Quantitative hedge funds on track for worst month in five years, says Goldman Sachs

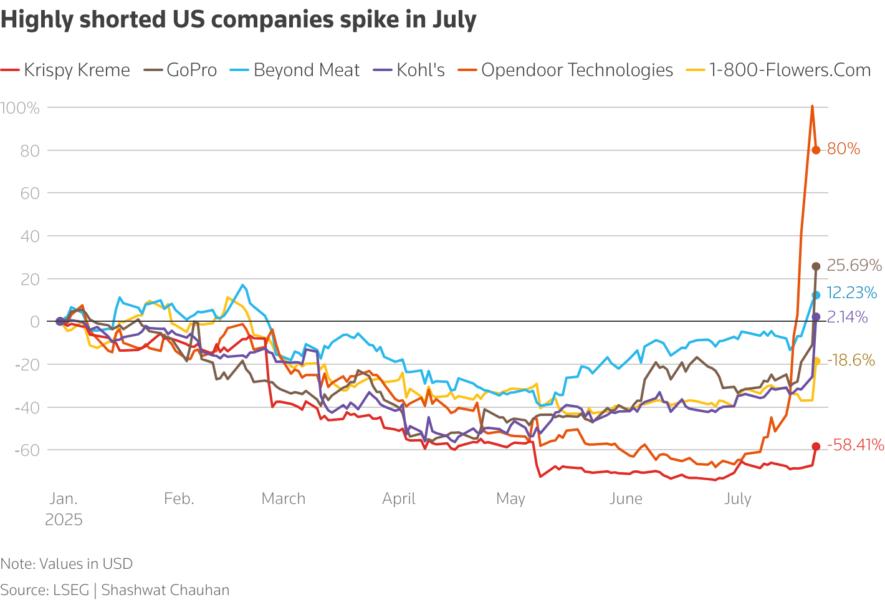

Quantitative hedge funds that use algorithms to trade markets are on track for their worst month in five years, according to a Goldman Sachs prime brokerage note, amid rising prices in highly shorted stocks.

These hedge funds are down 3.6% for the month so far, but still up 8.3% in the year to date, the note released late on Wednesday showed.

The funds' investment performance suffered when the funds were trying to exit crowded trades, particularly where they held short positions against stocks, Goldman Sachs said.

A short position is a bet that the value of an asset will fall, whereas a long position wagers it will rise. A short squeeze occurs when a stock price rises so much that bearish bets become too expensive to hold and investors are forced to buy them back, sometimes at a loss.

Hedge funds fled bets from stocks tracked in the Goldman Sachs Most Short index (.GSXUMSAL) and a separate index the bank tracks of unprofitable tech stocks, the prime brokerage said.

Individual investors including retail and non-institutional funds have been betting on riskier pockets of the market, including cryptocurrencies and lower-priced consumer-facing stocks, as the broader equity market has soared to record highs recently.

Wall Street shares rallied on Wednesday on reports that the EU and the United States were closing in on a trade deal, similar to the agreement U.S. President Donald Trump struck with Japan. The S&P 500 index SPX is up 2.6% since July 1.

"We may be moving towards the later innings of the short covering episode," Goldman said.

In July, the broader hedge fund industry exited trades and dialed down the amount of leverage used, it said.

Speculators dumped trading positions in most stock sectors including technology, consumer discretionary, industrials and health care, the note added.

Stockpickers returned 0.5% yesterday while the stock trading desks at multi-strategy funds were slightly down, said Goldman.