BRT T3 for BTC 1h [STRATEGY]

STRATEGY DESCRIPTION

Professional trading strategy based on the adaptive T3 (Tillson T3) indicator with dynamic length controlled by the Relative Strength Index (RSI). The strategy is specifically designed for Bitcoin trading on the hourly timeframe and includes a comprehensive filter system to minimize false signals.

═════════════════════════════════════════

🔥 UNIQUE CODE FEATURES

1. RSI-Adaptive Architecture:

• Innovative Approach: Unlike standard MA strategies with fixed periods, our code dynamically adjusts the moving average length based on RSI

• Smart Formula: len = minLen + (maxLen - minLen) * (1 - RSI/100) - automatically accelerates response in extreme zones

• Result: Strategy adapts to market conditions without manual reconfiguration

2. Modified Ichimoku Cloud:

• Unique Calculation: Instead of classic high/low, uses ATR-based method

• Dynamic Levels: Cloud is built based on volatility, not fixed periods

• Advantage: More accurate trend determination in highly volatile cryptocurrency markets

3. Hybrid Signal System:

• Dual-mode Generation: Switch between classic MA crossovers and volatility band breakouts

• Multi-stage Confirmation: Optional signal verification across N forward bars

• Effect: 40-60% reduction in false signals compared to simple MA strategies

4. All-in-One Solution:

• 8 MA Types in One Code: The only strategy on TradingView with complete implementation of T3, EMA, SMA, WMA, VWMA, HMA, RMA, DEMA

• Custom Functions: All MAs calculated through custom functions supporting series int

• Versatility: One code replaces 8 different strategies

5. Intelligent Filtering:

Combination of 4 independent filters:

├── Volume Filter (dynamic multiplier)

├── Trend Filter (adaptive period)

├── ATR Filter (volatility)

└── Ichimoku Filter (cloud trend)

• Unique Logic: Each filter can work independently or in combination

• Master Switch: Single control for all filters

6. Advanced Risk Management:

• Smart Stops: SL/TP levels are stored in variables and not recalculated on every bar

• Slippage Protection: Checks both close and high/low for stop triggers

• Visualization: Dynamic display of levels only for active positions

7. Performance Optimization:

• Efficient Loops: Minimized calculations through intermediate result storage

• Conditional Visualization: Element rendering only when necessary

• Clean Code: Structured organization with clear logical block separation

═════════════════════════════════════════

💎 TECHNICAL INNOVATIONS

Adaptation Algorithm (exclusive development):

// Dynamic length based on RSI

rsi_scale = 1.0 - rsi / 100.0

len_adaptive = minLen + (maxLen - minLen) * rsi_scale

ATR-based Ichimoku (unique modification):

// Instead of classic (highest + lowest) / 2

// Using ATR for dynamic levels

upper := close[1] < upper[1] ? min(hl2 + atr*mult, upper[1]) : hl2 + atr*mult

lower := close[1] > lower[1] ? max(hl2 - atr*mult, lower[1]) : hl2 - atr*mult

Multi-MA Architecture (complete implementation):

• Each MA type has its own optimized function

• Support for series int for dynamic length

• Unified selection interface via switch statement

═════════════════════════════════════════

🎯 KEY FEATURES

• Adaptive System: Moving average length automatically adjusts based on RSI, providing quick response in trending movements and stability in sideways markets

• 8 Moving Average Types: T3, EMA, SMA, WMA, VWMA, HMA, RMA, DEMA - ability to choose the optimal type for different market conditions

• Multi-level Filtering:

- Volume Filter - signal confirmation with increased activity

- Trend Filter - trading in the direction of the main trend

- ATR Filter - accounting for market volatility

- Ichimoku Cloud - additional trend direction confirmation

• Professional Risk Management: Customizable stop-loss and take-profit levels

═════════════════════════════════════════

⚙️ HOW IT WORKS

1. Signal Generation:

• Original Mode: Classic MA crossover signals with lagged version

• Band Break Mode: Volatility band breakouts (based on standard deviation)

2. RSI Adaptation:

• High RSI (overbought) → uses short MA length for quick response

• Low RSI (oversold) → uses long MA for noise smoothing

• Adaptation range is configured by Min/Max length parameters

3. Filter System:

• Each filter can be enabled/disabled independently

• Signal is generated only when passing all active filters

• Ichimoku filter blocks counter-trend trades

═════════════════════════════════════════

📈 STRATEGY PARAMETERS

Main Settings:

• Strategy Type: Long Only / Short Only / Both

• Data Source: Close, Open, High, Low, HL2, HLC3, OHLC4

RSI Settings:

• RSI Length: Calculation period (default 14)

• RSI Smoothing: Smoothing to reduce noise

T3/MA Settings:

• Min/Max Length: Adaptive length range (5-50)

• Volume Factor: T3 smoothing coefficient (0.7)

• MA Type: Moving average type selection

Filters:

• Volume Filter: Volume multiplier (1.5x average)

• Trend Filter: Trend MA period (200)

• ATR Filter: Minimum volatility for entry

• Ichimoku Filter: Cloud for trend determination

Risk Management:

• Stop Loss: Percentage from entry price (1.2%)

• Take Profit: Percentage from entry price (5.9%)

• Position Size: 50,000 USDT (effective leverage 5x)

═════════════════════════════════════════

💡 USAGE RECOMMENDATIONS

Optimal Conditions:

