Evening Wrap: ASX 200 dips as August reporting season concludes, lithium, rare earths, and uranium stocks soar

The S&P/ASX 200 closed 6.9 points lower, down 0.08%.

No new record for the ASX 200 today, not much of anything at all really. It barely budged on the last day of the week of the last day of the month on the last official day of August reporting season.

But that doesn't mean we don’t have a RECORD BUMPER Evening Wrap for you tonight! 💪💪💪

I’m quite sure we’ve never had so many Biggest Gainers to discuss, nor so many broker upgrades and downgrades of the biggest and fastest moving stocks on the ASX!

So, be sure to click/scroll through for the usual reporting of the major sector and stock-specific moves, the broker responses to them, as well as all the key economic data in tonight's Evening Wrap.

PLUS: I have detailed technical analysis on the Nasdaq Composite, the S&P/ASX 200, and Iron Ore in today's ChartWatch.

Let's dive in!

Today in Review

Fri 29 Aug 25, 5:17pm (AEST)

| Name | Value | % Chg |

|---|---|---|

| Major Indices | ||

| ASX 200 | 8,973.1 | -0.08% |

| All Ords | 9,243.0 | +0.02% |

| Small Ords | 3,611.4 | +0.84% |

| All Tech | 4,303.3 | +1.76% |

| Emerging Companies | 2,597.5 | +1.54% |

| Currency | ||

| AUD/USD | 0.6531 | -0.03% |

| US Futures | ||

| S&P 500 | 6,511.25 | -0.10% |

| Dow Jones | 45,625.0 | -0.18% |

| Nasdaq | 23,730.0 | -0.16% |

| Name | Value | % Chg |

|---|---|---|

| Sector | ||

| Information Technology | 2,993.5 | +3.07% |

| Energy | 9,315.2 | +0.99% |

| Consumer Staples | 12,440.9 | +0.42% |

| Consumer Discretionary | 4,594.0 | +0.35% |

| Materials | 17,984.7 | +0.24% |

| Utilities | 10,077.1 | +0.00% |

| Communication Services | 1,922.4 | -0.07% |

| Industrials | 8,710.9 | -0.12% |

| Health Care | 39,358.8 | -0.47% |

| Financials | 9,718.4 | -0.57% |

| Real Estate | 4,184.0 | -0.87% |

Markets

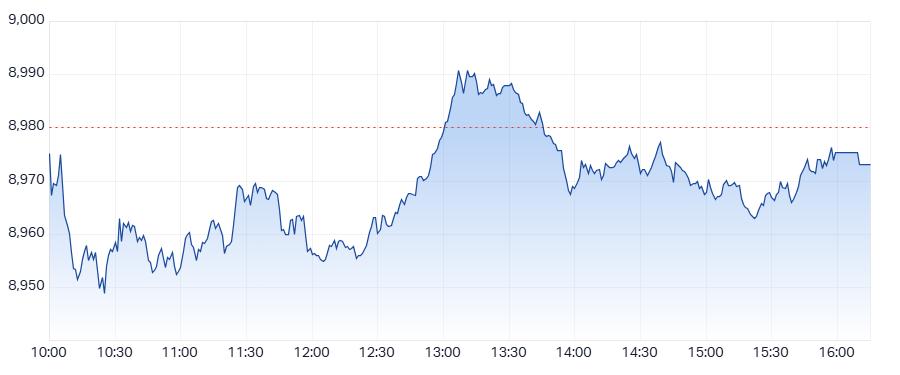

ASX 200 Session Chart

The S&P/ASX 200 (XJO) finished 6.9 points lower at 8,973.1, roughly mid-range, 0.28% from its session low and 0.20% from its high. Despite the minor slip in the benchmark, in the broader-based S&P/ASX 300 (XKO) advancers beat decliners by a decent margin – 157 to 119.

For the week, the XJO finished just 5.7 points higher or up 0.06%, 0.9% from its intraweek high and 0.6% from its intraweek low.

There wasn’t a great deal of movement today at the headline level, as evidenced by today’s slender 7 point loss. But scratch a little bit deeper, and there was a whole lot going on.

I won’t list all of the massive gains and losses – because they are suitably addressed in the Movers section below – but suffice it to say, the Gainers list pretty much reads like my ChartWatch ASX Scans Uptrends List! Hopefully that’s something you follow, as 4DX, APE, ASB, BGD, FAL, HVN, LIN, MMS, and VR1 are just a few that have popped up regularly over the last few weeks and months (for many).

It hasn’t been all one-way traffic, though as the odd earnings hand grenade has taken the odd strong uptrend with it. Clinuval (CUV) (-15%) and Bioxyne (BXN) (-13.8%) are a couple of examples of Uptrends Scan List constituents that got tagged today ☹️. Overall though, I would say it has been a largely productive earnings season 👍👍.

The other interesting items from today, for me, came from the ongoing resurgence of battery metals stocks, particularly the lithiums – and separately, a solid bounce in uranium stocks.

You would have noticed in ChartWatch ASX Scans recently a growing number of lithium names, including majors Mineral Resources (MIN) (+1.4%) and Pilbara Minerals (PLS) (+6.5%), and I can say with confidence that Liontown Resources (LTR) (+6.2%) will be added to the mix in Monday morning's edition.

