|---|---|---|

Australian Clinical Labs | ACL | $2.73 | +5.4% | -14.2% |

Australian Gold and Copper | AGC | $0.360 | +24.1% | +520.7% |

Alto Metals | AME | $0.064 | +82.9% | +18.5% |

Aspen Group | APZ | $2.18 | +17.8% | +24.6% |

BetaShares S&P/ASX Australian Technology ETF | ATEC | $25.92 | +7.3% | +32.0% |

Australian United Investment Company | AUI | $10.92 | +5.5% | +10.3% |

Accent Group | AX1 | $2.29 | +5.5% | +19.3% |

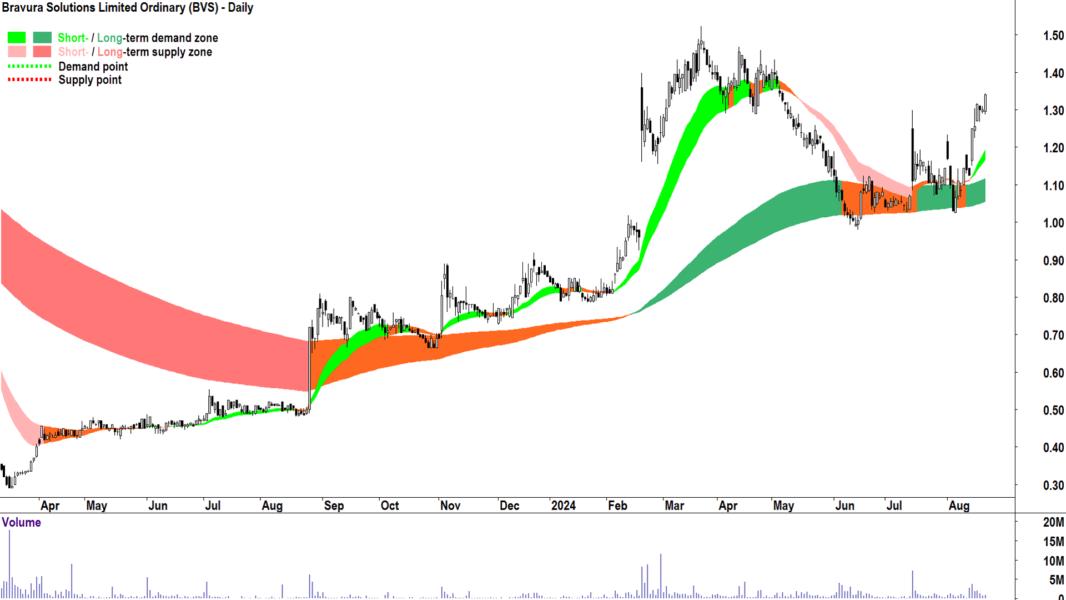

Bravura Solutions | BVS | $1.340 | +21.3% | +176.3% |

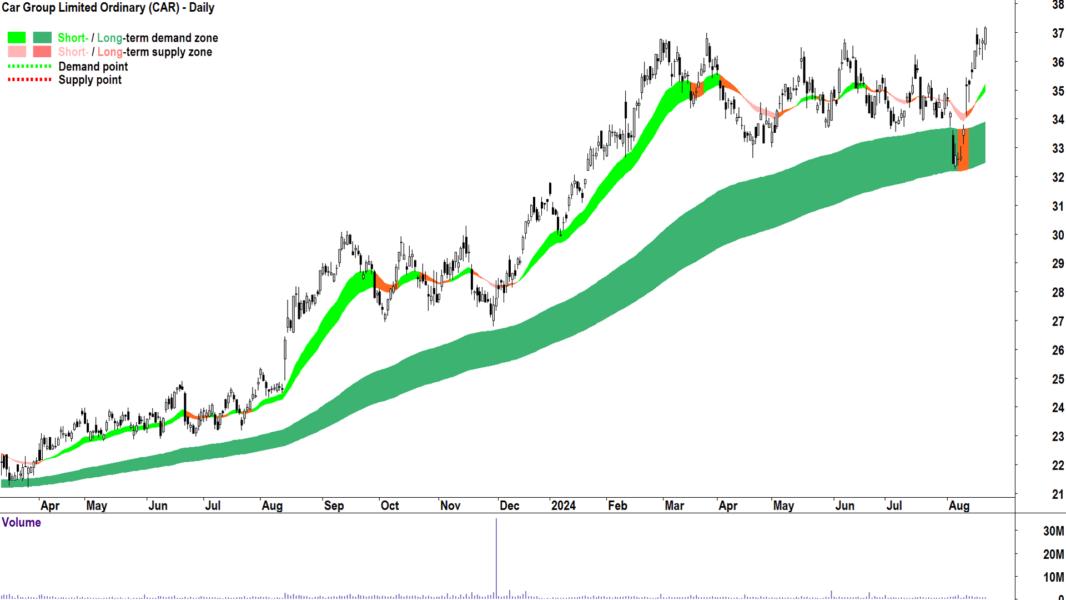

Car Group | CAR | $37.16 | +5.7% | +33.2% |

Catapult Group International | CAT | $2.17 | +6.9% | +110.7% |

Capricorn Metals | CMM | $6.01 | +13.4% | +49.9% |

Coles Group | COL | $18.44 | +3.4% | +6.6% |

BetaShares Australian Investment Grade Corporate Bond ETF | CRED | $23.33 | +2.7% | +6.5% |