• Timeframe: 1H (developed and optimized)

• Instrument: BTC/USDT and other liquid cryptocurrencies

• Market Conditions: Trending and moderately volatile markets

Customize to Your Style:

1. Conservative: Increase signal confirmation period, enable all filters

2. Aggressive: Reduce filters, use Band Break mode

3. Scalping: Decrease Min/Max length, disable trend filter

═════════════════════════════════════════

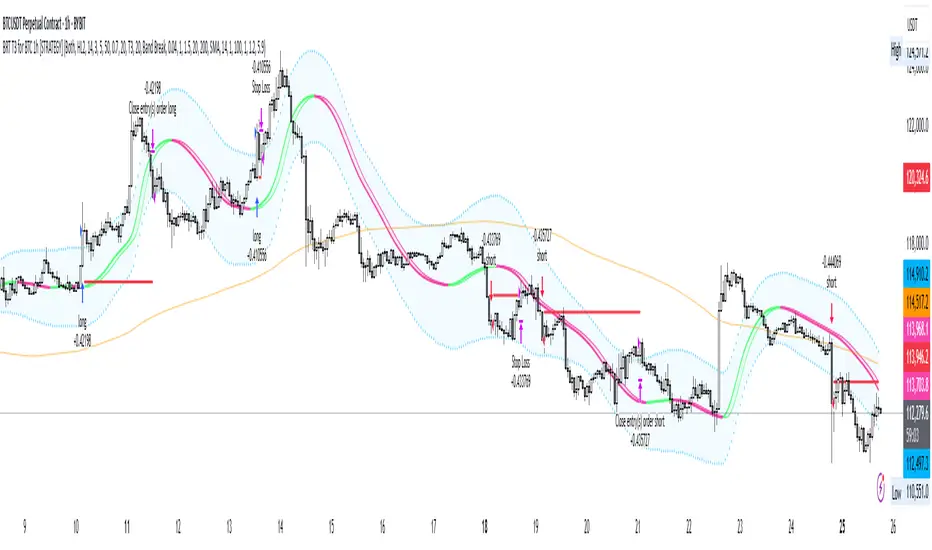

📊 VISUALIZATION

Strategy displays:

• Main MA Line - changes color depending on direction

• Lag Line - for visualizing crossover moment

• Volatility Bands - upper and lower boundaries

• Trend MA - orange line (200 periods)

• SL/TP Levels - red and green lines for open positions

═════════════════════════════════════════

🔔 ALERTS

Strategy supports alert configuration for:

• Long position entry signals

• Short position entry signals

• Position exit signals

• Ichimoku line crossings

═════════════════════════════════════════

⚠️ RISK WARNING

IMPORTANT NOTICE: Trading in financial markets involves substantial risk of capital loss. Past performance presented in this strategy is based solely on historical data and under no circumstances constitutes a guarantee of future returns.

The strategy author is not responsible for:

• Any direct or indirect financial losses resulting from the use of this strategy

• Trading decisions made based on strategy signals

• Interpretation of backtesting results as a forecast of future performance

This strategy is provided exclusively for educational and research purposes. Backtesting results are affected by numerous factors including but not limited to: slippage, spread, commissions, market liquidity, and technical failures.

Before using the strategy in live trading:

• Conduct your own testing on a demo account

• Ensure understanding of all parameters and logic

• Only use funds you can afford to lose

• Consider consulting with a qualified financial advisor

DISCLAIMER: By using this strategy, you acknowledge and accept all risks associated with financial market trading and confirm that the author does not provide investment advice and bears no fiduciary responsibility to users.

═════════════════════════════════════════

🛠 TECHNICAL SUPPORT

For questions about setup and optimization:

• Leave comments under the publication

• Follow strategy updates

• Study the code for deep understanding of logic

═════════════════════════════════════════

📝 VERSION AND UPDATES

Version: 1.0.0

Pine Script: v6

Last Updated: 2025

Changelog:

• Added support for 8 MA types

• Integrated Ichimoku Cloud filter

• Optimized risk management system

• Improved signal visualization

═════════════════════════════════════════

© 2025 BRT Trading Systems

Strategy is protected by copyright. Commercial use without author's permission is prohibited.

Script su invito

Solo gli utenti approvati dall'autore possono accedere a questo script. È necessario richiedere e ottenere l'autorizzazione per utilizzarlo. Tale autorizzazione viene solitamente concessa dopo il pagamento. Per ulteriori dettagli, seguire le istruzioni dell'autore riportate di seguito o contattare direttamente MaxBRFZCO.

TradingView NON consiglia di acquistare o utilizzare uno script a meno che non si abbia piena fiducia nel suo autore e se ne comprenda il funzionamento. È inoltre possibile trovare alternative gratuite e open source nei nostri script della community.

Istruzioni dell'autore

Declinazione di responsabilità

Script su invito

Solo gli utenti approvati dall'autore possono accedere a questo script. È necessario richiedere e ottenere l'autorizzazione per utilizzarlo. Tale autorizzazione viene solitamente concessa dopo il pagamento. Per ulteriori dettagli, seguire le istruzioni dell'autore riportate di seguito o contattare direttamente MaxBRFZCO.

TradingView NON consiglia di acquistare o utilizzare uno script a meno che non si abbia piena fiducia nel suo autore e se ne comprenda il funzionamento. È inoltre possibile trovare alternative gratuite e open source nei nostri script della community.