As for uranium, we discussed in ChartWatch (Evening Wrap version) earlier this week how the uranium price is on the mend after second quarter production reports from the major producers, but mainly Kazatomprom, appeared to show a modestly increased degree of supply-side constraint.

Today’s well received results from Boss Energy (BOE) (+7.7%) no doubt also helped the sector. I note that ChartWatch ASX Scans has recently added Deep Yellow (DYL) (+6.1%) and Nexgen Energy (NXG) (+5.2%) to the Uptrends Scan List.

Today's best blue chip gainers

Company | Last Price | Change $ | Change % | 1mo % | 1yr % |

|---|---|---|---|---|---|

Nextdc (NXT) | $16.50 | +$2.45 | +17.4% | +13.7% | -7.4% |

Pilbara Minerals (PLS) | $2.45 | +$0.15 | +6.5% | +52.6% | -20.5% |

Reece (REH) | $11.16 | +$0.3 | +2.8% | -17.9% | -58.6% |

Flight Centre Travel (FLT) | $13.03 | +$0.34 | +2.7% | +9.1% | -32.6% |

AGL Energy (AGL) | $8.23 | +$0.2 | +2.5% | -15.3% | -27.0% |

IGO (IGO) | $5.22 | +$0.12 | +2.4% | +17.8% | -1.7% |

Wisetech Global (WTC) | $101.79 | +$2.01 | +2.0% | -14.7% | -15.3% |

Evolution Mining (EVN) | $8.66 | +$0.16 | +1.9% | +21.8% | +99.5% |

Technology One (TNE) | $39.97 | +$0.72 | +1.8% | -2.7% | +77.0% |

JB HI-FI (JBH) | $117.21 | +$1.99 | +1.7% | +5.8% | +51.3% |

Treasury Wine Estates (TWE) | $7.83 | +$0.13 | +1.7% | +3.4% | -34.2% |

Woolworths Group (WOW) | $28.80 | +$0.46 | +1.6% | -8.6% | -17.9% |

Medibank Private (MPL) | $5.10 | +$0.08 | +1.6% | 0% | +33.5% |

QBE Insurance Group (QBE) | $21.65 | +$0.33 | +1.5% | -6.7% | +38.0% |

Mineral Resources (MIN) | $37.40 | +$0.53 | +1.4% | +30.8% | -18.0% |

Hub24 (HUB) | $109.06 | +$1.44 | +1.3% | +2.3% | +101.8% |

Atlas Arteria (ALX) | $5.33 | +$0.07 | +1.3% | +3.3% | +5.1% |

Pinnacle Investment Management (PNI) | $21.47 | +$0.27 | +1.3% | -4.1% | +22.5% |

Newmont Corporation (NEM) | $111.86 | +$1.28 | +1.2% | +15.6% | +45.8% |

Computershare (CPU) | $38.17 | +$0.4 | +1.1% | -9.4% | +36.4% |

Today's worst blue chip losers

Company | Last Price | Change $ | Change % | 1mo % | 1yr % |

|---|---|---|---|---|---|

Lynas Rare Earths (LYC) | $13.87 | -$0.86 | -5.8% | +29.1% | +104.0% |

IDP Education (IEL) | $5.62 | -$0.27 | -4.6% | +57.9% | -64.6% |

Orora (ORA) | $2.08 | -$0.07 | -3.3% | 0% | -15.1% |

Qantas Airways (QAN) | $11.75 | -$0.37 | -3.1% | +8.1% | +86.6% |

Resmed Inc (RMD) | $42.08 | -$1.3 | -3.0% | -0.9% | +25.3% |

Telix Pharmaceuticals (TLX) | $14.60 | -$0.35 | -2.3% | -30.6% | -26.9% |

Perseus Mining (PRU) | $3.78 | -$0.08 | -2.1% | +15.6% | +48.8% |

Light & Wonder (LNW) | $141.21 | -$2.96 | -2.1% | -6.7% | -11.2% |

Ansell (ANN) | $33.94 | -$0.65 | -1.9% | +13.3% | +14.7% |

Commonwealth Bank of Australia (CBA) | $170.30 | -$3.05 | -1.8% | -4.3% | +23.9% |

Cleanaway Waste (CWY) | $2.78 | -$0.04 | -1.4% | -3.5% | -4.8% |

Endeavour Group (EDV) | $3.82 | -$0.05 | -1.3% | -6.6% | -26.5% |

Stockland (SGP) | $6.20 | -$0.08 | -1.3% | +11.7% | +23.8% |

Goodman Group (GMG) | $34.35 | -$0.38 | -1.1% | -2.4% | +6.0% |

Whitehaven Coal (WHC) | $6.62 | -$0.07 | -1.0% | +2.8% | -5.2% |

Westpac Banking Corp. (WBC) | $38.61 | -$0.4 | -1.0% | +14.2% | +26.6% |

Steadfast Group (SDF) | $6.08 | -$0.06 | -1.0% | +2.2% | -3.9% |

Transurban Group (TCL) | $14.60 | -$0.14 | -1.0% | +5.6% | +8.6% |

GPT Group (GPT) | $5.58 | -$0.05 | -0.9% | +9.4% | +15.1% |

Mirvac Group (MGR) | $2.36 | -$0.02 | -0.8% | +4.9% | +16.3% |

ChartWatch

Nasdaq Composite Index

Nasdaq Composite Index chart (click here for full size image)

As I look at the chart of the Comp above, I am reminded of one of my favourite ever songs.

