GG-Shot

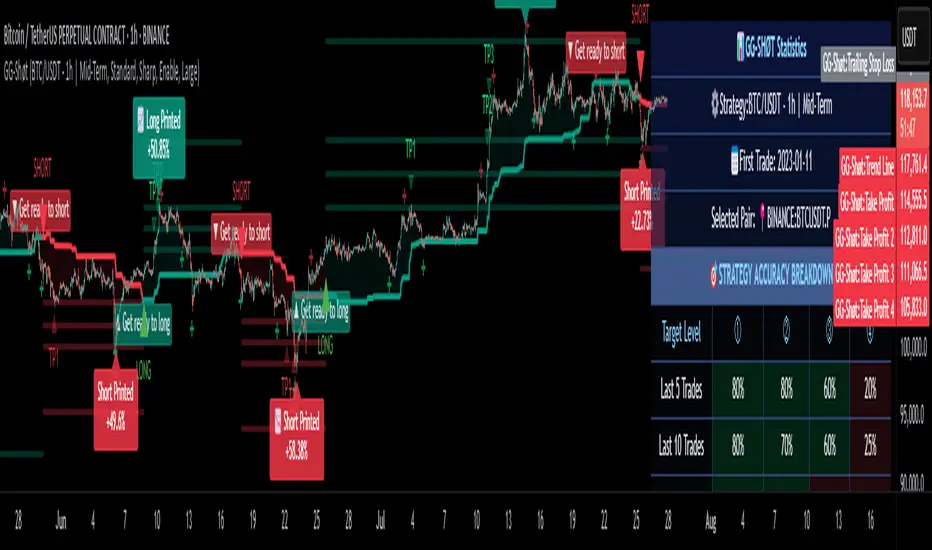

The GG-Shot indicator is built on analyzing key price levels to identify breakouts in both directions of the market. It tracks range boundaries to identify entry points for long and short positions. This indicator includes additional filters to eliminate false signals and increase accuracy in low-volatility conditions. The primary goal of the indicator is to identify levels whose breakout may signal the start of a new trend.

═════════════════════════════════════════════════

🔹 Key Features:

- 167 Trading Strategies: GG-Shot is equipped with 167 unique strategies, including two universal strategies suitable for most crypto assets. These strategies are adaptable to various market conditions and are beneficial for traders dealing with a wide range of assets.

- Take-Profit Levels (TP1-TP4): The indicator provides four static take-profit levels, calculated based on market volatility and strategy configuration. Additionally, two dynamic take-profit levels are adjusted in real-time.

- Long and Short Signals: The indicator generates clear long and short signals, helping traders stay prepared for upcoming market moves.

- Advanced, Standard, Classic and Channel Modes:

- Advanced Mode: Adds extra trend lines that act as support and resistance levels, useful for entering, increasing, or closing positions. You can also trade between these levels using price movements within the range.

- Standard Mode: Uses pre-set limit-based take-profit levels specifically tailored for each strategy, ensuring a structured approach to trade exits.

- Classic Mode: In this mode, limit-based take-profit levels are not displayed. Profit is instead taken based on dynamic take-profit levels or support/resistance levels.

- Channel Mode: Transforms indicator into a channel trading mode, generating signals when the price touches the upper or lower boundaries of the channel, good for range-bound markets. - Oscillator Mode:

- Enable: Generates signals in both directions, independent of the primary trend.

- By Trend: Filters signals to only work in the direction of the current trend based on the primary indicator signal. - Filtering: The indicator includes two filtering methods:

- Volume Filter: Automatically adjusts the threshold for volume based on the specific asset, helping to filter out signals in low-volume conditions and ensuring higher-quality trades.

- Flat Market Filter: Reduces the number of signals in low-volatility or flat market conditions, improving overall accuracy during periods of market inactivity. - Support and Resistance Zones: Highlights key support and resistance levels on the chart to help traders identify important entry and exit points.

- Real-Time Back-Test Panel: Available in both mobile and desktop versions, with only design differences. Both versions provide real-time performance data such as win rates, profit factor, and success rates for each take-profit level (TP1-TP4), along with detailed accuracy statistics for long and short trades.

