Stada gives buyout shops an escape hatch of sorts

Buyout barons lamenting their mountain of stuck assets have a new data point. On Monday, Cinven and Bain finally found a buyer for Stada, in a deal that values the German drugmaker at 10 billion euros ($12 billion) including debt. But given fellow private equity shop CapVest is only buying an unspecified majority stake rather than the whole thing, sector players wondering how to offload their portion of an unsold asset pile amounting to $3 trillion may not derive much comfort.

Cinven and Bain acquired Stada for 5.3 billion euros back in 2017, so in recent years have been trying to exit. That hasn’t been easy. The owners had tried to list the asset but abandoned the float in March due to market volatility. Talks with the buyer have dragged on for some time, a source close to the situation told Breakingviews.

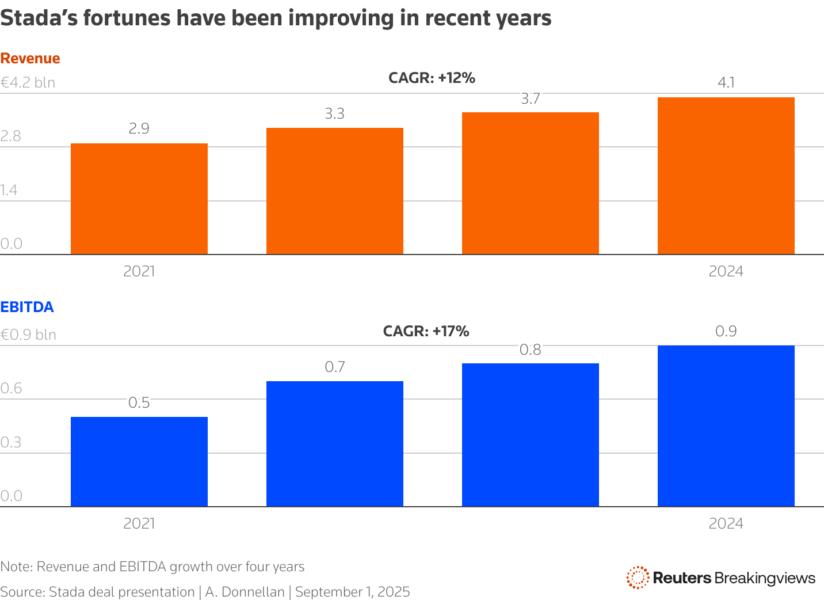

The owners’ keenness to exit may explain why CapVest looks to be getting a decent deal. Since 2021 Stada revenues, which are split between generic drugs, consumer health and specialty medicine, have increased by an annual average of over 12% while adjusted EBITDA has risen by over 17% a year. Yet a 10 billion euro sale valuation is only 10 times Stada’s expected EBITDA for 2025, lower than the 12 times multiple Bain and Cinven forked out in 2017.

Assume the buyer borrows 60% of the purchase price and manages to grow the 4.6 billion euros of revenue the company expects to deliver this year by just 7% annually, the midpoint of its forecast range and below the average of recent years. Assuming last year’s 22% margin, the company’s EBITDA should grow from 1 billion euros in 2026 to 1.4 billion euros by 2030. If CapVest can sell out at the same 10 times multiple, it could pocket a 20% internal rate of return, Breakingviews calculations show.

By contrast, Bain and Cinven’s return looks less cheery. Fitch assumes they have around 6 billion euros of leverage, so the equity from their CapVest deal may only be about 4 billion euros assuming no dividends. To have achieved the same 20% return they would have needed to put less than 1 billion euros of equity into their original 2017 deal, according to Breakingviews calculations – which seems low given the debt package back then was around 3 billion euros.

If CapVest’s new deal goes well, Bain and Cinven’s ongoing stake implies they will benefit too. But the generic drug market is particularly competitive, and Indian and Chinese rivals are aggressively trying to muscle in. Instead of a smooth exit at an agreeably high multiple, buyout onlookers may see a messy deal with ongoing risks – and opt to keep waiting.

Follow Aimee Donnellan on LinkedIn.

CONTEXT NEWS

Buyout firm CapVest Partners is to acquire a majority stake in Stada Arzneimittel, the German generic drugmaker said on September 1.

The company, which was acquired by Bain Capital and Cinven in 2017 and delisted thereafter, said in a statement that closing of the CapVest deal was expected in early 2026, but it did not disclose a price tag or the size of the stake.

Bain and Cinven will each retain a minority stake, it added. Sources close to the investment firms had previously told Reuters they had been eyeing a valuation of about 10 billion euros ($12 billion) in a stock market listing.