Evening Wrap: ASX 200 edges higher on strong results from Coles Group, Qantas Airways, Appen plunge continues

The S&P/ASX 200 closed 27.5 points higher, up 0.33%.

Only an incy wincy gain today compared to recent losses. Clearly we're not out of the woods, but today's market breadth was encouraging, as was the fact that most of the major ASX sector indices finished higher.

Of particular note was strong performances in blue chips Coles Group (COL) (+3.5%) and Qantas Airways (QAN) (+5.6%) as as both companies reported better than expected first-half results.

Elsewhere, gold stocks rose in response to a higher gold price overnight, and the iron ore majors rebounded after yesterday's heavy sell-off.

Click/scroll through for the usual reporting of the major sector and stock-specific moves, the broker responses to them, as well as all the key upcoming economic data in tonight's Evening Wrap.

Also, I have detailed technical analysis on Brent Crude Oil, Copper, and Iron Ore in today's ChartWatch.

Let's dive in!

Today in Review

Thu 27 Feb 25, 4:59pm (AEDT)

| Name | Value | % Chg |

|---|---|---|

| Major Indices | ||

| ASX 200 | 8,268.2 | +0.33% |

| All Ords | 8,506.1 | +0.34% |

| Small Ords | 3,176.5 | +0.76% |

| All Tech | 3,778.3 | -0.55% |

| Emerging Companies | 2,322.4 | +0.43% |

| Currency | ||

| AUD/USD | 0.6289 | -0.25% |

| US Futures | ||

| S&P 500 | 5,989.75 | +0.32% |

| Dow Jones | 43,588.0 | +0.19% |

| Nasdaq | 21,255.5 | +0.32% |

| Name | Value | % Chg |

|---|---|---|

| Sector | ||

| Consumer Staples | 12,298.2 | +1.55% |

| Materials | 16,653.0 | +0.98% |

| Industrials | 8,069.1 | +0.92% |

| Communication Services | 1,686.0 | +0.87% |

| Energy | 8,420.9 | +0.67% |

| Consumer Discretionary | 4,086.3 | +0.49% |

| Utilities | 9,160.2 | +0.34% |

| Financials | 8,710.7 | +0.22% |

| Real Estate | 3,722.1 | -0.37% |

| Information Technology | 2,577.4 | -1.01% |

| Health Care | 43,214.8 | -1.07% |

Markets

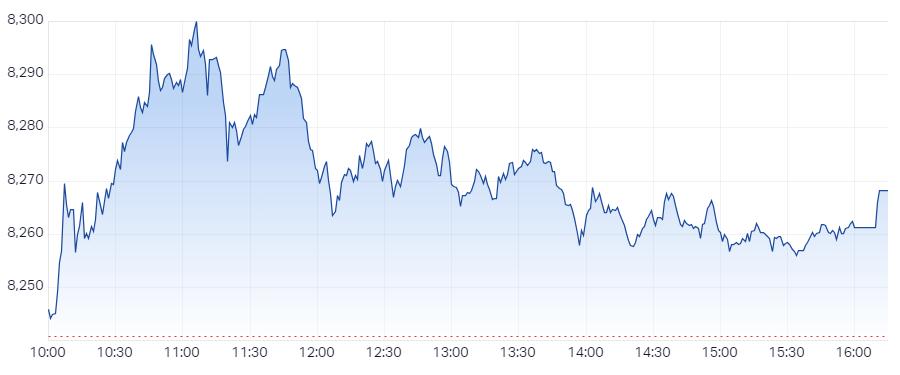

ASX 200 Session Chart

The S&P/ASX 200 (XJO) finished 27.5 points higher at 8,268.2, roughly mid-session range at 0.38% from its session high and 0.33% from its low. It was encouraging to see breadth in the broader-based S&P/ASX 300 (XKO) bounce back today, with advancers beat decliners by a tidy 188 to 88.

So, is this the bounce we were waiting for? The big return of the demand side? The scurrying retreat of the supply side? 🤔

Looking at the chart below of the XJO, and it's incy wincy white bodied candle – sullied by that upward pointing shadow indicating supply remains active in the system – and would would have to opine "No".

Is that the bounce we were waiting for on the S&P/ASX 200? 🤔 (

Clearly we're not out of the woods, but today's market breadth was encouraging, as was the fact that most of the major ASX sector indices finished higher.

