PROTECTED SOURCE SCRIPT

Omega Ratio Tracker -> PROFABIGHI_CAPITAL

🌟 Overview

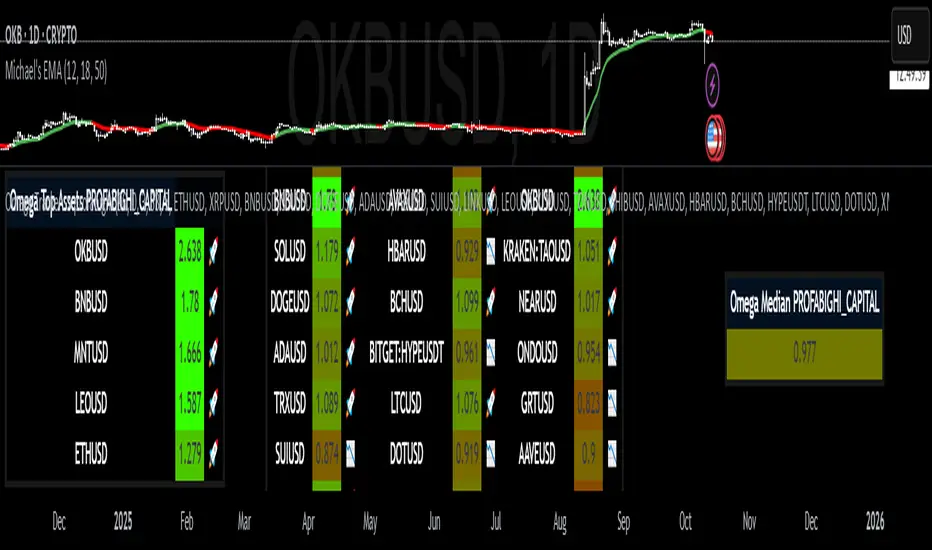

The Omega Ratio Tracker → PROFABIGHI_CAPITAL indicator quantifies the probability-weighted gain-to-loss efficiency by computing the Omega ratio for up to 33 customizable altcoins over a rolling lookback period, contrasting cumulative returns above a user-defined target against those below to assess favorable outcomes. It dynamically constructs color-gradient tables featuring individual Omegas, median benchmarks, and ranked top performers with emoji indicators, allowing traders to evaluate assets' upside potential relative to downside risks for informed, asymmetric opportunity selection.

⚙️ General Settings

– Calculation Period (Bars): Establishes the historical scope for return accumulation and threshold comparisons, where shorter windows spotlight immediate efficiencies amid market swings while extended periods gauge long-term gain/loss asymmetries—pivotal for matching trading cadences like intraday (e.g., 20-50 bars) or swing (e.g., 100+ bars).

– Target Return per Period (%): Specifies the aspirational return threshold per bar/day, serving as the pivot separating "gains" from "losses" in the ratio—elevated targets demand superior performance for positive Omegas, ideal for high-conviction filters, while modest ones broaden inclusion for diverse scans.

– Smoothing Period (EMA): Implements exponential moving average on raw ratios to mitigate transients, with low values (e.g., 1-2) retaining volatility for granular views and higher settings (e.g., 4-7) fostering trend persistence for strategic planning.

💎 Asset Selection Settings

– Number of Altcoins to Display: Dictates the primary table's expanse from a targeted 5-asset spotlight for swift evaluations to a maximal 33-symbol expanse for holistic risk-reward profiling—impacts processing demands and dashboard density.

– Number of Top Omega Assets: Tailors the elite leaderboard to showcase premier ratios, variable from 1 for ultra-focused highlights to the aggregate count for unfiltered excellence—expedites prioritization of high-gain/low-loss candidates.

– Asset 1-17 (Left Group): Loads the main table's left column with bedrock altcoins, facilitating bespoke curation from stalwarts like ETHUSD to varied mid-tiers such as XRPUSD—each solicits daily closes for autonomous Omega computation, with tooltips validating symbol protocols.

– Asset 18-33 (Right Group): Charges the right column for augmented diversification, embracing further tokens from LTCUSD to esoteric picks like MNTUSD—cultivates equilibrated tri-column ergonomics for lateral dataset traversal.

