PROTECTED SOURCE SCRIPT

Relative Measured Volatility [Seven Campbell]

Relative Measured Volatility

Overview:

This indicator measures the current daily volatility of an asset and compares it to the average volatility observed over the past 15 days. It provides a dynamic gauge of how much the market’s volatility is deviating from its recent historical norms.

Key Features:

Dynamic Comparison: The indicator calculates the standard deviation of daily price changes over a user-defined period (default is 14 days) and compares it to a smoothed average of this volatility over the last 15 days. This creates a "moving measuring stick" to highlight periods of unusually high or low volatility.

Customizable Settings:

Lookback Period: Set to 15 days by default, this period defines the historical window used to calculate the average volatility.

Volatility Length: Adjustable length (default is 14) for the standard deviation calculation, allowing you to fine-tune the sensitivity of the volatility measurement.

Smoothing Length: Set to 50 by default, this parameter smooths the volatility data to highlight longer-term trends.

How It Works:

Volatility Calculation: The indicator computes the daily returns using the logarithmic change in closing prices. It then calculates the standard deviation of these returns over the specified volatility length.

Smoothing: The standard deviation values are smoothed using a simple moving average over the smoothing length, providing a clearer view of trends.

Relative Measurement: The current daily volatility is divided by the smoothed volatility, giving a relative value. A value above 1 indicates higher volatility than the average over the past 15 days, while a value below 1 suggests lower volatility.

Visual Representation:

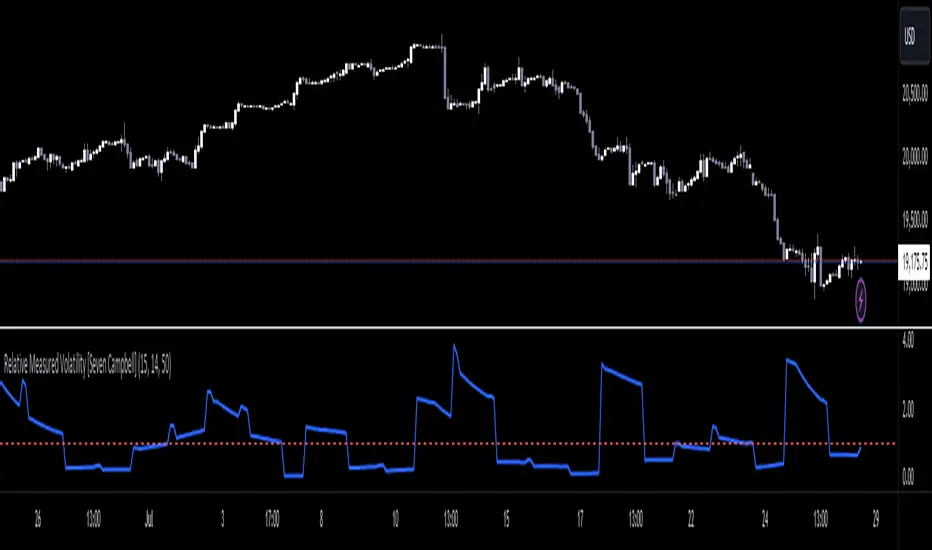

Line Plot: The relative volatility is plotted as a line, allowing you to quickly see changes in volatility relative to the historical average.

Reference Line: A horizontal line at 1 is included for easy reference. Values above this line indicate periods of higher-than-average volatility, and values below suggest lower-than-average volatility.

Use Cases:

Market Sentiment Analysis: Identify periods of high or low volatility to gauge market sentiment.

Trade Timing: Use the indicator to decide on entry and exit points, especially in volatile or calm market conditions.

Risk Management: Monitor volatility to adjust position sizes and stop-loss levels dynamically.

Example Usage:

When the line rises above 1, it signals increasing volatility, which may be a good time to take profit or adjust your stop-loss orders.

When the line drops below 1, it indicates lower volatility, potentially highlighting a stable market period.

Overview:

This indicator measures the current daily volatility of an asset and compares it to the average volatility observed over the past 15 days. It provides a dynamic gauge of how much the market’s volatility is deviating from its recent historical norms.

Key Features:

Dynamic Comparison: The indicator calculates the standard deviation of daily price changes over a user-defined period (default is 14 days) and compares it to a smoothed average of this volatility over the last 15 days. This creates a "moving measuring stick" to highlight periods of unusually high or low volatility.

Customizable Settings:

Lookback Period: Set to 15 days by default, this period defines the historical window used to calculate the average volatility.

Volatility Length: Adjustable length (default is 14) for the standard deviation calculation, allowing you to fine-tune the sensitivity of the volatility measurement.

Smoothing Length: Set to 50 by default, this parameter smooths the volatility data to highlight longer-term trends.

How It Works:

Volatility Calculation: The indicator computes the daily returns using the logarithmic change in closing prices. It then calculates the standard deviation of these returns over the specified volatility length.

Smoothing: The standard deviation values are smoothed using a simple moving average over the smoothing length, providing a clearer view of trends.

Relative Measurement: The current daily volatility is divided by the smoothed volatility, giving a relative value. A value above 1 indicates higher volatility than the average over the past 15 days, while a value below 1 suggests lower volatility.

Visual Representation:

Line Plot: The relative volatility is plotted as a line, allowing you to quickly see changes in volatility relative to the historical average.

Reference Line: A horizontal line at 1 is included for easy reference. Values above this line indicate periods of higher-than-average volatility, and values below suggest lower-than-average volatility.

Use Cases:

Market Sentiment Analysis: Identify periods of high or low volatility to gauge market sentiment.

Trade Timing: Use the indicator to decide on entry and exit points, especially in volatile or calm market conditions.

Risk Management: Monitor volatility to adjust position sizes and stop-loss levels dynamically.

Example Usage:

When the line rises above 1, it signals increasing volatility, which may be a good time to take profit or adjust your stop-loss orders.

When the line drops below 1, it indicates lower volatility, potentially highlighting a stable market period.

Script protetto

Questo script è pubblicato come codice protetto. Tuttavia, è possibile utilizzarle liberamente e senza alcuna limitazione – ulteriori informazioni qui.

Declinazione di responsabilità

Le informazioni e le pubblicazioni non sono intese come, e non costituiscono, consulenza o raccomandazioni finanziarie, di investimento, di trading o di altro tipo fornite o approvate da TradingView. Per ulteriori informazioni, consultare i Termini di utilizzo.

Script protetto

Questo script è pubblicato come codice protetto. Tuttavia, è possibile utilizzarle liberamente e senza alcuna limitazione – ulteriori informazioni qui.

Declinazione di responsabilità

Le informazioni e le pubblicazioni non sono intese come, e non costituiscono, consulenza o raccomandazioni finanziarie, di investimento, di trading o di altro tipo fornite o approvate da TradingView. Per ulteriori informazioni, consultare i Termini di utilizzo.