Cattle prices snag AACo’s interim profit: Outlook anything but bullish

- Australian Agricultural Company's interim net profit (on a statutory basis) was -38% lower at $51.6m

- Impacting the result was a lower fair value adjustment as cattle prices in Australia normalise

- Management flagged rising inflation and drought conditions in the US

Australian Agricultural Company (ASX: AAC) may well be reaping the benefits from expanding deeper into branded products - as the restaurant trade rebounds from a near three pandemic-plagued years – but the group was down -3.21% at noon following revelations net profit (on a statutory basis) was -38% lower at $51.6m.

Sitting just outside the S&P/ASX300, the company delivered a 28% surge in operating profit to $38.3m in the six months to September 30.

Much of this result is due to Westholme and Darling Downs branded products which between them comprised 88% of meat sales revenue, up 19% to $122.3m.

Focus on premium brands

Due to the company’s ongoing focus on its premium brands, average meat sales price per kilogram increased 25.9%.

Despite a lower volume compared to the previous period, Westholme sales in Australia increased 35%, which underpinned a strong increase in the average price.

Also underpinning the company’s strong financial position was a 3% increase in NTA to $2.33 per share, driven by an increase in the value of net assets to $1.4bn.

“Our margins are higher,” noted CEO David Harris.

“… we’ve been able to do more with less, producing 18% more live weight kilograms while only increasing production costs 1%.”

Higher input cost environment

But where the result came undone notes Harris was around lower fair value adjustment as cattle prices in Australia normalise.

While today’s update skirted around meaningful detail, useful insights include:

Operating Cash Flow of $3.4m, down versus the previous $17.3m

Increased spend associated 18% higher live weight kgs produced

Key markets beyond Australia

To the uninitiated, the company is the nation’s biggest meat producer, own 1% of Australia’s total land, and has on its shareholder register a rogue's gallery of billionaires including Tottenham Hotspur owner Joe Lewis, Andrew Forrest, and the Holmes a Court family.

Around half (46%) of total meat sales are derived from North America (29%) and Europe and the Middle East (17%).

Outlook

While the company provided neither specific guidance nor a dividend, management flagged rising inflation and drought conditions in the US.

“Global economic conditions have shifted significantly vs pcp, with rising inflation and interest rates impacting the cost of living,” management advised investors.

“We are wary of the evolving global economic conditions but will stick to the fundamentals and the strategy that have served us well through other challenges over recent years.”

Meantime, management is monitoring the heavy drought conditions and impact on herd size in the US, which may result in global opportunities as it coincides with the ongoing rebuild of herds across Australia.

What brokers think

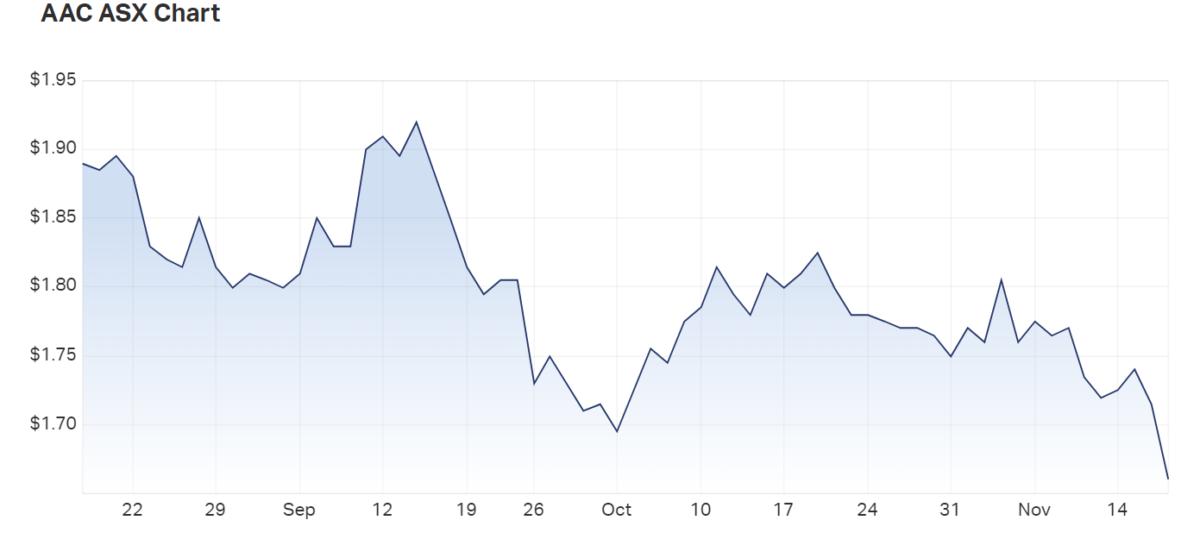

The company’s share price is down around -4% over one year but has been progressively unravelling since late June.

Consensus is Strong Sell.

Based on Morningstar’s fair value of $2.17 the stock appears to be undervalued.

Despite having a market cap of around 1$bn the stock receives surprisingly little broker coverage.

However, this could change should the stock move inside the S&P/ASX300.

Australian Agricultural Company's share price over 12 months.