ABS mandate to skid entry-level two-wheeler sales and profitability, spur component makers

The government’s plan to mandate anti-lock braking systems (ABS) for all two-wheelers starting January 1, 2026, could disrupt demand in the price-sensitive entry-level motorcycle and scooter market, even as suppliers stand to gain from a multi-fold jump in component demand.

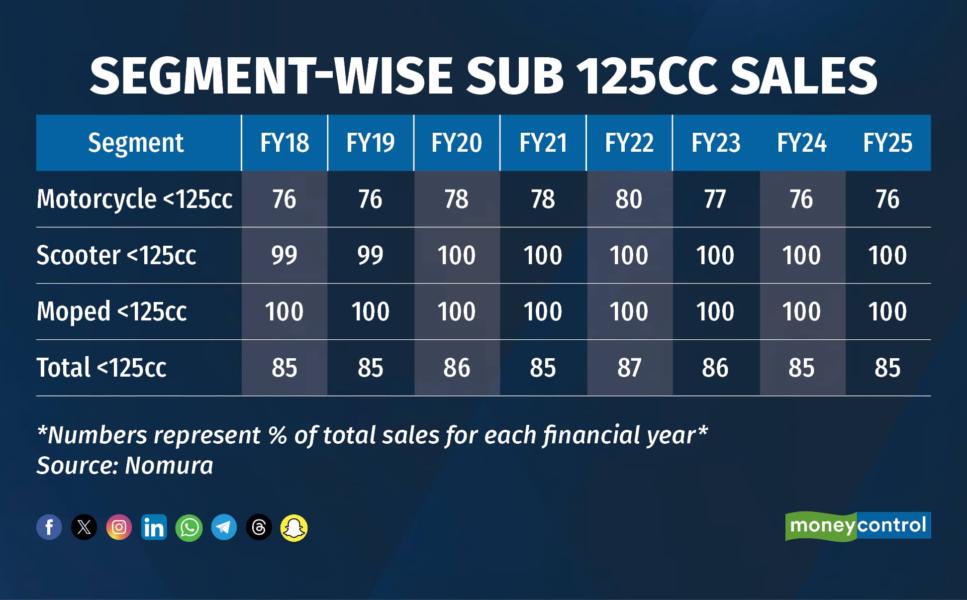

Currently, ABS is compulsory only for two-wheelers above 125cc, which account for just 16 percent of total industry volumes. The proposed regulation will extend the requirement to the remaining 84 percent—including 100cc motorcycles, scooters, and mopeds—which largely cater to cost-conscious buyers in semi-urban and rural markets.

Also read: Starlink, Amazon ink first satellite broadband pacts in India ahead of spectrum allocation

Brokerages anticipate a near-term hit to demand. Nomura estimates the cost of an ABS unit at around Rs 3,000 per vehicle, translating to a 3–5 percent price hike. Kotak Institutional Equities pegs the increase slightly higher, at Rs 3,000–5,000, or 4–6 percent of vehicle prices. This could lead to a 2–4 percent decline in sales volumes, especially in the entry segment.

Hero MotoCorp, which derives nearly 79 percent of its sales from sub-125cc bikes, is likely to be the most affected, according to Nomura. TVS Motor could also see a notable impact, with 54–64 percent of its portfolio falling within the regulation’s ambit. Bajaj Auto’s exposure stands lower at 24–35 percent, while Royal Enfield, which focuses exclusively on higher-displacement motorcycles, will remain unaffected.

Read more: Manipal Cards files confidential DRHP to raise Rs 1,200 crore at Rs 12,000-crore valuation

The new rule comes at a time when the sector is already facing headwinds. A supply crunch in rare-earth magnets—key to electric vehicle motors—has disrupted production schedules, and manufacturers are warning of potential halts. EV makers are considering price increases of up to 8 percent. "The industry could face margin erosions of 50 to 100 basis points, especially in the two-wheeler EV space," said Shridhar Kallani of Axis Securities.

While the near-term pain could be real for original equipment manufacturers (OEMs), auto component suppliers stand to benefit significantly from the regulatory shift. Bosch and Continental dominate the ABS market, while Endurance Technologies has a strong presence in both ABS and disc brake systems.

Kotak expects the two-wheeler ABS market to expand nearly fivefold to Rs 80,400 crore over the medium term. For Endurance Technologies, this could translate into incremental revenue of Rs 1,000–1,770 crore and a 5–9 percent lift in consolidated earnings.

The implementation timeline, however, is seen as ambitious. Scaling up industry-wide ABS production will require meaningful investment in manufacturing capacity. Whether the January 2026 deadline remains unchanged will depend on the outcome of ongoing discussions between government officials and industry stakeholders.

Shares of Hero MotoCorp were trading lower by 2 percent while Bajaj Auto and TVS Motor were down half a percent each. The Nifty Auto was down 0.5 percent in the afternoon.Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.