OPEN-SOURCE SCRIPT

Advanced Currency Strength Meter

# Advanced Currency Strength Meter (ACSM)

The Advanced Currency Strength Meter (ACSM) is a scientifically-based indicator that measures relative currency strength using established academic methodologies from international finance and behavioral economics. This indicator provides traders with a comprehensive view of currency market dynamics through multiple analytical frameworks.

### Theoretical Foundation

#### 1. Purchasing Power Parity (PPP) Theory

Based on Cassel's (1918) seminal work and refined by Froot & Rogoff (1995), PPP suggests that exchange rates should reflect relative price levels between countries. The ACSM momentum component captures deviations from long-term equilibrium relationships, providing insights into currency misalignments.

#### 2. Uncovered Interest Rate Parity (UIP) and Carry Trade Theory

Building on Fama (1984) and Lustig et al. (2007), the indicator incorporates volatility-adjusted momentum to capture carry trade flows and interest rate differentials that drive currency strength. This approach helps identify currencies benefiting from interest rate differentials.

#### 3. Behavioral Finance and Currency Momentum

Following Burnside et al. (2011) and Menkhoff et al. (2012), the model recognizes that currency markets exhibit persistent momentum effects due to behavioral biases and institutional flows. The indicator captures these momentum patterns for trading opportunities.

#### 4. Portfolio Balance Theory

Based on Branson & Henderson (1985), the relative strength matrix captures how portfolio rebalancing affects currency cross-rates and creates trading opportunities between different currency pairs.

### Technical Implementation

#### Core Methodologies:

- **Z-Score Normalization**: Following Sharpe (1994), provides statistical significance testing without arbitrary scaling

- **Momentum Analysis**: Uses return-based metrics (Jegadeesh & Titman, 1993) for trend identification

- **Volatility Adjustment**: Implements Average True Range methodology (Wilder, 1978) for risk-adjusted strength

- **Composite Scoring**: Equal-weight methodology to avoid overfitting and maintain robustness

- **Correlation Analysis**: Risk management framework based on Markowitz (1952) portfolio theory

#### Key Features:

- **Multi-Source Data Integration**: Supports OANDA, Futures, and CFD data sources

- **Scientific Methodology**: No arbitrary scaling or curve-fitting; all calculations based on established statistical methods

- **Comprehensive Dashboard**: Clean, professional table showing currency strengths and best trading pairs

- **Alert System**: Automated notifications for strong/weak currency conditions and extreme values

- **Best Pair Identification**: Algorithmic detection of highest-potential trading opportunities