Don’t stop me now…because I’m having a ball 🕺

Can anything stop this bull market?

Trump’s tariffs couldn’t.

The seemingly constantly on the verge of recession in the USA couldn’t.

China’s slowing economy couldn’t (check out their stock market! 📈).

The cries of value obsessed investors about "ridiculously high valuations" couldn’t (and cries and cries, into ultimately what is now a river of tears because they’re not invested…😭!!!).

As a trend following technical analysis, I can tell you there’s nothing sweeter than value investor tears in a bull market*! 😉

I received an email today from a reader asking about the meaning of “FRP”. I apoligise, we get new readers coming on all the time, and I really should refer to some of the assumed knowledge in ChartWatch more often!

It stands for Full Risk Position. It is a term that I have come to use over the years to describe my own personal allowable risk allocation to a particular market – in this case US equities.

The Comp is my benchmark index for US equities, and based on its trends, price action, and candles (all the stuff I’ve taught you), I'll decide a level of total US-portfolio exposure. Typically, it will be FRP, 2/3RP, or 1/3RP, but sometimes I'll split hairs and through in 1/2RP too.

These risk limits say nothing about the individual positions in stocks within the market I might take – those are dictated by their own respective technical analysis aspects. This is an overall portfolio-level risk management tool that ensures I am never too far out of whack with the broader market.

There’s a bit to dig into here – more than I have time to discuss on a Friday evening in ChartWatch! I hope to do more work on this and other risk management concepts within my trading model over the course of a series of webinars in the near future. Stay tuned on that one!

For now, with respect to the Comp, until I see the tell-tale signs of building supply-side control ⚠️:

A lower peak and or lower trough

Long black-bodied candles, long upward pointing shadows – particularly into known points of supply like 21805

Price closes below short term uptrend ribbon (presently 21130-21355)

Short term uptrend ribbon neutralises (i.e., turns amber)

Then, as the immortal Freddy Mercury said… Don’t stop me now = FRP 🤘!!!

*Or Collingwood supporters' tears after the 2018 AFL grand final 🦅

*Or English tears after we win 5-0 in the Ashes this year! 💪

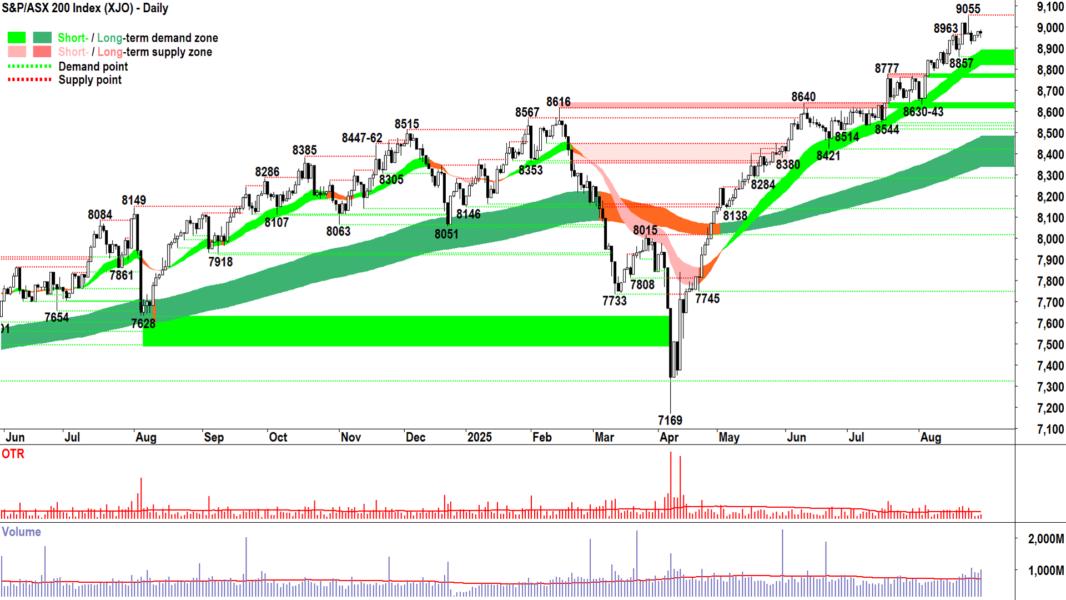

S&P/ASX 200 (XJO)

S&P/ASX 200 chart (click here for full size image)

Blip.

More specifically: Fridayblip.

More specifically: Friday, the last day of the month blip.

If I squint, I can see a tiny downward pointing shadow (👍), but as I write this sentence I realise what a waste of pixels I’ve just created.

Given it’s about that time on a Friday evening, let’s just cut to the chase here:

If the end of capitalism as we know it is about to befall the XJO – it’s not yet known by those investors with all the inside knowledge and the unlimited capital to move the dial.

So, if the world doesn’t seem concerned about proceedings – and those proceedings look substantially decent as per the trends, price action, and candles above – then who am I to worry? 🤷

Have a safe and wonderful FRP weekend everyone! 🍻

Iron Ore 62% (Front month, back-adjusted) SGX

"Developing" (click here for full size image)

The last time we covered iron ore was in ChartWatch in the Evening Wrap on 13 August.

