OPEN-SOURCE SCRIPT

Aggiornato LANZ Strategy 1.0

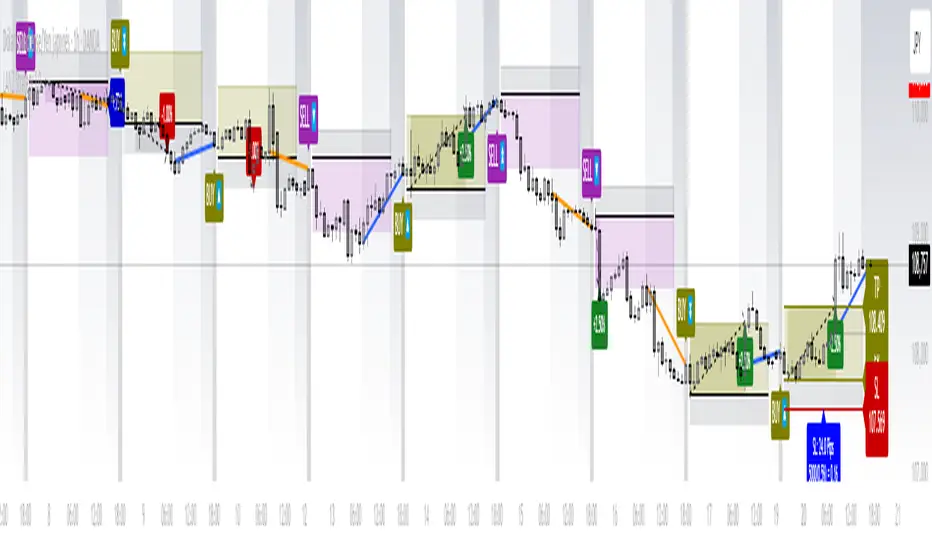

🔷 LANZ Strategy 1.0 — Session-Based Directional Logic with Visual Multi-Account Risk Management

LANZ Strategy 1.0 is a structured and disciplined trading strategy designed for the 1-hour timeframe, operating during the NY session and executing trades overnight. It uses the directional behavior between 08:00 and 18:00 New York time to define precise limit entries for the following night. Ideal for traders who prefer time-based execution, clear visuals, and professional risk management across multiple accounts.

🧠 Core Components:

1. Session Direction Confirmation:

At 18:00 NY, the system evaluates the market direction by comparing the open at 08:00 vs the close at 18:00:

2. EP Level & Risk Definition:

Once direction is defined:

The system automatically plots:

3. Time-Restricted Entry Execution:

4. Multi-Account Lot Sizing:

Traders can configure up to five different accounts, each with its own capital and risk percentage.

The system calculates and displays the lot size per account, based on SL distance and pip value, in a dynamic floating label.

5. Outcome Tracking:

📊 Visual Features:

⚙️ How It Works:

🔔 Alerts:

📝 Notes:

👨💻 Credits:

Developed by LANZ

A strategy created with precision, discipline, and a vision for traders who value time-based entries, clean execution logic, and visual confidence on the chart.

Special thanks to Kairos — your AI assistant — for the detailed structure, scripting, and documentation of the strategy.

LANZ Strategy 1.0 is a structured and disciplined trading strategy designed for the 1-hour timeframe, operating during the NY session and executing trades overnight. It uses the directional behavior between 08:00 and 18:00 New York time to define precise limit entries for the following night. Ideal for traders who prefer time-based execution, clear visuals, and professional risk management across multiple accounts.

🧠 Core Components:

1. Session Direction Confirmation:

At 18:00 NY, the system evaluates the market direction by comparing the open at 08:00 vs the close at 18:00:

- If the direction matches the previous day, it is reversed.

- If it differs, the current day’s direction is kept.

- This logic is designed to avoid trend exhaustion and favor potential reversal opportunities.

2. EP Level & Risk Definition:

Once direction is defined:

- For BUY, EP is set at the Low of the session.

- For SELL, EP is set at the High of the session.

The system automatically plots:

- SL fixed at 18 pips from EP

- TP at 3.00× the risk → 54 pips from EP

- All levels (EP, SL, TP) are shown with visual lines and price labels.

3. Time-Restricted Entry Execution:

- The entry is only valid if price touches the EP between 19:00 and 08:00 NY.

- If EP is not touched before 08:00 NY, the trade is automatically cancelled.

4. Multi-Account Lot Sizing:

Traders can configure up to five different accounts, each with its own capital and risk percentage.

The system calculates and displays the lot size per account, based on SL distance and pip value, in a dynamic floating label.

5. Outcome Tracking:

- If TP is hit, a +3.00% profit label is displayed along with a congratulatory alert.