### Practical Applications

#### For Swing Traders:

- Identify currencies in strong uptrends or downtrends

- Select optimal currency pairs based on relative strength divergence

- Time entries based on momentum convergence/divergence

#### For Day Traders:

- Use with real-time futures data for intraday opportunities

- Monitor currency correlations for risk management

- Detect early reversal signals through extreme value alerts

#### For Portfolio Managers:

- Multi-currency exposure analysis

- Risk management through correlation monitoring

- Strategic currency allocation decisions

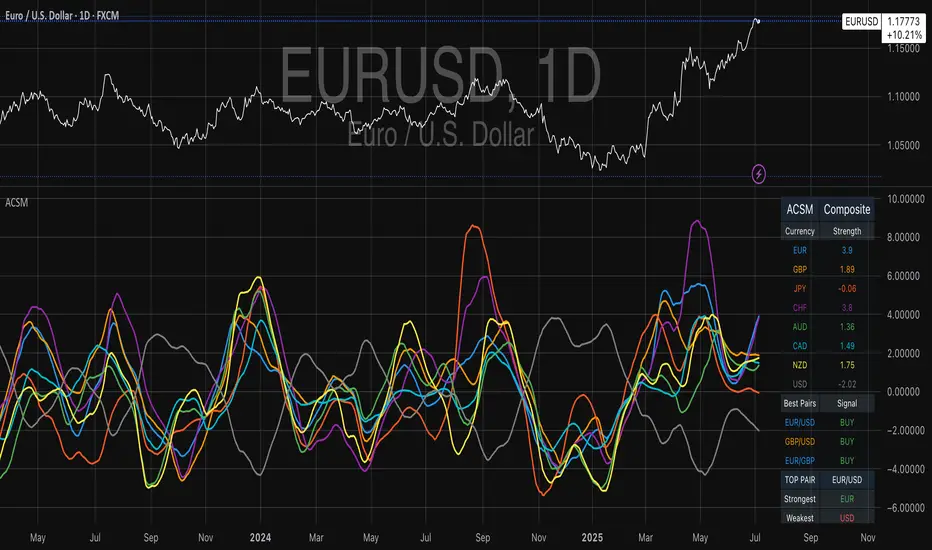

### Visual Design

The indicator features a clean, professional dashboard that displays:

- **Currency Strength Values**: Each major currency (EUR, GBP, JPY, CHF, AUD, CAD, NZD, USD) with color-coded strength values

- **Best Trading Pairs**: Filtered list of highest-potential currency pairs with BUY/SELL signals

- **Market Analysis**: Real-time identification of strongest and weakest currencies

- **Potential Score**: Quantitative measure of trading opportunity strength

### Data Sources and Latency

The indicator supports multiple data sources to accommodate different trading needs:

- **OANDA (Delayed)**: Free data with 15-20 minute delay, suitable for swing trading

- **Futures (Real-time)**: CME currency futures for real-time analysis

- **CFDs**: Alternative real-time data source option

### Mathematical Framework

#### Strength Calculation:

Momentum = (Price - Price[n]) / Price[n] * 100

Z-Score = (Price - Mean) / Standard Deviation

Volatility-Adjusted = Momentum / ATR-based Volatility

Composite = 0.5 * Momentum + 0.3 * Z-Score + 0.2 * Volatility-Adjusted

#### USD Strength Derivation:

USD strength is calculated as the weighted average of all USD-based pairs, providing a true baseline for relative strength comparison.

### Performance Considerations

The indicator is optimized for:

- **Computational Efficiency**: Uses Pine Script v6 best practices

- **Memory Management**: Appropriate lookback periods and array handling

- **Visual Clarity**: Clean table design optimized for both light and dark themes

- **Alert Reliability**: Robust signal generation with statistical significance testing

### Limitations and Risk Disclosure

- Model performance may vary during extreme market stress (Black Swan events)

- Requires stable data feeds for accurate calculations

- Not optimized for high-frequency scalping strategies

- Central bank interventions may temporarily distort signals

- Performance assumes normal market conditions with behavioral adjustments

### Academic References

- Branson, W. H., & Henderson, D. W. (1985). "The Specification and Influence of Asset Markets"

- Burnside, C., Eichenbaum, M., & Rebelo, S. (2011). "Carry Trade and Momentum in Currency Markets"

- Cassel, G. (1918). "Abnormal Deviations in International Exchanges"

- Fama, E. F. (1984). "Forward and Spot Exchange Rates"

- Froot, K. A., & Rogoff, K. (1995). "Perspectives on PPP and Long-Run Real Exchange Rates"

- Jegadeesh, N., & Titman, S. (1993). "Returns to Buying Winners and Selling Losers"

- Lustig, H., Roussanov, N., & Verdelhan, A. (2007). "Common Risk Factors in Currency Markets"

- Markowitz, H. (1952). "Portfolio Selection"

- Menkhoff, L., Sarno, L., Schmeling, M., & Schrimpf, A. (2012). "Carry Trades and Global FX Volatility"

- Sharpe, W. F. (1994). "The Sharpe Ratio"

- Wilder, J. W. (1978). "New Concepts in Technical Trading Systems"

### Usage Instructions

1. **Setup**: Add the indicator to your chart and select your preferred data source

2. **Currency Selection**: Choose which currencies to analyze (default: all major currencies)

3. **Methodology**: Select calculation method (Composite recommended for most users)

4. **Monitoring**: Watch the dashboard for strength changes and best pair opportunities

5. **Alerts**: Set up notifications for strong/weak currency conditions

The Advanced Currency Strength Meter (ACSM) is a scientifically-based indicator that measures relative currency strength using established academic methodologies from international finance and behavioral economics. This indicator provides traders with a comprehensive view of currency market dynamics through multiple analytical frameworks.