Just Health Care (XHJ) (-1.1%), Information Technology (XIJ) (-1.0%), and Real Estate Investment Trusts (XPJ) (-0.36%), lost ground today – but many of these moves were earnings-specific or driven largely by sector heavyweights.

On the positive side of the ledger, the Gold (XGD) sub index (+1.7%) bounced as it continued to track the gold price (also a modest bounce overnight). The move in gold stocks helped the broader Resources (XJR) (+1.0%) sector to a modest gain as the iron ore majors rebounded from yesterday's heavy losses. But, as you will see in ChartWatch below, today's strength in Resources was not accompanied by improving commodities pricing.

A well received first-half earnings report from Coles Group COL (+3.5%) helped drive Consumer Staples (XSJ) (+1.6%) higher, as did the Qantas Airways

QAN (+5.6%) first-half earnings report for Industrials (XNJ) (+0.92%).

ChartWatch

US 10 Year T-Bond Yield

Upper shadow on Weds = Growth concerns continue to linger (click here for full size image)

A quick follow up on the US 10’s yield from last night – seeing what’s going on in the US stock and bond markets seem to be the underlying driver of the fund flows that lap the shores of our humble little ASX.

In yesterday's Evening Wrap we noted the fledgling white bodied candle that was developing after the swift plunge from 4.66%. That plunge took the prices of many risk assets with it, including stocks and several commodities.

In the last couple of ChartWatch editions we’ve focussed more on the impact on stocks, today I’d like to look at a few commodities, namely Brent Crude Oil, High Grade Copper, and Iron Ore (charts below).

To close off on the above chart though, I note the opposite candle of what we were hoping for in Thursday’s candle (H.O.P.E = Helpless, Often Praying Endlessly!!! = Never leave your investing to H.O.P.E!!!)

The long upward pointing shadow on Wednesday’s candle, black body, and low close, suggests there’s still plenty of cash working its way into the safety of the bond market. It’s buy the dip stuff for bonds which means sell the rally in yields* due to the inverse relationship between bond prices and bond yields (*and stocks and commodities).

So, risk aversion continues to be the underlying theme here.

Add in the close below the long term uptrend ribbon. Also add in the long term trend ribbon has neutralised.

Is 4.12% next? If it is, what impact would such a move have on stocks and commodities? All excellent questions that will no doubt be answered over coming candles! 🕯️⚠️

Brent Crude Oil Futures (Front month, back-adjusted) ICE

Brent burnt 🔥 (click here for full size image)

I’m not trying to prove that falling yields / money moving into the relative safety of bonds / driven by concerns over US and global growth economic growth stemming from increased risks attached to Trump & Musk/DOGE policies / triggering lower interest rate expectations as a result / equates to lower stock and commodity prices…🤔

I just do charts. You can draw your own conclusions! 🧐

But, after yesterday and Tuesday’s Exhibits A, here are three items for a collective Exhibit B.

Your Honour, I give you Brent Crude Oil.

Which has taken a sharp turn for the worse over the last 4 trading sessions. Failing for a third time at the 76.96 point of supply, it then cracked the zone of demand between 72.89-73.99.

The next area likely to act as a zone of demand is 69.14-70.29. I can’t see anything in the chart that suggests we can’t get there.

Supply moves to 73.99, but I suggest there’s a block between there and 79.96 that’s likely to be supply-heavy.

The short term trend has turned down, and therefore the short term downtrend ribbon will also likely offer dynamic supply – coincidentally also likely to kick in around 73.990-ish.

The long term trend is neutral, but I note that it was a clear demand zone before this last break, and it will likely act as a just as clear supply zone going forward – kicking in at, you guessed it – around 73.990-ish.

High Grade Copper Futures (Front month, back-adjusted) COMEX

Copper gyrations amidst Trump tariffs, growth concerns (click here for full size image)

It's not quite ditto hear on Copper, because there have been some positive Trump policy drivers working their way through the system as recently as the last 24-hours. Yesterday, President Trump ordered a probe into US copper tariffs. The expectation is that a 25% tariff may be applied to US copper imports.

This news triggered a 4% pop from Tuesday's close to Wednesday's open in the chart above. Copper rallied another percent from there, topping at 4.75 before the supply side entered in force to sell the rally (suggest broader US economic and global growth concerns driven).

Regardless of the reason, the long black candle with upward pointing shadow is the result.

Wednesday's supply-side candle appears to confirm the excess supply at the 4.8775-4.906 supply zone has shifted lower, and therefore threatens the recent short term uptrend.

