OPEN-SOURCE SCRIPT

Aggiornato Average Daily Range (ADR) (Multi Timeframe, Multi Period)

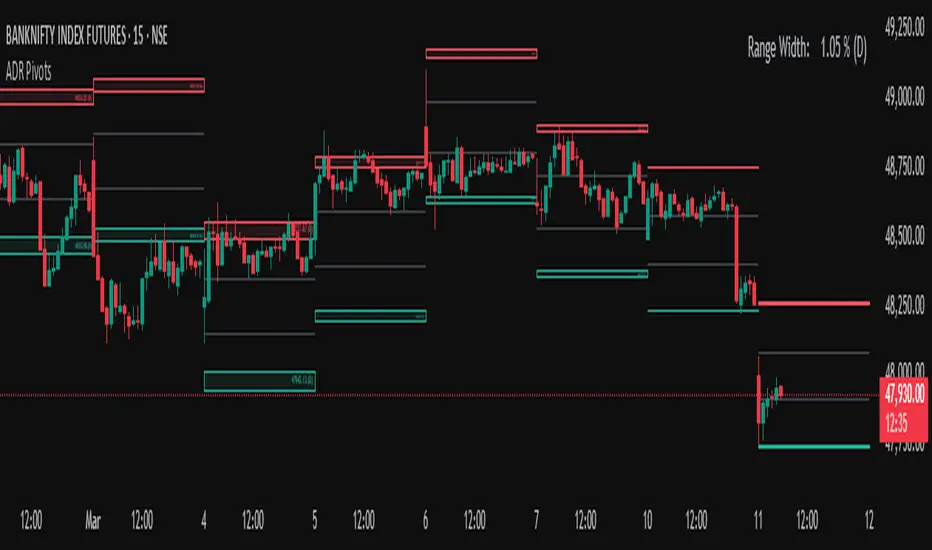

Average Daily Range (ADR)

(Multi Timeframe, Multi Period, Extended Levels)

Tips

• Narrow Zones are an indication of breakouts. It can be a very tight range as well.

• Wider Zones can be Sideways or Volatile.

What is this Indicator?

• This is Average Daily Range (ADR) Zones or Pivots.

• This have Multi Timeframe, Multi Period (Up to 3 Levels) and Extended Target Levels.

Advantages of this Indicator

• This is a Leading indicator, not Dynamic or Repaint.

• Helps to identify the reversal points.

• The levels are more accurate and not like the old formulas.

• Can practically follow the Buy Low and Sell High principle.

• Helps to keep minimum Stop Loss.

Who to use?

• Highly beneficial for Day Traders

• It can be used for Swing and Positions as well.

What timeframe to use?

• Any timeframe.

When to use?

• Any market conditions.

How to use?

Entry

• Long entry when the Price reach at or closer to the Green Support zone.

• Long entry when the Price retrace to the Red Resistance zone.

• Short entry when the Price reach at or closer to the Red Resistance zone.

• Short entry when the Price retrace to the Green Support zone.

• Long or Short at the Pivot line.

Exit

• Use past ADR levels as targets.

• Or use the Target levels in the indicator for breakouts.

• Use the Pivot line as target.

• Use Support or Resistance Zones as targets in reversal method.

What are the Lines?

Gray Line:

• It the day Open or can be considered as Pivot.

Red & Green ADR Zones:

• Red Zone is Resistance.

• Green Zone is Support.

• Mostly price can reverse from this Zones.

• Multiple Red and Green Lines forms a Zone.

• These lines are average levels of past days which helps to figure out the maximum and minimum price range that can be moved in that day.

• The default number of days are 5, 7 and 14. This can be customized.

Red & Green Target Lines:

• These are Target levels.

What are the Labels?

• First Number: Price of that level.

• Numbers in (): Percentage change and Change of price from LTP (Last Traded Price) to that Level.

General Tips

• It is good if Stock trend is same as that of the Index trend.

• Lots of indicators creates lots of confusion.

• Keep the chart simple and clean.

• Buy Low and Sell High.

• Master averages or 50%.

(Multi Timeframe, Multi Period, Extended Levels)

Tips

• Narrow Zones are an indication of breakouts. It can be a very tight range as well.

• Wider Zones can be Sideways or Volatile.

What is this Indicator?

• This is Average Daily Range (ADR) Zones or Pivots.

• This have Multi Timeframe, Multi Period (Up to 3 Levels) and Extended Target Levels.

Advantages of this Indicator

• This is a Leading indicator, not Dynamic or Repaint.

• Helps to identify the reversal points.

• The levels are more accurate and not like the old formulas.

• Can practically follow the Buy Low and Sell High principle.

• Helps to keep minimum Stop Loss.

Who to use?

• Highly beneficial for Day Traders

• It can be used for Swing and Positions as well.

What timeframe to use?

• Any timeframe.

When to use?

• Any market conditions.

How to use?

Entry

• Long entry when the Price reach at or closer to the Green Support zone.

• Long entry when the Price retrace to the Red Resistance zone.