🔹 How to Trade with GG-Shot:

When you receive a Long/Short signal from indicator, you have two primary options for entering a position:

Instant Entry: Enter immediately with a single entry if the following conditions are met:

- You observe that the trend is strong.

- There is no divergence on the rebound.

- Indicator signals are consistently pointing in one direction (with priority given to these signals).

- The Risk-to-Reward ratio is normal.

Split Entry or Pullback Entry: Enter in parts or wait for a pullback if the following conditions apply:

- The trend is flat or there is low market volatility.

- There are divergences on the rebound.

- The Risk-to-Reward ratio is negative or the signal appears abnormal.

Once you have entered the position, follow these guidelines for Take Profit and Stop Loss management:

Place limit Take Profit orders as follows:

- 50% of the position at the 1st take profit level (TP1).

- 25% at the 2nd take profit level (TP2).

- 15% at the 3rd take profit level (TP3).

- 10% at the 4th take profit level (TP4).

After reaching the first Take Profit (TP1), move the Stop Loss on the remaining position to breakeven to protect your capital.

Additional Trade Management with Oscillator Signals:

When TP1 is reached, and a green\red cross (oscillator function) appears against the trend direction, it is recommended to fully close the position. This signal indicates a potential reversal or a significant pause in the trend.

In certain cases, you can also open a small position in the opposite direction. Place your Stop Loss behind the nearest support or resistance level (using the Support and Resistance Zones or the Advanced Mode of GG-Shot). You can start taking profits at the nearest support or resistance levels or trend lines, while leaving part of the position open for further movement if a reversal signal appears. in most cases, price will bounce when there’s a combination of dynamic TP levels and the oscillator cross near important levels.

Re-entry Strategies:

If you see a cross from the trend line in the direction of the signal, you can re-enter the position with a more favorable Risk-to-Reward ratio. Use the nearest support or resistance level or a reverse signal as an entry point. After the price bounces off the Trend Line, move the Stop Loss to breakeven. Often, when the trend line follows the price, the price continues to track the line. This strategy can also be applied in combination with RSI, especially when there are divergences near the trend line.

Key Observations for Signal Strength:

In most cases, the trend line gives an early indication of future price movement. For example, if you receive a short signal, but the Trend Line is going up, the price is likely to touch the trend line before continuing downtrend. In such cases, it’s better to skip the signal or look for an entry from the Trend Line, especially when there are divergences supporting the direction of the signal.

Alternatively, when a short signal is accompanied by a falling trend line, the more it falls, the more significant the potential dump.

═════════════════════════════════════════════════

🔹 How to Use:

Step 1: Add GG-Shot to your TradingView chart.

Step 2: Choose one of the modes:

Advanced, Standard, or Channel, and select a strategy from the 167 available options.

Step 3: Check Long/Short signals for entering positions, using the provided take-profit and stop-loss levels.

Step 4: Use the Back-Test Panel to assess the performance of the chosen strategy and adjust your approach based on real-time data.

Note: All trading involves risk, and past performance is not indicative of future results.

Added new 21 strategies and 50 indicator strategies have been optimized for current market conditions.

Introduced dynamic (volatility-based) take-profit and stop-loss levels that automatically adjust to current market conditions.

Optimized Indicator Strategies:

Internal algorithms have been improved for more accurate and efficient calculations across all strategies.

New “Show Next Entry Signal” Feature:

Visually displays the exact entry point for a future signal.

Added Two New Strategies:

PEPE/USDT – 1h | Mid-Term

POPCAT/USDT – 1h | Mid-Term

Analytics system that reads assets, decodes trends, and adapts in real-time. Works with Crypto, Forex, Stocks and Commodities on any timeframe. Auto-adjusts filters, TP & SL parameters.

Added Immediate Entry

Signals are triggered instantly when it appears. All indicator signals sent to ggshot_bot now use immediate entry by default.

New Dynamic TP [x4]

Fully reworked take profit logic with 4 adaptive levels built for momentum.

Max PnL Tracker

Displays maximum ROI by each signal

Additional Entry Levels

Highlights precise entry or scaling points after signal with clear, rule-based expansion.

New Backtest Panel

Performance snapshot for last 5/10/20 trades. Shows avg duration, PnL factor, and streaks. Features modular layout with small or full panel options.

Refined Code & Interface

All features added with zero script load. Logic optimized for performance with cleaner interface.

Strategies Optimization

All strategies refined for current market conditions, volatility cycles and dominant trend structures.

New Strategies Deployed

Six high-performance strategies added:

CRV/USDT – 4h | Long-Term

ENA/USDT – 1h | Mid-Term

HBAR/USDT – 1h | Mid-Term

TAO/USDT – 30m | Mid-Term

W/USDT – 30m | Mid-Term

RARE/USDT – 30m | Mid-Term

ALGO, ALPHA, ALT, API3, APT, ARB, ARKM, AUCTION, AVAX, BAKE, BAND, BEL, BIG, BNB, BNT, BTC, CAKE, CELER, CHZ, COTI, CRV, CYBER, DASH, DOT, DYDX, ETH, ETHFI, FET, FIL, FLM, GALA, GMT, GRT, HOOK, ICP, ID, INJ, IOTX, JASMY, JUP, KAVA, KSM, LDO, LEVER, LQTY, MAGIC, MASK, MKR, NEAR, NOT, NTRN, OGN, ONE, ONT, OP, PEOPLE, PYTH, RSR, RUNE, SAND, SKL, SNX, SOL, STORJ, STX, TAO, TIA, TRB, TWT, VANRY, VET, WIF, WLD, WOO, ZIL, С98

New Strategies:

"ENJ/USDT - 1h | Mid-Term", "ALICE/USDT - 4h | Long-Term", "DEGEN/USDT - 30m | Mid-Term", "NMR/USDT - 1h | Mid-Term", "ACH/USDT - 1h | Mid-Term", "JTO/USDT - 1h | Mid-Term", "IMX/USDT - 4h | Long-Term", "RLC/USDT - 4h | Long-Term", "ZRO/USDT - 30m | Mid-Term", "TURBO/USDT - 1h | Mid-Term", "ICX/USDT - 4h | Mid-Term", "APE/USDT - 30m | Mid-Term", "CETUS/USDT - 30m | Mid-Term", "BCH/USDT - 1h | Mid-Term", "LPT/USDT - 1h | Mid-Term"

NEW: Trend Line Logic System:

Sharp - Uses pure price extremes for precise trend calculation

Balanced - Statistical approach with advanced filtering to reduce false signals

Smooth - Dynamic calculation that adapts to current market volatility

Additional Enhancements:

Fixed display bugs with max profit labels when using Universal AI strategy

Resolved rendering issues when multiple Dynamic TP targets trigger on a single candle

Added Flat Zones Filter toggle compatibility with Universal AI mode

Added the ability to add alerts for Buy and Sell signals for all Scalp and Scalp v1 indicator strategies.

Script su invito

Solo gli utenti approvati dall'autore possono accedere a questo script. È necessario richiedere e ottenere l'autorizzazione per utilizzarlo. Tale autorizzazione viene solitamente concessa dopo il pagamento. Per ulteriori dettagli, seguire le istruzioni dell'autore riportate di seguito o contattare direttamente GG-Traders.

TradingView NON consiglia di acquistare o utilizzare uno script a meno che non si abbia piena fiducia nel suo autore e se ne comprenda il funzionamento. È inoltre possibile trovare alternative gratuite e open source nei nostri script della community.

Istruzioni dell'autore

✔️For access, write in a PM or telegram: t.me/ggtraders

Declinazione di responsabilità

Script su invito

Solo gli utenti approvati dall'autore possono accedere a questo script. È necessario richiedere e ottenere l'autorizzazione per utilizzarlo. Tale autorizzazione viene solitamente concessa dopo il pagamento. Per ulteriori dettagli, seguire le istruzioni dell'autore riportate di seguito o contattare direttamente GG-Traders.

TradingView NON consiglia di acquistare o utilizzare uno script a meno che non si abbia piena fiducia nel suo autore e se ne comprenda il funzionamento. È inoltre possibile trovare alternative gratuite e open source nei nostri script della community.

Istruzioni dell'autore

✔️For access, write in a PM or telegram: t.me/ggtraders