The short term uptrend ribbon is acting as dynamic demand for now, but should it fail, there's some static demand from 4.4355-4.5165 backing. The long term uptrend ribbon also isn't far way.

So, there's potentially plenty of latent demand in the system here and a bit lower. That's potentially positive for the copper short and long term uptrends, but equally, we therefore also have a definitive zone of demand that should not be breached if the demand-side is to remain in control.

Supply is likely heavy between here and all the way back up to 4.8775-4.906.

The promising Jan-Feb copper rally appears over. Equilibrium at best is my tip from here unless the demand-side can engineer some decent white bodied candles and or downward pointing shadows very soon...

Iron Ore 62% (Front month, back-adjusted) SGX

Back to the snooze button on iron ore!!! 😴 (click here for full size image)

A mild decline here also, synchronous with all of the gyrations discussed above. Like copper, also a bummer because the iron ore price was just beginning to trend nicely higher.

The short term uptrend has neutralised, and the long term trend (neutral) has flattened again. So, neutral-neutral again for iron ore.

The long term trend ribbon is the next key zone of demand (dynamic), and below it sits 102 (static). A close below both would likely facilitate a deeper probing of demand into 94.65-95.45.

Supply is clear (and likely heavy) at 108.80-109.30. I suggest that until iron ore can once again close above there, it's a case of equilibrium / neutral at best.

Economy

Today

There weren't any major data releases in our time zone today (+0% actual vs +% forecast vs +% previous)

Later this week

Friday

00:30 USA Preliminary GDP December quarter y/y (+2.3% p.a. forecast vs +2.3% p.a. in September quarter)

00:30 USA Core Durable Goods Orders January m/m (+0.4% m/m vs +0.3% m/m in December)

Saturday

00:30 USA Core Personal Consumption Expenditures (PCE) Price Index January m/m (+0.3% m/m vs +0.2% m/m in December)

Note: This is the Federal Reserve's preferred measure of US inflation!

12:30 CHN Manufacturing & Services Purchasing Managers Index February (PMI)

Manufacturing: 50.0 vs 49.1 in January

Services: 50.3 vs 50.2 in January

Latest News

Technical Analysis arn blx

ChartWatch ASX Scans: Fortescue, Champion Iron, Goodman Group, Domino's Pizza, Boss Energy, Tabcorp

Thu 27 Feb 25, 12:30pm (AEDT)

Market Wraps

Morning Wrap: Mixed session on Wall Street to provide no relief for Aussie market slide

Thu 27 Feb 25, 9:01am (AEDT)

Market Wraps acl apx

Evening Wrap: ASX 200 dips as iron ore stocks FMG, CIA and RIO tumble, banks and Woodside bounce

Wed 26 Feb 25, 6:15pm (AEDT)

Markets rea

Why REA is flashing a buy the dip opportunity

Wed 26 Feb 25, 1:59pm (AEDT)

Reporting Season wow

Woolworths earnings, dividends and guidance miss: Just how bad was the half-year result?

Wed 26 Feb 25, 12:07pm (AEDT)

Technical Analysis a2m adt

ChartWatch ASX Scans: Viva Energy, Lifestyle Communities, Domino's Pizza, Brambles, Adriatic Metals, Telix Pharma

Wed 26 Feb 25, 9:00am (AEDT)

More News

Interesting Movers

Trading higher

+22.3% Australian Ethical Investment (AEF) - AEF Investor Presentation H1 FY2025, rise is consistent with prevailing long term uptrend 🔎📈

+19.9% Eagers Automotive (APE) - FY 2024 Results Presentation, rise is consistent with prevailing short term uptrend and long term trend is transitioning from down to up, a recent regular in ChartWatch ASX Scans Uptrends list 🔎📈

+14.3% Clearview Wealth (CVW) - CVW HY25 Investor Presentation.

+13.8% Regal Partners (RPL) - No news since 26-Feb 2024 Full Year Results Presentation, rebounded from yesterday's sharp post-results sell-off on generally positive comments from brokers and price target increases (see Broker Moves section below for details).

+12.9% Chalice Mining (CHN) - No news since 25-Feb Change of Director's Interest Notice - R Hacker, upgraded to buy from hold at Morgans.

+10.9% McMillan Shakespeare (MMS) - 1HFY25 Results Presentation.

+10.4% DUG Technology (DUG) - FY25-H1 Results Presentation.