### Theoretical Foundation

#### 1. Purchasing Power Parity (PPP) Theory

Based on Cassel's (1918) seminal work and refined by Froot & Rogoff (1995), PPP suggests that exchange rates should reflect relative price levels between countries. The ACSM momentum component captures deviations from long-term equilibrium relationships, providing insights into currency misalignments.

#### 2. Uncovered Interest Rate Parity (UIP) and Carry Trade Theory

Building on Fama (1984) and Lustig et al. (2007), the indicator incorporates volatility-adjusted momentum to capture carry trade flows and interest rate differentials that drive currency strength. This approach helps identify currencies benefiting from interest rate differentials.

#### 3. Behavioral Finance and Currency Momentum

Following Burnside et al. (2011) and Menkhoff et al. (2012), the model recognizes that currency markets exhibit persistent momentum effects due to behavioral biases and institutional flows. The indicator captures these momentum patterns for trading opportunities.

#### 4. Portfolio Balance Theory

Based on Branson & Henderson (1985), the relative strength matrix captures how portfolio rebalancing affects currency cross-rates and creates trading opportunities between different currency pairs.

### Technical Implementation

#### Core Methodologies:

- **Z-Score Normalization**: Following Sharpe (1994), provides statistical significance testing without arbitrary scaling

- **Momentum Analysis**: Uses return-based metrics (Jegadeesh & Titman, 1993) for trend identification

- **Volatility Adjustment**: Implements Average True Range methodology (Wilder, 1978) for risk-adjusted strength

- **Composite Scoring**: Equal-weight methodology to avoid overfitting and maintain robustness

- **Correlation Analysis**: Risk management framework based on Markowitz (1952) portfolio theory

#### Key Features:

- **Multi-Source Data Integration**: Supports OANDA, Futures, and CFD data sources

- **Scientific Methodology**: No arbitrary scaling or curve-fitting; all calculations based on established statistical methods

- **Comprehensive Dashboard**: Clean, professional table showing currency strengths and best trading pairs

- **Alert System**: Automated notifications for strong/weak currency conditions and extreme values

- **Best Pair Identification**: Algorithmic detection of highest-potential trading opportunities

### Practical Applications

#### For Swing Traders:

- Identify currencies in strong uptrends or downtrends

- Select optimal currency pairs based on relative strength divergence

- Time entries based on momentum convergence/divergence

#### For Day Traders:

- Use with real-time futures data for intraday opportunities

- Monitor currency correlations for risk management

- Detect early reversal signals through extreme value alerts

#### For Portfolio Managers:

- Multi-currency exposure analysis

- Risk management through correlation monitoring

- Strategic currency allocation decisions

### Visual Design

The indicator features a clean, professional dashboard that displays:

- **Currency Strength Values**: Each major currency (EUR, GBP, JPY, CHF, AUD, CAD, NZD, USD) with color-coded strength values

- **Best Trading Pairs**: Filtered list of highest-potential currency pairs with BUY/SELL signals

- **Market Analysis**: Real-time identification of strongest and weakest currencies

- **Potential Score**: Quantitative measure of trading opportunity strength

### Data Sources and Latency

The indicator supports multiple data sources to accommodate different trading needs:

- **OANDA (Delayed)**: Free data with 15-20 minute delay, suitable for swing trading

- **Futures (Real-time)**: CME currency futures for real-time analysis

- **CFDs**: Alternative real-time data source option

### Mathematical Framework

#### Strength Calculation:

Momentum = (Price - Price[n]) / Price[n] * 100

Z-Score = (Price - Mean) / Standard Deviation

Volatility-Adjusted = Momentum / ATR-based Volatility

Composite = 0.5 * Momentum + 0.3 * Z-Score + 0.2 * Volatility-Adjusted

#### USD Strength Derivation:

USD strength is calculated as the weighted average of all USD-based pairs, providing a true baseline for relative strength comparison.