– Dynamic Input Activation: Manifests fields per asset tally, obfuscating redundants to forestall faults and declutter—empowers fluid augmentation from succinct rosters to panoramic oversight sans reconfiguration.

🎨 Table Style Settings

– Low Omega Color: Grounds the gradient's unfavorable terminus (e.g., stark red for ratios below 1.0), instantaneously tagging assets with skewed losses over gains that might erode portfolio viability.

– High Omega Color: Secures the advantageous apex (e.g., radiant green for ratios above 1.0), illuminating prospects with dominant upsides relative to downsides for asymmetric edge hunting.

– Neutral Omega Value: Locates the color fulcrum at equilibrium efficiency (typically 1.0 for balanced outcomes), where ratios modulate from penalty to premium—refinement inclines toward prudent or venturesome outlooks.

– Omega Color Range: Regulates the transitional amplitude encircling neutral, favoring expansive fades for refined gradations or constricted shifts for unequivocal high/low bifurcation.

– Table Background: Imposes a discreet dark semi-opaque substrate for thematic cohesion and theme-agnostic legibility, evoking a refined analytics interface.

– Table Border: Encases perimeters with subdued gray for tacit delineation, encapsulating intelligence without stylistic encumbrance.

📡 Data Fetching

– Asset Data Retrieval: Undertakes simultaneous daily close interrogations for nominated symbols, interposing NA for lacunae to buttress table solidity.

– Return Series Computation: Extracts 1-period percentage variances from asset trajectories, proffering the elemental grist for gain/loss partitioning.

– Void Data Fortification: Implants sentinels (-9999) for lacunae, materializing as grays in renderings to signify incompleteness sans architectural compromise.

🧮 Calculations

– Periodic Return Generation: Forges bar/daily percentage alterations as source divided by antecedent minus unity, underpinning the discrete quanta for target-relative dissection.

– Target Threshold Decimalization: Transmutes percentage input to fractional form, delineating the demarcation betwixt accretive and detractive outcomes.

– Cumulative Gain Accrual: Aggregates excesses above target over the period, encapsulating favorable deviations' aggregate potency.

– Cumulative Loss Accrual: Tallies shortfalls below target, quantifying adverse deviations' collective burden.

– Raw Omega Formulation: Divides gains by losses, yielding the probability-adjusted efficiency quotient—defaults to NA on nil losses for interpretive clarity.

– EMA Transient Suppression: Exponentially averages raw quotients to quell ephemera, engendering interpretable contours over jagged dailies.

– Annualization Omission: Presents periodic ratios without scaling, prioritizing raw bar-level insights for intraday or short-term applicability.

📋 Table Display

– Dynamic Layout Optimization: Assembles columns (apex 9 for tri-set orchestration) and rows calibrated to asset quantum plus header, vouchsafing succinct potency for 1-33 symbols.

– Main Table Architecture: Branded header vaults the apical row, shadowed by asset symbols, rounded quotients (3 decimals), and efficiency emojis in parsimonious trios for row-thrifty perusal.

– Omega Color Continuum: Cartographs values from low (red) via neutral (midpoint) to high (green), with grays for voids—precipitates immediate gain/loss equilibrium profiling.

– Emoji Efficiency Markers: Dispatches rocket for above-median quotients (asymmetric victors) and downward arrow for below (lopsided laggards), infusing expeditious visual discernment.

– Median Table Encapsulation: Terse single-column depiction of pivotal quotient with gradient tint, mooring relative appraisals as a parity linchpin.

– Top Omega Table Hierarchy: Descending stratification in 3-column lattice (symbol, value, emoji) with header branding, converging on paramount assets for gain-dominant dispositions.

– Index-Fueled Ranking: Mobilizes array indices for descending distillation, refabricating sorted arrays while custodians originals for scrupulous median genesis.

🔔 Alerts

– Dynamic Alert Fabrication: Erects newline-segmented compendia of symbols and rounded quotients on the ultimate bar, amputating prefixes for laconic phrasing.

– Once-Per-Bar Dispatch: Ignites alerts at closure with the plenary dataset, harmonizing external adjuncts like dispatches or automata.

– Output Refinement: Distills parseable essence by eliding NAs, honing on operable datum for unencumbered conduit amalgamation.