+10.0% Medibank Private (MPL) - HY25 Results - Investor Presentation, rise is consistent with prevailing short and long term uptrends, a regular in ChartWatch ASX Scans Uptrends list 🔎📈

+8.9% Neuren Pharmaceuticals (NEU) - DAYBUE (trofinetide) 2024 net sales US$348 million.

+8.3% Core Lithium (CXO) - No news, general strength across the broader Lithium sector today.

+8.0% Challenger (CGF) - Challenger welcomes APRAs update on capital settings.

+7.7% Iress (IRE) - Becoming a substantial holder, (Norges Bank).

+6.8% Ramsay Health Care (RHC) - N.

+6.6% Catalyst Metals (CYL) - Appendix 4D and half year accounts, rise is consistent with prevailing short and long term uptrends, a regular in ChartWatch ASX Scans Uptrends list 🔎📈

Trading lower

-14.3% Appen (APX) - Continued negative response to 26-Feb Investor Presentation.

-9.3% Moneyme (MME) - 1H25 Results Investor Presentation.

-9.2% Perpetual (PPT) - 1H25 Results Presentation.

-8.2% Objective Corporation (OCL) - First Half FY2025 Investor Presentation.

-7.5% IDP Education (IEL) - H1 FY25 Investor Presentation, fall is consistent with prevailing short and long term downtrends, one of the most Featured (highest conviction) stocks in ChartWatch ASX Scans Downtrends list 🔎📉

-7.0% Acrow (ACF) - FY25 Half Year Results Presentation.

-6.7% Ioneer (INR) - Update on Rhyolite Ridge Project Joint Venture.

-6.5% Austin Engineering (ANG) - FY2025 Half Year Investor Presentation, fall is consistent with prevailing short term downtrend and long term trend is transitioning from up to down, a regular in ChartWatch ASX Scans Downtrends list 🔎📉

-6.0% Integral Diagnostics (IDX) - Continued negative response to 26-Feb FY25 Half Year Results Investor Presentation.

-5.6% Macquarie Technology Group (MAQ) - Half Year Results presentation, fall is consistent with prevailing short term downtrend and long term trend is transitioning from up to down, a regular in ChartWatch ASX Scans Downtrends list 🔎📉

-5.5% Stanmore Resources (SMR) - No news, lower coking and thermal coal prices last 24-hours, fall is consistent with prevailing short and long term downtrends, a regular in ChartWatch ASX Scans Downtrends list 🔎📉

-4.2% Novonix (NVX) - No news, fall is consistent with prevailing short and long term downtrends, a regular in ChartWatch ASX Scans Downtrends list 🔎📉

Broker Moves

29METALS (29M)

Retained at sell at Canaccord Genuity; Price Target: $0.150 from $0.160

Retained at outperform at Macquarie; Price Target: $0.300

ARN Media (A1N)

Retained at neutral at E&P; Price Target: $0.700

Australian Clinical Labs (ACL)

Retained at neutral at Macquarie; Price Target: $3.15 from $2.95

Retained at buy at Ord Minnett; Price Target: $3.80 from $3.90

Amplitude Energy (AEL)

Retained at neutral at Goldman Sachs; Price Target: $0.260

Retained at outperform at Macquarie; Price Target: $0.310 from $0.290

Ampol (ALD)

Upgraded to buy from neutral at UBS; Price Target: $31.40 from $31.25

Aristocrat Leisure (ALL)

Retained at neutral at UBS; Price Target: $75.50 from $76.20

Atlas Arteria (ALX)

Retained at buy at Citi; Price Target: $5.70

Retained at sector perform at RBC Capital Markets; Price Target: $5.00

Aurelia Metals (AMI)

Retained at outperform at Macquarie; Price Target: $0.250

Retained at buy at Ord Minnett; Price Target: $0.310

ANZ Group (ANZ)

Retained at neutral at Macquarie; Price Target: $28.00

Eagers Automotive (APE)

Retained at neutral at UBS; Price Target: $10.60

Atturra (ATA)

Retained at add at Morgans; Price Target: $1.000 from $1.150

Retained at buy at Shaw and Partners; Price Target: $1.200

Articore Group (ATG)

Retained at sector perform at RBC Capital Markets; Price Target: $0.350

Retained at neutral at UBS; Price Target: $0.420

Aurizon (AZJ)

Upgraded to buy from neutral at Goldman Sachs; Price Target: $3.70

Bapcor (BAP)