In that update, I noted a “credible showing of developing demand-side control”.

Looking at the above chart, let’s go with “still developing” – but developing in the right direction!

We have another higher trough, plus a couple of very solid demand-side candles (long, full white bodies) on 25 and 28 August, and the short term uptrend ribbon appears to be doing its job as acting a zone of dynamic demand.

Really, the only thing we don’t have is a test of the major point of supply at 107.45. Some decent candles into there, with high closes, would suggest the latent supply that likely exists at that level has been consumed.

Yes, I know what you’re thinking, even if iron ore can get through 105.20-107.45, there’s another massive zone of supply at 109.20-109.90.

Well spotted – and yes – it will likely take some serious excess demand to crack them all. But I’ll circle back to the “developing” thesis at this point, and conclude that the balance of probabilities continues to lie with upside progress – albeit likely gradually so.

Economy

Today

There weren't any major economic data releases in our time zone today

Later this week

Friday

22:30 USA July Personal Consumption Expenditures ("PCE")

Core PCE Price Index: +0.3% m/m forecast vs +0.3% m/m in June

Personal Income: +0.4% m/m forecast vs +0.3% m/m in June

Personal Spending: +0.5% m/m forecast vs +0.3% m/m in June

Latest News

Banks anz cba

NAB ranked top Big Four bank by Morgan Stanley as lending rebounds

Fri 29 Aug 25, 11:48am (AEST)

Technical Analysis 29m aee

ChartWatch ASX Scans: "Bargain" CSL keeps dipping as "expensive" NAB and WBC continue to gain momentum

Fri 29 Aug 25, 9:00am (AEST)

Market Wraps

Morning Wrap: ASX 200 futures flat, S&P 500 crosses 6,500 for the first time + Austal, Bapcor, Pexa earnings

Fri 29 Aug 25, 8:40am (AEST)

Market Wraps

ASX 200 Live Today - Friday, 29th August

Fri 29 Aug 25, 8:34am (AEST)

Market Wraps ape boq

Evening Wrap: ASX 200 gains on ANZ, CBA, NAB and WBC as IDP Education soars on earnings, Telix Pharma dives on US FDA setback

Thu 28 Aug 25, 5:47pm (AEST)

Markets 29m bhp

BHP, Rio Tinto, Mineral Resources, Sandfire, or Pilbara Minerals – which is the cheapest ASX mining stock?

Thu 28 Aug 25, 2:43pm (AEST)

More News

Interesting Movers

Trading higher

+18.8% 4DMEDICAL (4DX) – FY2025 Full year results, rise is consistent with prevailing short term uptrend and long term trend is transitioning from down to up, a recent regular in ChartWatch ASX Scans Uptrends list 🔎📈

+17.4% Nextdc (NXT) – FY25 Results Presentation.

+17.2% Invictus Energy (IVZ) – Continued positive response to 27-Aug Strategic Investor & Alliance Agreement.

+15.4% St George Mining (SGQ) – No news, rise is consistent with prevailing short and long term uptrends, a regular in ChartWatch ASX Scans Uptrends list 🔎📈

+15.1% Austal (ASB) – FY2025 Results Presentation, rise is consistent with prevailing short and long term uptrends, one of the most Featured (highest conviction) stocks in ChartWatch ASX Scans Uptrends list 🔎📈

+13.5% Viridis Mining and Minerals (VMM) – No news, rise is consistent with prevailing short and long term uptrends, a regular in ChartWatch ASX Scans Uptrends list 🔎📈

+12.0% Smartgroup Corporation (SIQ) – Continued positive response to 28-Aug Half Year Results 2025 Investor Presentation, rise is consistent with prevailing short term uptrend and long term trend is transitioning from down to up, a recent regular in ChartWatch ASX Scans Uptrends list 🔎📈

+12.0% Meteoric Resources (MEI) – No news, general strength across the broader Critical Minerals sector today.

+11.8% Duratec (DUR) – Continued positive response to 27-Aug FY25 Results Presentation, rise is consistent with prevailing short and long term uptrends, a recent regular in ChartWatch ASX Scans Uptrends list 🔎📈

+11.5% Harvey Norman (HVN) – Presentation of Results FY25, rise is consistent with prevailing short and long term uptrends, a regular in ChartWatch ASX Scans Uptrends list 🔎📈

+11.2% Falcon Metals (FAL) – No news, rise is consistent with prevailing short and long term uptrends, a regular in ChartWatch ASX Scans Uptrends list 🔎📈

+10.5% Energy Transition Minerals (ETM) – Share Purchase Plan Closes Early Raising $8M, general strength across the broader Critical Minerals sector today.