Clarity Pharmaceuticals | CU6 | $6.33 | -0.6% | +551.3% |

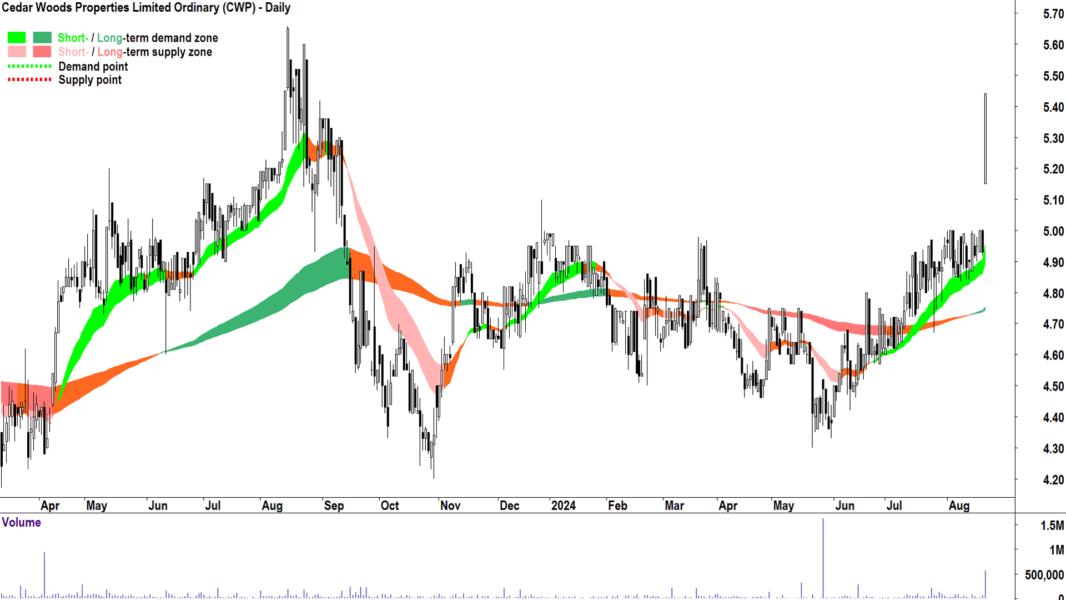

Cedar Woods Properties | CWP | $5.44 | +9.9% | -1.1% |

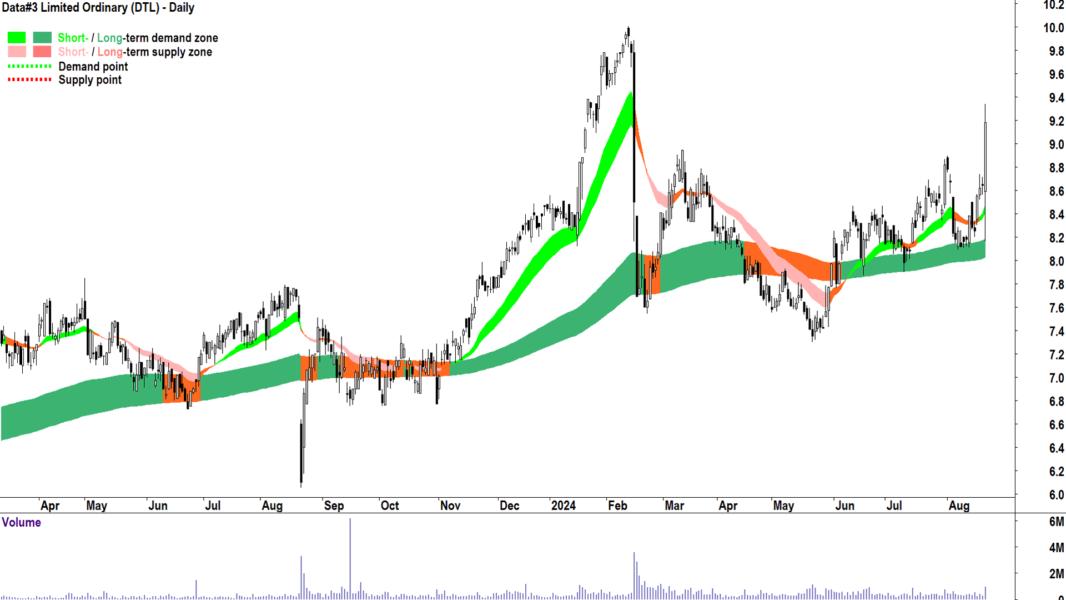

Data#3 | DTL | $9.18 | +7.4% | +19.4% |

Diversified United Investment | DUI | $5.28 | +1.9% | +6.5% |

Emeco | EHL | $0.860 | +1.2% | +30.3% |

Emerald Resources | EMR | $4.14 | +8.4% | +76.2% |

Evolution Mining | EVN | $4.34 | +10.2% | +29.2% |

BetaShares Australian Sustainability Leaders ETF | FAIR | $20.25 | +3.0% | +11.0% |