✅ Key Takeaways

– Gain/loss partitioning via target thresholds unveils asymmetric efficiency beyond traditional metrics.

– Rolling computations with smoothing furnish trend-stable, noise-attenuated efficiency vistas.

– Profuse symbol pliancy forges bespoke crypto observatories from titans to obscurities.

– Gradient lattices with medians and tops hasten low-loss/high-gain discernment through optics.

– Automated alerts encapsulate scans into consumable missives, hastening from scrutiny to stratagem.

The Omega Ratio Tracker → PROFABIGHI_CAPITAL indicator quantifies the probability-weighted gain-to-loss efficiency by computing the Omega ratio for up to 33 customizable altcoins over a rolling lookback period, contrasting cumulative returns above a user-defined target against those below to assess favorable outcomes. It dynamically constructs color-gradient tables featuring individual Omegas, median benchmarks, and ranked top performers with emoji indicators, allowing traders to evaluate assets' upside potential relative to downside risks for informed, asymmetric opportunity selection.

⚙️ General Settings

– Calculation Period (Bars): Establishes the historical scope for return accumulation and threshold comparisons, where shorter windows spotlight immediate efficiencies amid market swings while extended periods gauge long-term gain/loss asymmetries—pivotal for matching trading cadences like intraday (e.g., 20-50 bars) or swing (e.g., 100+ bars).

– Target Return per Period (%): Specifies the aspirational return threshold per bar/day, serving as the pivot separating "gains" from "losses" in the ratio—elevated targets demand superior performance for positive Omegas, ideal for high-conviction filters, while modest ones broaden inclusion for diverse scans.

– Smoothing Period (EMA): Implements exponential moving average on raw ratios to mitigate transients, with low values (e.g., 1-2) retaining volatility for granular views and higher settings (e.g., 4-7) fostering trend persistence for strategic planning.

💎 Asset Selection Settings

– Number of Altcoins to Display: Dictates the primary table's expanse from a targeted 5-asset spotlight for swift evaluations to a maximal 33-symbol expanse for holistic risk-reward profiling—impacts processing demands and dashboard density.

– Number of Top Omega Assets: Tailors the elite leaderboard to showcase premier ratios, variable from 1 for ultra-focused highlights to the aggregate count for unfiltered excellence—expedites prioritization of high-gain/low-loss candidates.

– Asset 1-17 (Left Group): Loads the main table's left column with bedrock altcoins, facilitating bespoke curation from stalwarts like ETHUSD to varied mid-tiers such as XRPUSD—each solicits daily closes for autonomous Omega computation, with tooltips validating symbol protocols.

– Asset 18-33 (Right Group): Charges the right column for augmented diversification, embracing further tokens from LTCUSD to esoteric picks like MNTUSD—cultivates equilibrated tri-column ergonomics for lateral dataset traversal.

– Dynamic Input Activation: Manifests fields per asset tally, obfuscating redundants to forestall faults and declutter—empowers fluid augmentation from succinct rosters to panoramic oversight sans reconfiguration.

🎨 Table Style Settings

– Low Omega Color: Grounds the gradient's unfavorable terminus (e.g., stark red for ratios below 1.0), instantaneously tagging assets with skewed losses over gains that might erode portfolio viability.

– High Omega Color: Secures the advantageous apex (e.g., radiant green for ratios above 1.0), illuminating prospects with dominant upsides relative to downsides for asymmetric edge hunting.

– Neutral Omega Value: Locates the color fulcrum at equilibrium efficiency (typically 1.0 for balanced outcomes), where ratios modulate from penalty to premium—refinement inclines toward prudent or venturesome outlooks.

– Omega Color Range: Regulates the transitional amplitude encircling neutral, favoring expansive fades for refined gradations or constricted shifts for unequivocal high/low bifurcation.

– Table Background: Imposes a discreet dark semi-opaque substrate for thematic cohesion and theme-agnostic legibility, evoking a refined analytics interface.

– Table Border: Encases perimeters with subdued gray for tacit delineation, encapsulating intelligence without stylistic encumbrance.

📡 Data Fetching

– Asset Data Retrieval: Undertakes simultaneous daily close interrogations for nominated symbols, interposing NA for lacunae to buttress table solidity.