+10.0% Lindian Resources (LIN) – No news, rise is consistent with prevailing short and long term uptrends, a regular in ChartWatch ASX Scans Uptrends list 🔎📈

+9.5% Eagers Automotive (APE) – Continued positive response to News Date 2025 Half Year Results Presentation, rise is consistent with prevailing short and long term uptrends, a regular in ChartWatch ASX Scans Uptrends list 🔎📈

+9.3% McMillan Shakespeare (MMS) – FY25 Results Investor Presentation, rise is consistent with prevailing short and long term uptrends, a regular in ChartWatch ASX Scans Uptrends list 🔎📈

+9.2% Artrya (AYA) – No news, rise is consistent with prevailing short and long term uptrends, a regular in ChartWatch ASX Scans Uptrends list 🔎📈

+9.1% Bubs Australia (BUB) – FY25 Results Presentation, rise is consistent with prevailing short and long term uptrends, a regular in ChartWatch ASX Scans Uptrends list 🔎📈

+9.1% Caprice Resources (CRS) – No news, rise is consistent with prevailing short and long term uptrends, a regular in ChartWatch ASX Scans Uptrends list 🔎📈

+8.8% Peak Minerals (PUA) – No news, rise is consistent with prevailing short and long term uptrends, a regular in ChartWatch ASX Scans Uptrends list 🔎📈

+8.6% American Rare Earths (ARR) – No news, general strength across the broader Critical Minerals sector today, rise is consistent with prevailing short and long term uptrends 🔎📈

+8.3% Arafura Rare Earths (ARU) – No news, general strength across the broader Critical Minerals sector today.

+8.1% Lotus Resources (LOT) – No news, general strength across the broader Uranium sector today.

+8.0% Vection Technologies (VR1) – Vection Reports FY25 Results, rise is consistent with prevailing short and long term uptrends, a regular in ChartWatch ASX Scans Uptrends list 🔎📈

+7.8% Paladin Energy (PDN) – No news, general strength across the broader Uranium sector today.

+7.7% Boss Energy (BOE) – FY2025 Financial Results and Change of Director's Interest Notice (D. Craib sell down), general strength across the broader Uranium sector today, .

+7.7% Bisalloy Steel Group (BIS) – FY25 Full Year Results, rise is consistent with prevailing short and long term uptrends, a regular in ChartWatch ASX Scans Uptrends list 🔎📈

+7.2% Qoria (QOR) – No news since 28-Aug FY25 Full Year Results Presentation, rise is consistent with prevailing short and long term uptrends, a regular in ChartWatch ASX Scans Uptrends list 🔎📈

+6.7% Metals X (MLX) – No news, general strength across the broader Critical Minerals sector today, rise is consistent with prevailing short and long term uptrends, a recent regular in ChartWatch ASX Scans Uptrends list 🔎📈

+6.5% Pilbara Minerals (PLS) – No news, general strength across the broader Critical Minerals sector today.

+6.5% Barton Gold (BGD) – No news, rise is consistent with prevailing short and long term uptrends, a regular in ChartWatch ASX Scans Uptrends list 🔎📈

+6.5% Australian Finance Group (AFG) – Continued positive response to 27-Aug AFG FY25 Results Investor Presentation, rise is consistent with prevailing short and long term uptrends, a regular in ChartWatch ASX Scans Uptrends list 🔎📈

+6.4% Brazilian Rare Earths (BRE) – Half Yearly Report and Accounts, general strength across the broader Critical Minerals sector today.

+6.3% Galan Lithium (GLN) – No news, general strength across the broader Critical Minerals sector today, rise is consistent with prevailing short term uptrend and long term trend is transitioning from down to up 🔎📈

+6.2% Liontown Resources (LTR) – No news, general strength across the broader Critical Minerals sector today, rise is consistent with prevailing short term uptrend and long term trend is transitioning from down to up 🔎📈

+6.1% Deep Yellow (DYL) – No news, general strength across the broader Uranium sector today, rise is consistent with prevailing short and long term uptrends, a recent regular in ChartWatch ASX Scans Uptrends list 🔎📈

+5.6% Electro Optic Systems (EOS) – EOS LAND 156 Additional Information, rise is consistent with prevailing short and long term uptrends, a regular in ChartWatch ASX Scans Uptrends list 🔎📈

+5.5% BetaShares Global Uranium ETF (URNM) – No news, Uranium stocks ETF.

+5.2% Nexgen Energy (NXG) – No news, general strength across the broader Uranium sector today, rise is consistent with prevailing short and long term uptrends, a recent regular in ChartWatch ASX Scans Uptrends list 🔎📈

Trading lower

-15.0% Clinuvel Pharmaceuticals (CUV) - Investor Presentation.

-13.8% Bioxyne (BXN) - BXN Full Year 2026 Guidance and FY2025 Results Presentation.

-9.9% Mesoblast (MSB) - MSB Annual Financial Results and Operational Update.

-9.3% Pexa Group (PXA) - PEXA Group FY25 Results Presentation.

-7.8% Broken Hill Mines (BHM) - BHMH 2025 Financial Report.

-7.3% Kaiser Reef (KAU) - Strategic Review of the A1 Gold Mine.

-7.0% Kaili Resources (KLR) - No news 28-Aug Drilling at Limestone Coast to commence on 8 Sep 2025, today's move is consistent with recent volatility.

-6.3% Clarity Pharmaceuticals (CU6) - Continued negative response to 28-Aug Preliminary Final Report.

-5.8% Lynas Rare Earths (LYC) - Lynas Successfully Completes A$750 Million Placement.