G8 Education | GEM | $1.405 | +8.9% | +23.2% |

Gold Road Resources | GOR | $1.845 | +4.8% | +21.8% |

Guzman y Gomez | GYG | $32.78 | +19.6% | 0% |

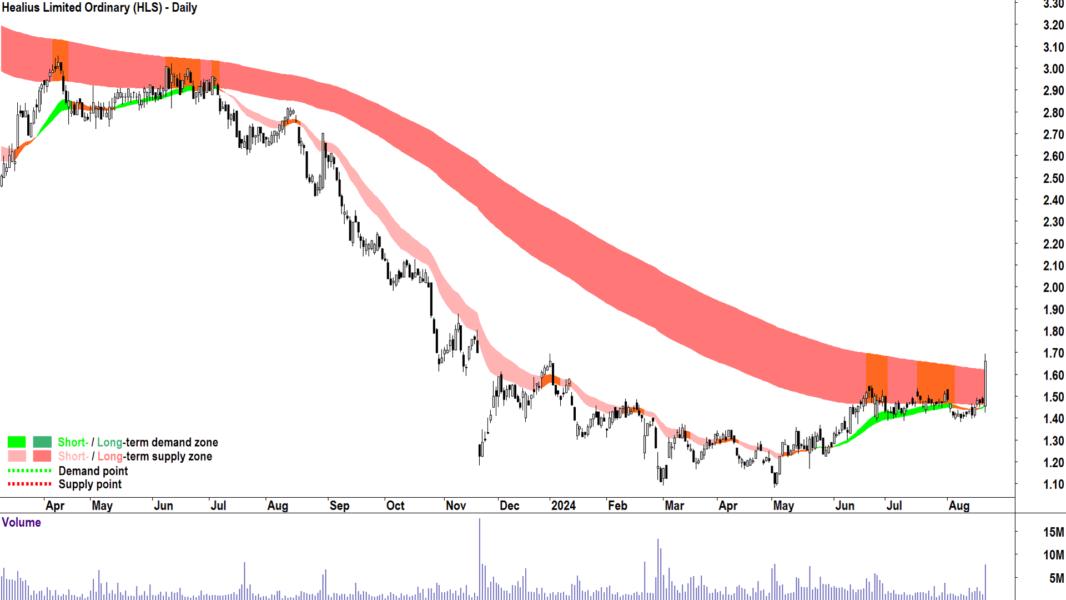

Healius | HLS | $1.660 | +12.9% | -39.8% |

Hub24 | HUB | $53.55 | +13.7% | +93.3% |

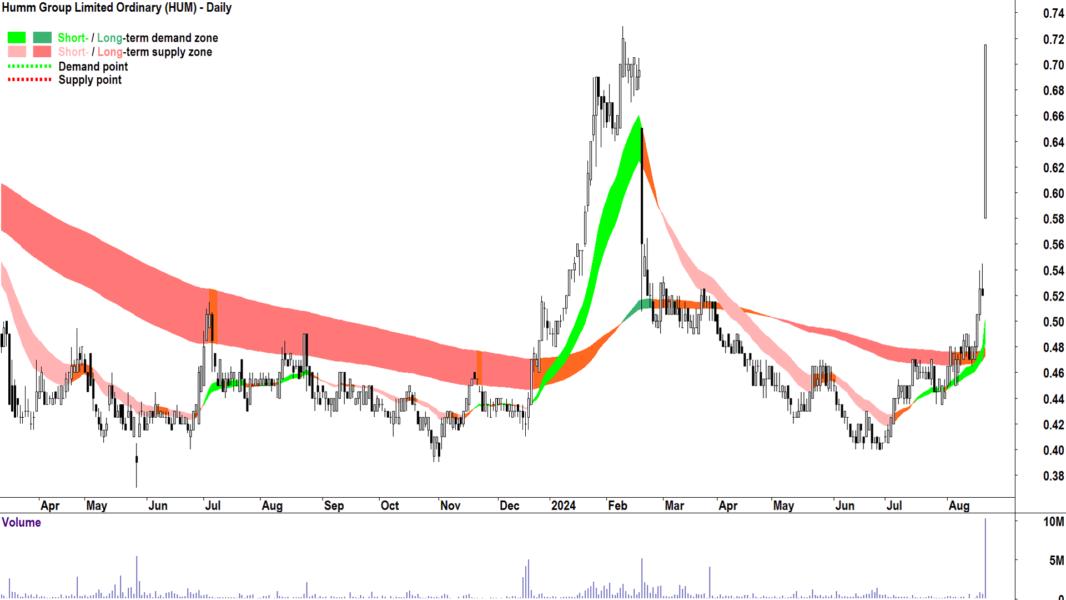

Humm Group | HUM | $0.715 | +57.1% | +53.8% |

Harvey Norman | HVN | $4.90 | +7.0% | +30.7% |

Insignia Financial | IFL | $2.93 | +9.7% | +2.8% |

Lovisa | LOV | $36.37 | +7.4% | +76.0% |

LTR Pharma | LTP | $1.325 | +47.2% | 0% |

Lynas Rare Earths | LYC | $6.81 | +13.1% | -0.3% |