Retained at hold at Canaccord Genuity; Price Target: $4.99 from $4.80

Retained at neutral at Goldman Sachs; Price Target: $5.40 from $5.20

Retained at outperform at Macquarie; Price Target: $5.85 from $5.25

Upgraded to add from hold at Morgans; Price Target: $5.95 from $5.25

Retained at hold at Ord Minnett; Price Target: $5.30

Retained at sector perform at RBC Capital Markets; Price Target: $5.50 from $5.00

Bendigo and Adelaide Bank (BEN)

Retained at underperform at Macquarie; Price Target: $10.00

Bank of Queensland (BOQ)

Retained at underperform at Macquarie; Price Target: $5.75

Brightstar Resources (BTR)

Retained at buy at Canaccord Genuity; Price Target: $0.060

Commonwealth Bank of Australia (CBA)

Retained at underperform at Macquarie; Price Target: $105.00

Cuscal Group (CCL)

Retained at buy at Ord Minnett; Price Target: $3.61 from $3.55

Credit Clear (CCR)

Retained at buy at Shaw and Partners; Price Target: $0.440

Chalice Mining (CHN)

Upgraded to buy from hold at Morgans; Price Target: $2.80 from $3.45

Centuria Capital Group (CNI)

Retained at sell at UBS; Price Target: $1.740

COG Financial Services (COG)

Retained at buy at Bell Potter; Price Target: $1.230 from $1.250

Retained at buy at Ord Minnett; Price Target: $1.340

Cochlear (COH)

Retained at neutral at UBS; Price Target: $285.00

Coles Group (COL)

Retained at buy at UBS; Price Target: $19.50

Cettire (CTT)

Retained at hold at Bell Potter; Price Target: $1.250 from $1.450

Upgraded to neutral from sell at Citi; Price Target: $1.200 from $1.300

Calix (CXL)

Retained at buy at Shaw and Partners; Price Target: $1.700

Catalyst Metals (CYL)

Retained at buy at Canaccord Genuity; Price Target: $5.00 from $4.25

Dicker Data (DDR)

Retained at buy at UBS; Price Target: $10.00

Domino's Pizza Enterprises (DMP)

Retained at hold at Ord Minnett; Price Target: $31.00 from $33.00

Endeavour Group (EDV)

Retained at buy at UBS; Price Target: $5.00

Eureka Group (EGH)

Retained at add at Morgans; Price Target: $0.790 from $0.800

Emerald Resources (EMR)

Retained at buy at Canaccord Genuity; Price Target: $5.30

Flight Centre Travel Group (FLT)

Retained at hold at Canaccord Genuity; Price Target: $17.10 from $16.65

Retained at buy at Citi; Price Target: $18.45 from $20.35

Retained at positive at E&P; Price Target: $22.55 from $25.72

Retained at neutral at Goldman Sachs; Price Target: $17.50

Retained at outperform at Macquarie; Price Target: $22.34

Retained at add at Morgans; Price Target: $19.80

Retained at buy at Ord Minnett; Price Target: $22.54 from $22.51

Retained at sector perform at RBC Capital Markets; Price Target: $18.00 from $19.00

Retained at buy at UBS; Price Target: $20.00 from $22.10

Genetic Signatures (GSS)

Retained at buy at Bell Potter; Price Target: $1.050

Helloworld Travel (HLO)

Retained at buy at Ord Minnett; Price Target: $2.28 from $2.65

Retained at buy at Shaw and Partners; Price Target: $2.70

Income Asset Management Group (IAM)

Retained at buy at Morgans; Price Target: $0.084 from $0.088

Integral Diagnostics (IDX)

Retained at buy at Bell Potter; Price Target: $3.59 from $3.87

Upgraded to buy from hold at Canaccord Genuity; Price Target: $2.90 from $2.50

Retained at neutral at Citi; Price Target: $2.70 from $3.00

Retained at outperform at Macquarie; Price Target: $3.20 from $3.50

Retained at buy at Ord Minnett; Price Target: $3.00 from $3.30

IDP Education (IEL)

Retained at positive at E&P; Price Target: $19.30

Retained at neutral at UBS; Price Target: $14.70

Iluka Resources (ILU)

Retained at equal-weight at Morgan Stanley; Price Target: $4.45 from $4.75

Ioneer (INR)

Retained at buy at Ord Minnett; Price Target: $0.300

Impedimed (IPD)

