OPEN-SOURCE SCRIPT

Bitcoin Power Law Model

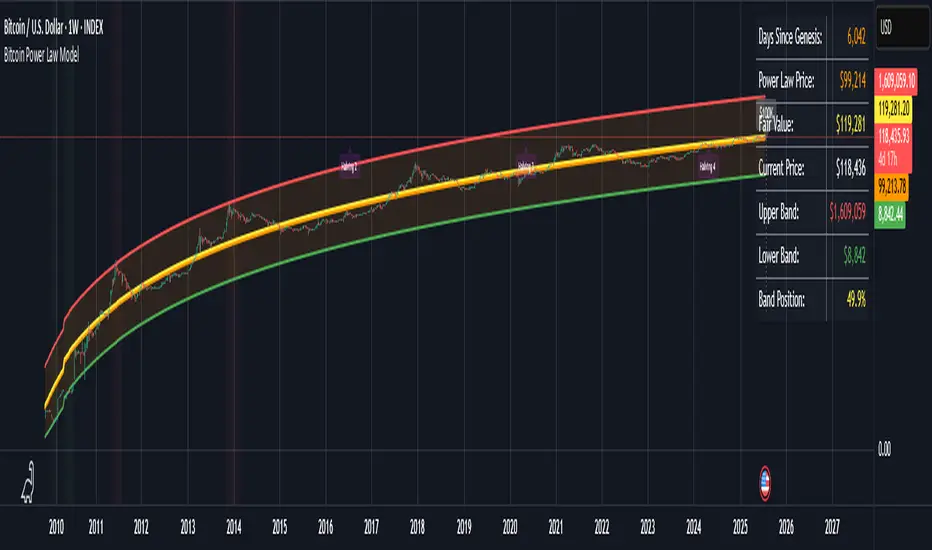

Bitcoin Power Law Model with Cycle Predictions

Scientific Price Modeling for Bitcoin

This indicator implements **Dr. Giovanni Santostasi's Bitcoin Power Law Theory** - a discovery that Bitcoin's price follows mathematical laws similar to natural phenomena. Unlike traditional financial models, this treats Bitcoin as a scale-invariant system that grows predictably over time.

What Makes This Special

Dr. Santostasi, an astrophysicist who studied gravitational waves, discovered that Bitcoin's price forms a perfect straight line when plotted on a log-log scale over its entire 15-year history. This isn't just another technical indicator - it's a fundamental law that has held true through multiple 80%+ crashes and recoveries.

Core Features

Power Law Model

- Orange Line: The power law trajectory showing Bitcoin's long-term growth path

- Yellow Line: Fair value (geometric mean between support and resistance)

- Green/Red Bands: Support and resistance levels that have historically contained price movements

- Band Position %: Shows exactly where price sits within the power law channel (0-100%)

How to Use It

For Long-term Investors

1. Accumulate when price is near the green support line (band position < 20%)

2. Hold when price is between the bands

3. Consider profits when approaching red resistance (band position > 80%)

4. Never panic - the model shows $30K+ is now the permanent floor

Key Metrics to Watch

- **Band Position: <20% = Oversold, >80% = Overbought

- Fair Value: Price above = Overvalued, below = Undervalued

- Support Line: Breaking below suggests model invalidation

Current Cycle Projections

Based on the November 2022 bottom at ~$15,500:

- Cycle Peak: ~$155,000-$230,000 (October 2025)

- Next Bottom: ~$70,000-$100,000 (October 2026)

- Long-term: $1 million by 2033 (power law projection)

Customizable Settings

Model Parameters

- Intercept & Slope: Fine-tune the power law formula

- Band Offsets: Adjust support/resistance distances

Display Options

- Toggle each visual element on/off

- Show/hide future projections

- Enable/disable cycle analysis

- Customize halving markers

Understanding the Math

The model uses the formula: **Price = 10^(A + B × log10(days since genesis))**

Where:

- A = -17.01 (intercept)

- B = 5.82 (slope)

- Days counted from Bitcoin's genesis block (Jan 3, 2009)

This creates parallel support/resistance lines in log-log space that have contained Bitcoin's price for 15+ years.