Macmahon | MAH | $0.315 | +14.5% | +96.9% |

MFF Capital Investments | MFF | $3.85 | -0.5% | +32.8% |

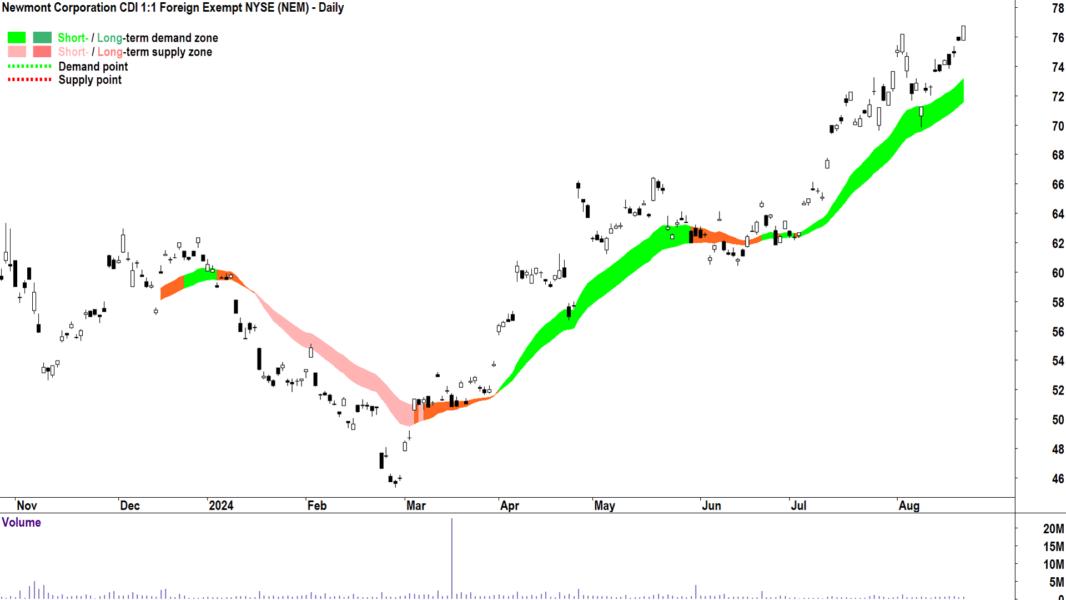

Newmont Corporation | NEM | $76.77 | +8.4% | 0% |

Northern Star Resources | NST | $14.90 | +6.3% | +43.8% |

NRW | NWH | $3.55 | +7.3% | +29.6% |

Netwealth Group | NWL | $23.18 | +2.4% | +51.2% |

Nextdc | NXT | $17.67 | +3.9% | +37.0% |

Predictive Discovery | PDI | $0.280 | +43.6% | +53.4% |

Pro Medicus | PME | $149.89 | +11.7% | +113.8% |

Premier Investments | PMV | $34.16 | +9.0% | +57.1% |

Pinnacle Investment Management Group | PNI | $17.82 | +9.4% | +89.4% |

