Glencore and Rio's smartest move: merge then split

By Karen Kwok

Anglo American’s AAL merger with Teck Resources

TECK has sparked a cottage industry of speculation about other M&A gambits. One of the more promising ideas is a combination between Glencore

GLEN and Rio Tinto

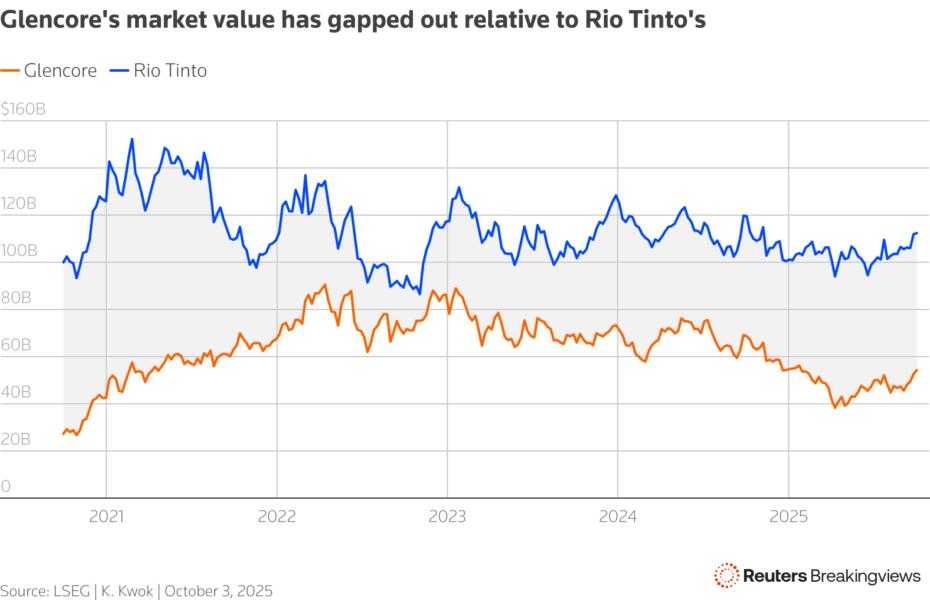

RIO, building on talks last year that didn't ultimately go anywhere. What could really grease the wheels, though, is a two-step process: a tie-up between the $54 billion Swiss miner and its $112 billion rival, followed by a breakup that splits the enlarged entity into energy transition metals and carbon-heavy businesses.

The main obstacle to a Glencore deal with Rio or anyone else is valuation. Weak coal prices have dragged on earnings, and net debt has climbed to $14.5 billion, well above the Swiss miner's $10 billion target. With less cash for buybacks and dividends, the shares are down 20% in the past year, the worst among major diversified miners.

The Anglo-Teck deal, though, could shift the balance. The tie-up is forecast to deliver $1.4 billion of extra EBITDA by 2030, largely by boosting production at the Collahuasi copper mine, where Glencore owns a 44% stake. That gives boss Gary Nagle a piece of the upside, and potentially makes Glencore more palatable to Rio’s new Chief Executive Simon Trott, who is rejigging a new strategy to reduce his company's historic reliance on iron ore.

Nagle has already done some legwork. He recently moved Glencore’s coal and South African ferroalloy operations into a standalone Australian subsidiary, which holds $2.9 billion of franking credits. These, along with the Chilean value Glencore could secure simply by doing nothing, could persuade Trott to offer a bigger chunk of the combined company than the 33% implied by the combination of the duo's current market values.

Combining Glencore’s coal and Rio’s iron ore operations would create a carbon-heavy unit generating $17 billion of EBITDA in 2026, according to Visible Alpha. At around five times EBITDA, in line with Australian-listed peers like Whitehaven Coal WHC and New Hope

NHC, the unit could be worth $90 billion.

The remaining businesses, containing a mix of copper, aluminium, lithium and zinc, would be more appealing to investors focused on clean energy metals. At $18 billion of projected 2026 EBITDA and a multiple around 9 times - in line with Southern Copper SCCO, Antofagasta

ANTO and Freeport-McMoRan

FCX, the group would be worth $167 billion. Netting out $30 billion of combined debt, the total equity value hits $227 billion. That’s a 37% uplift to the two miners’ current market capitalisations. And it doesn't even factor in Glencore’s trading arm, expected to add $3.5 billion of EBITDA in 2026.

Combining one of the world's biggest miners with one of its biggest miner-traders would come with all manner of cultural and practical challenges. But the numbers behind a Rio-Glencore tie-up followed by a split look compelling. It would be strange if Trott hadn't noticed.

Follow Karen Kwok on LinkedIn and X.

CONTEXT NEWS

Shares of Rio Tinto and Glencore have been respectively flat and off 7% since January 16, the day before Bloomberg reported that Rio and Glencore had held talks about a combination. Those discussions, which took place in 2024, were as of January described as no longer active.