Important

1.Not Financial Advice: This is a mathematical model, not a guarantee

2. Long-term Focus: Best suited for macro analysis, not day trading

3. Model Limitations: Past performance doesn't ensure future results

4. Volatility Expected: 50-80% drawdowns are normal within the model

Background

Dr. Giovanni Santostasi discovered this model while analyzing Bitcoin through the lens of physics. He found that Bitcoin behaves more like a city or organism than a financial asset, growing according to universal power laws found throughout

Scientific Price Modeling for Bitcoin

This indicator implements **Dr. Giovanni Santostasi's Bitcoin Power Law Theory** - a discovery that Bitcoin's price follows mathematical laws similar to natural phenomena. Unlike traditional financial models, this treats Bitcoin as a scale-invariant system that grows predictably over time.

What Makes This Special

Dr. Santostasi, an astrophysicist who studied gravitational waves, discovered that Bitcoin's price forms a perfect straight line when plotted on a log-log scale over its entire 15-year history. This isn't just another technical indicator - it's a fundamental law that has held true through multiple 80%+ crashes and recoveries.

Core Features

Power Law Model

- Orange Line: The power law trajectory showing Bitcoin's long-term growth path

- Yellow Line: Fair value (geometric mean between support and resistance)

- Green/Red Bands: Support and resistance levels that have historically contained price movements

- Band Position %: Shows exactly where price sits within the power law channel (0-100%)

How to Use It

For Long-term Investors

1. Accumulate when price is near the green support line (band position < 20%)

2. Hold when price is between the bands

3. Consider profits when approaching red resistance (band position > 80%)

4. Never panic - the model shows $30K+ is now the permanent floor

Key Metrics to Watch

- **Band Position: <20% = Oversold, >80% = Overbought

- Fair Value: Price above = Overvalued, below = Undervalued

- Support Line: Breaking below suggests model invalidation

Current Cycle Projections

Based on the November 2022 bottom at ~$15,500:

- Cycle Peak: ~$155,000-$230,000 (October 2025)

- Next Bottom: ~$70,000-$100,000 (October 2026)

- Long-term: $1 million by 2033 (power law projection)

Customizable Settings

Model Parameters

- Intercept & Slope: Fine-tune the power law formula

- Band Offsets: Adjust support/resistance distances

Display Options

- Toggle each visual element on/off

- Show/hide future projections

- Enable/disable cycle analysis

- Customize halving markers

Understanding the Math

The model uses the formula: **Price = 10^(A + B × log10(days since genesis))**

Where:

- A = -17.01 (intercept)

- B = 5.82 (slope)

- Days counted from Bitcoin's genesis block (Jan 3, 2009)

This creates parallel support/resistance lines in log-log space that have contained Bitcoin's price for 15+ years.

Important

1.Not Financial Advice: This is a mathematical model, not a guarantee

2. Long-term Focus: Best suited for macro analysis, not day trading

3. Model Limitations: Past performance doesn't ensure future results

4. Volatility Expected: 50-80% drawdowns are normal within the model

Background

Dr. Giovanni Santostasi discovered this model while analyzing Bitcoin through the lens of physics. He found that Bitcoin behaves more like a city or organism than a financial asset, growing according to universal power laws found throughout

Script open-source

In pieno spirito TradingView, il creatore di questo script lo ha reso open-source, in modo che i trader possano esaminarlo e verificarne la funzionalità. Complimenti all'autore! Sebbene sia possibile utilizzarlo gratuitamente, ricorda che la ripubblicazione del codice è soggetta al nostro Regolamento.

Declinazione di responsabilità

Le informazioni ed i contenuti pubblicati non costituiscono in alcun modo una sollecitazione ad investire o ad operare nei mercati finanziari. Non sono inoltre fornite o supportate da TradingView. Maggiori dettagli nelle Condizioni d'uso.

Script open-source

In pieno spirito TradingView, il creatore di questo script lo ha reso open-source, in modo che i trader possano esaminarlo e verificarne la funzionalità. Complimenti all'autore! Sebbene sia possibile utilizzarlo gratuitamente, ricorda che la ripubblicazione del codice è soggetta al nostro Regolamento.

Declinazione di responsabilità

Le informazioni ed i contenuti pubblicati non costituiscono in alcun modo una sollecitazione ad investire o ad operare nei mercati finanziari. Non sono inoltre fornite o supportate da TradingView. Maggiori dettagli nelle Condizioni d'uso.