Polynovo | PNV | $2.61 | +0.4% | +72.3% |

REA Group | REA | $219.56 | +11.8% | +37.8% |

Resolute Mining | RSG | $0.690 | +10.4% | +115.6% |

St Barbara | SBM | $0.255 | +13.3% | +21.4% |

Steadfast Group | SDF | $6.47 | +2.4% | +12.9% |

Spartan Resources | SPR | $1.380 | +12.2% | +444.7% |

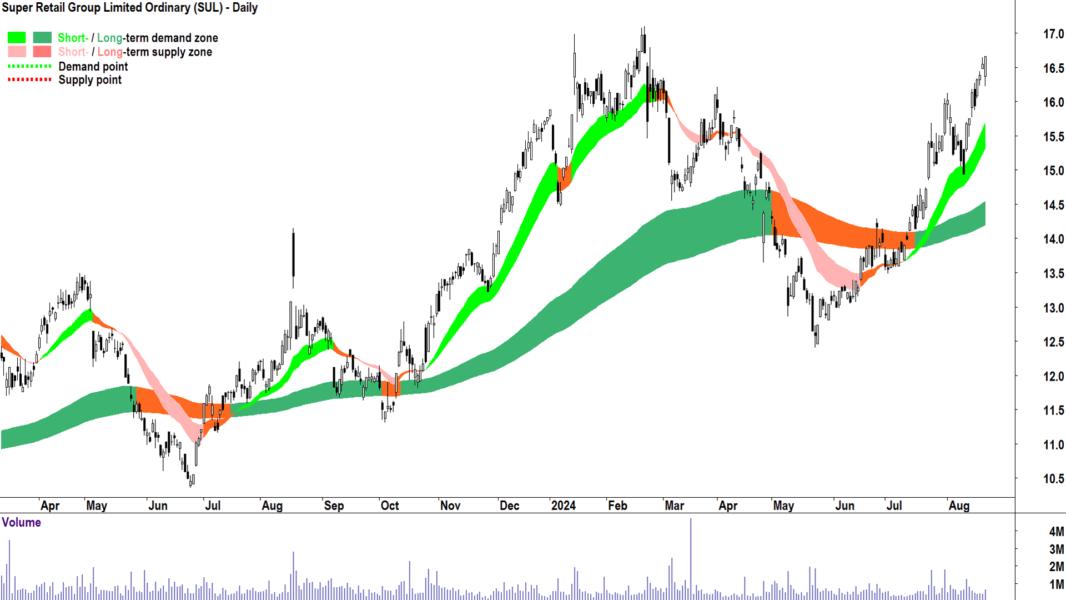

Super Retail Group | SUL | $16.66 | +8.3% | +33.0% |

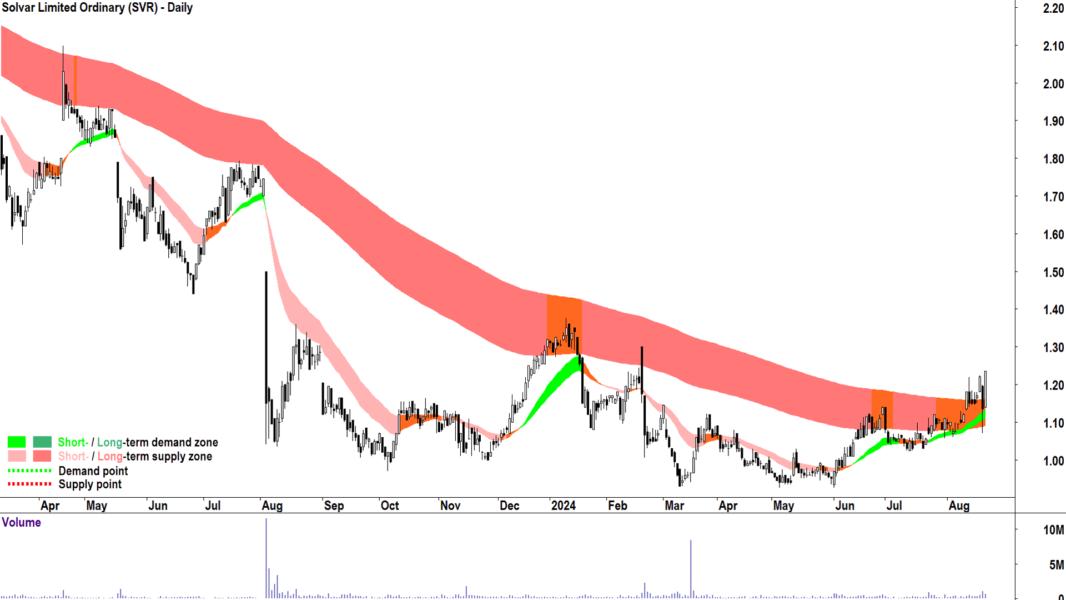

Solvar | SVR | $1.235 | +15.4% | -5.4% |

Transurban Group | TCL | $13.49 | +4.3% | +2.4% |

Telix Pharmaceuticals | TLX | $19.97 | -1.7% | +104.0% |

Technology One | TNE | $22.76 | +20.0% | +57.1% |

WA1 Resources | WA1 | $15.73 | +4.9% | +199.0% |

Wesfarmers | WES | $74.81 | +3.6% | +51.4% |

Westgold Resources | WGX | $3.05 | +16.9% | +114.8% |

Woolworths Group | WOW | $35.37 | +1.3% | -5.9% |

Waypoint Reit | WPR | $2.60 | +6.6% | +3.6% |

Xero | XRO | $144.41 | +6.3% | +26.4% |

Zip Co. | ZIP | $2.19 | +21.7% | +476.3% |

Today's Uptrends Scan List

Feature charts from today's Uptrends List 🔎📈

The stocks that I feel are showing the strongest excess demand from today's Uptrends List are: Alto Metals AAME, BetaShares S&P/ASX Australian Technology ETF ATEC, Accent Group