- If SL is hit, a -1.00% label appears with a loss alert.

- If the trade is still open by 09:00 NY, it is manually closed, and the result is shown as a percentage of the initial risk.

📊 Visual Features:

- Custom-colored angle and guide lines.

- Dynamic angle line starts at 08:00 NY and tracks price until 18:00.

- Shaded backgrounds for key time zones (e.g., 08:00, 18:00, 19:00).

- BUY/SELL signals shown at 19:00 based on match/divergence logic.

- Label panel showing risk metrics and lot size for each active account.

⚙️ How It Works:

- 08:00 NY: Marks the session open and initiates a dynamic angle line.

- 18:00 NY: Evaluates the session direction and calculates EP/SL/TP based on outcome.

- 19:00 NY: Activates limit order monitoring.

- During the night (until 08:00 NY): If EP is touched, the trade is triggered.

- At 08:00 NY: If no touch occurred, trade is cancelled.

- Overnight: TP/SL logic is enforced, showing percentage outcomes.

- At 09:00 NY: If still open, trade is closed manually and result is labeled visually.

🔔 Alerts:

- 🚀 EP execution alert when touched

- 💢 Stop Loss hit alert

- ⚡ Take Profit hit alert

- ✅ Manual close at 09:00 NY with performance result

- 🔔 Daily reminder at 19:00 NY to configure and prepare the trade

📝 Notes:

- Strategy is exclusive to the 1-hour timeframe.

- Works best on assets with clean NY session movement.

- Perfect for structured, semi-automated swing/overnight trading styles.

- Fully visual, self-explanatory, and backtest-friendly.

👨💻 Credits:

Developed by LANZ

A strategy created with precision, discipline, and a vision for traders who value time-based entries, clean execution logic, and visual confidence on the chart.

Special thanks to Kairos — your AI assistant — for the detailed structure, scripting, and documentation of the strategy.

Note di rilascio

Recent UpdateA new parameter called EP Offset was added, allowing the user to dynamically control the entry level (Entry Price). If set to 0, the entry is placed at the edge of the 6:00 PM NY candle (Low for BUY, High for SELL). If the value is greater than zero, the EP is calculated as a percentage of the candle’s range, simulating intermediate levels similar to Fibonacci. This logic has been implemented in both the indicator and the strategy (backtest) versions.

Note di rilascio

Update - 🪄 LANZ Strategy 1.0 now includes a fully dynamic system for Take Profit labeling based on the TP/SL ratio set by the user. Additionally, the manual close logic allows traders to define a custom time (New York session) to automatically close the trade and display the exact result in percentage. The EP, SL, and TP lines are now drawn according to that manual closing time, maintaining visual coherence throughout the session. Clean, efficient, and highly customizable.

Note di rilascio

Update - 🎁Adjusted the plotting of EP, SL, and TP lines to start from bar_index + 1 for cleaner alignment with future bars and improved visual clarity.

Note di rilascio

Script Updates - 🤑This update improves the clarity and accuracy of LANZ Strategy 1.0 in two key areas:

- The manual close alert now displays the actual New York time of execution (e.g., "16:00 NY") by using timenow instead of the input value, ensuring the message reflects the real moment the candle closes.

- The position of the lot size label has been dynamically adjusted to always appear at the midpoint between the signal and the manual close, regardless of the number of bars. This keeps your lot information visually centered and easier to read.

Script open-source

Nello spirito di TradingView, l'autore di questo script lo ha reso open source, in modo che i trader possano esaminarne e verificarne la funzionalità. Complimenti all'autore! Sebbene sia possibile utilizzarlo gratuitamente, ricordiamo che la ripubblicazione del codice è soggetta al nostro Regolamento.

Declinazione di responsabilità

Le informazioni e le pubblicazioni non sono intese come, e non costituiscono, consulenza o raccomandazioni finanziarie, di investimento, di trading o di altro tipo fornite o approvate da TradingView. Per ulteriori informazioni, consultare i Termini di utilizzo.

Script open-source

Nello spirito di TradingView, l'autore di questo script lo ha reso open source, in modo che i trader possano esaminarne e verificarne la funzionalità. Complimenti all'autore! Sebbene sia possibile utilizzarlo gratuitamente, ricordiamo che la ripubblicazione del codice è soggetta al nostro Regolamento.

Declinazione di responsabilità

Le informazioni e le pubblicazioni non sono intese come, e non costituiscono, consulenza o raccomandazioni finanziarie, di investimento, di trading o di altro tipo fornite o approvate da TradingView. Per ulteriori informazioni, consultare i Termini di utilizzo.