Broker Moves

Adairs (ADH)

Retained at hold at Bell Potter; Price Target: $2.60 from $2.15

Air New Zealand (AIZ)

Downgraded to sell from neutral at UBS; Price Target: $0.55 from $0.63

Alcidion Group (ALC)

Upgraded to buy from hold at Bell Potter; Price Target: $0.13

Atlas Arteria (ALX)

Retained at equal-weight at Morgan Stanley; Price Target: $5.14 from $5.26

Retained at hold at Morgans; Price Target: $5.05

Retained at neutral at UBS; Price Target: $5.35

Eagers Automotive (APE)

Retained at hold at Bell Potter; Price Target: $24.00 from $17.50

Upgraded to buy from hold at Canaccord Genuity; Price Target: $28.00 from $17.20

Downgraded to neutral from overweight at JPMorgan; Price Target: $22.80 from $19.60

Retained at outperform at Macquarie; Price Target: $27.33 from $20.60

Retained at overweight at Morgan Stanley; Price Target: $20.00

Retained at accumulate at Morgans; Price Target: $26.90 from $19.15

Downgraded to hold from accumulate at Ord Minnett; Price Target: $23.50 from $15.00

Retained at sell at UBS; Price Target: $17.00 from $16.50

Airtasker (ART)

Retained at buy at Morgans; Price Target: $0.55

Atturra (ATA)

Retained at buy at Shaw and Partners; Price Target: $1.20

Adveritas (AV1)

Retained at buy at Bell Potter; Price Target: $0.20

Bapcor (BAP)

Retained at outperform at RBC Capital Markets; Price Target: $4.50

Betmakers Technology Group (BET)

Retained at buy at Ord Minnett; Price Target: $0.27 from $0.26

Bellevue Gold (BGL)

Retained at speculative buy at Canaccord Genuity; Price Target: $1.65

Retained at outperform at Macquarie; Price Target: $1.20 from $1.25

Beacon Lighting Group (BLX)

Upgraded to accumulate from hold at Morgans; Price Target: $3.80 from $3.55

Retained at buy at Ord Minnett; Price Target: $3.85 from $3.60

Beamtree Holdings (BMT)

Retained at buy at Shaw and Partners; Price Target: $0.60 from $0.70

Bank of Queensland (BOQ)

Retained at sell at Citi; Price Target: $6.00

Retained at equal-weight at Morgan Stanley; Price Target: $6.60

Retained at sell at UBS; Price Target: $6.50

Camplify Holdings (CHL)

Retained at buy at Ord Minnett; Price Target: $0.67 from $1.03

Cettire (CTT)

Retained at underperform at RBC Capital Markets; Price Target: $0.20 from $0.90

Clinuvel Pharmaceuticals (CUV)

Retained at buy at Bell Potter; Price Target: $19.00 from $21.75

Downgraded to hold from speculative buy at Morgans; Price Target: $14.00 from $15.00

Caravel Minerals (CVV)

Retained at speculative buy at Canaccord Genuity; Price Target: $0.62

Clearview Wealth (CVW)

Retained at buy at Morgans; Price Target: $0.69 from $0.68

Cyclopharm (CYC)

Retained at buy at Bell Potter; Price Target: $1.50 from $2.20

Dicker Data (DDR)

Retained at neutral at Macquarie; Price Target: $9.45 from $9.35

Retained at overweight at Morgan Stanley; Price Target: $10.30

Retained at buy at UBS; Price Target: $10.20 from $9.30

Domino's Pizza Enterprises (DMP)

Downgraded to neutral from buy at Goldman Sachs; Price Target: $17.50 from $23.90

Retained at neutral at JPMorgan; Price Target: $18.00 from $20.00

Retained at buy at Ord Minnett; Price Target: $24.00 from $28.00

Retained at sector perform at RBC Capital Markets; Price Target: $15.00 from $18.00

Duratec (DUR)

Retained at buy at Bell Potter; Price Target: $1.90 from $1.85

EBOS Group (EBO)

Retained at accumulate at Morgans; Price Target: $34.82 from $39.15

Flight Centre Travel Group (FLT)

Retained at buy at Jarden; Price Target: $17.20 from $18.50

Generation Development Group (GDG)

Retained at overweight at Morgan Stanley; Price Target: $6.25

Retained at accumulate at Morgans; Price Target: $7.49 from $6.25

Greatland Resources (GGP)

Retained at outperform at Macquarie; Price Target: $7.10 from $7.20

Gemlife Communities Group (GLF)

Retained at overweight at Morgan Stanley; Price Target: $5.35

Downgraded to accumulate from buy at Morgans; Price Target: $5.40 from $5.20

GenusPlus Group (GNP)

Retained at buy at Bell Potter; Price Target: $6.00 from $5.00

Retained at buy at Euroz Hartleys; Price Target: $5.55 from $5.50

Retained at buy at Moelis Australia; Price Target: $5.50 from $4.40

Humm Group (HUM)

Retained at buy at Shaw and Partners; Price Target: $0.80 from $0.90

IDP Education (IEL)

Retained at equal-weight at Morgan Stanley; Price Target: $4.25

Retained at buy at UBS; Price Target: $7.80 from $4.95

IGO (IGO)

Retained at hold at Canaccord Genuity; Price Target: $5.00 from $4.60

Retained at outperform at Macquarie; Price Target: $5.50 from $5.00

Retained at neutral at UBS; Price Target: $5.65 from $5.75

ImpediMed (IPD)

Retained at speculative buy at Morgans; Price Target: $0.14 from $0.15

Kinatico (KYP)