AX1, Bravura Solutions

BVS, Car Group

CAR, Cedar Woods Properties

CWP, Data#3

DTL, Evolution Mining

EVN, Healius

HLS, Hub24

HUB, Humm Group

HUM, Lynas Rare Earths

LYC, Newmont Corporation

NEM, Northern Star Resources

NST, Premier Investments

PMV, Pinnacle Investment Management Group

PNI, REA Group

REA, Super Retail Group

SUL, Solvar

SVR, Woolworths Group

WOW, Xero

XRO.

Charts of each below:

Downtrends Scan List

Company | Code | Last Price | 1mo % | 1yr % |

|---|---|---|---|---|

Auckland International Airport | AIA | $6.86 | -2.3% | -10.0% |

Beach Energy | BPT | $1.285 | -14.9% | -15.7% |

Kelsian Group | KLS | $5.05 | -1.6% | -24.9% |

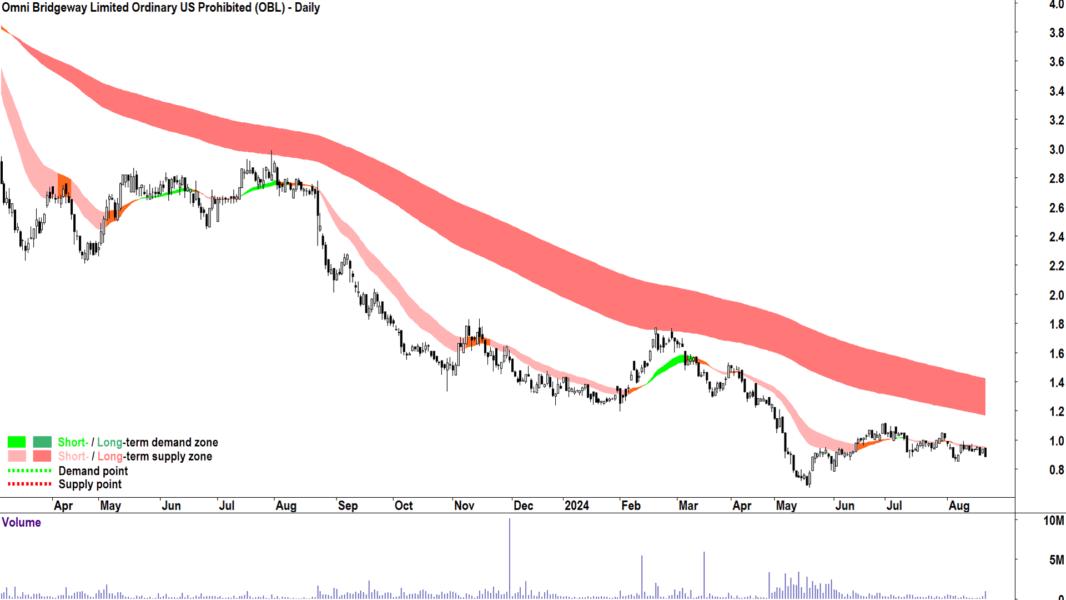

Omni Bridgeway | OBL | $0.885 | -9.2% | -68.3% |

OOH!Media | OML | $1.330 | -3.3% | -2.9% |

Power | PWH | $9.41 | -21.5% | -3.7% |

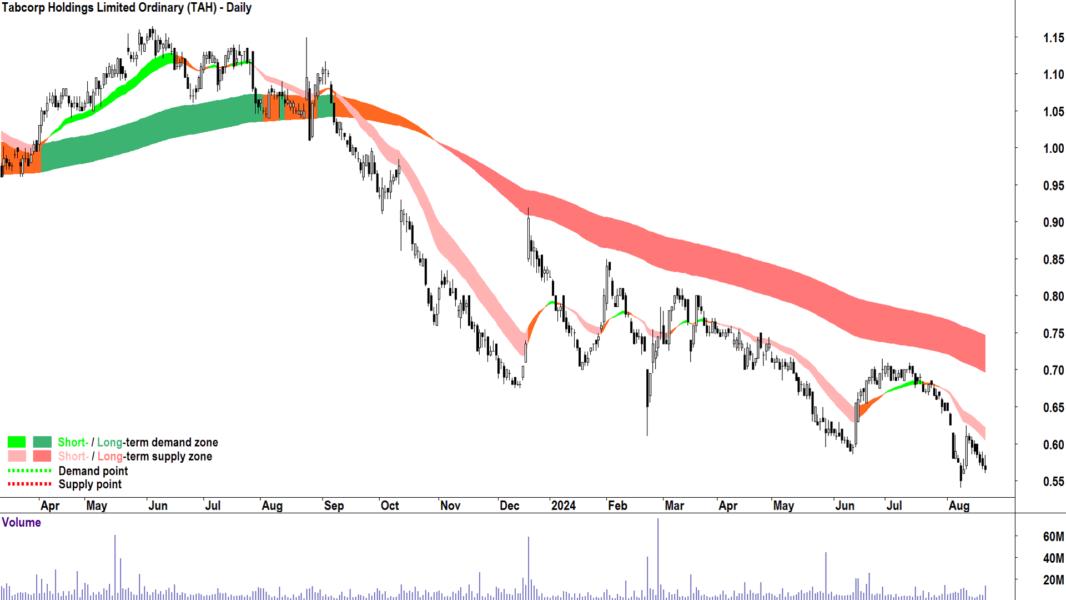

Tabcorp | TAH | $0.565 | -16.9% | -46.2% |

The Lottery Corporation | TLC | $4.83 | -2.2% | -6.0% |

Today's Downtrends Scan List

Feature charts from today's Downtrends List 🔎📉

The stocks that I feel are showing the strongest excess supply from today's Downtrends List are: Kelsian Group KLS, Omni Bridgeway

OBL, OOH!Media

OML, Tabcorp

TAH, The Lottery Corporation

TLC.

Charts of each below:

ChartWatch ASX Scans Criteria

Criteria for Uptrends List

Short term uptrend (ST trend ribbon is light green)

Long term uptrend or long term trend is transitioning from down to up (LT trend ribbon is dark green, or LT trend ribbon is amber and contracting)

Demand-side price action (rising peaks and rising troughs is preferred, but based upon weight of evidence of other criteria rising peaks only or rising troughs only may be permitted)

