Shein disclosure row flags London’s IPO quandary

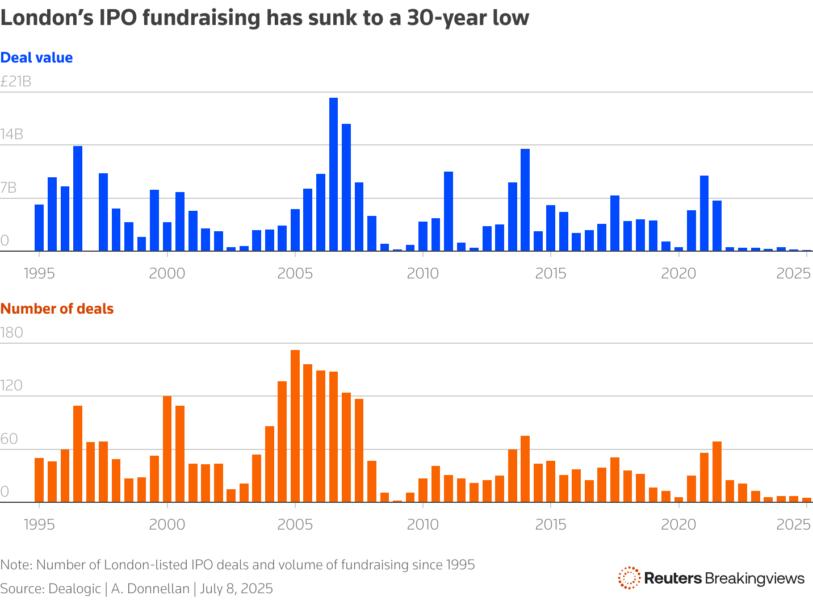

Like a toddler seeing how far they can push the boundaries, Shein may be testing the UK’s rules on IPO disclosures. The fast-fashion retailer has filed a prospectus for a float in Hong Kong but is still hankering for a London listing, the Financial Times reckons. That should be welcome news to the UK given fundraising is at a 30-year low, but it could also encourage others to embark on a never-ending list of demands.

As recently as May, Shein’s London listing seemed dead in the water. Back then, the Singapore-based company, which sells $20 dresses, failed to get the nod from the Chinese regulator for a planned UK float. It therefore seemed destined to debut in Hong Kong. But on Tuesday, the Financial Times reported that the company led by Executive Chairman Donald Tang is hoping the UK may back down on some of its disclosure requirements that had stymied the London listing.

That would be a big step. Late last year, Financial Conduct Authority Chief Executive Nikhil Rathi said the regulator would not seek to stop a company with legal risks from listing, as long as it disclosed those dangers to investors. In Shein’s case that would require it to reveal details about its supply chain, including whether any of the cotton in its T-shirts and sweatshirts comes from the Xinjiang region where China has been accused of using forced labour. Shein says it strictly prohibits forced labour in its supply chain globally. However, the language in the group’s planned prospectus was not approved by Beijing, effectively forcing the retailer to abandon London, the FT says.

Rathi is already bending over backwards to win fresh IPOs and stop listed firms decamping to New York. He recently changed the requirement for companies to adopt shareholder protections like equal voting rights to get a London premium listing. Investors for their part are more accepting of higher executive pay, a key lure of the New York market. But so far neither have made a difference. In the first half of this year, fundraising from IPOs plummeted to its lowest level in 30 years and the five listings that did feature only raised 160 million pounds, according to Dealogic data.

It’s possible the UK could find a way to tweak the prospectus language so as to avoid angering China. However, watering down disclosure rules would be a risky move. It could encourage other companies to push the boundaries and potentially leave British pension funds and asset managers exposed to greater risks. The snag is that if London is unable to revive its flagging IPO market, the FCA is likely to come under more pressure to find ways to make the City appealing. Ever looser rules, however, may have diminishing returns.

Follow Aimee Donnellan on LinkedIn.

CONTEXT NEWS

China-founded fast-fashion retailer Shein has filed for an IPO in Hong Kong but is also still hoping that Britain’s regulators may approve a London float, the Financial Times reported on July 8.

The company privately filed a draft prospectus last week with Hong Kong’s exchange and sought a regulatory nod from the China Securities Regulatory Commission, the report said, citing people familiar with the matter. If the UK’s Financial Conduct Authority is willing to accept a CSRC-approved prospectus, London would still be Shein’s preferred exchange, the FT report said.

Reuters first reported in June that Shein was planning to file a draft prospectus confidentially for its Hong Kong listing, citing three sources with knowledge of the matter.

Reuters also reported in May, citing sources, that Shein was working towards a listing in Hong Kong after its proposed London IPO failed to secure the green light from Chinese regulators.

Shein declined to comment on the FT report.