PROTECTED SOURCE SCRIPT

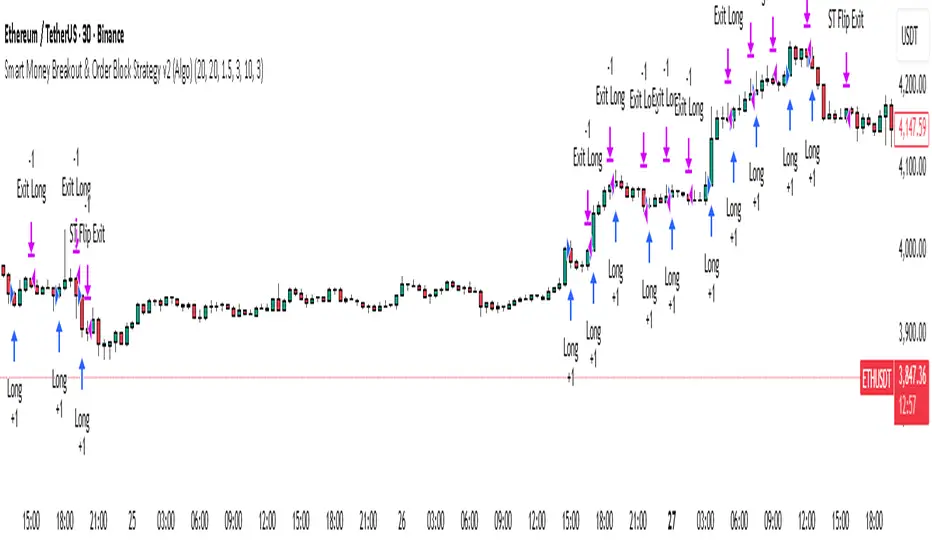

Smart Money Breakout & Order Block Strategy v2 (Algo)

⚙️ Smart Money Breakout & Order Block Strategy v2 (Algo)

Created by: Shubham

Category: Smart Money Concepts • Breakout • Order Block • Volatility + Trend Algo

🧠 Description:

Smart Money Breakout & Order Block Strategy v2 (Algo) is an advanced version of the original system that blends Breakout Trading, Order Block Detection, and Supertrend Trend Confirmation.

It’s built to identify institutional-style entries with high momentum and manage them using dynamic ATR-based stops, trailing protection, and volatility-based filters.

This version is a full Algo system — optimized for performance, backtesting, and automated execution.

⚡ Major Improvements Over Older Version:

🧩 Core Concept:

⚙️ Adjustable Inputs:

🎯 Optimized & Tested Conditions:

💡 Trading Logic Summary:

b]📊 Highlights:

⚠️ Tips & Notes:

✅ Summary:

Smart Money Breakout & Order Block Strategy v2 (Algo) combines institutional structure logic, volatility filters, and adaptive ATR risk control into one professional system.

Specially optimized and tested live on ETH 30-minute timeframe, it delivers precise, trend-aligned entries with smart exit management.

A clean, reliable, and automation-ready algo for serious traders.

Advanced Smart Money Algo for ETH (30m) — breakout + order-block entries with volatility and Supertrend filters, ATR-based dynamic stops. Tested live; invite-only soon — test now while it's free.

Created by: Shubham

Category: Smart Money Concepts • Breakout • Order Block • Volatility + Trend Algo

🧠 Description:

Smart Money Breakout & Order Block Strategy v2 (Algo) is an advanced version of the original system that blends Breakout Trading, Order Block Detection, and Supertrend Trend Confirmation.

It’s built to identify institutional-style entries with high momentum and manage them using dynamic ATR-based stops, trailing protection, and volatility-based filters.

This version is a full Algo system — optimized for performance, backtesting, and automated execution.

⚡ Major Improvements Over Older Version:

- [] Supertrend Filter Added – Trades only in confirmed trend direction (Up = Long, Down = Short).

[] Supertrend Flip Exit – Automatically closes trades when Supertrend changes direction.

[] Hold N Candles Before Exit – Prevents early exits after entry, improving stability.