Predominance of demand-side candles (i.e., white bodies and or downward pointing shadows)

The last candle in particular is a strong demand-side candle

Criteria for Downtrends List

Short term downtrend (ST trend ribbon is light pink)

Long term downtrend or long term trend is transitioning from up to down (LT trend ribbon is dark pink, or LT trend ribbon is amber and contracting)

Supply-side price action (falling peaks and falling troughs is preferred, but based upon weight of evidence of other criteria falling peaks only or falling troughs only may be permitted)

Predominance of supply-side candles (i.e., black bodies and or upward pointing shadows)

The last candle in particular is a strong supply-side candle

Important considerations when using the ChartWatch ASX Scan Lists:

1. The future is unknown. Anything can happen to change the trends in the lists above. A stock in a perfect uptrend or downtrend may not remain that way by the close of trading today. 2. These lists are not exhaustive, they are curated by Carl. You will find that certain stocks might not appear in a particular list on consecutive days but might reappear when Carl feels it deserves to return to the list. 3. This is not a recommendation service, merely an aid to help you better understand the workings of Carl’s technical analysis model in a practical way. Carl will not alert you to stocks that have dropped off a list because their trend has changed – it is up to you to apply the criteria to determine why a particular stock might not still be included. 4. This is general, educational information only – always do your own research.