PROTECTED SOURCE SCRIPT

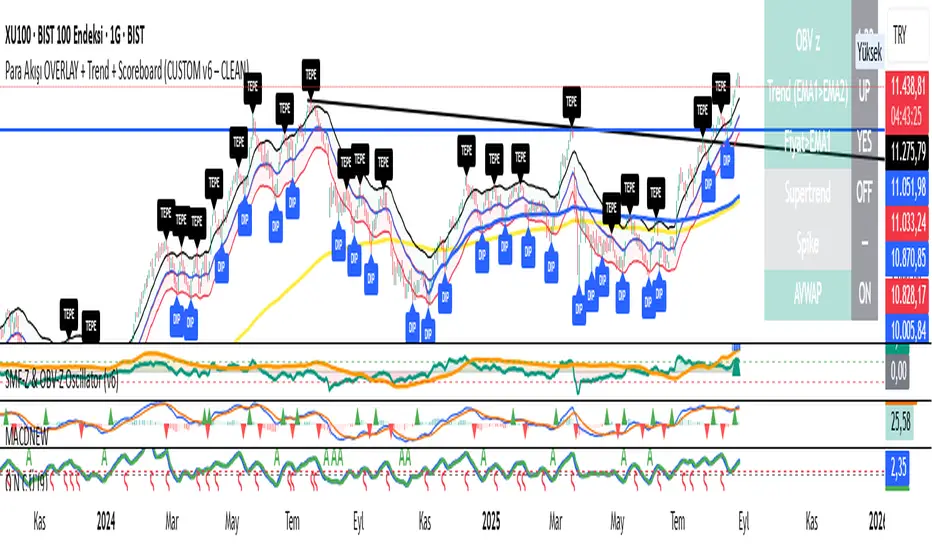

SMF-Z & OBV-Z Oscillator (v6)

🧭 Quick Reference

• SMF-Z (teal): flow of money.

• OBV-Z (orange): volume support for price moves.

• Zero line (0): neutral. Positive side = bullish bias, negative side = bearish bias.

• ±2 levels: “extreme” zone (unusual inflow/outflow).

• IN/OUT triangles: short-term strong money inflow/outflow (spike signals).

✅ Core Rules

LONG (buy/hold)

Both SMF-Z and OBV-Z above zero and rising (upward slope).

Zero line crossover (especially if both cross around the same bar) + IN spike = strong confirmation.

Expansion toward +2 = momentum intact, let profits run.

EXIT / SELL (close long or consider short)

Either SMF-Z or OBV-Z drops below zero (especially both together).

OUT spike (heavy selling pressure) = aggressive exit signal.

Rolling over from +2 downward (especially if OBV-Z turns first) = momentum fading.

SHORT (sell side)

Both indicators below zero and falling; zero line crossunders + OUT spike = strong confirmation.

Expansion toward −2 shows trend strength; taking profit on reversal from −2 is reasonable.

♟️ Divergences (most reliable signal)

Positive divergence: Price makes a new low while SMF-Z/OBV-Z form a higher low → strong accumulation sign (especially if paired with an IN spike).

Negative divergence: Price makes a new high while SMF-Z/OBV-Z form a lower high → distribution/selling sign (confirmed with an OUT spike).

🔧 Parameter Effects

SMF z-window / OBV z-window: shorter (20–50) = more sensitive but noisier; longer (100–200) = slower but more reliable.

OBV EMA: smaller (10–13) = faster response; larger (34–55) = smoother.

Spike window & σ (spK): shorter window or smaller sigma = more frequent spikes; larger = fewer but more selective spikes.

📝 Simple Playbook

Filter: Check if both SMF-Z and OBV-Z are on the same side of zero before taking a trade.

Trigger: Zero line crossover + IN/OUT spike.

Management:

For longs: exit/reduce if OBV-Z falls below zero or an OUT spike appears.

For shorts: exit/reduce if SMF-Z rises above zero or an IN spike appears.

Extra confirmation: If Supertrend/EMA from the overlay indicator agrees with SMF-Z & OBV-Z, confidence is stronger.

⚠️ Cautions

In sideways markets, frequent whipsaws around zero are common → always wait for confirmation (both indicators + spike + trend filter).

+2/−2 zones do not guarantee reversal by themselves; in strong trends the indicators can stay there for a while.

• SMF-Z (teal): flow of money.

• OBV-Z (orange): volume support for price moves.

• Zero line (0): neutral. Positive side = bullish bias, negative side = bearish bias.

• ±2 levels: “extreme” zone (unusual inflow/outflow).

• IN/OUT triangles: short-term strong money inflow/outflow (spike signals).

✅ Core Rules

LONG (buy/hold)

Both SMF-Z and OBV-Z above zero and rising (upward slope).

Zero line crossover (especially if both cross around the same bar) + IN spike = strong confirmation.

Expansion toward +2 = momentum intact, let profits run.

EXIT / SELL (close long or consider short)

Either SMF-Z or OBV-Z drops below zero (especially both together).

OUT spike (heavy selling pressure) = aggressive exit signal.

Rolling over from +2 downward (especially if OBV-Z turns first) = momentum fading.

SHORT (sell side)

Both indicators below zero and falling; zero line crossunders + OUT spike = strong confirmation.

Expansion toward −2 shows trend strength; taking profit on reversal from −2 is reasonable.

♟️ Divergences (most reliable signal)

Positive divergence: Price makes a new low while SMF-Z/OBV-Z form a higher low → strong accumulation sign (especially if paired with an IN spike).

Negative divergence: Price makes a new high while SMF-Z/OBV-Z form a lower high → distribution/selling sign (confirmed with an OUT spike).

🔧 Parameter Effects

SMF z-window / OBV z-window: shorter (20–50) = more sensitive but noisier; longer (100–200) = slower but more reliable.

OBV EMA: smaller (10–13) = faster response; larger (34–55) = smoother.

Spike window & σ (spK): shorter window or smaller sigma = more frequent spikes; larger = fewer but more selective spikes.

📝 Simple Playbook

Filter: Check if both SMF-Z and OBV-Z are on the same side of zero before taking a trade.

Trigger: Zero line crossover + IN/OUT spike.

Management:

For longs: exit/reduce if OBV-Z falls below zero or an OUT spike appears.

For shorts: exit/reduce if SMF-Z rises above zero or an IN spike appears.

Extra confirmation: If Supertrend/EMA from the overlay indicator agrees with SMF-Z & OBV-Z, confidence is stronger.

⚠️ Cautions

In sideways markets, frequent whipsaws around zero are common → always wait for confirmation (both indicators + spike + trend filter).

+2/−2 zones do not guarantee reversal by themselves; in strong trends the indicators can stay there for a while.

Script protetto

Questo script è pubblicato come codice protetto. Tuttavia, è possibile utilizzarlo liberamente e senza alcuna limitazione – per saperne di più clicca qui.

Declinazione di responsabilità

Le informazioni ed i contenuti pubblicati non costituiscono in alcun modo una sollecitazione ad investire o ad operare nei mercati finanziari. Non sono inoltre fornite o supportate da TradingView. Maggiori dettagli nelle Condizioni d'uso.

Script protetto

Questo script è pubblicato come codice protetto. Tuttavia, è possibile utilizzarlo liberamente e senza alcuna limitazione – per saperne di più clicca qui.

Declinazione di responsabilità

Le informazioni ed i contenuti pubblicati non costituiscono in alcun modo una sollecitazione ad investire o ad operare nei mercati finanziari. Non sono inoltre fornite o supportate da TradingView. Maggiori dettagli nelle Condizioni d'uso.