[] Advanced Exit Logic – Tracks bar of entry and allows conditional exit control.

[] Improved Volatility Filter – Avoids choppy or flat market conditions.

[] Algo-Only Mode – No visuals, lightweight logic for live or strategy-based execution.

[] Dynamic ATR Stops – Risk adapts automatically to market volatility.

[] More Controlled Breakout Logic – Cleaner structure and smarter order-block detection.

🧩 Core Concept:

- [] Detects recent Support & Resistance Breakouts.

[] Spots Order Block / Gap Reversals for smart-money entry timing.

[] Confirms strong momentum with a Volatility Filter.

[] Applies Supertrend Trend Confirmation for direction filtering.

[] Manages risk using ATR-based dynamic stop loss and trailing protection.

[] Closes trades automatically on Supertrend Flip or trailing trigger. - Allows holding for a set number of candles before normal exits start.

⚙️ Adjustable Inputs:

- [] Levels Period

[] Volatility Filter

[] ATR Multiplier

[] Hold N Candles Before Exit

[] Supertrend ATR Length

[] Supertrend Multiplier - ON/OFF for Supertrend Filter

🎯 Optimized & Tested Conditions:

- [] Specially optimized and backtested for ETH/USDT on the 30-minute timeframe.

[] Verified and live-tested by me personally for consistency and reliability.

[] Performs strongly during trending sessions and volatility expansions.

[] Suitable for Crypto, Forex, and Index pairs with similar behavior.

💡 Trading Logic Summary:

- [] Long Entry: Price breaks resistance → volatility passes filter → Supertrend UP → Buy.

[] Short Entry: Price breaks support → volatility passes filter → Supertrend DOWN → Sell.

[] Order Block Entries: Gap or block structure confirmed → entry triggered.

[] Stop Loss: ATR × Multiplier (auto-scaled).

[] Trailing Stop: Locks profits as price moves in favor.

[] Supertrend Flip: Instant exit to secure results. - Hold Period: Trade remains locked for defined bars before normal exit logic starts.

b]📊 Highlights:

- [] Institutional logic simplified into an easy, automated algo.

[] Combines structure + trend + volatility for high-probability trades.

[] ATR and Supertrend make the system adaptive to all market conditions.

[] Fully automated — perfect for backtesting or live algo trading. - Tuned for ETH 30-min chart but can be adapted to other assets.

⚠️ Tips & Notes:

- [] Adjust settings based on instrument volatility.

[] Use larger “Hold Candles” on lower timeframes to avoid false exits.

[] Always forward-test before going live on new markets.

[] Avoid overtrading during low-volume or sideways sessions. - Maintain single active position per direction for clarity.

✅ Summary:

Smart Money Breakout & Order Block Strategy v2 (Algo) combines institutional structure logic, volatility filters, and adaptive ATR risk control into one professional system.

Specially optimized and tested live on ETH 30-minute timeframe, it delivers precise, trend-aligned entries with smart exit management.

A clean, reliable, and automation-ready algo for serious traders.

Advanced Smart Money Algo for ETH (30m) — breakout + order-block entries with volatility and Supertrend filters, ATR-based dynamic stops. Tested live; invite-only soon — test now while it's free.

Script protetto

Questo script è pubblicato come codice protetto. Tuttavia, è possibile utilizzarlo liberamente e senza alcuna limitazione – per saperne di più clicca qui.

Declinazione di responsabilità

Le informazioni ed i contenuti pubblicati non costituiscono in alcun modo una sollecitazione ad investire o ad operare nei mercati finanziari. Non sono inoltre fornite o supportate da TradingView. Maggiori dettagli nelle Condizioni d'uso.

Script protetto

Questo script è pubblicato come codice protetto. Tuttavia, è possibile utilizzarlo liberamente e senza alcuna limitazione – per saperne di più clicca qui.

Declinazione di responsabilità

Le informazioni ed i contenuti pubblicati non costituiscono in alcun modo una sollecitazione ad investire o ad operare nei mercati finanziari. Non sono inoltre fornite o supportate da TradingView. Maggiori dettagli nelle Condizioni d'uso.