Retained at buy at Morgans; Price Target: $0.160 from $0.170

Judo Capital (JDO)

Retained at neutral at Macquarie; Price Target: $1.850

Johns Lyng Group (JLG)

Retained at overweight at Morgan Stanley; Price Target: $3.40 from $4.60

Kogan.Com (KGN)

Retained at hold at Bell Potter; Price Target: $5.00 from $5.10

Kelsian Group (KLS)

Retained at overweight at JP Morgan; Price Target: $4.50 from $5.10

Downgraded to neutral from outperform at Macquarie; Price Target: $3.20 from $4.80

Retained at sector perform at RBC Capital Markets; Price Target: $3.50 from $4.50

Retained at buy at UBS; Price Target: $4.80 from $5.60

Liberty Financial Group (LFG)

Upgraded to equal-weight from underweight at Morgan Stanley; Price Target: $1.300 from $0.950

Lifestyle Communities (LIC)

Retained at hold at Canaccord Genuity; Price Target: $8.99 from $9.75

Retained at buy at Moelis Australia; Price Target: $11.50 from $12.00

Light & Wonder (LNW)

Retained at buy at Bell Potter; Price Target: $205.00 from $192.00

Retained at buy at Goldman Sachs; Price Target: $184.60 from $172.40

Retained at outperform at Macquarie; Price Target: $198.00 from $191.00

Retained at buy at UBS; Price Target: $198.00 from $175.00

Lovisa (LOV)

Retained at buy at Bell Potter; Price Target: $30.00

Lynas Rare Earths (LYC)

Retained at hold at Bell Potter; Price Target: $7.30 from $7.20

Retained at buy at Canaccord Genuity; Price Target: $7.50

Retained at sell at Citi; Price Target: $5.50

Retained at neutral at Goldman Sachs; Price Target: $7.00 from $7.40

Retained at neutral at Macquarie; Price Target: $7.10 from $7.20

Retained at underweight at Morgan Stanley; Price Target: $5.70

Retained at buy at Ord Minnett; Price Target: $7.80

Microba Life Sciences (MAP)

Retained at buy at Bell Potter; Price Target: $0.360

Retained at buy at Morgans; Price Target: $0.340 from $0.330

Macquarie Technology Group (MAQ)

Retained at neutral at Goldman Sachs; Price Target: $84.90

Retained at outperform at RBC Capital Markets; Price Target: $110.00

Matrix Composites & Engineering (MCE)

Upgraded to buy from hold at Bell Potter; Price Target: $0.280 from $0.330

Retained at buy at Morgans; Price Target: $0.300 from $0.440

Medibank Private (MPL)

Retained at neutral at Macquarie; Price Target: $3.90

Retained at buy at UBS; Price Target: $4.30

Monash IVF Group (MVF)

Retained at outperform at RBC Capital Markets; Price Target: $1.750

National Australia Bank (NAB)

Retained at buy at Citi; Price Target: $2.70

Retained at neutral at Macquarie; Price Target: $35.00

NIB (NHF)

Retained at neutral at Citi; Price Target: $6.95 from $6.75

Retained at underperform at Macquarie; Price Target: $5.55 from $5.50

Retained at neutral at UBS; Price Target: $6.75

National Storage Reit (NSR)

Retained at buy at Citi; Price Target: $2.53

Upgraded to outperform from neutral at Macquarie; Price Target: $2.42 from $2.40

Retained at underweight at Morgan Stanley; Price Target: $2.25

Retained at neutral at UBS; Price Target: $2.59

Nexted Group (NXD)

Retained at buy at Ord Minnett; Price Target: $0.300

Objective Corporation (OCL)

Retained at neutral at UBS; Price Target: $17.00

Oneview Healthcare (ONE)

Retained at buy at Bell Potter; Price Target: $0.450 from $0.400

Pointsbet (PBH)

Retained at hold at Bell Potter; Price Target: $1.100 from $0.900

Downgraded to hold from buy at Jefferies; Price Target: $1.100 from $0.950

Paladin Energy (PDN)

Downgraded to hold from buy at Jefferies; Price Target: $1.100 from $1.300

Retained at buy at Canaccord Genuity; Price Target: $14.80 from $14.90

Retained at buy at Citi; Price Target: $13.30 from $13.50

Retained at buy at Shaw and Partners; Price Target: $15.50

Retained at outperform at RBC Capital Markets; Price Target: $1.700

Platinum Asset Management (PTM)

