Multi-Oscillator Adaptive Kernel

Introduction

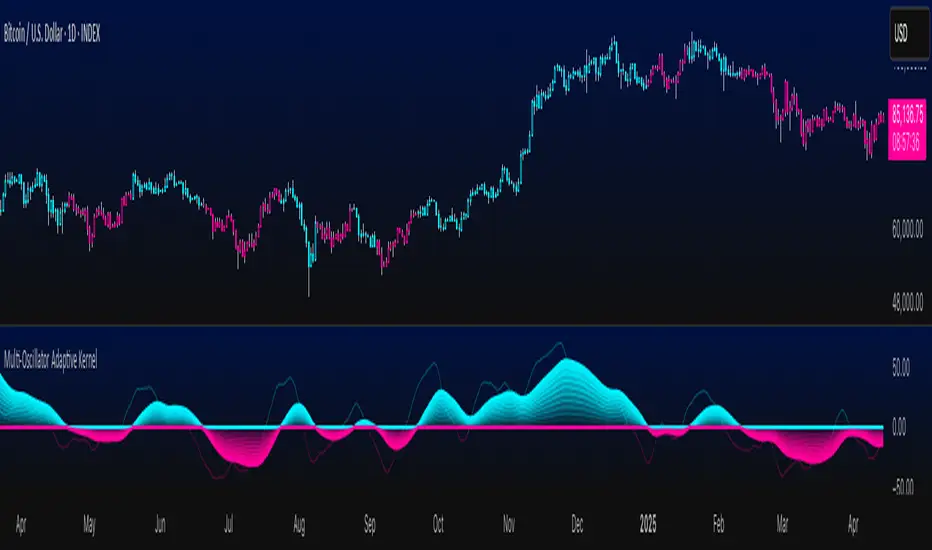

The Multi-Oscillator Adaptive Kernel (MOAK) is a powerful momentum-based indicator that fuses multiple popular oscillators RSI, Stochastic, MFI, and CCI into a single, adaptive tool. Through advanced kernel smoothing techniques, MOAK is engineered to filter out market noise and deliver clearer, more consistent trend signals. Whether in trending or ranging markets, MOAK equips traders with a holistic perspective on momentum across multiple timeframes.

Key Features

- Oscillator Fusion: Combines normalized values from RSI, Stochastic, Money Flow Index, and Commodity Channel Index to capture broader momentum shifts.

- Advanced Kernel Smoothing: Utilizes three kernel smoothing algorithms—Exponential, Linear, and Gaussian—to refine raw oscillator data and minimize false signals.

- Customizable Sensitivity: Traders can tailor the indicator's responsiveness by adjusting lookback periods, kernel lengths, and smoothing sensitivity.

- Clear Visual Signals: Features a color-coded signal line—cyan for bullish, magenta for bearish—with gradient fills to reflect trend intensity and direction.

- Overbought/Oversold Zones: A central zero line helps identify momentum extremes, with layered gradients to indicate the strength of potential reversals or continuations.

- Adaptive Signal Design: Dynamically adjusts its output to align with changing market conditions, offering reliable performance across diverse market environments.

How It Works

- MOAK starts by calculating and normalizing input from four widely used momentum oscillators: Relative Strength Index (RSI), Stochastic Oscillator, Money Flow Index (MFI), and Commodity Channel Index (CCI). These values are then aggregated to form a composite momentum reading.

- To reduce market noise and enhance signal clarity, the composite reading is passed through one of three user-selectable kernel smoothing filters—Exponential, Linear, or Gaussian. These algorithms shape the data curve, softening abrupt fluctuations while preserving meaningful trends.

- The resulting smoothed output is rendered visually as a central signal line, colored cyan for upward momentum and magenta for downward momentum. A series of gradient fills around this line illustrates the intensity of the underlying momentum, with the zero line acting as a visual boundary between overbought and oversold regions. Users can customize key parameters such as lookback window, kernel length, and sensitivity level, ensuring the indicator can be optimized for different assets and trading styles.

Examples

MOAK is able to provide clear trend detection on large cap token such as Bitcoin in the example shown below and resistant to noise during consolidation period.

Downside positions are also handled by the indicator, this time on Solana which is more volatile than Bitcoin but even with more volatility MOAK was able to catch an early entry in the downside move.

Below an example on a lower timeframe with a low cap token Fartcoin where MOAK triggered an early entry on a positive uptrend.

Conclusion

MOAK is a sophisticated yet intuitive momentum indicator, merging the strengths of multiple oscillators into a cohesive and adaptive signal. Its kernel-based smoothing and customizable parameters make it a valuable tool for traders seeking to identify trend direction, assess momentum strength, and filter out short-term noise with precision. Ideal for both trend-following and range-trading strategies, MOAK offers a versatile edge in dynamic market conditions.

Disclaimer

This indicator is provided for informational and educational purposes only. It does not constitute financial advice, nor does it guarantee specific results. Always perform your own analysis and consult a licensed financial advisor before making any trading decisions. Use at your own risk.

Script open-source

In pieno spirito TradingView, il creatore di questo script lo ha reso open-source, in modo che i trader possano esaminarlo e verificarne la funzionalità. Complimenti all'autore! Sebbene sia possibile utilizzarlo gratuitamente, ricorda che la ripubblicazione del codice è soggetta al nostro Regolamento.

Per un accesso rapido a un grafico, aggiungi questo script ai tuoi preferiti: per saperne di più clicca qui.

Want to diving into Trading, Investing. Connect with our vibrant Community! 👇

discord.gg/4yzTVGMP

Declinazione di responsabilità

Script open-source

In pieno spirito TradingView, il creatore di questo script lo ha reso open-source, in modo che i trader possano esaminarlo e verificarne la funzionalità. Complimenti all'autore! Sebbene sia possibile utilizzarlo gratuitamente, ricorda che la ripubblicazione del codice è soggetta al nostro Regolamento.

Per un accesso rapido a un grafico, aggiungi questo script ai tuoi preferiti: per saperne di più clicca qui.

Want to diving into Trading, Investing. Connect with our vibrant Community! 👇

discord.gg/4yzTVGMP