### Performance Considerations

The indicator is optimized for:

- **Computational Efficiency**: Uses Pine Script v6 best practices

- **Memory Management**: Appropriate lookback periods and array handling

- **Visual Clarity**: Clean table design optimized for both light and dark themes

- **Alert Reliability**: Robust signal generation with statistical significance testing

### Limitations and Risk Disclosure

- Model performance may vary during extreme market stress (Black Swan events)

- Requires stable data feeds for accurate calculations

- Not optimized for high-frequency scalping strategies

- Central bank interventions may temporarily distort signals

- Performance assumes normal market conditions with behavioral adjustments

### Academic References

- Branson, W. H., & Henderson, D. W. (1985). "The Specification and Influence of Asset Markets"

- Burnside, C., Eichenbaum, M., & Rebelo, S. (2011). "Carry Trade and Momentum in Currency Markets"

- Cassel, G. (1918). "Abnormal Deviations in International Exchanges"

- Fama, E. F. (1984). "Forward and Spot Exchange Rates"

- Froot, K. A., & Rogoff, K. (1995). "Perspectives on PPP and Long-Run Real Exchange Rates"

- Jegadeesh, N., & Titman, S. (1993). "Returns to Buying Winners and Selling Losers"

- Lustig, H., Roussanov, N., & Verdelhan, A. (2007). "Common Risk Factors in Currency Markets"

- Markowitz, H. (1952). "Portfolio Selection"

- Menkhoff, L., Sarno, L., Schmeling, M., & Schrimpf, A. (2012). "Carry Trades and Global FX Volatility"

- Sharpe, W. F. (1994). "The Sharpe Ratio"

- Wilder, J. W. (1978). "New Concepts in Technical Trading Systems"

### Usage Instructions

1. **Setup**: Add the indicator to your chart and select your preferred data source

2. **Currency Selection**: Choose which currencies to analyze (default: all major currencies)

3. **Methodology**: Select calculation method (Composite recommended for most users)

4. **Monitoring**: Watch the dashboard for strength changes and best pair opportunities

5. **Alerts**: Set up notifications for strong/weak currency conditions

Script open-source

Nello spirito di TradingView, l'autore di questo script lo ha reso open source, in modo che i trader possano esaminarne e verificarne la funzionalità. Complimenti all'autore! Sebbene sia possibile utilizzarlo gratuitamente, ricordiamo che la ripubblicazione del codice è soggetta al nostro Regolamento.

Where others speculate, we systematize.

edgetools.org

edgetools.org

Declinazione di responsabilità

Le informazioni e le pubblicazioni non sono intese come, e non costituiscono, consulenza o raccomandazioni finanziarie, di investimento, di trading o di altro tipo fornite o approvate da TradingView. Per ulteriori informazioni, consultare i Termini di utilizzo.

Script open-source

Nello spirito di TradingView, l'autore di questo script lo ha reso open source, in modo che i trader possano esaminarne e verificarne la funzionalità. Complimenti all'autore! Sebbene sia possibile utilizzarlo gratuitamente, ricordiamo che la ripubblicazione del codice è soggetta al nostro Regolamento.

Where others speculate, we systematize.

edgetools.org

edgetools.org

Declinazione di responsabilità

Le informazioni e le pubblicazioni non sono intese come, e non costituiscono, consulenza o raccomandazioni finanziarie, di investimento, di trading o di altro tipo fornite o approvate da TradingView. Per ulteriori informazioni, consultare i Termini di utilizzo.