Retained at hold at Bell Potter; Price Target: $0.750

Retained at sell at Goldman Sachs; Price Target: $0.650 from $0.750

Retained at neutral at Jarden; Price Target: $0.690 from $0.680

Retained at underweight at JP Morgan; Price Target: $0.650

Qantas Airways (QAN)

Retained at sector perform at RBC Capital Markets; Price Target: $9.00

Retained at neutral at UBS; Price Target: $9.00

Readytech (RDY)

Downgraded to neutral from overweight at Jarden; Price Target: $3.05 from $3.54

Retained at buy at Ord Minnett; Price Target: $3.75 from $3.97

Retained at buy at Shaw and Partners; Price Target: $4.50

Ramsay Health Care (RHC)

Retained at sector perform at RBC Capital Markets; Price Target: $45.00

Rio Tinto (RIO)

Retained at overweight at Morgan Stanley; Price Target: $130.50

Resimac Group (RMC)

Retained at buy at Bell Potter; Price Target: $1.100

Retained at neutral at Macquarie; Price Target: $1.000 from $1.050

Regal Partners (RPL)

Retained at buy at Bell Potter; Price Target: $5.00 from $4.85

Retained at positive at E&P; Price Target: $5.90

Retained at buy at Ord Minnett; Price Target: $4.30 from $4.40

Scentre Group (SCG)

Retained at buy at Citi; Price Target: $3.90 from $3.91

Retained at overweight at Morgan Stanley; Price Target: $4.44

Retained at neutral at UBS; Price Target: $3.74

Steadfast Group (SDF)

Retained at outperform at Macquarie; Price Target: $6.80 from $6.50

Retained at overweight at Morgan Stanley; Price Target: $6.71 from $6.98

Siteminder (SDR)

Retained at outperform at CLSA; Price Target: $7.00 from 6..9

Retained at positive at E&P; Price Target: $6.94 from $7.33

Retained at neutral at Goldman Sachs; Price Target: $5.90 from $6.10

Retained at overweight at Morgan Stanley; Price Target: $6.80

Downgraded to hold from add at Morgans; Price Target: $6.40 from $6.50

Retained at buy at Ord Minnett; Price Target: $7.20 from $7.55

Retained at overweight at Wilsons; Price Target: $7.22 from $7.60

Sheffield Resources (SFX)

Retained at hold at Ord Minnett; Price Target: $0.160 from $0.120

The Star Entertainment Group (SGR)

Retained at neutral at UBS; Price Target: $0.290

Smartgroup Corporation (SIQ)

Retained at buy at Bell Potter; Price Target: $10.15 from $10.00

Downgraded to hold from buy at Canaccord Genuity; Price Target: $8.70 from $8.50

Retained at buy at Citi; Price Target: $9.60

Retained at outperform at Macquarie; Price Target: $9.06 from $9.60

Downgraded to hold from add at Morgans; Price Target: $8.95 from $8.65

Retained at buy at Ord Minnett; Price Target: $10.00 from $10.50

Southern Cross Gold (SX2)

Retained at buy at Shaw and Partners; Price Target: $3.69

Tabcorp (TAH)

Retained at neutral at UBS; Price Target: $0.680

The Lottery Corporation (TLC)

Retained at buy at UBS; Price Target: $5.80

Tyro Payments (TYR)

Retained at buy at UBS; Price Target: $1.350

Upgraded to overweight from market-weight at Wilsons; Price Target: $1.150 from $1.180

Viva Energy Group (VEA)

Retained at outperform at Macquarie; Price Target: $2.80 from $3.40

Retained at buy at Ord Minnett; Price Target: $3.40 from $3.50

Viridis Mining and Minerals (VMM)

Retained at buy at Ord Minnett; Price Target: $1.000

Westpac Banking Corporation (WBC)

Retained at underperform at Macquarie; Price Target: $28.00

Wagners Holding Company (WGN)

Retained at add at Morgans; Price Target: $2.00 from $1.550

Worley (WOR)

Retained at buy at Citi; Price Target: $18.00

Retained at buy at Goldman Sachs; Price Target: $18.00

Retained at outperform at Macquarie; Price Target: $17.90 from $17.83

Retained at add at Morgans; Price Target: $17.70 from $17.40

Retained at buy at Ord Minnett; Price Target: $16.90 from $16.40

Retained at buy at UBS; Price Target: $22.00

Woolworths Group (WOW)