– Return Series Computation: Extracts 1-period percentage variances from asset trajectories, proffering the elemental grist for gain/loss partitioning.

– Void Data Fortification: Implants sentinels (-9999) for lacunae, materializing as grays in renderings to signify incompleteness sans architectural compromise.

🧮 Calculations

– Periodic Return Generation: Forges bar/daily percentage alterations as source divided by antecedent minus unity, underpinning the discrete quanta for target-relative dissection.

– Target Threshold Decimalization: Transmutes percentage input to fractional form, delineating the demarcation betwixt accretive and detractive outcomes.

– Cumulative Gain Accrual: Aggregates excesses above target over the period, encapsulating favorable deviations' aggregate potency.

– Cumulative Loss Accrual: Tallies shortfalls below target, quantifying adverse deviations' collective burden.

– Raw Omega Formulation: Divides gains by losses, yielding the probability-adjusted efficiency quotient—defaults to NA on nil losses for interpretive clarity.

– EMA Transient Suppression: Exponentially averages raw quotients to quell ephemera, engendering interpretable contours over jagged dailies.

– Annualization Omission: Presents periodic ratios without scaling, prioritizing raw bar-level insights for intraday or short-term applicability.

📋 Table Display

– Dynamic Layout Optimization: Assembles columns (apex 9 for tri-set orchestration) and rows calibrated to asset quantum plus header, vouchsafing succinct potency for 1-33 symbols.

– Main Table Architecture: Branded header vaults the apical row, shadowed by asset symbols, rounded quotients (3 decimals), and efficiency emojis in parsimonious trios for row-thrifty perusal.

– Omega Color Continuum: Cartographs values from low (red) via neutral (midpoint) to high (green), with grays for voids—precipitates immediate gain/loss equilibrium profiling.

– Emoji Efficiency Markers: Dispatches rocket for above-median quotients (asymmetric victors) and downward arrow for below (lopsided laggards), infusing expeditious visual discernment.

– Median Table Encapsulation: Terse single-column depiction of pivotal quotient with gradient tint, mooring relative appraisals as a parity linchpin.

– Top Omega Table Hierarchy: Descending stratification in 3-column lattice (symbol, value, emoji) with header branding, converging on paramount assets for gain-dominant dispositions.

– Index-Fueled Ranking: Mobilizes array indices for descending distillation, refabricating sorted arrays while custodians originals for scrupulous median genesis.

🔔 Alerts

– Dynamic Alert Fabrication: Erects newline-segmented compendia of symbols and rounded quotients on the ultimate bar, amputating prefixes for laconic phrasing.

– Once-Per-Bar Dispatch: Ignites alerts at closure with the plenary dataset, harmonizing external adjuncts like dispatches or automata.

– Output Refinement: Distills parseable essence by eliding NAs, honing on operable datum for unencumbered conduit amalgamation.

✅ Key Takeaways

– Gain/loss partitioning via target thresholds unveils asymmetric efficiency beyond traditional metrics.

– Rolling computations with smoothing furnish trend-stable, noise-attenuated efficiency vistas.

– Profuse symbol pliancy forges bespoke crypto observatories from titans to obscurities.

– Gradient lattices with medians and tops hasten low-loss/high-gain discernment through optics.

– Automated alerts encapsulate scans into consumable missives, hastening from scrutiny to stratagem.

Script protetto

Questo script è pubblicato come codice protetto. Tuttavia, è possibile utilizzarlo liberamente e senza alcuna limitazione – per saperne di più clicca qui.

Declinazione di responsabilità

Le informazioni ed i contenuti pubblicati non costituiscono in alcun modo una sollecitazione ad investire o ad operare nei mercati finanziari. Non sono inoltre fornite o supportate da TradingView. Maggiori dettagli nelle Condizioni d'uso.

Script protetto

Questo script è pubblicato come codice protetto. Tuttavia, è possibile utilizzarlo liberamente e senza alcuna limitazione – per saperne di più clicca qui.

Declinazione di responsabilità

Le informazioni ed i contenuti pubblicati non costituiscono in alcun modo una sollecitazione ad investire o ad operare nei mercati finanziari. Non sono inoltre fornite o supportate da TradingView. Maggiori dettagli nelle Condizioni d'uso.