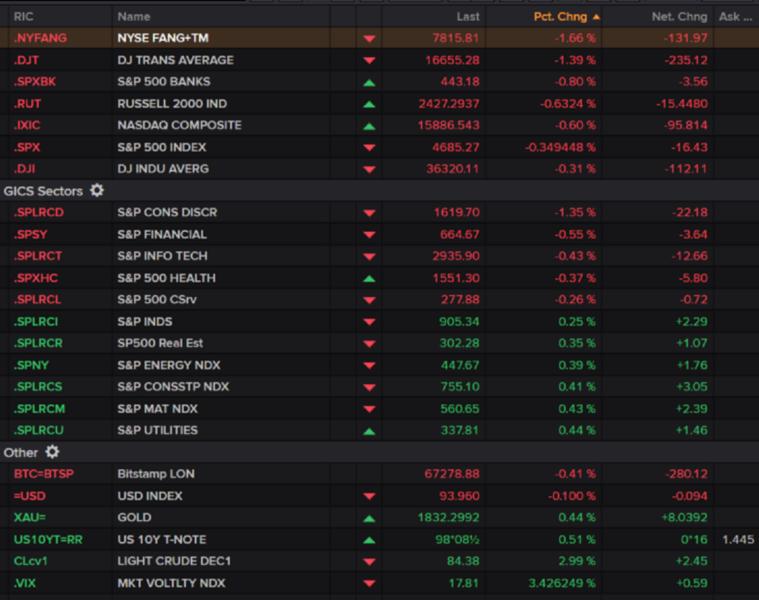

U.S. stocks close lower on inflation woes, profit-taking

- Major U.S. indexes end lower; Transports, FANGs weak

- Cons disc weakest major S&P 500 sector; defensives outperform

- Dollar slips; gold, crude up; bitcoin dips

- U.S. 10-Year Treasury yield ~1.44%

U.S. STOCKS CLOSE LOWER ON INFLATION WOES, PROFIT-TAKING (1602 EDT/2102 GMT)

Wall Street ended lower on Tuesday, as profit-taking took over and worries over persistent inflation triggered a broad sell-off.

All three major U.S. stock indexes fell, ending an eight-session streak of all-time closing highs set by the S&P 500 and the Nasdaq.

Meanwhile, U.S. producer prices (PPI) data that showed inflation continuing to heat up last month amid ongoing goods and labor supply challenge, reinforced concerns about higher prices.

Markets are looking to Wednesday's CPI report, for further confirmation of whether inflation remains elevated on the consumer level side.

Among individual stocks, General Electric Co GE surged following the 129-year-old industrial conglomerate's announcement that it would split into three separate public companies to simplify its business.

Tesla Inc TSLA, meanwhile, extended losses, weighing down the consumer discretionary sector

S5COND after Chief Executive Elon Musk's Twitter poll proposing to sell a tenth of his holdings garnered a 57.9% vote in favor of the sale.

Here is the closing snapshot:

(Gertrude Chavez-Dreyfuss)

*****

BITCOIN HEADED FOR NEW RECORD HIGHS -GLASSNODE (1351 EDT/1851 GMT)

As bitcoin climbed to record peaks on Tuesday, the virtual currency's on-chain data showed it may be headed for further all-time highs, according to the latest report from blockchain data provider Glassnode.

Bitcoin's on-chain market continues to show strength in supply dynamics, while activity remains well below bull-market highs. Long-term bitcoin holders have distributed a very small fraction of their holdings, as has been the case in all previous cycles, reflecting expectations for further gains.

Despite hitting lifetime highs, on-chain activity remains only marginally above bear market levels, Glassnode said. This suggests that "smart money" accumulation is ongoing and bitcoin is currently in the first phase of a bull market.

Additionally, bitcoin balances in exchanges continue to deplete, while miner hashrate, which reflects mining activity, and U.S. dollar revenue are approaching new highs.

"This combination of strong supply dynamics, mining network recovery, and relatively low network activity points to a fairly constructive outlook for bitcoin over the coming weeks," Glassnode said.

Bitcoin BTCUSD rose as high as $68,564.40 and was last down 1.1% at $66,834.

Martha Reyes, head of research at digital asset prime brokerage and exchange BEQUANT believes that $100,000 for bitcoin is on the horizon.

(Gertrude Chavez-Dreyfuss)

*****

HEDGE FUNDS KEEP THEIR FOOTING IN A TUMULTUOUS YEAR (1315 EDT/1815 GMT)

Hedge funds overall have navigated 2021's high profile market events including the collapse of Archegos Capital, meme stock short squeezes and yield curve uncertainties fairly well, according to hedge fund data provider PivotalPath.

PivotalPath's Composite index, which tracks hedge fund performance across varying strategies, is up about 9% year-to-date, only declining in July. The index has generated 7% alpha to the S&P over the last year, according to PivotalPath CEO Jon Caplis.

