Two metals stocks under Rs 200 to add to your watchlist

In the current market, passive investors may feel like they are watching their portfolios sink. With seemingly bearish momentum and some stocks losing steam, it can be easy to lose enthusiasm about the stock market. However, 2025 might be the year that traders take centre stage, especially those who are actively seeking momentum-based opportunities. Forget the days of 30-40% stock movements; this market seems to gravitate towards smaller 8-10% gains.

For traders, staying active is the key, and one area that seems to be gaining traction is the metals sector. Over the past few weeks, the Nifty Metal Index has shown signs of bullish momentum, making it a sector worth focusing on for potential gains. Let's dive deeper into the Nifty Metal Index and its bullish trend and spotlight two stocks under Rs 200 worth watching closely for the upcoming months.

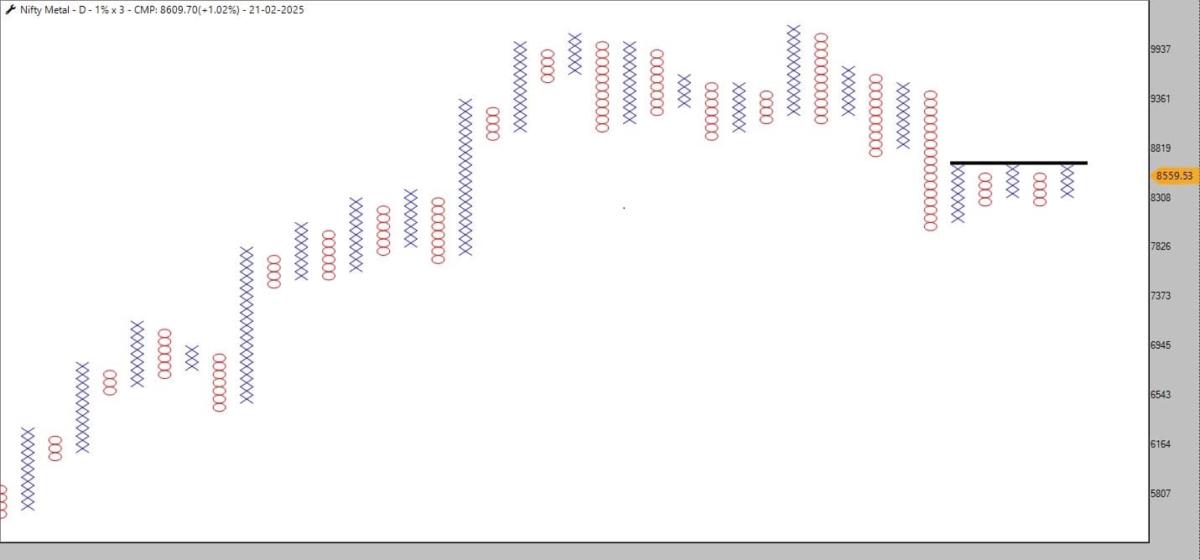

Nifty Metal Index P&F Chart

Looking at the Nifty Metal Index through a 1% X 3 Daily Point & Figure (P&F) chart, we can see that the index is on the verge of breaking out from a Triple Top Buy (TTB) pattern, which is placed at 8,650.

A Triple Top Buy is a classic bullish pattern in P&F charts. It signals that the stock or index has repeatedly tested a resistance level. When the price finally breaks above this resistance, it often triggers a strong upward move.

The Nifty Metal Index’s bullish tone is evident, and the charts suggest that the momentum could continue. As sector rotation continues to play out, metals seem to be at the forefront, and two stocks, SAIL and Tata Steel, are catching the eye of traders looking for potential moves within this bullish sector.

SAIL (Steel Authority of India)

SAIL, one of India’s largest steel manufacturers, is creating a lot of buzz among traders right now. The stock has been showing promising signs of a bullish reversal, and its performance on the Point & Figure chart suggests it may be primed for an uptrend.

On the 0.25% X 3 Daily P&F chart, SAIL has broken out from a 3-column triangle pattern, with a 45-degree trendline reinforcing the potential for a significant reversal. This critical signal indicates that the stock is no longer trapped in a sideways range and could soon move higher.

What makes SAIL even more interesting is its price action around a key psychological level of Rs 100. The stock has consistently formed a similar bottom near this level, a pattern traders often look for when a reversal is on the horizon. In addition, the King Oscillator, a tool used to measure momentum, has shown a bullish crossover and is rising, further supporting the argument that the trend is shifting in favour of the bulls.

For traders looking at SAIL, the key level to watch is Rs 96. If the stock price closes below this level, it could signal that the trend has reversed. However, as long as the stock holds above Rs 96, the potential bullish momentum will likely continue.

Tata Steel

Tata Steel, one of the most prominent names in the Indian metal industry, is another stock that looks ripe for a bullish move. Last week, the metal stocks witnessed significant attention, and Tata Steel was one of the top performers, hitting new highs for 2025.

Looking at the 0.25% X 3 Daily P&F chart, we see that Tata Steel has recently broken out from not one but two bullish patterns: the Anchor Column Follow-Through (AFT) pattern and the 45-degree trendline. These two breakouts suggest that the stock is experiencing strong upward momentum, and traders who are quick to spot this could benefit from the next move up.

The bullish price action is further supported by a bullish crossover and range shift on the King Oscillator, confirming that the momentum is firmly in favour of the bulls. With these technical indicators, Tata Steel’s potential for further gains looks promising, especially with the overall strength in the metals sector.

For traders, the key level to watch is the price action near the previous resistance levels. As long as Tata Steel can maintain its position above these levels, it may potentially continue its northward trajectory.

Conclusion: Watch These Stocks Closely

As we move through 2025, it’s clear that traders must remain active and stay ahead of the curve to capitalize on momentum-based opportunities. With its strong technical patterns and growth potential, the metals sector is an area worth monitoring closely. Both SAIL and Tata Steel have strong bullish indicators on their charts, and with the Nifty Metal Index on the verge of a breakout, these stocks are worth adding to your watchlist.

If you're an active trader looking for smaller but consistent gains in the market, these two stocks could offer a solid opportunity to ride the wave of momentum in the metals sector. Keep an eye on the key levels, watch for continued bullish momentum, and you may find the right opportunities to trade in the coming months.

Note: The purpose of this article is only to share interesting charts, data points and thought-provoking opinions. It is not a recommendation. This article is strictly for educative purposes only.Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.