• Short entry when the Price reach at or closer to the Red Resistance zone.

• Short entry when the Price retrace to the Green Support zone.

• Long or Short at the Pivot line.

Exit

• Use past ADR levels as targets.

• Or use the Target levels in the indicator for breakouts.

• Use the Pivot line as target.

• Use Support or Resistance Zones as targets in reversal method.

What are the Lines?

Gray Line:

• It the day Open or can be considered as Pivot.

Red & Green ADR Zones:

• Red Zone is Resistance.

• Green Zone is Support.

• Mostly price can reverse from this Zones.

• Multiple Red and Green Lines forms a Zone.

• These lines are average levels of past days which helps to figure out the maximum and minimum price range that can be moved in that day.

• The default number of days are 5, 7 and 14. This can be customized.

Red & Green Target Lines:

• These are Target levels.

What are the Labels?

• First Number: Price of that level.

• Numbers in (): Percentage change and Change of price from LTP (Last Traded Price) to that Level.

General Tips

• It is good if Stock trend is same as that of the Index trend.

• Lots of indicators creates lots of confusion.

• Keep the chart simple and clean.

• Buy Low and Sell High.

• Master averages or 50%.

Note di rilascio

Updated on 3 Sep 2022- Added multiple timeframe levels.

Note di rilascio

Average Daily Range (ADR) (Multi Timeframe, Multi Period)Updated on 2 Sept 2023:

Code Cleanup: The code is cleaned and optimized for better performance and readability.

ADR Table: Added a table displaying ADR percentage and points, helping you identify price range status:

- Green Text: Price has crossed above ADR.

- Red Text: Price is below ADR.

- White Text: Price is within ADR.

Moving Averages: We've added up to five levels of moving averages for enhanced trading analysis.

To return to the previous version:

1. Add the indicator to your chart.

2. Click the '{}' (Source code) button.

3. In Pine Editor, set 'Select revision' to '4.0'.

4. Click 'Add to chart' to restore the previous version.

Feel free to reach out with feedback or issues.

Note di rilascio

Update 13 September 2023:- Extra Level Multipliers: Added extra level multipliers which can act as support, resistance and targets levels.

- Color and Line Style Changes: Revamped the colors and line styles to make it easier to distinguish different levels.

- Multitimeframe Moving Averages: Added three multi timeframe moving averages, allowing you to analyze market trends across different timeframes for better decision-making.

Note di rilascio

Update 13 September 2023:- Extra Level Multipliers: Added extra level multipliers which can act as support, resistance and targets levels.

- Color and Line Style Changes: Revamped the colors and line styles to make it easier to distinguish different levels.

- Multitimeframe Moving Averages: Added three multi timeframe moving averages, allowing you to analyze market trends across different timeframes for better decision-making.

Note di rilascio

Update - October 25, 2023- Improved multiplier values for accuracy.

- Enhanced customization options.

- Display 3 different timeframes.

- Levels extend to the day end.

- Show ADR or 2-length as a zone.

- Code optimized for cleanliness and speed.

- Streamlined user interface for simplicity.

Note di rilascio

Update - October 26, 2023- Minor typo corrections.

Note di rilascio

Update - October 26, 2023- Minor typo corrections.

Note di rilascio

Updated on 23 Sept 2023- Added historical plots for comprehensive visualization.

- Reverted to previous multiplier values for better accuracy.

- Modified the table to display when price is near a particular level.

- Integration of a screener formula for efficient screening.

- Improved code speed for faster performance.

- Enhanced code readability for easier understanding.

Note di rilascio

Updated on 08 Fecruary 2025- Cleaned the code and menu.

- Removed VWAP and Supertrend.

Note di rilascio

Updated on 09 February 2025- Corrected the timeframe label.

Note di rilascio

Updated on 11 March 2025- Adjusted minimum value of multipliers.

Script open-source

In pieno spirito TradingView, il creatore di questo script lo ha reso open-source, in modo che i trader possano esaminarlo e verificarne la funzionalità. Complimenti all'autore! Sebbene sia possibile utilizzarlo gratuitamente, ricorda che la ripubblicazione del codice è soggetta al nostro Regolamento.

Declinazione di responsabilità

Le informazioni ed i contenuti pubblicati non costituiscono in alcun modo una sollecitazione ad investire o ad operare nei mercati finanziari. Non sono inoltre fornite o supportate da TradingView. Maggiori dettagli nelle Condizioni d'uso.

Script open-source

In pieno spirito TradingView, il creatore di questo script lo ha reso open-source, in modo che i trader possano esaminarlo e verificarne la funzionalità. Complimenti all'autore! Sebbene sia possibile utilizzarlo gratuitamente, ricorda che la ripubblicazione del codice è soggetta al nostro Regolamento.

Declinazione di responsabilità

Le informazioni ed i contenuti pubblicati non costituiscono in alcun modo una sollecitazione ad investire o ad operare nei mercati finanziari. Non sono inoltre fornite o supportate da TradingView. Maggiori dettagli nelle Condizioni d'uso.