"This shows that individual strategies and funds are generating unique return streams and not relying solely on equity market performance or other macro factors to generate returns," Caplis told the Reuters Global Markets Forum.

As investors broadly rotated from growth to value in the equity space, PivotalPath's indexes tracking financial and energy-focused hedge funds gained 17% and 20%, respectively.

Commodity funds made money irregardless of whether crude or natural gas rallied significantly or sold off, Caplis noted.

Despite some "wrong way" bets on the U.S. Treasury yield curve amid uncertainties over inflation and Federal Reserve policy, PivotalPath's credit index has generated 10.5% YTD, led by distressed credit strategies which are up 16.4% for the year.

Funds following a convertible bond arbitrage strategy, which had the highest exposure to Treasury yield curve steepeners, are up 9.4% year to date, Caplis said.

Globally, U.S. long-short equity strategies have held on to their lead, with PivotalPath's index up 13% compared to PivotalPath Europe Long-Short index which is up 9%.

An index tracking Asian funds has gained 6% year-to-date, with Caplis noting many managers seeing current ructions in Chinese markets as holding opportunity but some shifting focus to other areas in the region.

"Credit has moved more to Singapore while equity managers seem to still be comfortable in Hong Kong," he said.

(Lisa Mattackal)

*****

TIME FOR BE SELECTIVE WHEN IT COMES TO TECH (1240 EDT/1740 GMT)

In her latest weekly market comments, Saira Malik, CIO, head of global equities at Nuveen, says it's no secret that low interest rates and the expansion of the digital economy in recent years has powered growth and technology stocks.

Malik notes that growth accelerated almost exponentially in 2020 thanks to the economic impacts of COVID-19. With this, she highlights that even mature industries that have lagged the broader tech sector have done well, saying that PCs, for example, experienced their highest U.S. growth rate in two decades.

However, she also says that while the sector has appreciated significantly as a whole, its leadership over the past five years has narrowed considerably. In fact, the vast majority of growth over the time period came from the five largest names in the S&P 500, which now make up approximately 25% of index.

Their combined market capitalization exploded nearly 500% since the end of 2016, from $2.0 trillion to $9.9 trillion, with more than half of that increase coming since March 2020 alone.

Although, Nuveen is a structural bull on the technology sector and believes that mega-cap tech companies will remain dominant in their respective arenas over the long term, Malik thinks these areas now face significant headwinds.

Rising interest rates, higher inflation and slowing growth have already taken a toll on earnings, and she thinks that if these headwinds persist, the remarkable pace of outperformance by mega-cap names will likely prove unsustainable over the near term.

"As a result, we have become more selective toward technology stocks and expect a broadening of leadership in the sector to provide investors with attractive opportunities beyond the best-known names."

(Terence Gabriel)

*****

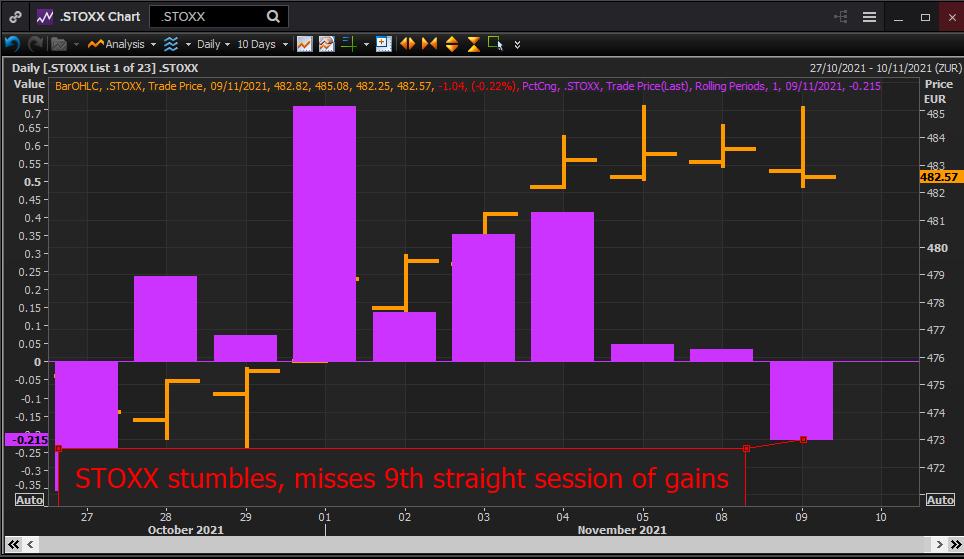

STOXX STUMBLES, MISSES 9TH STRAIGHT SESSION OF GAINS (1157 EDT/1657 GMT)

Today's session started with some encouraging milestones, notably French and German blue chip indexes reaching new record highs in late morning trading.

Sentiment, however, gradually fizzled in afternoon trading when Wall Street opened and went into negative territory as the rally lost a few puffs of steam.

Granted, there is absolutely nothing spectacular with European equities losing a modest 0.2% today, but it marks the end of eight-straight sessions of gains.