Retained at hold at Bell Potter; Price Target: $30.75 from $31.75

Retained at neutral at Citi; Price Target: $33.00

Retained at buy at Goldman Sachs; Price Target: $36.10

Retained to reduce from overweight at Jarden; Price Target: $37.00 from $36.70

Retained to reduce from hold at Jefferies; Price Target: $29.50 from $30.00

Downgraded to underweight from neutral at JP Morgan; Price Target: $29.00 from $31.30

Retained at outperform at Macquarie; Price Target: $30.80 from $31.30

Retained at overweight at Morgan Stanley; Price Target: $34.10

Retained at hold at Morgans; Price Target: $31.00 from $31.60

Upgraded to buy from hold at Ord Minnett; Price Target: $36.00 from $32.00

Retained at neutral at UBS; Price Target: $30.50 from $30.00

Wisetech Global (WTC)

Retained at buy at Bell Potter; Price Target: $122.50 from $136.25

Retained at outperform at CLSA; Price Target: $122.00 from $120.00

Retained at positive at E&P; Price Target: $142.00 from $153.00

Retained at buy at Goldman Sachs; Price Target: $128.00 from $138.00

Retained at overweight at JP Morgan; Price Target: $110.00 from $112.00

Retained at outperform at Macquarie; Price Target: $152.70

Retained at overweight at Morgan Stanley; Price Target: $140.00

Retained at add at Morgans; Price Target: $124.10 from $135.30

Upgraded to buy from accumulate at Ord Minnett; Price Target: $124.00 from $132.00

Retained at buy at UBS; Price Target: $145.00 from $153.00

Scans

Top Gainers

| Code | Company | Last | % Chg |

|---|---|---|---|

| WWG | Wiseway Group Ltd | $0.21 | +55.56% |

| BB1 | Blinklab Ltd | $0.445 | +28.99% |

| BXN | Bioxyne Ltd | $0.034 | +25.93% |

| EV1 | Evolution Energy ... | $0.021 | +23.53% |

| AEF | Australian Ethica... | $6.20 | +22.29% |

View all top gainers

Top Fallers

| Code | Company | Last | % Chg |

|---|---|---|---|

| SGQ | ST George Mining Ltd | $0.021 | -34.38% |

| APC | APC Minerals Ltd | $0.016 | -33.33% |

| CHL | Camplify Holdings... | $0.565 | -26.14% |

| CCG | Comms Group Ltd | $0.06 | -25.00% |

| BDG | Black Dragon Gold... | $0.04 | -24.53% |

View all top fallers

52 Week Highs

| Code | Company | Last | % Chg |

|---|---|---|---|

| WWG | Wiseway Group Ltd | $0.21 | +55.56% |

| AEF | Australian Ethica... | $6.20 | +22.29% |

| APE | Eagers Automotive... | $14.93 | +19.92% |

| EPX | Ep&T Global Ltd | $0.038 | +18.75% |

| SGI | Stealth Group Hol... | $0.73 | +15.87% |

View all 52 week highs

52 Week Lows

| Code | Company | Last | % Chg |

|---|---|---|---|

| CHL | Camplify Holdings... | $0.565 | -26.14% |

| 5EA | 5E Advanced Mater... | $0.865 | -21.36% |

| FL1 | First Lithium Ltd | $0.067 | -16.25% |

| IVT | Inventis Ltd | $0.024 | -11.11% |

| BLG | Bluglass Ltd | $0.019 | -9.52% |

View all 52 week lows

Near Highs

| Code | Company | Last | % Chg |

|---|---|---|---|

| PCI | Perpetual Credit ... | $1.185 | +2.16% |

| WVOL | Ishares MSCI Worl... | $44.07 | +0.14% |

| IAGPF | Insurance Austral... | $104.31 | +0.11% |

| VVLU | Vanguard Global V... | $75.62 | +0.68% |

| IHD | Ishares S&P/ASX D... | $14.49 | +0.98% |

View all near highs

Relative Strength Index (RSI) Oversold

| Code | Company | Last | % Chg |

|---|---|---|---|

| RDX | REDOX Ltd | $3.15 | +0.32% |

| MFF | MFF Capital Inves... | $4.34 | -2.03% |

| WTC | Wisetech Global Ltd | $93.99 | -2.60% |

| CLG | Close the Loop Ltd | $0.105 | 0.00% |

| EYE | Nova EYE Medical Ltd | $0.105 | -8.70% |

View all RSI oversold