Retained at buy at Shaw and Partners; Price Target: $0.37 from $0.28

Lifestyle Communities (LIC)

Upgraded to buy from neutral at Citi; Price Target: $7.00 from $4.50

Retained at buy at UBS; Price Target: $7.60 from $8.83

Liontown Resources (LTR)

Retained at underperform at Macquarie; Price Target: $0.65 from $0.60

Lynas Rare Earths (LYC)

Retained at sell at Citi; Price Target: $9.50 from $5.50

Downgraded to hold from buy at Jefferies; Price Target: $12.50

Downgraded to sell from hold at Ord Minnett; Price Target: $10.00 from $10.80

Downgraded to neutral from buy at UBS; Price Target: $15.10 from $12.20

Mineral Resources (MIN)

Downgraded to neutral from speculative buy at E&P; Price Target: $38.00 from $34.00

Retained at overweight at Morgan Stanley; Price Target: $41.50 from $37.50

Downgraded to trim from hold at Morgans; Price Target: $34.00 from $31.00

Medibank Private (MPL)

Retained at neutral at Citi; Price Target: $5.05

Retained at neutral at Macquarie; Price Target: $4.70 from $4.50

Retained at overweight at Morgan Stanley; Price Target: $5.55 from $5.57

Retained at accumulate at Ord Minnett; Price Target: $5.35 from $5.15

Retained at neutral at UBS; Price Target: $5.35 from $5.45

Micro-X (MX1)

Retained at speculative buy at Morgans; Price Target: $0.17

Nido Education (NDO)

Retained at buy at Shaw and Partners; Price Target: $1.30 from $1.50

Nine Entertainment Co. Holdings (NEC)

Retained at overweight at Morgan Stanley; Price Target: $1.90

Neuren Pharmaceuticals (NEU)

Retained at outperform at Macquarie; Price Target: $21.20 from $18.60

Nickel Industries (NIC)

Retained at hold at Canaccord Genuity; Price Target: $0.68 from $0.65

Downgraded to neutral from outperform at Macquarie; Price Target: $0.73 from $0.75

NEXTDC (NXT)

Retained at buy at Citi; Price Target: $18.35

Retained at buy at UBS; Price Target: $20.20

Objective Corporation (OCL)

Retained at neutral at UBS; Price Target: $20.50 from $16.00

Paladin Energy (PDN)

Downgraded to hold from buy at Argonaut Securities; Price Target: $8.00 from $8.55

Retained at buy at Canaccord Genuity; Price Target: $13.05 from $12.60

Retained at buy at Citi; Price Target: $9.30 from $9.90

Downgraded to accumulate from buy at Ord Minnett; Price Target: $7.70 from $7.60

Retained at buy at Shaw and Partners; Price Target: $10.40 from $10.10

Retained at buy at UBS; Price Target: $9.00

Paragon Care (PGC)

Retained at buy at Bell Potter; Price Target: $0.47 from $0.52

Pilbara Minerals (PLS)

Retained at outperform at Macquarie; Price Target: $2.30 from $2.20

PlaySide Studios (PLY)

Retained at buy at Shaw and Partners; Price Target: $0.43

Patriot Battery Metals Inc. (PMT)

Retained at outperform at Macquarie; Price Target: $0.50 from $0.36

Perpetual (PPT)

Retained at buy at Bell Potter; Price Target: $24.00 from $23.00

Retained at neutral at Citi; Price Target: $20.50 from $21.00

Retained at equal-weight at Morgan Stanley; Price Target: $20.40

Downgraded to neutral from buy at UBS; Price Target: $22.50

Perseus Mining (PRU)

Retained at buy at Canaccord Genuity; Price Target: $5.80

Retained at outperform at Macquarie; Price Target: $4.10

Retained at buy at UBS; Price Target: $4.75 from $4.85

Qantas Airways (QAN)

Retained at buy at Citi; Price Target: $13.60 from $12.20

Upgraded to overweight from neutral at Jarden; Price Target: $12.90 from $10.20

Retained at buy at Jefferies; Price Target: $14.45 from $11.97

Downgraded to neutral from overweight at JPMorgan; Price Target: $11.60 from $9.80

Retained at neutral at Macquarie; Price Target: $12.00 from $10.40

Retained at overweight at Morgan Stanley; Price Target: $13.50 from $12.00

Retained at hold at Morgans; Price Target: $12.80 from $10.80

Upgraded to buy from accumulate at Ord Minnett; Price Target: $13.80 from $11.40

Retained at neutral at UBS; Price Target: $12.00 from $10.30

Qoria (QOR)

Retained at buy at Ord Minnett; Price Target: $0.67 from $0.56

ReadyTech Holdings (RDY)

Retained at buy at Shaw and Partners; Price Target: $4.20 from $4.50

Ramsay Health Care (RHC)

Retained at equal-weight at Morgan Stanley; Price Target: $36.70 from $39.00

Retained at hold at Morgans; Price Target: $35.22 from $37.10

Retained at hold at Ord Minnett; Price Target: $32.80 from $37.50

Retained at neutral at UBS; Price Target: $35.90 from $38.50

Resimac Group (RMC)

Retained at neutral at Citi; Price Target: $1.00 from $0.88

RMA Global (RMY)