That said, the pan-European STOXX closed at 482.71, about 0.5% away from its all-time high of 485.13 reached on November 5.

While the momentum provided by an upbeat Q3 earnings season seems to be fading away, there also seems to be no imminent threat to the rally with central banks in no apparent rush to hike rates.

(Julien Ponthus)

*****

THE OTHER GLOBAL WARMING: PPI, BUSINESS SENTIMENT (1100 EDT/1600 GMT)

Inflation continues to gather heat in the United States, and words like 'persistent' and 'prolonged' are starting to drown the Fed's 'transitory' chant.

And data released on Tuesday confirmed that stubbornly tight supply of goods and labor is causing the mercury continues to rise at U.S. businesses.

Producer prices (PPI) (USPPFD=ECI), prices U.S. goods makers receive for their merchandise at the loading dock, rose as expected last month to 0.6% an uptick from September's 0.5% increase.

A quick stroll of the data line-by-line reveals that spiking prices for energy goods and services and raw materials provided the heftiest thrust, offsetting declines in vehicles.

"Inflation readings continue to reflect pandemic-related effects including demand and supply imbalances. The demand impact should fade over coming months," writes Rubeela Farooqi, chief U.S. economist at High Frequency Economics. "But there is a risk from broken supply chains, which could keep goods prices and inflation elevated for longer."

Stripping away volatile food, energy and trade services, so-called "core" PPI (USPPTY=ECI) added 0.3 percentage points to reach 6.2% on an annual basis, joining other indicators in their ascent and worrying market participants that they could be approaching Fed target escape velocity.

The graphic below shows major inflation markers - including core PPI - and their protracted flight well above the central bank's average annual 2% target.

Tune in tomorrow for the Labor Department's CPI report, which could provide clues regarding the extent to which prices are being passed along to the consumer.

In a separate report, the ongoing goods and labor supply crunch dampened the mood of small business owners a bit last month.

The Business Optimism index (USOPIN=ECI) slipped 0.9 points to a reading of 98.2 in October, according to the National Federation of Independent Business (NFIB).

While the 'uncertainty' component eased, so did the number of business owners expecting improved business conditions.

"Small business owners are attempting to take advantage of current economic growth but remain pessimistic about business conditions in the near future," writes Bill Dunkelberg, NFIB's Chief Economist.

Labor and goods supply scarcity appear to be the culprits.

"Acute hiring challenges and persistent supply chain bottlenecks are keeping upward pressure on wages and prices," says Lydia Boussour, lead U.S. economist at Oxford Economics. "The shares of small firms raising wages and prices both rose to new records in October."

It should be noted that the NFIB is a politically active membership organization.

Wall Street appears to be losing stamina after - barely - extending its streak of record closing highs on Monday.

All three indexes were modestly red, with consumer discretionary S5COND and smallcaps

RUT leading the broader slide.

(Stephen Culp)

*****

U.S. STOCKS FALL ON EARLY TRADE; INFLATION CONCERNS WEIGH (1000 EDT/1500 GMT)

Wall Street shares are weaker in early trading with inflation concerns following the rise in U.S. producer prices last month, outweighing the surge in General Electric on a plan to split into three public companies.

There could also be some profit-taking following Monday's all-time peaks in the S&P 500 and Nasdaq.

But some of the focus may be on inflation, analysts said. U.S. producer prices rose 0.6% October, driven by surging costs for gasoline and motor vehicle retailing, suggesting that high inflation could persist for a while amid tight supply chains related to the pandemic.

The S&P 500 and the Nasdaq closed at all-time highs on Monday for the eighth straight session, while the Dow clocked its second consecutive record closing high.

Here is where markets stand in early trade:

(Gertrude Chavez-Dreyfuss)

****

DOW INDUSTRIALS: MAKE-OR-BREAK MOMENT (0900 EDT/1400 GMT)

Major U.S indexes have certainly been on a run of late. The S&P 500 SPX and Nasdaq Composite

IXIC have both risen eight-straight days.

The Dow DJI is just off that pace, posting a gain in seven of the past eight days. That said, the blue-chip average is on pace to rise for a sixth-straight week, which would be its longest such streak since a 9-week run of gains in late-December 2018 to late-February 2019.

However, the Dow is rapidly nearing a hurdle in the form of a weekly log-scale resistance line from its early January 2018 high, which now resides around 36,650, or just 0.6% above Monday's close:

This line capped strength in mid-August, leading to a more than 5%, five-week slide.

Meanwhile, weekly momentum, which has been essentially coiling within a triangular pattern over the past year or so, also finds itself bucking up against its own resistance hurdle.

Therefore, with major indexes appearing stretched to the upside over various time frames, the Dow may be reaching another make-or-break moment.

(Terence Gabriel)

*****

FOR TUESDAY'S LIVE MARKETS' POSTS PRIOR TO 0900 EDT/1300 GMT - CLICK HERE: