PROTECTED SOURCE SCRIPT

IKODO Harmonic Patterns

IKODO Harmonic Patterns How its Works

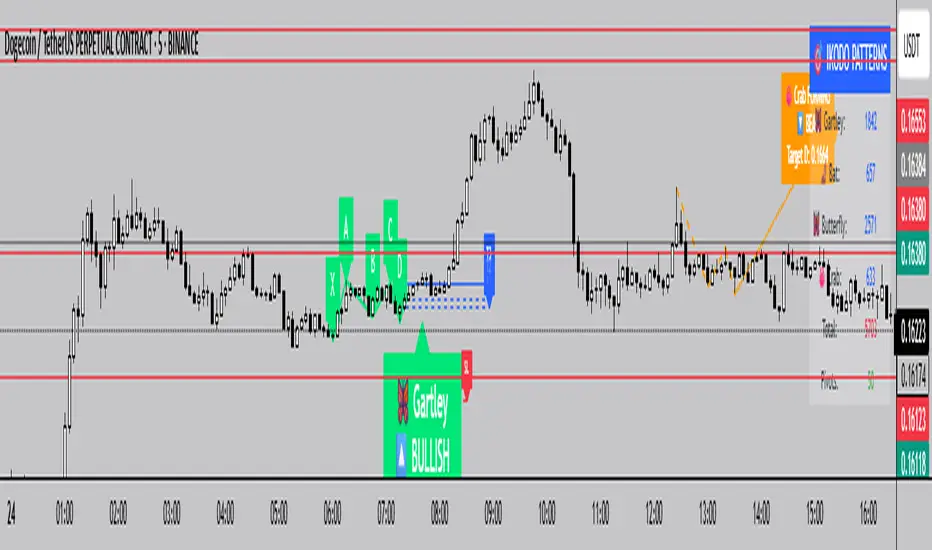

IKODO Harmonic Patterns automatically scans your chart to detect Gartley , Bat , Butterfly , and Crab harmonic patterns in real-time, using strict Fibonacci ratio checks with configurable tolerance and pivot lengths.

Pivot Detection

Uses pivot highs/lows with a configurable length to mark potential turning points on the chart.

Stores and updates the last 50 pivots for performance.

Pattern Identification

Continuously checks for XABCD structures:

Confirms alternating pivot highs/lows.

Calculates XA, AB, BC, CD, AD legs.

Validates Fibonacci ratios within your defined tolerance:

Gartley: AB = 0.618 XA, AD = 0.786 XA

Bat: AB = 0.382/0.5 XA, AD = 0.886 XA

Butterfly: AB = 0.786 XA, AD = 1.272/1.618 XA

Crab: AB = 0.382/0.618 XA, AD = 1.618 XA

Visualization

Draws XABCD lines and labels on your chart.

Displays entry, three target levels (T1, T2, T3), and a stop-loss suggestion for risk management.

Uses color coding:

Green for bullish patterns.

Red for bearish patterns.

Orange for potential (forming) patterns.

Alerts & Table Stats

Generates alerts when a valid pattern completes.

Displays a live table showing:

Count of each pattern type found.

Total patterns detected.

Number of pivots tracked.

Potential Pattern Projection

If a potential pattern is forming (XAB complete, D pending), the indicator:

Projects the potential D point based on Fibonacci extensions.

Marks the path with dotted/dashed lines.

Displays a label with expected D price and pattern type.

Why Use This?

Automates advanced harmonic detection without manual drawing.

Helps in identifying precise reversal points for high-R/R trades.

Supports visual learning of harmonics while trading.

IKODO Harmonic Patterns automatically scans your chart to detect Gartley , Bat , Butterfly , and Crab harmonic patterns in real-time, using strict Fibonacci ratio checks with configurable tolerance and pivot lengths.

Pivot Detection

Uses pivot highs/lows with a configurable length to mark potential turning points on the chart.

Stores and updates the last 50 pivots for performance.

Pattern Identification

Continuously checks for XABCD structures:

Confirms alternating pivot highs/lows.

Calculates XA, AB, BC, CD, AD legs.

Validates Fibonacci ratios within your defined tolerance:

Gartley: AB = 0.618 XA, AD = 0.786 XA

Bat: AB = 0.382/0.5 XA, AD = 0.886 XA

Butterfly: AB = 0.786 XA, AD = 1.272/1.618 XA

Crab: AB = 0.382/0.618 XA, AD = 1.618 XA

Visualization

Draws XABCD lines and labels on your chart.

Displays entry, three target levels (T1, T2, T3), and a stop-loss suggestion for risk management.

Uses color coding:

Green for bullish patterns.

Red for bearish patterns.

Orange for potential (forming) patterns.

Alerts & Table Stats

Generates alerts when a valid pattern completes.

Displays a live table showing:

Count of each pattern type found.

Total patterns detected.

Number of pivots tracked.

Potential Pattern Projection

If a potential pattern is forming (XAB complete, D pending), the indicator:

Projects the potential D point based on Fibonacci extensions.

Marks the path with dotted/dashed lines.

Displays a label with expected D price and pattern type.

Why Use This?

Automates advanced harmonic detection without manual drawing.

Helps in identifying precise reversal points for high-R/R trades.

Supports visual learning of harmonics while trading.

Script protetto

Questo script è pubblicato come codice protetto. Tuttavia, è possibile utilizzarle liberamente e senza alcuna limitazione – ulteriori informazioni qui.

Declinazione di responsabilità

Le informazioni e le pubblicazioni non sono intese come, e non costituiscono, consulenza o raccomandazioni finanziarie, di investimento, di trading o di altro tipo fornite o approvate da TradingView. Per ulteriori informazioni, consultare i Termini di utilizzo.

Script protetto

Questo script è pubblicato come codice protetto. Tuttavia, è possibile utilizzarle liberamente e senza alcuna limitazione – ulteriori informazioni qui.

Declinazione di responsabilità

Le informazioni e le pubblicazioni non sono intese come, e non costituiscono, consulenza o raccomandazioni finanziarie, di investimento, di trading o di altro tipo fornite o approvate da TradingView. Per ulteriori informazioni, consultare i Termini di utilizzo.