Retained at speculative buy at Bell Potter; Price Target: $0.10

Retained at buy at Bell Potter; Price Target: $0.10

South32 (S32)

Retained at buy at Morgans; Price Target: $3.55 from $4.10

Steadfast Group (SDF)

Retained at overweight at Morgan Stanley; Price Target: $6.71

Retained at buy at UBS; Price Target: $7.00 from $6.85

Sandfire Resources (SFR)

Downgraded to hold from buy at Argonaut Securities; Price Target: $13.00

Downgraded to hold from buy at Canaccord Genuity; Price Target: $12.50 from $12.00

Retained at neutral at Macquarie; Price Target: $12.50 from $12.00

Retained at hold at Morgans; Price Target: $12.50 from $12.55

Retained at accumulate at Ord Minnett; Price Target: $13.35 from $12.35

Downgraded to neutral from buy at UBS; Price Target: $13.10 from $13.35

Smartgroup Corporation (SIQ)

Retained at hold at Bell Potter; Price Target: $8.60 from $8.50

Upgraded to buy from hold at Canaccord Genuity; Price Target: $9.10 from $8.70

Retained at outperform at Macquarie; Price Target: $8.99 from $9.06

Retained at equal-weight at Morgan Stanley; Price Target: $9.00

Retained at buy at Ord Minnett; Price Target: $10.30 from $10.00

SomnoMed (SOM)

Retained at speculative buy at Morgans; Price Target: $0.99 from $1.00

Summit Minerals (SUM)

Retained at buy at Bell Potter; Price Target: $15.25 from $15.10

Sayona Mining (SYA)

Retained at outperform at Macquarie; Price Target: $0.04 from $0.03

Telix Pharmaceuticals (TLX)

Retained at buy at Bell Potter; Price Target: $23.00 from $30.00

Downgraded to neutral from overweight at JPMorgan; Price Target: $16.50 from $26.25

Retained at overweight at Morgan Stanley; Price Target: $25.60

Retained at overweight at Morgan Stanley; Price Target: $25.60

Retained at buy at UBS; Price Target: $36.00

TPG Telecom (TPG)

Retained at hold at Morgans; Price Target: $5.50 from $5.40

Retained at neutral at UBS; Price Target: $5.40 from $4.80

Trajan Group Holdings (TRJ)

Retained at buy at Bell Potter; Price Target: $1.25 from $1.45

Titomic (TTT)

Retained at speculative buy at Bell Potter; Price Target: $0.50

Scans

Top Gainers

| Code | Company | Last | % Chg |

|---|---|---|---|

| SNS | Sensen Networks Ltd | $0.04 | +53.85% |

| DTZ | DOTZ Nano Ltd | $0.055 | +48.65% |

| MML | Mclaren Minerals Ltd | $0.03 | +42.86% |

| YUG | Yugo Metals Ltd | $0.05 | +42.86% |

| ATV | Activeport Group Ltd | $0.023 | +35.29% |

View all top gainers

Top Fallers

| Code | Company | Last | % Chg |

|---|---|---|---|

| BSA | BSA Ltd | $0.094 | -32.86% |

| HCL | Highcom Ltd | $0.315 | -27.59% |

| AGR | Aguia Resources Ltd | $0.022 | -20.00% |

| EGY | Energy Technologi... | $0.023 | -17.86% |

| CVB | Curvebeam Ai Ltd | $0.118 | -16.07% |

View all top fallers

52 Week Highs

| Code | Company | Last | % Chg |

|---|---|---|---|

| YUG | Yugo Metals Ltd | $0.05 | +42.86% |

| COD | Coda Minerals Ltd | $0.115 | +29.21% |

| ADC | Acdc Metals Ltd | $0.079 | +16.18% |

| PIM | Pinnacle Minerals... | $0.11 | +15.79% |

| EXP | Experience Co Ltd | $0.15 | +15.39% |

View all 52 week highs

52 Week Lows

| Code | Company | Last | % Chg |

|---|---|---|---|

| AGR | Aguia Resources Ltd | $0.022 | -20.00% |

| TRU | Truscreen Group Ltd | $0.015 | -11.77% |

| PRO | Prophecy Internat... | $0.345 | -11.54% |

| GAP | Gale Pacific Ltd | $0.087 | -11.22% |

| GSS | Genetic Signature... | $0.27 | -10.00% |

View all 52 week lows

Near Highs

| Code | Company | Last | % Chg |

|---|---|---|---|

| SMLL | Betashares Austra... | $4.20 | +1.45% |

| ECF | Elanor Commercial... | $0.71 | +0.71% |

| OZBD | Betashares Austra... | $45.39 | +0.04% |

| DFND | Vaneck Global Def... | $35.95 | -0.88% |

| WVOL | Ishares MSCI Worl... | $44.13 | -0.74% |

View all near highs

Relative Strength Index (RSI) Oversold

| Code | Company | Last | % Chg |

|---|---|---|---|

| PEN | Peninsula Energy Ltd | $0.35 | +1.45% |

| PGC | Paragon Care Ltd | $0.335 | -1.47% |

| REH | Reece Ltd | $11.16 | +2.76% |

| MAQ | Macquarie Technol... | $61.10 | +0.99% |

| RFG | Retail Food Group... | $1.415 | -1.39% |

View all RSI oversold